Makers of Dove Soap, Nescafe Are Raising Prices Again -- Update

October 18 2018 - 5:59AM

Dow Jones News

By Saabira Chaudhuri

Two of the world's largest consumer goods companies, Unilever

PLC and Nestlé SA, reported stronger sales as a wave of inflation

in many markets emboldened them to raise prices.

The new pricing power gives a boost of confidence to the entire

industry, which has struggled in recent years with fierce

competition and rapidly changing consumer tastes.

Unilever, the maker Hellmann's mayonnaise and Dove soap, on

Thursday said third-quarter sales climbed 3.8% on an underlying

basis, with prices up 1.4%. Nestlé, which makes Kit Kat chocolate

and Nescafe coffee, reported organic sales up 2.9% for the quarter,

saying prices grew by 0.9%.

Both companies' figures exclude the impact of currency changes

and acquisitions and disposals. Neither reported profits figures.

Shares in Unilever fell 1.2%, while Nestlé rose 0.4%.

Many consumer goods makers have in recent quarters struggled to

raise prices amid weak inflation, Amazon.com Inc.'s growing prowess

in selling more household staples, and a decline in brand loyalty

as consumers use the internet to shop around. A shift to discount

retailers, from dollar stores across the U.S. to European

discounters like Germany's Aldi, has further pushed down

prices.

But inflation, especially in emerging markets, is changing the

picture.

"The combination of underlying commodity increases but also the

stronger U.S. dollar is really putting a lot of inflation into our

market," said Unilever Chief Financial Officer Graeme Pitkethly. "I

see pricing being a key feature of the entire sector through the

balance of the year and in 2019."

Unilever said commodity costs and hence price growth was

particularly strong in emerging markets while both companies said

prices rose in the U.S. However, in Western Europe both cut

prices.

Kimberly-Clark Corp., which makes Huggies diapers and Kleenex

tissues, in August said it was raising prices in North America to

offset higher commodity costs. It reports third quarter results

next week.

Procter & Gamble Co. reports fiscal first-quarter results

Friday. The maker of Tide and Bounty has grappled with fierce

competition in categories like hair care and laundry detergent,

forcing it to keep a lid on prices. In July it reported prices in

the fourth quarter dropped 2%.

In developed markets, Unilever said underlying third-quarter

sales climbed by 1.3%, driven mostly by volume gains. Emerging

market sales jumped 5.6% as Unilever was able to raise prices by

2.1%. The results exclude pricing in Argentina, which is going

through a period of hyperinflation. The company raised prices there

by 34% in the third quarter while volumes dropped 10%.

Overall Unilever's third-quarter sales came in at EUR12.5

billion ($14.4 billion).

Finance chief Mr. Pitkethly said investing in brands was key in

an inflationary environment to ensure that volumes continue to grow

even as the company raises prices.

"We got to get the price moving but keep volume first," he said.

"The true test of the strength of a brand is the ability to price

and give a degree of inflation protection."

Switzerland-based Nestlé said third-quarter sales came in at

22.5 billion Swiss francs.

Revenues were held back in part by the strength of the Swiss

franc against emerging-market currencies, which weakened foreign

sales when they were translated into francs.

Jefferies analyst Martin Deboo noted that Nestlé's third-quarter

pricing was ahead of forecasts and a sharp improvement from the

0.2% growth it reported in the first half, which he said bodes well

for profit margins.

Nestlé said higher pricing in the third quarter reflected

inflation in commodity and freight costs in North America.

--Brian Blackstone contributed to this article.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

October 18, 2018 05:44 ET (09:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

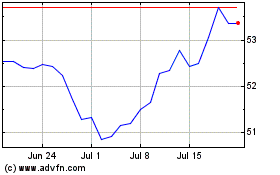

Unilever (EU:UNA)

Historical Stock Chart

From Aug 2024 to Sep 2024

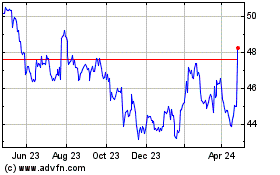

Unilever (EU:UNA)

Historical Stock Chart

From Sep 2023 to Sep 2024