Coty Feels Strain of $12 Billion Bet on P&G Beauty Business

August 21 2018 - 1:38PM

Dow Jones News

By Sharon Terlep

Nearly two years after Coty Inc. paid $12 billion to acquire

Procter & Gamble Co.'s beauty business, the deal remains a drag

on the struggling beauty giant.

Weak performance of former P&G brands, including names like

CoverGirl makeup and Clairol hair dye, drove down sales in the most

recent quarter, Coty said Tuesday. A trucker strike in Brazil also

contributed to a loss of $181.3 million, or 24 cents a share,

compared with a loss of $304.8 million a year ago.

Separately, the company announced the resignation of Finance

Chief Patrice de Talhouet, in the job since 2014, saying he left

"to pursue other opportunities."

Coty shares fell 9.8% to $11.19 in midday trading and have lost

more than half their value since the P&G deal closed in October

2016.

Coty CEO Camillo Pane blamed problems with the former P&G

business on the drawn-out acquisition -- the deal took 16 months to

close after being announced -- and said the brands were in worse

condition than Coty anticipated when it agreed to buy them.

But he also said more universal factors are at play. Shoppers

have cooled on mass-market beauty brands sold at drugstores and

big-box retailers, while demand for premium beauty products has

soared in the past year.

Estée Lauder Cos., with high-end names from MAC to Bobbi Brown

to Clinique, on Monday reported a 12% increase in sales, not

including currency moves. The company's stock is up nearly 30% from

a year ago.

Coty reported 0.3% organic sales growth for the period ended

June 30, stripping out currency changes, acquisitions and

divestitures. Organic sales rose 5.3% in Coty's luxury segment

while professional beauty was up 2.1%. Consumer beauty, which

comprises about half the company's sales and includes mass-market

makeup brands like CoverGirl, fell 3.4% in the quarter.

"E-commerce is slowing traffic and consumers are looking for

more of an experience. You see a trade-up to prestige and

specialty," Mr. Pane said in an interview. "This is something I'm

not sure people were expecting, but it is the reality."

He said Coty is spending money to grow in more promising areas,

such as online sales, emerging markets and in direct-to-consumer

sales, which it entered last year with the acquisition of

social-media-driven cosmetics company Younique LLC.

Analysts, on a call with Coty executives, pressed the company to

address continued problems.

Jonathan Patrick, of Feeney Consumer Edge Research, noted on the

call that Coty has been "negatively surprised by the evolution of

the business."

Mr. Pane said Coty won't sell any of the struggling big P&G

brands and that he believes the deal will prove beneficial over the

long term. CoverGirl, one of the biggest U.S. mass beauty brands,

has "a lot of problems," but also is improving, he said. CoverGirl

sales fell by mid-single-digit percentage points in the recent

period, down from double-digit percentage declines in previous

years.

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

August 21, 2018 13:23 ET (17:23 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

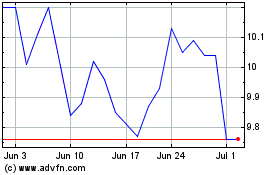

Coty (NYSE:COTY)

Historical Stock Chart

From Aug 2024 to Sep 2024

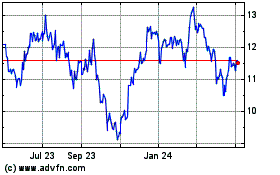

Coty (NYSE:COTY)

Historical Stock Chart

From Sep 2023 to Sep 2024