Washington, D.C. 20549

PETRÓLEO BRASILEIRO S.A. - PETROBRAS

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Consolidated financial information revised by independent auditors, prepared in accordance with International Financial Reporting Standards - IFRS.

Petrobras reported net income of R$ 17,033 million in 1H-2018, a growth of 257%, being the best semester result since 2011, determined by:

The operational generation and the cash-in from divestments of US$ 4,914 million led to amortization and prepayment of debt, resulting in a significant 16% decrease in gross debt, which reached US$ 91,712 million and 13% in net debt of US$ 73,662 million.

Free Cash Flow * remained positive for the thirteenth quarter in a row, reaching R$ 29,366 million in 1H-2018, a 29% increase compared to the first half of the previous year, mainly due to the higher operating generation, combined with the lower investments.

Pursuant to the Shareholders' Remuneration Policy and taking into account the net income obtained in the quarter and the financial deleveraging target, the anticipation of interest on own capital, in the amount of R$ 0.05 per share, both for preferred and common shares, adopting the same amounts already distributed in 1Q-2018 of R$ 652.2 million. In view of that, the anticipation of interest on own capital totaled R$ 1,304.4 million in the semester.

The net debt to LTM Adjusted EBITDA* ratio decreased to 3.23 in June 2018, compared to 3.67 in December 2017. Leverage* reduced from 51% to 50% in this period.

Excluding the provision for the Class Action agreement, the company would have presented the net debt / LTM Adjusted EBITDA ratio of 2.86, on a convergent path to the target of 2.5 until the end of 2018.

Petrobras' total production of oil and natural gas in 1H-2018 was 2,669 thousand barrels of oil equivalent per day (boed), of which 2,572 thousand boed in Brazil, 4% less than 1H-2017, mainly reflecting divestments in Lapa and Roncador fields.

In this quarter, there was start-up of the first production system in the Transfer of Rights area, in Buzios field, with FPSOs P-74, and a new production system in the Campos Basin, in Tartaruga Verde field. It is also worth to highlight the increase of the exploratory portfolio, through the acquisition of areas with high potential, in the ANP Bid Rounds.

Compared to 1H-2017, domestic oil products production fell by 3%, while domestic oil products sales fell by 6% to 1,759 thousand barrels per day (bpd) and 1,823 thousand bpd, respectively, due to the reduction in sales of naphtha to Braskem and the loss of market share from gasoline to ethanol. Compared to 1Q-2018, there was an increase in the market share of diesel and gasoline, resulting in an increase in sales volume, especially diesel, which grew 15%.

The company maintained its position as a net exporter, with a balance of 372 thousand bpd in 1H-2018 (vs. 401 thousand bpd in 1H-2017).

|

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

Investor Relations Department

e-mail:

petroinvest@petrobras.com.br

/

acionistas@petrobras.com.br

Av. República do Chile, 65 – 1002 – 20031-912 – Rio de Janeiro, RJ

Phone: 55 (21) 3324- 1510 / 9947 I 0800-282-1540

|

B

3

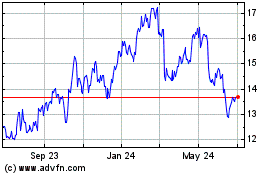

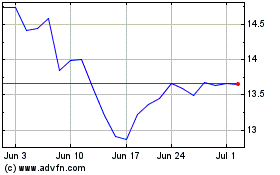

: PETR3, PETR4

NYSE: PBR, PBRA

BCBA: APBR, APBRA

LATIBEX: XPBR, XPBRA

|

|

|

|

|

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

* See definitions of Free Cash Flow, Adjusted EBITDA, Adjusted LTM EBITDA and Net debt in glossary and the respective reconciliations of such items in Liquidity and Capital Resources, Reconciliation of Adjusted EBITDA, Adjusted LTM EBITDA and Net debt.

|

3

*

Table 01 - Main Items and Consolidated Economic Indicators

|

|

R$ million

|

|

|

Jan-Jun

|

|

|

|

|

|

|

2018

|

2017

|

2018 x 2017 (%)

|

2Q-2018

|

1Q-2018

|

2Q18 X 1Q18 (%)

|

2Q-2017

|

|

Sales revenues

|

158,856

|

135,361

|

17

|

84,395

|

74,461

|

13

|

66,996

|

|

Gross profit

|

58,396

|

45,155

|

29

|

31,623

|

26,773

|

18

|

21,369

|

|

Operating expenses

|

(23,915)

|

(15,895)

|

(50)

|

(14,957)

|

(8,958)

|

(67)

|

(6,379)

|

|

Operating income (loss)

|

34,481

|

29,260

|

18

|

16,666

|

17,815

|

(6)

|

14,990

|

|

Net finance income (expense)

|

(9,893)

|

(16,590)

|

40

|

(2,647)

|

(7,246)

|

63

|

(8,835)

|

|

Consolidated net income (loss) attributable to the shareholders of Petrobras

|

17,033

|

4,765

|

257

|

10,072

|

6,961

|

45

|

316

|

|

Basic and diluted earnings (losses) per share attributable to the shareholders of Petrobras

|

1.31

|

0.37

|

254

|

0.78

|

0.54

|

44

|

0.02

|

|

Market capitalization (Parent Company)

|

240,831

|

167,538

|

44

|

240,831

|

293,795

|

(18)

|

167,538

|

|

Adjusted EBITDA*

|

55,835

|

44,348

|

26

|

30,067

|

25,768

|

17

|

19,094

|

|

Adjusted EBITDA margin* (%)

|

35

|

33

|

2

|

36

|

35

|

1

|

29

|

|

Gross margin* (%)

|

37

|

33

|

4

|

37

|

36

|

1

|

32

|

|

Operating margin* (%)

|

22

|

22

|

−

|

20

|

24

|

(4)

|

22

|

|

Net margin* (%)

|

11

|

4

|

7

|

12

|

9

|

3

|

−

|

|

Total capital expenditures and investments*

|

21,259

|

22,994

|

(8)

|

11,311

|

9,948

|

14

|

11,452

|

|

Exploration & Production

|

18,660

|

18,303

|

2

|

9,717

|

8,943

|

9

|

9,089

|

|

Refining, Transportation and Marketing

|

1,519

|

1,864

|

(19)

|

930

|

588

|

58

|

1,057

|

|

Gas & Power

|

593

|

2,450

|

(76)

|

381

|

212

|

80

|

1,116

|

|

Distribution

|

195

|

148

|

32

|

111

|

84

|

32

|

77

|

|

Biofuel

|

31

|

33

|

(6)

|

11

|

20

|

(45)

|

15

|

|

Corporate

|

261

|

196

|

33

|

161

|

101

|

59

|

98

|

|

Average commercial selling rate for U.S. dollar

|

3.42

|

3.18

|

8

|

3.61

|

3.24

|

11

|

3.22

|

|

Period-end commercial selling rate for U.S. dollar

|

3.86

|

3.31

|

17

|

3.86

|

3.32

|

16

|

3.31

|

|

Variation of the period-end commercial selling rate for U.S. dollar (%)

|

16.6

|

1.5

|

15

|

16.0

|

0.5

|

16

|

4.4

|

|

Domestic basic oil products price (R$/bbl)

|

274.91

|

223.55

|

23

|

292.33

|

255.61

|

14

|

219.48

|

|

Brent crude (R$/bbl)

|

242.34

|

164.52

|

47

|

268.17

|

216.51

|

24

|

159.97

|

|

Brent crude (US$/bbl)

|

70.55

|

51.81

|

36

|

74.35

|

66.76

|

11

|

49.83

|

|

Domestic Sales Price

|

|

|

|

|

|

|

|

|

Crude oil (U.S. dollars/bbl)

|

65.00

|

48.98

|

33

|

67.78

|

62.27

|

9

|

47.25

|

|

Natural gas (U.S. dollars/bbl)

|

40.09

|

37.61

|

7

|

40.08

|

40.10

|

−

|

38.90

|

|

International Sales price

|

|

|

|

|

|

|

|

|

Crude oil (U.S. dollars/bbl)

|

63.07

|

45.03

|

40

|

65.87

|

60.18

|

9

|

43.77

|

|

Natural gas (U.S. dollars/bbl)

|

25.70

|

19.94

|

29

|

26.40

|

25.01

|

6

|

20.17

|

|

Total sales volume (Mbbl/d)**

|

|

|

|

|

|

|

|

|

Diesel

|

717

|

712

|

1

|

766

|

668

|

15

|

721

|

|

Gasoline

|

472

|

536

|

(12)

|

475

|

468

|

1

|

533

|

|

Fuel oil

|

42

|

53

|

(21)

|

35

|

49

|

(29)

|

50

|

|

Naphtha

|

94

|

145

|

(35)

|

91

|

97

|

(6)

|

125

|

|

LPG

|

228

|

231

|

(1)

|

238

|

218

|

9

|

238

|

|

Jet fuel

|

106

|

99

|

7

|

104

|

107

|

(3)

|

96

|

|

Others

|

164

|

167

|

(2)

|

167

|

161

|

4

|

170

|

|

Total oil products

|

1,823

|

1,943

|

(6)

|

1,876

|

1,768

|

6

|

1,933

|

|

Ethanol, nitrogen fertilizers, renewables and other products

|

64

|

105

|

(39)

|

65

|

63

|

3

|

112

|

|

Natural gas

|

345

|

335

|

3

|

349

|

340

|

3

|

350

|

|

Total domestic market

|

2,232

|

2,383

|

(6)

|

2,290

|

2,171

|

5

|

2,395

|

|

Crude oil, oil products and others exports

|

639

|

720

|

(11)

|

591

|

688

|

(14)

|

659

|

|

International sales

|

243

|

239

|

2

|

215

|

269

|

(20)

|

237

|

|

Total international market

|

882

|

959

|

(8)

|

806

|

957

|

(16)

|

896

|

|

Total

|

3,114

|

3,342

|

(7)

|

3,096

|

3,128

|

(1)

|

3,291

|

|

*

See definition of Adjusted EBITDA, Adjusted EBITDA Margin, Gross Margin, Total

capital expenditures and investments, Operating Margin and Net Margin in glossary and the respective reconciliation in Reconciliation of Adjusted EBITDA.

21

|

|

|

**

Operational data is not audited by the independent auditors.

|

|

4

1H-2018 x 1H-2017 Results

*

:

Net income for 1H-2018 was 3.6 times of the same period of previous year, reaching R$ 17,033 million. This result was possible due to the higher oil export margins, mainly due to the increase in Brent and the sale of oil products in Brazil, which more than compensated for the decrease in sales volume of oil products (mainly gasoline and naphtha) and export of oil.

The increase in operating expenses, due to higher sales expenses, negative results from oil hedges, lower gains from divestments and exchange rate variation on the Class Action balance, was offset by the reduction in equipment idleness, tax expenses and the improvement in financial results, reflecting the gain from the renegotiation of Eletrobras System debts and lower financing expenses.

Adjusted EBITDA and Free Cash Flow rose 26% and 29%, respectively, as a result of the increase in the domestic oil product sales margin and the oil export margin. In addition, the lower investments contributed to the increase in Free Cash Flow.

2Q-2018 x 1Q-2018 Results**:

Net income of R$ 10,072 million, compared to R$ 6,961 million in 1Q-2018, reflected the increase in the market share of diesel and gasoline, due to the reduction of imports by third parties, resulting in a 6% increase in sales in the domestic market, especially diesel, which grew 15%. There were also higher margins in oil exports, due to the increase in Brent and the sale of oil products, due to inventories formed at lower prices.

The increase in operating expenses, due to the negative result with the oil hedge and the price adjustments related to the closing of the sale of Roncador field and the exchange variation on the Class Action balance, was offset by the improvement in the financial result, reflecting the gain with the renegotiation of Eletrobras System debts and the reduction of financing expenses. It should also be noted that maintenance of administrative and sales expenses.

Adjusted EBITDA totaled R$ 30,067 million, an increase of 17% compared to R$ 25,768 million in 1Q-2018, due to higher sales margins.

Free Cash Flow reached R$ 16,373 million, an increase of 26%, reflecting the increase in operating cash generation due to higher oil export margins and sales of oil products in Brazil, combined with the lower investments.

|

*

Additional information about oper

ating results of 1H-2018 x 1H-2017, see item 6.

|

|

|

**

Additional information related to operating results 2Q-2018 x 1Q-2018, see item 7

.

|

|

5

Table 02 - Exploration & Production Main Indicators

|

|

R$ million

|

|

|

Jan-Jun

|

|

|

|

|

|

|

2018

|

2017

|

2018 x 2017 (%)

|

2Q-2018

|

1Q-2018

|

2Q18 X 1Q18 (%)

|

2Q-2017

|

|

Sales revenues

|

88,958

|

65,055

|

37

|

48,250

|

40,708

|

19

|

31,804

|

|

Brazil

|

87,173

|

63,598

|

37

|

47,294

|

39,879

|

19

|

31,109

|

|

Abroad

|

1,785

|

1,457

|

23

|

956

|

829

|

15

|

695

|

|

Gross profit

|

37,455

|

22,269

|

68

|

20,835

|

16,620

|

25

|

10,448

|

|

Brazil

|

36,618

|

21,794

|

68

|

20,415

|

16,203

|

26

|

10,265

|

|

Abroad

|

837

|

475

|

76

|

420

|

417

|

1

|

183

|

|

Operating expenses

|

(2,447)

|

(5,248)

|

53

|

(3,297)

|

850

|

(488)

|

(3,315)

|

|

Brazil

|

(2,171)

|

(4,205)

|

48

|

(3,188)

|

1,017

|

(413)

|

(2,395)

|

|

Abroad

|

(276)

|

(1,043)

|

74

|

(109)

|

(167)

|

35

|

(920)

|

|

Operating income (loss)

|

35,008

|

17,021

|

106

|

17,538

|

17,470

|

−

|

7,133

|

|

Brazil

|

34,447

|

17,589

|

96

|

17,227

|

17,220

|

−

|

7,871

|

|

Abroad

|

561

|

(568)

|

199

|

311

|

250

|

24

|

(738)

|

|

Net income (loss) attributable to the shareholders of Petrobras

|

23,128

|

11,371

|

103

|

11,592

|

11,536

|

−

|

4,871

|

|

Brazil

|

22,735

|

11,598

|

96

|

11,366

|

11,369

|

−

|

5,243

|

|

Abroad

|

393

|

(227)

|

273

|

226

|

167

|

35

|

(372)

|

|

Adjusted EBITDA of the segment*

|

49,515

|

32,844

|

51

|

26,856

|

22,659

|

19

|

15,014

|

|

Brazil

|

48,348

|

32,810

|

47

|

26,211

|

22,137

|

18

|

15,447

|

|

Abroad

|

1,167

|

34

|

3332

|

645

|

522

|

24

|

(433)

|

|

EBITDA margin of the segment (%)*

|

56

|

50

|

5

|

56

|

56

|

−

|

47

|

|

Capital expenditures of the segment

|

18,660

|

18,303

|

2

|

9,717

|

8,943

|

9

|

9,089

|

|

Average Brent crude (R$/bbl)

|

242.34

|

164.52

|

47

|

268.17

|

216.51

|

24

|

159.97

|

|

Average Brent crude (US$/bbl)

|

70.55

|

51.81

|

36

|

74.35

|

66.76

|

11

|

49.83

|

|

Sales price - Brazil

|

|

|

|

|

|

|

|

|

Crude oil (US$/bbl)

|

65.00

|

48.98

|

33

|

67.78

|

62.27

|

9

|

47.25

|

|

Sales price - Abroad

|

|

|

|

|

|

|

|

|

Crude oil (US$/bbl)

|

63.07

|

45.03

|

40

|

65.87

|

60.18

|

9

|

43.77

|

|

Natural gas (US$/bbl)

|

25.70

|

19.94

|

29

|

26.40

|

25.01

|

6

|

20.17

|

|

Crude oil and NGL production (Mbbl/d)**

|

2,134

|

2,237

|

(5)

|

2,122

|

2,146

|

(1)

|

2,225

|

|

Brazil

|

2,074

|

2,171

|

(4)

|

2,063

|

2,085

|

(1)

|

2,160

|

|

Abroad

|

39

|

42

|

(7)

|

38

|

40

|

(5)

|

42

|

|

Non-consolidated production abroad

|

21

|

24

|

(13)

|

21

|

21

|

−

|

23

|

|

Natural gas production (Mbbl/d)**

|

535

|

554

|

(3)

|

537

|

534

|

1

|

551

|

|

Brazil

|

498

|

500

|

−

|

500

|

497

|

1

|

498

|

|

Abroad

|

37

|

54

|

(31)

|

37

|

37

|

−

|

53

|

|

Total production

|

2,669

|

2,791

|

(4)

|

2,659

|

2,680

|

(1)

|

2,776

|

|

Lifting cost - Brazil (US$/barrel)

|

|

|

|

|

|

|

|

|

excluding production taxes

|

11.10

|

11.02

|

1

|

10.68

|

11.51

|

(7)

|

11.21

|

|

including production taxes

|

24.01

|

19.54

|

23

|

24.43

|

23.58

|

4

|

18.71

|

|

Lifting cost - Brazil (R$/barrel)

|

|

|

|

|

|

|

|

|

excluding production taxes

|

38.04

|

34.87

|

9

|

38.94

|

37.15

|

5

|

36.09

|

|

including production taxes

|

84.45

|

62.03

|

36

|

92.68

|

76.26

|

22

|

61.34

|

|

Lifting cost – Abroad without production taxes (US$/barrel)

|

5.40

|

5.12

|

5

|

5.87

|

4.91

|

20

|

5.67

|

|

Production taxes - Brazil

|

18,881

|

11,603

|

63

|

10,914

|

7,967

|

37

|

5,401

|

|

Royalties

|

8,365

|

5,969

|

40

|

4,658

|

3,707

|

26

|

2,847

|

|

Special participation charges

|

10,426

|

5,540

|

88

|

6,211

|

4,215

|

47

|

2,507

|

|

Retention of areas

|

90

|

94

|

(4)

|

45

|

45

|

−

|

47

|

|

Production taxes - Abroad

|

36

|

46

|

(22)

|

19

|

17

|

12

|

15

|

*

|

*

See definition of Adjusted EBITDA and Adjusted EBITDA Margin in Glossary and reconciliation in Reconciliation of Consoli

dated Adjusted EBITDA Statement by Segment.

|

|

|

**

Operational data is not audited by the independent auditors.

|

|

6

RESULT BY BUSINESS SEGMENT

EXPLORATION & PRODUCTION

|

1H-2018 x 1H-2017

|

|

2Q-2018 x 1Q-2018

|

|

Results

|

|

|

|

The growth in gross profit reflects the increase in Brent and the depreciation of Real, partially offset by lower production and higher production expenses.

The higher operating income was due to the increase in gross profit and the result of the assignment of the rights of Lapa, Iara and Carcará areas and the lower idleness of equipment.

|

|

The increase in gross profit was due to the growth in Brent and the depreciation of Real, partially offset by higher production expenses.

Operating Profit remained stable, despite the growth in gross profit, due to the price adjustments related to the closing of Roncador's disposal and the 1Q-2018 result with the assignment of rights to Lapa, Iara and Carcará area.

|

|

Operating Results

|

|

|

|

Production

|

|

|

|

The production of oil, NGL and natural gas decreased compared to the same period of last year, mainly due to the divestments in Lapa and Roncador fields, the natural decline of production, the end of the Extended Well Test in Itapu field, in Santos Basin, and the production stoppage at Hadrian South field in the USA.

|

|

Oil, NGL and natural gas production in 2Q18 decreased compared to 1Q18, mainly due to the maintenance stops in the second quarter of 2018 and the 25% stake sale of Roncador field, events that were partially offset by the start of production in Búzios field, with P-74.

|

|

Lifting Cost

|

|

|

|

The dollar indicator increased mainly due to the reduction in production and the higher expenses with well intervention.

In addition, we had higher production taxes as a result of the increase in international oil prices.

|

|

The dollar indicator decreased due to the appreciation of the dollar on the expenses in Reais, in addition to the lower expenses with well intervention.

In addition, we had higher production taxes as a result of the increase in international oil prices.

|

7

*

Table 03 -

Refining, Transportation and Marketing

Main Indicators

|

|

R$ million

|

|

|

Jan-Jun

|

|

|

|

|

|

|

2018

|

2017

|

2018 x 2017 (%)

|

2Q-2018

|

1Q-2018

|

2Q18 X 1Q18 (%)

|

2Q-2017

|

|

Sales revenues

|

120,760

|

105,230

|

15

|

65,431

|

55,329

|

18

|

51,301

|

|

Brazil (includes trading operations abroad)

|

125,193

|

107,645

|

16

|

67,793

|

57,400

|

18

|

52,747

|

|

Abroad

|

5,356

|

2,840

|

89

|

2,998

|

2,358

|

27

|

1,877

|

|

Eliminations

|

(9,789)

|

(5,255)

|

(86)

|

(5,360)

|

(4,429)

|

(21)

|

(3,323)

|

|

Gross profit

|

15,357

|

14,017

|

10

|

9,185

|

6,172

|

49

|

6,639

|

|

Brazil

|

15,218

|

14,117

|

8

|

9,016

|

6,202

|

45

|

6,690

|

|

Abroad

|

139

|

(100)

|

239

|

169

|

(30)

|

663

|

(51)

|

|

Operating expenses

|

(4,321)

|

(4,119)

|

(5)

|

(1,953)

|

(2,368)

|

18

|

(1,997)

|

|

Brazil

|

(4,279)

|

(4,031)

|

(6)

|

(1,936)

|

(2,343)

|

17

|

(1,967)

|

|

Abroad

|

(42)

|

(88)

|

52

|

(17)

|

(25)

|

32

|

(30)

|

|

Operating income (loss)

|

11,036

|

9,898

|

11

|

7,232

|

3,804

|

90

|

4,642

|

|

Brazil

|

10,939

|

10,086

|

8

|

7,080

|

3,859

|

83

|

4,723

|

|

Abroad

|

97

|

(188)

|

152

|

152

|

(55)

|

376

|

(81)

|

|

Net income (loss) attributable to the shareholders of Petrobras

|

8,315

|

7,530

|

10

|

5,259

|

3,056

|

72

|

3,470

|

|

Brazil

|

8,251

|

7,654

|

8

|

5,159

|

3,092

|

67

|

3,523

|

|

Abroad

|

64

|

(124)

|

152

|

100

|

(36)

|

378

|

(53)

|

|

Adjusted EBITDA of the segment*

|

14,703

|

13,953

|

5

|

8,843

|

5,860

|

51

|

6,730

|

|

Brazil

|

14,506

|

14,048

|

3

|

8,640

|

5,866

|

47

|

6,760

|

|

Abroad

|

197

|

(95)

|

307

|

203

|

(6)

|

3483

|

(30)

|

|

EBITDA margin of the segment (%)*

|

12

|

13

|

(1)

|

14

|

11

|

3

|

13

|

|

Capital expenditures of the segment

|

1,519

|

1,864

|

(19)

|

930

|

588

|

58

|

1,057

|

|

Domestic basic oil products price (R$/bbl)

|

274.91

|

223.55

|

23

|

292.33

|

255.61

|

14

|

219.48

|

|

Imports (Mbbl/d)**

|

266

|

316

|

(16)

|

353

|

179

|

97

|

341

|

|

Crude oil import

|

131

|

116

|

13

|

180

|

82

|

120

|

139

|

|

Diesel import

|

25

|

5

|

-

|

50

|

−

|

-

|

10

|

|

Gasoline import

|

5

|

10

|

(50)

|

7

|

3

|

133

|

7

|

|

Other oil product import

|

105

|

185

|

(43)

|

116

|

94

|

23

|

185

|

|

Exports (Mbbl/d)**

|

638

|

717

|

(11)

|

591

|

686

|

(14)

|

654

|

|

Crude oil export

|

462

|

548

|

(16)

|

429

|

496

|

(14)

|

487

|

|

Oil product export

|

176

|

169

|

4

|

162

|

190

|

(15)

|

167

|

|

Exports (imports), net

|

372

|

401

|

(7)

|

238

|

507

|

(53)

|

313

|

|

Refining Operations - Brazil (Mbbl/d)**

|

|

|

|

|

|

|

|

|

Oil products output

|

1,759

|

1,805

|

(3)

|

1,841

|

1,679

|

10

|

1,798

|

|

Reference feedstock

|

2,176

|

2,176

|

−

|

2,176

|

2,176

|

−

|

2,176

|

|

Refining plants utilization factor (%)

|

76

|

77

|

(1)

|

81

|

72

|

9

|

78

|

|

Processed feedstock (excluding NGL)

|

1,661

|

1,686

|

(1)

|

1,752

|

1,569

|

12

|

1,691

|

|

Processed feedstock

|

1,717

|

1,735

|

(1)

|

1,810

|

1,623

|

12

|

1,745

|

|

Domestic crude oil as % of total processed feedstock

|

94

|

94

|

−

|

93

|

94

|

(1)

|

93

|

|

Refining Operations - Abroad (Mbbl/d)**

|

|

|

|

|

|

|

|

|

Total processed feedstock

|

110

|

84

|

31

|

110

|

109

|

1

|

112

|

|

Oil products output

|

106

|

86

|

23

|

110

|

102

|

8

|

113

|

|

Reference feedstock

|

100

|

100

|

−

|

100

|

100

|

−

|

100

|

|

Refining plants utilization factor (%)

|

102

|

79

|

23

|

103

|

101

|

2

|

102

|

|

Refining cost - Brazil

|

|

|

|

|

|

|

|

|

Refining cost (US$/barrel)

|

2.64

|

2.95

|

(11)

|

2.36

|

2.96

|

(20)

|

2.86

|

|

Refining cost (R$/barrel)

|

9.05

|

9.38

|

(4)

|

8.57

|

9.58

|

(11)

|

9.28

|

|

Refining cost - Abroad (US$/barrel)

|

4.51

|

4.53

|

−

|

4.46

|

4.55

|

(2)

|

4.18

|

|

Sales volume (includes sales to BR Distribuidora and third-parties)**

|

|

|

|

|

|

|

|

|

Diesel

|

648

|

656

|

(1)

|

709

|

586

|

21

|

663

|

|

Gasoline

|

408

|

465

|

(12)

|

419

|

396

|

6

|

462

|

|

Fuel oil

|

42

|

57

|

(26)

|

35

|

50

|

(30)

|

57

|

|

Naphtha

|

94

|

145

|

(35)

|

91

|

97

|

(6)

|

125

|

|

LPG

|

228

|

231

|

(1)

|

238

|

217

|

9

|

239

|

|

Jet fuel

|

120

|

112

|

7

|

118

|

122

|

(4)

|

109

|

|

Others

|

181

|

183

|

(1)

|

181

|

179

|

1

|

181

|

|

Total domestic oil products (mbbl/d)

|

1,720

|

1,849

|

(7)

|

1,791

|

1,648

|

9

|

1,836

|

|

*

See definition of Adjusted EBITDA and Adjusted EBITDA Margin in Glossary and reconciliation in Reconciliation of Consolidated Adjusted EBITDA

Statement by Segment.

|

|

|

**

Operational data is not audited by the independent auditors.

|

|

8

REFINING, TRANSPORTATION AND MARKETING

|

1H-2018 x 1H-2017

|

|

2Q-2018 x 1Q-2018

|

|

Results

|

|

|

|

The increase in operating income was due to the higher sales margin of oil products as a result of the realization of inventories formed at lower prices. On the other hand, there were lower sales volumes.

|

|

The increase in operating income was due to the higher sales margin of oil products due to the realization of inventories formed at lower prices. In addition, there was an increase in sales volume and the market share of diesel and gasoline. Operating expenses were lower due to the reversal of impairment at the closing of the sale of Petroquímica Suape.

|

|

Operating Performance

|

|

|

|

Imports and Exports of Crude Oil and Oil Products

|

|

|

|

There was a reduction in net oil exports due to lower production.

Net export of oil products was due to the loss of market share from gasoline to ethanol and a reduction in sales of naphtha to Braskem.

|

|

The export of oil decreased mainly due to increased processed feedstock. There was also an increase in the oil imports due to higher processed feedstock and to the imported volume for the next quarter.

There was net import of oil products due to the increase in sales in the domestic market, mainly of diesel and gasoline.

|

|

Refining Operations

|

|

|

|

Processed feedstock was lower, mainly due to gasoline loss of market to ethanol.

|

|

Processed feedstock was higher, mainly due to the reduction of imports by third parties.

|

|

Refining Cost

|

|

|

|

The reduction in the indicator is due to cost efficiencies.

|

|

Refining cost was lower mainly reflecting an increase in processed feedstock.

|

|

|

|

|

9

Table 04 - Gas & Power Main Indicators

|

|

R$ million

|

|

|

Jan-Jun

|

|

|

|

|

|

|

2018

|

2017

|

2018 x 2017 (%)

|

2Q-2018

|

1Q-2018

|

2Q18 X 1Q18 (%)

|

2Q-2017

|

|

Sales revenues

|

19,596

|

16,971

|

15

|

10,398

|

9,198

|

13

|

9,268

|

|

Brazil

|

19,519

|

16,921

|

15

|

10,347

|

9,172

|

13

|

9,240

|

|

Abroad

|

77

|

50

|

54

|

51

|

26

|

96

|

28

|

|

Gross profit

|

6,121

|

4,984

|

23

|

2,756

|

3,365

|

(18)

|

2,541

|

|

Brazil

|

6,118

|

4,981

|

23

|

2,757

|

3,361

|

(18)

|

2,545

|

|

Abroad

|

3

|

3

|

−

|

(1)

|

4

|

(125)

|

(4)

|

|

Operating expenses

|

(4,718)

|

3,561

|

(232)

|

(2,144)

|

(2,574)

|

17

|

4,449

|

|

Brazil

|

(4,697)

|

3,596

|

(231)

|

(2,133)

|

(2,564)

|

17

|

4,475

|

|

Abroad

|

(21)

|

(35)

|

40

|

(11)

|

(10)

|

(10)

|

(26)

|

|

Operating income (loss)

|

1,403

|

8,545

|

(84)

|

612

|

791

|

(23)

|

6,990

|

|

Brazil

|

1,420

|

8,577

|

(83)

|

623

|

797

|

(22)

|

7,020

|

|

Abroad

|

(17)

|

(32)

|

47

|

(11)

|

(6)

|

(83)

|

(30)

|

|

Net income (loss) attributable to the shareholders of Petrobras

|

752

|

5,624

|

(87)

|

271

|

481

|

(44)

|

4,603

|

|

Brazil

|

796

|

5,602

|

(86)

|

298

|

498

|

(40)

|

4,599

|

|

Abroad

|

(44)

|

22

|

(300)

|

(27)

|

(17)

|

(59)

|

4

|

|

Adjusted EBITDA of the segment*

|

2,613

|

3,139

|

(17)

|

1,297

|

1,316

|

(1)

|

883

|

|

Brazil

|

2,627

|

3,149

|

(17)

|

1,307

|

1,320

|

(1)

|

893

|

|

Abroad

|

(14)

|

(10)

|

-

|

(10)

|

(4)

|

(150)

|

(10)

|

|

EBITDA margin of the segment (%)*

|

13

|

18

|

(5)

|

12

|

14

|

(2)

|

10

|

|

Capital expenditures of the segment

|

593

|

2,450

|

(76)

|

381

|

212

|

80

|

1,116

|

|

Physical and financial indicators - Brazil**

|

|

|

|

|

|

|

|

|

Electricity sales (Free contracting market - ACL) - average MW

|

888

|

778

|

14

|

873

|

903

|

(3)

|

797

|

|

Electricity sales (Regulated contracting market - ACR) - average MW

|

2,788

|

3,058

|

(9)

|

2,788

|

2,788

|

−

|

3,058

|

|

Generation of electricity - average MW

|

2,108

|

2,351

|

(10)

|

2,248

|

1,966

|

14

|

2,682

|

|

Electricity price in the spot market - Differences settlement price (PLD) - R$/MWh

|

237

|

221

|

7

|

288

|

186

|

55

|

286

|

|

Avaliability of Brazilian natural gas (Mbbl/d)

|

321

|

334

|

(4)

|

318

|

324

|

(2)

|

338

|

|

LNG imports (Mbbl/d)***

|

22

|

17

|

29

|

29

|

14

|

107

|

21

|

|

Natural gas imports (Mbbl/d)

|

141

|

132

|

7

|

143

|

140

|

2

|

146

|

*

|

*

See definition of Adjusted EBITDA and Adjusted EBITDA Margin in Glossary and reconciliation in Reconciliation of Consolidated Adjusted EBITDA Statement by Segment.

|

|

|

**

Operational data is not audited by the independent auditors.

|

|

|

***

Imports of regasified LNG have been considered as from the RMF 2Q-2018. Until the RMF 1Q-2018, it considered imports of LNG, regardless of its regasification within the analyzed period.

|

|

10

GAS & POWER

|

1H-2018 x 1H-2017

|

|

2Q-2018 x 1Q-2018

|

|

Results

|

|

|

|

Slightly higher gas sales prices led to an increase in gross profit. Nevertheless, operating income was lower mainly due to higher selling expenses resulting from the payment of tariffs for the use of gas pipelines, to the provision for expected credit losses in the gas supply to the thermoelectric segment in the North region, as well as to the gain on the sale of NTS in 2Q17.

|

|

Despite higher volumes and prices of natural gas, gross profit dropped due to higher acquisition costs, with LNG import volume, as a result of lower delivery of domestic gas and higher consumption by the thermoelectrical market.

The decrease in operational income was due to the provision for expected credit losses in the gas supply to the thermoelectric segment in the North region

|

|

Operating Performance

|

|

|

|

Physical and Financial Indicators

|

|

|

|

Increased imports of Bolivian natural gas and LNG due to lower domestic gas availability.

There was an increase in sales in the Free Contracting Environment (ACL) due to short-term market opportunities. The volume reduction in the Regulated Contracting Environment (RCA) is due to the termination of contracts.

The volume of energy generation showed a small drop as a result of a higher acquisition cost of the gas.

|

|

Increased imports of Bolivian natural gas and LNG due to higher demand from the thermoelectric segment and lower availability of domestic gas.

The negative variation in sales in the ACL is due to a reduction in the expected demand for contracts with third parties and lower realization of additional sales.

The increase in energy generation was a reflection of an unfavorable hydrological scenario in 2Q-2018, which caused increases in the Settlement Price of Differences (PLD) and in the thermoelectric dispatch.

|

11

Table 05 - Distribution Main Indicators

|

|

R$ million

|

|

|

Jan-Jun

|

|

|

|

|

|

|

2018

|

2017

|

2018 x 2017 (%)

|

2Q-2018

|

1Q-2018

|

2Q18 X 1Q18 (%)

|

2Q-2017

|

|

Sales revenues

|

48,090

|

41,239

|

17

|

24,674

|

23,416

|

5

|

20,327

|

|

Brazil

|

45,562

|

39,098

|

17

|

23,321

|

22,241

|

5

|

19,258

|

|

Abroad

|

2,528

|

2,141

|

18

|

1,353

|

1,175

|

15

|

1,069

|

|

Gross profit

|

2,944

|

2,869

|

3

|

1,373

|

1,571

|

(13)

|

1,326

|

|

Brazil

|

2,758

|

2,690

|

3

|

1,278

|

1,480

|

(14)

|

1,238

|

|

Abroad

|

186

|

179

|

4

|

95

|

91

|

4

|

88

|

|

Operating expenses

|

(2,133)

|

(1,952)

|

(9)

|

(1,104)

|

(1,029)

|

(7)

|

(967)

|

|

Brazil

|

(2,007)

|

(1,867)

|

(7)

|

(1,038)

|

(969)

|

(7)

|

(935)

|

|

Abroad

|

(126)

|

(85)

|

(48)

|

(66)

|

(60)

|

(10)

|

(32)

|

|

Operating income (loss)

|

811

|

917

|

(12)

|

269

|

542

|

(50)

|

359

|

|

Brazil

|

751

|

824

|

(9)

|

240

|

511

|

(53)

|

304

|

|

Abroad

|

60

|

93

|

(35)

|

29

|

31

|

(6)

|

55

|

|

Net income (loss) attributable to the shareholders of Petrobras

|

393

|

604

|

(35)

|

122

|

271

|

(55)

|

235

|

|

Brazil

|

353

|

542

|

(35)

|

102

|

251

|

(59)

|

198

|

|

Abroad

|

40

|

62

|

(35)

|

20

|

20

|

−

|

37

|

|

Adjusted EBITDA of the segment*

|

1,038

|

1,138

|

(9)

|

378

|

660

|

(43)

|

459

|

|

Brazil

|

953

|

1,043

|

(9)

|

337

|

616

|

(45)

|

414

|

|

Abroad

|

85

|

95

|

(11)

|

41

|

44

|

(7)

|

45

|

|

EBITDA margin of the segment (%)*

|

2

|

3

|

(1)

|

2

|

3

|

−

|

2

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures of the segment

|

195

|

148

|

32

|

111

|

84

|

32

|

77

|

|

|

|

|

|

|

|

|

|

|

Sales Volumes - Brazil (Mbbl/d)**

|

|

|

|

|

|

|

|

|

Diesel

|

290

|

290

|

−

|

292

|

288

|

2

|

295

|

|

Gasoline

|

168

|

190

|

(13)

|

165

|

170

|

(3)

|

191

|

|

Fuel oil

|

31

|

42

|

(26)

|

25

|

38

|

(35)

|

39

|

|

Jet fuel

|

53

|

50

|

5

|

51

|

54

|

(5)

|

48

|

|

Others

|

77

|

86

|

(10)

|

79

|

75

|

5

|

87

|

|

Total domestic oil products

|

619

|

659

|

(6)

|

612

|

625

|

(2)

|

659

|

*

|

*

Se

e definition of Adjusted EBITDA and Adjusted EBITDA Margin in Glossary and reconciliation in Reconciliation of Consolidated Adjusted EBITDA Statement by Segment.

|

|

|

**

Operational data is not audited by the independent auditors.

|

|

12

DISTRIBUTION

|

1H-2018 x 1H-2017

|

|

2Q-2018 x 1Q-2018

|

|

Results

|

|

|

|

Higher gross profit reflected the increase in average sales margins, mitigated by the lower sale volumes. Operating income decreased mainly due to the impact of the reversals in 2017 of the provision for indemnities of Voluntary Separation Plan, due to the withdrawals in the period, associated to the registration of the provision in 2018 for the program reopening.

|

|

The decrease in gross profit was due to the reduction in margins mainly to the loss of inventories due to the decrease in the price of diesel, as a result of the truck drivers' strike.

|

|

|

|

|

|

13

Liquidity and Capital Resources

Table 06 – Liquidity and Capital Resources

|

|

R$ million

|

|

|

Jan-Jun

|

|

|

|

|

|

2018

|

2017

|

2Q-2018

|

1Q-2018

|

2Q-2017

|

|

Adjusted cash and cash equivalents* at the beginning of period

|

80,731

|

71,664

|

70,267

|

80,731

|

63,783

|

|

Government bonds and time deposits with maturities of more than 3 months at the beginning of period

|

(6,237)

|

(2,556)

|

(3,905)

|

(6,237)

|

(2,909)

|

|

Cash and cash equivalents at the beginning of period

|

74,494

|

69,108

|

66,362

|

74,494

|

60,874

|

|

Net cash provided by (used in) operating activities

|

47,813

|

42,878

|

25,595

|

22,218

|

19,653

|

|

Net cash provided by (used in) investing activities

|

666

|

(11,311)

|

28

|

638

|

(3,049)

|

|

Capital expenditures, investments in investees and dividends received

|

(18,447)

|

(20,156)

|

(9,222)

|

(9,225)

|

(10,299)

|

|

Proceeds from disposal of assets (divestment)

|

16,880

|

9,455

|

9,378

|

7,502

|

7,582

|

|

Investments in marketable securities

|

2,233

|

(610)

|

(128)

|

2,361

|

(332)

|

|

(=) Net cash provided by operating and investing activities

|

48,479

|

31,567

|

25,623

|

22,856

|

16,604

|

|

Net financings

|

(64,806)

|

(23,487)

|

(34,199)

|

(30,607)

|

(2,257)

|

|

Proceeds from long-term financing

|

27,231

|

43,988

|

7,973

|

19,258

|

30,960

|

|

Repayments

|

(92,037)

|

(67,475)

|

(42,172)

|

(49,865)

|

(33,217)

|

|

Dividends paid to non- controlling interest

|

(903)

|

(410)

|

(903)

|

−

|

(410)

|

|

Acquisition of non-controlling interest

|

(23)

|

(142)

|

(144)

|

121

|

(12)

|

|

Effect of exchange rate changes on cash and cash equivalents

|

8,295

|

1,334

|

8,797

|

(502)

|

3,171

|

|

Cash and cash equivalents at the end of period

|

65,536

|

77,970

|

65,536

|

66,362

|

77,970

|

|

Government bonds and time deposits with maturities of more than 3 months at the end of period

|

4,060

|

3,317

|

4,060

|

3,905

|

3,317

|

|

Adjusted cash and cash equivalents* at the end of period

|

69,596

|

81,287

|

69,596

|

70,267

|

81,287

|

|

Reconciliation of Free Cash Flow

|

|

|

|

|

|

|

Net cash provided by (used in) operating activities

|

47,813

|

42,878

|

25,595

|

22,218

|

19,653

|

|

Capital expenditures, investments in investees and dividends received

|

(18,447)

|

(20,156)

|

(9,222)

|

(9,225)

|

(10,299)

|

|

Free cash flow*

|

29,366

|

22,722

|

16,373

|

12,993

|

9,354

|

As of June 30, 2018, the balance of cash and cash equivalents was R$ 65,536 million and the balance of adjusted cash and cash equivalents was R$ 69,596 million. The funds provided by net cash of operating activities of R$ 47,813 million, funding of R$ 27,231 million, receipts from the sale of assets of R$ 16,880 million were allocated to comply with debt service and financing of investments in the business areas.

Cash generation from operating activities was R$ 47,813 million, 12% higher than 1H-2017, due to the increase in oil exports margins and sale of oil product margins in the domestic market, partially offset by the decrease in volumes.

Capital expenditures totaled R$ 18,447 million in 1H-2018, a decrease of 8% compared to 1H-2017, being 89% in E&P business segment.

The above mentioned factors resulted in a positive Free Cash Flow* for the thirteenth consecutive quarter, from R$ 16,373 million in 2Q-2018 and R$ 29,366 million in 1H-2018, 29% higher than the first half of the previous year.

In 1H-2018, the company raised R$ 27,231 million, of which: (i) the offering of global notes in the international capital markets (maturities in 2029) amounting to R$ 6,359 million (US$ 1,962 million); (ii) funding in the national and international banking market, with an average term of 6.5 years, in the total amount of R$ 17,038 million and (iii) funding of R$ 3,549 in financing with export credit agencies.

In addition, the Company settled several loans and financing, with highlights to: (i) the repurchase and / or redemption of R$ 41,228 million (US$ 11,760 million) of global notes in the international capital market, with maturities between 2019 and 2043 with the payment of net premium to the holders of securities that delivered their securities in the operation in the amount of R$ 1,154 million; (ii) the prepayment of R$ 31,809 million of loans in the domestic and international banking market; and (iii) prepayment of R$ 2,385 million of financing from the BNDES.

Repayments of principal and interest were, respectively, R$ 81,506 million and R$ 10,531 million, totaling R$ 92,037 million in 1H-2018 and the nominal cash flow (

cash view

), including principal and interest payments, by maturity, is set out in R$ million, below:

Table 07 - N

ominal cash flow including principal and interest payments

|

|

Consolidated

|

|

Maturity

|

2018

|

2019

|

2020

|

2021

|

2022

|

2023 and thereafter

|

06.30.2018

|

12.31.2017

|

|

Principal

|

4,572

|

10,403

|

25,361

|

32,404

|

51,324

|

233,384

|

357,448

|

365,632

|

|

Interest

|

10,479

|

20,553

|

19,771

|

18,351

|

16,356

|

128,096

|

213,606

|

200,887

|

|

Total

|

15,051

|

30,956

|

45,132

|

50,755

|

67,680

|

361,480

|

571,054

|

566,519

|

*

|

*

See reconciliation of Adjus

ted Cash and Cash Equivalents in Net debt and definition of Adjusted Cash and Cash Equivalents and Free Cash Flow in glossary.

|

|

14

Consolidated debt

Between January and June 2018, gross debt in Reais fell 2%, mainly as a result of debt repayment, net debt increased 1% due to the depreciation of the real against the US dollar and the average maturity of the debt was 9.11 years (8.62 years as of December 31, 2017). The average financing rate increased from 6.1% in December 2017 to 6.2% in June 2018.

Current debt and non-current debt include finance lease obligations of R$ 87 million and R$ 666 million as of December 31, 2017, respectively (R$ 84 million and R$ 675 million on December 31, 2017).

The ratio between net debt

and the LTM Adjusted EBITDA

* decreased from 3.67 as of December 31, 2017 to 3.23 as of June 30, 2018 due to asset sales and positive free cash flow.

Table 08 -

Consolidated debt in reais

|

|

R$ million

|

|

|

06.30.2018

|

12.31.2017

|

Δ%

|

|

Current debt

|

15,353

|

23,244

|

(34)

|

|

Non-current debt

|

338,270

|

338,239

|

−

|

|

Total

|

353,623

|

361,483

|

(2)

|

|

Cash and cash equivalents

|

65,536

|

74,494

|

(12)

|

|

Government securities and time deposits (maturity of more than 3 months)

|

4,060

|

6,237

|

(35)

|

|

Adjusted cash and cash equivalents*

|

69,596

|

80,731

|

(14)

|

|

Net debt*

|

284,027

|

280,752

|

1

|

|

Net debt/(net debt+shareholders' equity) - Leverage

|

50%

|

51%

|

(1)

|

|

Total net liabilities*

|

780,686

|

750,784

|

4

|

|

(Net third parties capital / total net liabilities)

|

63%

|

64%

|

(1)

|

|

Net debt/Adjusted EBITDA ratio*

|

3.23

|

3.67

|

(12)

|

|

Average interest rate (% p.a.)

|

6.2

|

6.1

|

1

|

|

Net debt/Operating Cash Flow ratio*

|

3.11

|

3.25

|

(4)

|

Table 09 -

Consolidated debt in dollar

|

|

U.S.$ million

|

|

|

06.30.2018

|

12.31.2017

|

Δ%

|

|

Current debt

|

3,982

|

7,026

|

(43)

|

|

Non-current debt

|

87,730

|

102,249

|

(14)

|

|

Total

|

91,712

|

109,275

|

(16)

|

|

Net debt*

|

73,662

|

84,871

|

(13)

|

|

Average maturity of debt (years)

|

9.11

|

8.62

|

0.49

|

*

Table 10 -

Consolidated debt by rate, currency and maturity

|

|

R$ million

|

|

|

06.30.2018

|

12.31.2017

|

Δ%

|

|

Summarized information on financing

|

|

|

|

|

By rate

|

|

|

|

|

Floating rate debt

|

179,529

|

176,943

|

1

|

|

Fixed rate debt

|

173,341

|

183,781

|

(6)

|

|

Total

|

352,870

|

360,724

|

(2)

|

|

By currency

|

|

|

|

|

Brazilian Real

|

66,396

|

71,129

|

(7)

|

|

US Dollars

|

263,624

|

263,614

|

−

|

|

Euro

|

13,593

|

17,773

|

(24)

|

|

Other currencies

|

9,257

|

8,208

|

13

|

|

Total

|

352,870

|

360,724

|

(2)

|

|

By maturity

|

|

|

|

|

2018

|

10,203

|

23,160

|

(56)

|

|

2019

|

10,007

|

21,423

|

(53)

|

|

2020

|

24,811

|

31,896

|

(22)

|

|

2021

|

31,838

|

42,168

|

(24)

|

|

2022

|

50,998

|

59,594

|

(14)

|

|

2023 on

|

225,013

|

182,483

|

23

|

|

Total

|

352,870

|

360,724

|

(2)

|

|

*

See definition of Adjusted Cash and Cash Equivalents, Net Debt, Total Net Liabilities, Adjusted EBITDA, OCF and Leverage in glo

ssary and reconciliation in Reconciliation of LTM Adjusted EBITDA and LTM OCF.

|

|

15

ADDITIONAL

INFORMATION

|

|

1.

|

Reconciliation of Adjusted EBITDA

|

Our Adjusted EBITDA is a performance measure computed by using the EBITDA (net income before net finance income (expense), income taxes, depreciation, depletion and amortization). Petrobras presents the EBITDA according to Instrução CVM nº 527 of October 4, 2012, adjusted by items not considered as part of Company’s primary business, which include results in equity-accounted investments, results from disposal and write-offs of assets, impairment and cumulative foreign exchange adjustments reclassified to the income statement.

In calculating Adjusted EBITDA, we adjusted our EBITDA for the periods of 2018 by adding foreign exchange gains and losses resulting from provisions for legal proceedings denominated in foreign currencies. Legal provisions in foreign currencies primarily consist of Petrobras’s portion of the class action settlement provision created in December 2017. The foreign exchange gains or losses on legal provisions are presented in other income and expenses for accounting purposes but management does not consider them to be part of the Company’s primary business, as well as they are substantially similar to the foreign exchange effects presented within net finance income. No adjustments have been made to the comparative measures presented as amounts were not significant in these periods.

The LTM Adjusted EBITDA reflects the sum of the last twelve months of Adjusted EBITDA and represents an alternative measure to our net cash provided by operating activities. This measure is used to calculate the metric Net Debt/LTM Adjusted EBITDA, which is established in the Business Plan 2018-2022, to support management’s assessment of liquidity and leverage.

EBITDA, Adjusted EBITDA and LTM Adjusted EBITDA are not defined in the International Financial Reporting Standards – IFRS. Our calculation may not be comparable to the calculation of Adjusted EBITDA by other companies and it should not be considered as a substitute for any measure calculated in accordance with IFRS. These measures must be considered in conjunction with other measures and indicators for a better understanding of the Company's operational performance and financial conditions.

Table 11 - Reconciliation of Adjusted EBITDA

|

|

R$ million

|

|

|

Jan-Jun

|

|

|

|

|

|

|

2018

|

2017

|

2017 X 2016 (%)

|

2Q-2018

|

1Q-2018

|

2Q18 X 1Q18 (%)

|

2Q-2017

|

|

Net income (loss)

|

16,816

|

5,099

|

230

|

9,691

|

7,125

|

36

|

292

|

|

Net finance income (expense)

|

9,893

|

16,590

|

(40)

|

2,647

|

7,246

|

(63)

|

8,835

|

|

Income taxes

|

8,593

|

8,798

|

(2)

|

4,638

|

3,955

|

17

|

6,478

|

|

Depreciation, depletion and amortization

|

22,020

|

21,148

|

4

|

10,963

|

11,057

|

(1)

|

10,382

|

|

EBITDA

|

57,322

|

51,635

|

11

|

27,939

|

29,383

|

(5)

|

25,987

|

|

Share of earnings in equity-accounted investments

|

(821)

|

(1,227)

|

33

|

(310)

|

(511)

|

39

|

(615)

|

|

Impairment losses / (reversals)

|

(119)

|

207

|

(157)

|

(177)

|

58

|

(405)

|

228

|

|

Realization of cumulative translation adjustment

|

−

|

116

|

(100)

|

−

|

−

|

−

|

−

|

|

Gains/ losses on disposal/ write-offs of non-current assets*

|

(2,123)

|

(6,383)

|

67

|

1,138

|

(3,261)

|

135

|

(6,506)

|

|

Foreign exchange gains or losses on material provisions for legal proceedings

|

1,576

|

−

|

−

|

1,477

|

99

|

1,392

|

−

|

|

Adjusted EBITDA

|

55,835

|

44,348

|

26

|

30,067

|

25,768

|

17

|

19,094

|

|

Income Tax

|

(8,593)

|

(8,798)

|

2

|

(4,638)

|

(3,955)

|

(17)

|

(6,478)

|

|

Allowance of impairment of other receivables

|

1,483

|

1,458

|

2

|

1,040

|

443

|

135

|

1,464

|

|

Change in Accounts receivables

|

(5,034)

|

383

|

(1,414)

|

(6,844)

|

1,810

|

(478)

|

(1,130)

|

|

Change in inventory

|

(6,526)

|

823

|

(893)

|

(5,384)

|

(1,142)

|

(371)

|

(391)

|

|

Change in suppliers

|

1,046

|

(2,381)

|

144

|

2,403

|

(1,357)

|

277

|

909

|

|

Change in deferred income tax, social contribution

|

1,164

|

5,399

|

(78)

|

531

|

633

|

(16)

|

3,905

|

|

Change in tax and contributions

|

2,575

|

3,278

|

(21)

|

2,111

|

464

|

355

|

3,242

|

|

Other assets and liabilities

|

5,863

|

(1,632)

|

459

|

6,309

|

(446)

|

1,515

|

(962)

|

|

Funds generated by operating activities (OCF)

|

47,813

|

42,878

|

12

|

25,595

|

22,218

|

15

|

19,653

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA margin (%)

|

35

|

33

|

2

|

36

|

35

|

1

|

29

|

*

In 2018, it primarily includes the results with divestments. In 2017, it primarily includes returned areas, canceled projects and the gain with NTS divestment.

16

|

|

2.

|

Reconciliation of Operating Cash Flow

|

Table 12 - Reconciliation of OCF

|

|

R$ million

|

|

|

Last Twelve Months

|

|

|

06.30.2018

|

31.12.2017

|

|

Net income (loss)

|

12,094

|

377

|

|

Net finance income (expense)

|

24,902

|

31,599

|

|

Income taxes

|

5,592

|

5,797

|

|

Depreciation, depletion and amortization

|

43,350

|

42,478

|

|

EBITDA

|

85,938

|

80,251

|

|

Share of earnings in equity-accounted investments

|

(1,743)

|

(2,149)

|

|

Impairment losses / (reversals)

|

3,536

|

3,862

|

|

Realization of cumulative translation adjustment

|

−

|

116

|

|

Gains/ losses on disposal/ write-offs of non-current assets*

|

(1,263)

|

(5,523)

|

|

Foreign exchange gains or losses on material provisions for legal proceedings

|

1,576

|

-

|

|

Adjusted EBITDA

|

88,044

|

76,557

|

|

Income Tax

|

(5,592)

|

(5,797)

|

|

Allowance of impairment of other receivables

|

2,296

|

2,271

|

|

Change in Accounts receivables

|

(8,557)

|

(3,140)

|

|

Change in inventory

|

(8,479)

|

(1,130)

|

|

Change in suppliers

|

3,267

|

(160)

|

|

Change in deferred income tax, social contribution

|

(2,783)

|

1,452

|

|

Change in tax and contributions

|

6,208

|

6,911

|

|

Other assets and liabilities

|

16,998

|

9,503

|

|

Funds generated by operating activities (OCF)

|

91,402

|

86,467

|

*

|

*