Bank of New York Mellon -- Earnings Review

July 19 2018 - 7:20AM

Dow Jones News

By Kimberly Chin

Bank of New York Mellon Corp. (BK) reported its second-quarter

earnings Thursday. Here's what you need to know:

EARNINGS: The bank reported net income of $1.1 billion, or

earnings of $1.03 a share, up 14% from the same period last year.

That was slightly more than the $1 billion in net income, or $1.02

a share, analysts polled by Thomson Reuters expected.

REVENUE: Revenue increased 5% to $4.1 billion, helped by higher

interest rates and stronger markets. This was in line with

analysts' expectations. Fee revenue increased 3% and net interest

revenue increased 11%, driven by underlying growth in some of its

franchises.

EXPENSES: Noninterest expense increased 3% to $2.7 billion due

to a weaker U.S. dollar, higher real-estate consolidation expenses

and technology investments.

ASSETS UNDER CUSTODY AND MANAGEMENT: Assets under custody and

administration increased 8% to $33.6 trillion, while assets under

management increased 2% to $1.8 trillion. This was slightly weaker

due to the divestiture of CenterSquare Investment Management

earlier in the year.

ASSET-SERVICING REVENUE: Much of the custodial bank's revenue is

derived from managing the money of big banks, asset managers and

the investments of clients. Its asset-servicing revenue was up 10%

to $1.5 billion, much of that from Pershing LLC, a subsidiary of

the bank. Revenue from Pershing was $558 million.

DIVIDENDS: The bank authorized a quarterly common stock dividend

of 28 cents a share.

Write to Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

July 19, 2018 07:05 ET (11:05 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

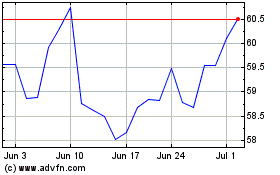

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Aug 2024 to Sep 2024

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Sep 2023 to Sep 2024