Some companies adjust operations to comply with new revenue

regulations

By Tatyana Shumsky

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (June 13, 2018).

New accounting rules are prompting some corporate finance chiefs

to change how they do business.

More than half of the S&P 500 companies disclosed some

impact on their accounting policies since December, when new rules

unified how companies account for revenues from sales and services.

The change, which was in the works for more than a decade, replaces

previously disparate, industry-specific rules and aligns U.S.

standards closer to international guidelines.

For finance chiefs of some companies, including Red Hat Inc.,

Ciena Corp. and Mosaic Co., adopting the new revenue recognition

standard from the Financial Accounting Standards Board means

adjusting their business operations to be in line with the new

accounting framework, which is more focused on contracts and when

goods and services are delivered to customers.

Around 380 companies in the stock index have reported under the

new rules as of June 8, and 294 companies in the index disclosed an

impact on financial statements from adopting the standard,

according to Audit Analytics.

Finance teams spent months rewriting accounting processes and

procedures and preparing new financial statements to comply with

the new rules. Roughly one in five public companies surveyed by

PricewaterhouseCoopers LLP said they spent or expected to spend $1

million or more on this effort.

Software-service provider Red Hat previously would tailor the

price for its subscription bundles for each customer. Now, the

Raleigh, N.C., company will have uniform pricing and discounts for

clients of its open-source software, said Chief Financial Officer

Eric Shander. The new reporting rules require companies to more

thoroughly account for the cost of sales, such as discounts and

marketing efforts.

"We're being much more prescriptive on where you're placing the

discount, " Mr. Shander said. "It will be more standardized." The

company closed 169 deals over $1 million during its fourth quarter,

and 81% of them included multiple technologies, he said.

Some companies expect the new rules to accelerate revenue, while

others say the timing of when they can record revenue as earned

will be delayed, even though their underlying business remains

unchanged.

Telecommunications networking-equipment maker Ciena expects to

recognize some of its revenue sooner when it switches over to the

new rules in November, said CFO Jim Moylan. The company's fiscal

year ends in October, giving it some extra time to make the

transition.

"We are certainly talking about how we will restructure our

contracts in a way to get access to that favorable accounting," Mr.

Moylan said.

In the past, Ciena would sell and install its

internet-networking equipment, but only pass title and control to

the customer when everything was deployed. Under the new accounting

rules, the company plans to pass title to its customers sooner so

it can record revenue on the equipment first, and later book the

revenue on the service as it deploys that equipment, Mr. Moylan

said.

"We want to make sure that we're structuring our contracts so

that change of title occurs perhaps earlier than it would have," he

said.

Other companies doubled down on explaining the accounting

changes to investors. Dunkin' Brands Group Inc. held a special call

with analysts and investors last October to discuss pending revenue

accounting changes. CFO Kate Jaspon again walked stakeholders

through the new math during the company's analyst and investor day

in February.

Dunkin' now records its franchise fees over the term of the

related license, among other changes. Previously, Dunkin'

recognized franchise fees up front, either when a new restaurant

was opened or when a renewal agreement became effective.

"Given the sweeping changes to revenue accounting rules, we felt

it was important to educate our investment community on the impacts

to our financial results early in the process and with great

transparency," Ms. Jaspon said in a statement. "In doing so, we

were able to transition into 2018 with a focus on the fundamentals

of our underlying business, which have not changed, and limit any

investor confusion from accounting rule changes."

But other companies are opting to adjust operating practices,

where possible, rather than disrupt the pattern of revenue

investors have come to expect of the business.

Fertilizer maker Mosaic changed some of its arrangements and

systems to ensure that revenue could be recorded when control of

its products -- potash and phosphate -- transferred to the

customer.

"The policy changes did not affect our business economics," said

a Mosaic spokesman, adding that the company complied with the new

accounting rules while also providing investors with consistent

information.

Most businesses say the tweaks are a way to keep the accounting

outcome under the new rules consistent with that of the old rules,

said Adam Brown, national assurance managing partner for accounting

at BDO USA.

"If historically they've had revenue as you go, then that's

where they will consider some changes to preserve when revenue gets

booked," Mr. Brown said.

(END) Dow Jones Newswires

June 13, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

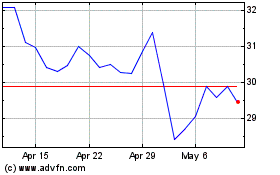

Mosaic (NYSE:MOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

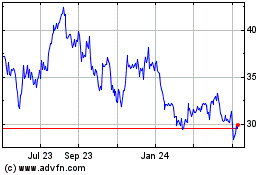

Mosaic (NYSE:MOS)

Historical Stock Chart

From Apr 2023 to Apr 2024