Denmark Reopens Money-Laundering Probe -- WSJ

September 21 2018 - 3:02AM

Dow Jones News

By Patricia Kowsmann and Drew Hinshaw

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 21, 2018).

Danish authorities reopened an investigation into a massive

Russia-linked money laundering scandal at their country's largest

bank, as investors looked to assess the impact after the lender

admitted to letting $233 billion move through a single Eastern

European branch.

The Danish Financial Supervisory Authority, said Thursday that

it would revisit a probe at Danske Bank that it had closed in May,

when it reprimanded the bank and ordered it to set aside $800

million in capital for any risks. The regulator can't directly

impose fines, but it can report its findings to the police and deem

executives unfit. Employees at the bank's Estonia branch are under

investigation by Estonian prosecutors for helping customers from

Russia and other ex-Soviet Union states spirit ill-gotten gains

abroad.

The move by regulators comes after Danske Bank published a

report Wednesday saying employees had failed to run basic

background checks on thousands of customers who lived outside the

Baltic country. Customers often deposited money in cash.

Investigators the bank hired suspect a "large portion" of those

transactions were laundered money, the report said.

U.S. officials have expressed concern that Denmark, a founding

member of the North Atlantic Treaty Organization, didn't do more to

crack down on inflows of illicit Russian wealth at a time of

heightened tensions between Moscow and the West. The report has

embarrassed officials in the Scandinavian country, which is often

ranked among the world's most transparent.

Danish politicians have called for swift punishment for any

employees or executives found to be involved and steeper fines for

such behavior going forward. On Wednesday, Danske Bank's CEO Thomas

Borgen resigned.

Separate from Denmark's banking regulator, prosecutors there are

investigating Danske for alleged money laundering crimes.

"This is a serious case," Danish State Prosecutor Morten Niels

Jakobsen told The Wall Street Journal.

The renewed probe increases pressure on Danske, whose shares

have fallen almost a third this year as the size of the scandal

kept growing bigger. Analysts have estimated fines between $600

million to billions of dollars if the U.S. decides to impose its

own. Analysts say the bank has enough capital to withstand even a

large fine.

The biggest risk, analysts and regulators have said, is that

Denmark's largest bank could be cut off from the global dollar-led

financial system. Under U.S. law, the Treasury has the power to

restrict the flow of U.S. dollars to a foreign bank suspected of

laundering money, a penalty known as the "death blow sanction"

because it often sends lenders into financial collapse. U.S.

authorities can also use threats of that penalty to force the bank

to settle for steep fines.

The Justice Department, Treasury Department, and the Securities

and Exchange Commission are each examining the bank, The Wall

Street Journal reported this month. Danske officials said Wednesday

they aren't aware of any U.S. investigations.

"There's huge uncertainty around the scale of any fines, with

the U.S. being the biggest question mark," Berenberg analyst Adam

Barrass said. Mr. Barrass said the bank has enough capital to

withstand his current estimate of $1 billion.

Danske Bank, one of the 25 largest banks in Europe by assets,

doesn't have a banking subsidiary in the U.S., but does operate a

securities arm there. It also has several U.S. dollar bond issues

that were marketed to U.S. investors. Its stock is traded

over-the-counter an American depository receipt.

Danske Bank's share price rose 4% percent Thursday as some

investors concluded that the bank was unlikely to face stiff

penalties from either Danish or American regulators. The bank has

said it so far as found no evidence that it breached U.S.

sanctions.

But it also hasn't checked some 8,000 clients out of the 15,000

its Estonian branched managed. Nor has it checked who those clients

sent their money to, the bank said Wednesday.

"The problem with the bank is, it's a matter of luck," said John

Byrne, CEO at Corlytics, a regulatory risk intelligence firm. "If

there's any party on a U.S. sanction list that they've processed

transactions for, that's where the trouble starts."

Write to Patricia Kowsmann at patricia.kowsmann@wsj.com and Drew

Hinshaw at drew.hinshaw@wsj.com

(END) Dow Jones Newswires

September 21, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

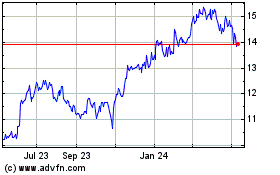

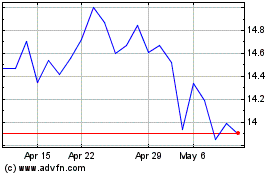

Danske Bank AVS (PK) (USOTC:DNKEY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Danske Bank AVS (PK) (USOTC:DNKEY)

Historical Stock Chart

From Apr 2023 to Apr 2024