Platinum Group Metals Ltd. (PTM:TSX; PLG:NYSE

American) (“Platinum Group” “PTM” or the “Company”) is pleased to

announce as project operator that Waterberg JV Resources (Pty) Ltd.

(“Waterberg JV Co.”) has filed a Mining Right Application for the

large-scale Waterberg PGM Project. The application was

submitted to South Africa’s Department of Mineral Resources

(“DMR”), consisting of the Mining Work Program, Social and Labour

Plan and associated Environmental Applications. The

applications are supported by all of the JV partners including

Impala Platinum Holdings Ltd. (“Implats”), Japan Oil, Gas

and Metals National Corporation (“JOGMEC”) and Mnombo Wethu

Consultants (Pty) Ltd. (“Mnombo”).

President and CEO of Platinum Group R. Michael

Jones stated, “The filing of the Mining Right Application

represents a significant milestone in the evolution of the

Waterberg Project. First discovered in 2011, Waterberg has

grown both in scale and stature to become a significant mineral

asset and a rare, large scale, low cost primary palladium deposit.

The project has the potential to positively impact South

Africa’s economic development, creating high-value jobs and skills

training opportunities for local residents. We look forward

to ongoing interaction with all of our stakeholders, including

government, local communities and our joint venture partners to

help ensure the successful development and operation of the

Waterberg Project.”

Waterberg represents a large scale resource of

platinum group metals (“PGM”), including palladium, platinum and

gold, with an attractive risk profile. Given its shallow

nature and ability to support a fully mechanized operation, the

Waterberg Project has the potential to be amongst the lowest cost

producers in the PGM sector. A pre-feasibility study (“PFS”)

was completed in 2016 and a definitive feasibility study (“DFS”) is

in progress for completion in calendar Q1 2019. The DFS is

considering two options including the 600ktpm complex outlined in

the PFS and a phased approach commencing with a smaller, 250ktpm to

350ktpm alternative. Stantec Consulting International LLC and DRA

Projects SA (Proprietary) Limited are the lead independent project

engineers.

Platinum Group currently holds an effective

50.02% interest in the Waterberg Project. Implats, the

world’s second largest platinum producer, owns a 15% interest.

Mnombo, a black empowerment company, holds a 26% interest.

The Company owns a 49.9% interest in Mnombo. JOGMEC holds a

21.95% interest in the Waterberg Project and is in the process of

transferring a 9.755% interest to Japanese conglomerate Hanwa Co.,

Ltd. Hosken Consolidated Investments Limited, a South African

black empowerment investment holding company listed on the JSE with

a US$1.1 billion market capitalization, owns a 15% stake in

Platinum Group. Implats is an active participant in the joint

venture and holds an option to increase their stake to 50.01%

following the completion of the DFS.

Implats has identified Waterberg as a potential

low-cost alternative to deep conventional PGM mining, with an

attractive metal balance for the future. Palladium has been

gaining market interest based on continued demand in the auto

sector, due to a growing trend towards gasoline engines and hybrids

that use palladium dominant catalysts.

Current Platinum Group Element (“PGE”) Probable

Mineral Reserves at the Waterberg Project (100%) are 12.3 million

ounces, comprising 61% palladium, 30% platinum, 8% gold and 1%

rhodium plus 191 million and 333 million pounds of copper and

nickel respectively and will be updated as part of the DFS.

(See the technical report dated October 19, 2016 and filed on SEDAR

titled “Independent Technical Report on the Waterberg Project

Including Mineral Resource Update and Pre-Feasibility Study”.)

Much of the Waterberg Project area remains to be drilled and

assessed. The Waterberg deposit remains open down dip and

along strike.

Waterberg Mineral Resource and Mineral Reserve

Details

Mineral Reserve Details (100% Project

Basis)

|

Prill Split |

Grade |

|

Zone |

Pt % |

Pd % |

Au % |

Rh % |

Cu % |

Ni % |

|

T-Zone |

29 |

49 |

21 |

1 |

0.16 |

0.08 |

|

F-Zone |

30 |

64 |

5 |

1 |

0.07 |

0.16 |

Probable Mineral Reserve at 2.5 g/t 4E Cut-off– Tonnage

and Grades

| Waterberg Probable Mineral Reserve – Tonnage

and Grades |

|

Zone |

Mt |

Cut-off grade (g/t) |

Pt (g/t) |

Pd (g/t) |

Au (g/t) |

Rh (g/t) |

4E (g/t) |

Cu (%) |

Ni (%) |

|

T-Zone |

16.5 |

2.5 |

1.14 |

1.93 |

0.83 |

0.04 |

3.94 |

0.16 |

0.08 |

|

F-Zone |

86.2 |

2.5 |

1.11 |

2.36 |

0.18 |

0.04 |

3.69 |

0.07 |

0.16 |

|

Total |

102.7 |

2.5 |

1.11 |

2.29 |

0.29 |

0.04 |

3.73 |

0.08 |

0.15 |

Probable Mineral Reserve at 2.5 g/t 4E Cut-off–

Contained Metal

| Waterberg Probable Mineral Reserve – Contained

Metal |

|

Zone |

Mt |

Pt (Moz) |

Pd (Moz) |

Au (Moz) |

Rh (Moz) |

4E (Moz) |

4E content (kg) |

Cu (Mlb) |

Ni (Mlb) |

|

T-Zone |

16.5 |

0.61 |

1.03 |

0.44 |

0.02 |

2.09 |

65,097 |

58.21 |

29.10 |

|

F-Zone |

86.2 |

3.07 |

6.54 |

0.51 |

0.10 |

10.22 |

318,007 |

132.97 |

303.94 |

|

Total |

102.7 |

3.67 |

7.57 |

0.95 |

0.12 |

12.32 |

383,103 |

191.18 |

333.04 |

Reasonable prospects of economic extraction were

determined with the following assumptions: Metal prices used in the

reserve estimate are as follows based on a 3-year trailing average

(as at July 31/2016) in accordance with U.S. Securities and

Exchange Commission ("SEC") guidance for the assessment of

resources and reserves; US$1,212/oz Pt, US$710/oz Pd, US$1229/oz

Au, US$984/oz Rh, US$6.10/lb Ni, US$2.56/lb Cu, US$/ZAR15.

Smelter payability of 85% was estimated for 4E and 73% for Cu

and 68% for Ni. The effective date is October 17, 2016.

A 2.5 g/t Cut-off was used and checked against a pay-limit

calculation. Independent Qualified Person for the Statement of

Reserves is Mr. RL Goosen (WorleyParsons RSA (Pty) Ltd Trading as

Advisian). The Mineral Reserves may be materially affected by

changes in metals prices, exchange rates, labor costs, electricity

supply issues or many other factors. See Risk Factors in

Independent Technical Report 43-101 Effective Date: October 17,

2016 on www.sedar.com and the Company’s Annual Information Form.

The Mineral Reserves are estimated under SAMREC with no

material difference to the CIM 2014 definitions in this

case.

The estimation of mineral reserves has taken into account

environmental, permitting and legal, title, taxation,

socio-economic, marketing and political factors. Based on the

cut-off grade and a maximum depth cut-off of 1,250 metres the

probable reserve will support an 18-year mine life.

An update to Mineral Resource based on

completed in-fill drilling is in progress. This updated

estimate with increased confidence will be the basis of the DFS

mine design.

Qualified Person

R. Michael Jones, P.Eng., the Company’s

President, Chief Executive Officer and a shareholder of the

Company, is a non-independent qualified person as defined in

National Instrument 43-101 Standards of Disclosure for Mineral

Projects (“NI 43-101”) and is responsible for preparing the

technical information contained in this news release. He has

verified the data by reviewing the detailed information of the

geological and engineering staff and independent qualified person

reports as well as visiting the Waterberg Project site

regularly.

About Platinum Group Metals

Ltd.

Platinum Group is focused on, and is the

operator of, the Waterberg Project, a bulk mineable underground

deposit in northern South Africa. Waterberg was discovered by the

Company. Waterberg has potential to be a low cost dominantly

palladium mine and Impala Platinum recently made a strategic

investment in the Waterberg Project.

On behalf of the Board of Platinum Group Metals

Ltd.

R. Michael JonesPresident, CEO and Director

For further information contact:

R. Michael Jones, President or Kris

Begic, VP, Corporate Development Platinum

Group Metals Ltd., Vancouver Tel: (604)

899-5450 / Toll Free: (866) 899-5450

www.platinumgroupmetals.net

Disclosure

The Toronto Stock Exchange and the NYSE American

LLC have not reviewed and do not accept responsibility for the

accuracy or adequacy of this news release, which has been prepared

by management.

This press release contains forward-looking

information within the meaning of Canadian securities laws and

forward-looking statements within the meaning of U.S. securities

laws (collectively “forward-looking statements”).

Forward-looking statements are typically identified by words

such as: believe, expect, anticipate, intend, estimate, plans,

postulate and similar expressions, or are those, which, by their

nature, refer to future events. All statements that are not

statements of historical fact are forward-looking statements.

Forward-looking statements in this press release include, without

limitation, JOGMEC’s potential transfer of a portion of its

interest in the Waterberg Project to Hanwa; the potential for

Implats to exercise its rights and fund additional development work

on the Waterberg Project; the timing and completion of a DFS; the

completion of a DFS drill program and an updated Mineral Resource

estimate to increase the confidence in certain areas of the

Waterberg Project known Mineral Resource to the measured category;

the filing and acceptance of a mining right application for the

Waterberg Project; the Waterberg Project’s potential to be a large

scale, bulk mineable, fully mechanized, low-cost dominantly

palladium mine. Although the Company believes the

forward-looking statements in this press release are reasonable, it

can give no assurance that the expectations and assumptions in such

statements will prove to be correct. The Company cautions

investors that any forward-looking statements by the Company are

not guarantees of future results or performance and that actual

results may differ materially from those in forward-looking

statements as a result of various factors, including additional

financing requirements; the Company’s history of losses; the

Company’s inability to generate sufficient cash flow or raise

sufficient additional capital to make payment on its indebtedness,

and to comply with the terms of such indebtedness; the LMM Facility

is, and any new indebtedness may be, secured and the Company has

pledged its shares of PTM RSA, and PTM RSA has pledged its shares

of Waterberg JV Resources (Pty) Limited (“Waterberg JV Co.”) to

Liberty Metals & Mining Holdings, LLC, a subsidiary of LMM,

under the LMM Facility, which potentially could result in the loss

of the Company’s interest in PTM RSA and the Waterberg Project in

the event of a default under the LMM Facility or any new secured

indebtedness; the Company’s negative cash flow; the Company’s

ability to continue as a going concern; completion of the

definitive feasibility study for the Waterberg Project, which is

subject to resource upgrade and economic analysis requirements;

uncertainty of estimated production, development plans and cost

estimates for the Waterberg Project; discrepancies between actual

and estimated Mineral Reserves and Mineral Resources, between

actual and estimated development and operating costs, between

actual and estimated metallurgical recoveries and between estimated

and actual production; fluctuations in the relative values of the

U.S. Dollar, the Rand and the Canadian Dollar; volatility in metals

prices; the failure of the Company or the other shareholders to

fund their pro rata share of funding obligations for the Waterberg

Project; any disputes or disagreements with the other shareholders

of Waterberg JV Co. or Mnombo Wethu Consultants (Pty) Ltd; the

ability of the Company to retain its key management employees and

skilled and experienced personnel; contractor performance and

delivery of services, changes in contractors or their scope of work

or any disputes with contractors; conflicts of interest; capital

requirements may exceed its current expectations; the uncertainty

of cost, operational and economic projections; the ability of the

Company to negotiate and complete future funding transactions and

either settle or restructure its debt as required; litigation or

other administrative proceedings brought against the Company;

actual or alleged breaches of governance processes or instances of

fraud, bribery or corruption; exploration, development and mining

risks and the inherently dangerous nature of the mining industry,

and the risk of inadequate insurance or inability to obtain

insurance to cover these risks and other risks and uncertainties;

property and mineral title risks including defective title to

mineral claims or property; changes in national and local

government legislation, taxation, controls, regulations and

political or economic developments in Canada and South Africa;

equipment shortages and the ability of the Company to acquire

necessary access rights and infrastructure for its mineral

properties; environmental regulations and the ability to obtain and

maintain necessary permits, including environmental authorizations

and water use licences; extreme competition in the mineral

exploration industry; delays in obtaining, or a failure to obtain,

permits necessary for current or future operations or failures to

comply with the terms of such permits; risks of doing business in

South Africa, including but not limited to, labour, economic and

political instability and potential changes to and failures to

comply with legislation; and other risk factors described in

the Company’s most recent Form 20-F annual report, annual

information form and other filings with the U.S. Securities and

Exchange Commission (“SEC”) and Canadian securities regulators,

which may be viewed at www.sec.gov and www.sedar.com,

respectively. Proposed changes in the mineral law in South

Africa if implemented as proposed would have a material adverse

effect on the Company’s business and potential interest in

projects. Any forward-looking statement speaks only as of the

date on which it is made and, except as may be required by

applicable securities laws, the Company disclaims any intent or

obligation to update any forward- looking statement, whether as a

result of new information, future events or results or

otherwise.

Estimates of mineralization and other technical

information included herein have been prepared in accordance with

National Instrument 43-101 – Standards of Disclosure for Mineral

Projects (“NI 43-101”). The definitions of proven and

probable Mineral Reserves used in NI 43-101 differ from the

definitions in SEC Industry Guide 7. Under SEC Industry Guide

7 standards, a “final” or “bankable” feasibility study is required

to report Mineral Reserves, the three-year historical average price

is used in any Mineral Reserve or cash flow analysis to designate

Mineral Reserves and the primary environmental analysis or report

must be filed with the appropriate governmental authority. As

a result, the reserves reported by the Company in accordance with

NI 43-101 may not qualify as “Mineral Reserves” under SEC

standards. In addition, the terms “Mineral Resource” and

“measured Mineral Resource” are defined in and required to be

disclosed by NI 43-101; however, these terms are not defined terms

under SEC Industry Guide 7 and normally are not permitted to be

used in reports and registration statements filed with the SEC.

Mineral Resources that are not Mineral Reserves do not have

demonstrated economic viability. Investors are cautioned not

to assume that any part or all of the mineral deposits in these

categories will ever be converted into reserves. Accordingly,

descriptions of the Company’s mineral deposits in this press

release may not be comparable to similar information made public by

U.S. companies subject to the reporting and disclosure requirements

of United States federal securities laws and the rules and

regulations thereunder.

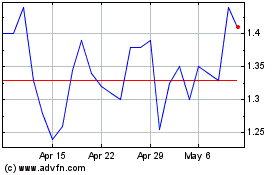

Platinum Group Metals (AMEX:PLG)

Historical Stock Chart

From Mar 2024 to Apr 2024

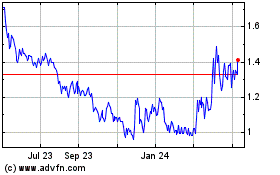

Platinum Group Metals (AMEX:PLG)

Historical Stock Chart

From Apr 2023 to Apr 2024