By Mark DeCambre, MarketWatch

U.S. stocks on Thursday stumbled out of the gate Thursday, as

investors reacted negatively to Federal Reserve minutes that are

being interpreted as slightly hawkish by some investors, as well as

a tough day for Chinese equities

(http://www.marketwatch.com/story/asian-markets-pull-back-led-by-sharp-declines-in-china-2018-10-17),

which sank to new four-year lows.

How are benchmarks performing

The Dow Jones Industrial Average fell 171 points, or 0.7%, to

25,540, and those for the S&P 500 index declined by 19 points

to 2,970, a fall of 0.7%. Meanwhile the Nasdaq Composite Index was

down 62 points, or 0.8%, to 7582, in early morning trading.

On Wednesday, the Dow finished the day down 91.74 points, or

0.4%, at 2706.88. The S&P 500 lost 0.71 point, or less than

0.1%, falling to 2,809.21, while the Nasdaq Composite Index shed

2.79 points to close at 7,642.70.

The three main benchmarks haven't posted consecutive losses

since Oct. 11, according to FactSet data.

What's driving markets?

Chinese stock markets touched a fresh four-year low and a

seemingly hawkish Fed has combined to undercut investor sentiment

on Thursday.

The minutes of the Fed's September meeting, released on

Wednesday, indicated that policy makers are forging ahead with

increases and could hike rates again as early as December, as

expected. Tightening policy comes as no surprise but it does

elevate concerns about increasing borrowing costs and the impact

that that could have on equity prices, market participants say.

Last week's downdraft in stocks was attributed partly to a jump

in yields of U.S. government bonds, which can also undercut

appetite for stocks compared against so-called risk-free Treasurys.

Rates hikes are expected to drive yields higher still.

Read:Here's why stock-market investors suddenly freaked out over

rising bond yields

(http://www.marketwatch.com/story/stock-market-investors-are-right-to-be-frightened-by-rising-bond-yields-economist-2018-10-12)

Concerns about the vitality of Asian markets, in particular

China's, may also be weighing on the investment mood. Shanghai's

composite index fell 2.9% and the Shenzhen A-Share dropped 2.7%.

Weakness in Beijing's markets came after China's currency, the

yuan, briefly touched its weakest level since January of 2017. One

buck last fetched 6.9379 yuan , up 0.2%. Those currency moves came

after Treasury refrained from labeling China a currency manipulator

(http://www.marketwatch.com/story/us-treasury-declines-to-label-china-a-currency-manipulator-but-says-recent-yuan-weakness-is-a-concern-2018-10-17)

in its biannual report on currency practices released late

Wednesday.

The U.S. and China have been locked in a trade spat that doesn't

show signs of easing and that threatens to produce intermittent

headwinds for markets.

Which stocks are in focus?

Philip Morris International Inc. shares (PM) jumped 3.4% in

early trading, after the company beat earnings estimates for the

third quarter.

Alcoa Corp. shares (AA) also popped after the open, following

better-than-expected earnings

(http://www.marketwatch.com/story/alcoa-stock-rises-on-earnings-beat-company-predicts-2018-aluminum-deficit-2018-10-17),

and predictions frome execs of aluminum deficit for this year. The

stock is up 8.5%.

Invesco Ltd.(IVZ) shares are up 3.6% in premarket action, after

it announced the acquisition of OppenheimerFunds, a subsidiary of

Massachusetts Mutual Life Insurance.

Endocyte Inc. shares (ECYT) soared more than 50% after Novartis

AG(NOVN.EB) (NOVN.EB) said it would buy the cancer-drug maker for

$2.1 billion

(http://www.marketwatch.com/story/novartis-lifts-view-announces-21b-endocyte-deal-2018-10-18).

Shares of Travelers Cos. Inc. fell 1.5% in early morning action,

even as it posted earnings

(http://www.marketwatch.com/story/travelers-profit-rises-as-catastrophe-losses-fall-2018-10-18)and

revenue above analyst expectations.

Danaher Corp. (DHR), stock is down 2.6% Thursday morning, though

it too announced third quarter earnings and revenue above analyst

estimates.

Earnings reports for American Express Co. (AXP) and PayPal

Holdings Inc. (PYPL) were due after the close.

Which data are in focus?

First-time jobless claims fell by 5,000 from a week ago, as the

Labor Department reported just 210,000 Americans applying for

initial jobless benefits in the week ending Oct. 13, in line with

economist estimates, according to a poll by MarketWatch, and close

to 49-year lows

(http://www.marketwatch.com/story/jobless-claims-drop-5000-to-210000-in-mid-october-2018-10-18).

The Philly Fed manufacturing index came in slightly below

(http://www.marketwatch.com/story/philly-fed-manufacturing-index-signals-steady-growth-in-october-2018-10-18)last

month's reading, with a print of 22.2 in October, compared with

22.9 in September. Still, the figures were above expectations and

indicate healthy activity in the factory sector.

The Conference Board said its leading economic indicators rose

0.5% in September.

What are strategists saying?

Tom Essaye, president of the Sevens Report, pointed to weak

export Japanese export data and a poor showing in the Chinese

equities market as reason for softness in premarket trading

Thursday morning.

"Are any of those hugely negative events for U.S. equities?

Probably not, but we need some good news for the market to turn

higher," he said. Essaye predicted that as earnings season heats up

next week, that good news will be on the offing, " But until we get

a solid run of earnings growth and macro data, the stocks will move

sideways, if not down."

"U.S. Treasury bond yields pushed higher after the FOMC news

with 10-year yields back above 3.2% early today. If interest rates

continue to move higher from their current levels, investors will

become even more reluctant to buy the dips in stocks," wrote

Hussein Sayed, chief market strategist at FXTM in a Thursday

research note.

(END) Dow Jones Newswires

October 18, 2018 10:10 ET (14:10 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

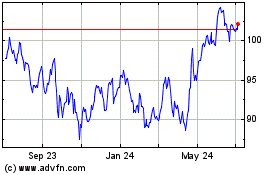

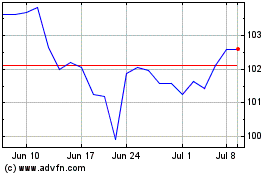

Philip Morris (NYSE:PM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Philip Morris (NYSE:PM)

Historical Stock Chart

From Apr 2023 to Apr 2024