Fox, Disney Reach Sweetened Merger Agreement -- Update

June 20 2018 - 9:02AM

Dow Jones News

By Keach Hagey

21st Century Fox and Walt Disney Co. announced a new merger

agreement Wednesday, increasing the value of their deal and adding

a cash component.

Under the new deal, Disney agreed to acquire Fox's entertainment

assets for more than $70 billion, compared with the original deal

price of $52.4 billion in stock and Comcast's roughly $65 billion

all-cash offer.

Fox shareholders could choose to take the new Disney offer in

cash or stock, subject to a 50% stock, 50% cash proration.

Fox, in a statement, said the new Disney deal "is superior to

the proposal" made by the Comcast Corp. earlier this month.

Shares of Fox rose 5.1%, while Disney shares increased nearly

2%. Comcast shares slid 0.3% to $32.71.

The assets in play include the Twentieth Century Fox film and TV

studio; U.S. cable networks including FX and regional sports

channels; international assets including Sky PLC and Star India;

and Fox's one-third stake in the streaming service Hulu.

Neither proposed deal includes Fox News, Fox Sports 1, the Fox

broadcast network or its television stations. In either scenario,

those assets would be spun off into a new company, for the moment,

dubbed "New Fox."

Before it struck a deal with Disney, Fox rejected an offer from

Comcast that was 16% higher on a per-share basis. Comcast then

revived its pursuit this year.

Fox's board and shareholders have had to weigh a number of

factors as they consider which suitor is best. The total price, or

equity value, of the offer is one major consideration, of

course.

But the structure of the offer also matters. Some Fox

shareholders might prefer a premium cash offer like the one Comcast

is offering, even though the capital gains would be taxable.

Other shareholders, particularly the large institutional

shareholders that are Fox's biggest investors, tend to care much

less about taxes, Mr. Willens added.

People close to Fox have said that the Murdochs are looking for

the best financial deal and are working in the best interests of

all shareholders. 21st Century Fox and Wall Street Journal parent

News Corp share common ownership.

If Fox leans toward a cash-heavy deal, Disney is in position to

inject cash into its offer, people familiar with the matter

say.

In addition to its tax benefits, Disney's stock deal has the

potential long-term benefit of giving Fox investors the upside of

any rise in Disney's stock, which analysts expect to be

substantial. However, such an outcome is also, by definition,

uncertain.

Regulatory hurdles are also a consideration. The Justice

Department would have to sign off on either deal, and Fox cited

regulatory concerns among its reasons for rebuffing Comcast's

initial approach.

However, last week, a judge struck down the Justice Department's

attempt to block AT&T's acquisition of Time Warner Inc. Comcast

believes the court's approval of a "vertical" merger between a

distributor and a content company should nullify Fox's regulatory

concerns, since a Comcast-Fox tie-up would have similar

characteristics, people close to the cable giant say.

Write to Keach Hagey at keach.hagey@wsj.com

(END) Dow Jones Newswires

June 20, 2018 08:47 ET (12:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

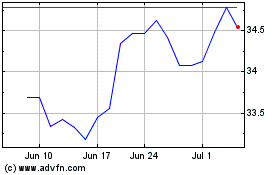

Fox (NASDAQ:FOXA)

Historical Stock Chart

From Apr 2024 to May 2024

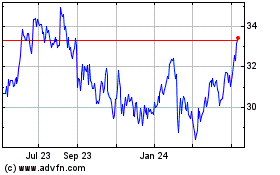

Fox (NASDAQ:FOXA)

Historical Stock Chart

From May 2023 to May 2024