Report of Foreign Issuer (6-k)

May 15 2018 - 8:38AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

6-K

Report of

Foreign Private Issuer

Pursuant to Rule

13a-16

or

15d-16

under

the Securities Exchange Act of 1934

For the month of May 2018

Commission File

No. 000-54189

MITSUBISHI

UFJ FINANCIAL GROUP, INC.

(Translation of registrant’s name into English)

7-1,

Marunouchi

2-chome,

Chiyoda-ku

Tokyo

100-8330,

Japan

(Address of principal executive office)

Indicate by

check mark whether the registrant files or

will file annual reports under cover of Form

20-F

or Form

40-F.

Form

20-F

X

Form

40-F

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(7):

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 15, 2018

|

|

|

|

|

Mitsubishi UFJ Financial Group, Inc.

|

|

|

|

|

By:

|

|

/s/ Zenta Morokawa

|

|

Name:

|

|

Zenta Morokawa

|

|

Title:

|

|

Managing Director, Head of

Documentation & Corporate

Secretary Department,

|

|

|

|

Corporate Administration Division

|

Mitsubishi UFJ Financial Group, Inc. (MUFG)

Dividends for the Fiscal Year Ended March 31, 2018

and Annual Dividend Forecast

for the Fiscal Year Ending March 31, 2019

Tokyo, May

15, 2018

— MUFG hereby announces that its Board of Directors today resolved to pay the

year-end

dividends as stated below. The record date thereof is March 31, 2018.

MUFG will submit the proposal

therefor at the General Meeting of Shareholders to be held on June 28, 2018.

The annual dividend forecast for the fiscal year ending March 31,

2019 is also stated below.

|

1.

|

Dividends for the Fiscal Year Ended March 31, 2018

|

|

(1)

|

Description of Dividends

|

|

|

|

|

|

|

|

|

|

|

|

Determined

amount

|

|

Most recent

dividend forecast

(announced on

February 2, 2018)

|

|

Actual results for

previous fiscal year

(ended March 31, 2017)

|

|

Record date

|

|

March 31, 2018

|

|

March 31, 2018

|

|

March 31, 2017

|

|

Dividends per share

|

|

¥10

|

|

¥9

|

|

¥9

|

|

Total amount of dividends

|

|

¥131,934 million

|

|

—

|

|

¥121,160 million

|

|

Effective date

|

|

June 29, 2018

|

|

—

|

|

June 30, 2017

|

|

Resource of the dividends

|

|

Retained earnings

|

|

—

|

|

Retained earnings

|

MUFG’s basic policies call for continuously seeking to improve shareholder returns, focusing on

dividends in the pursuit of an optimal balance with solid equity capital and strategic investment for growth.

MUFG will aim for the stable and

sustainable increase in dividends per share through profit growth, with a dividend payout ratio target of 40%. MUFG will flexibly repurchase its own shares as part of its shareholder return strategies in order to improve capital efficiency. Also, in

principle, MUFG will hold a maximum of approximately 5% of the total number of issued shares, and cancel the shares that exceed this amount.

Based on

these policies, MUFG proposes the

year-end

dividend of ¥10 per share. Combined with the interim dividend of ¥9 per share, annual dividends will total ¥19 per share, an increase ¥1 per share

over the previous fiscal year.

1

|

2.

|

Annual Dividend Forecast for the Fiscal Year Ending March 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends per share (¥)

|

|

|

Record Date

|

|

Interim

dividends

|

|

|

Year-end

dividends

|

|

|

Annual

dividends

|

|

|

Dividend forecast (Fiscal year ending March 31, 2019)

|

|

¥

|

10

|

|

|

¥

|

10

|

|

|

¥

|

20

|

|

(Reference)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends per share (¥)

|

|

|

Record Date

|

|

Interim

dividends

|

|

|

Year-end

dividends

|

|

|

Annual

dividends

|

|

|

Actual result for fiscal year ended March 31, 2018

|

|

¥

|

9

|

|

|

¥

|

10

|

*

|

|

¥

|

19

|

*

|

|

Actual result for fiscal year ended March 31, 2017

|

|

¥

|

9

|

|

|

¥

|

9

|

|

|

¥

|

18

|

|

|

*

|

The

year-end

dividend for the fiscal year ended March 31, 2018 (¥10) is based on the assumption that it will be approved at the General Meeting of Shareholders to be held

on June 28, 2018

|

- End -

About MUFG

Mitsubishi UFJ Financial Group, Inc. (MUFG)

is one of the world’s leading financial groups. Headquartered in Tokyo and with over 360 years of history, MUFG has a global network with over 1,800 locations in more than 50 countries. The Group has over 150,000 employees and offers

services including commercial banking, trust banking, securities, credit cards, consumer finance, asset management, and leasing. The Group aims to “be the world’s most trusted financial group” through close collaboration among our

operating companies and flexibly respond to all of the financial needs of our customers, serving society, and fostering shared and sustainable growth for a better world. MUFG’s shares trade on the Tokyo, Nagoya, and New York stock exchanges.

For more information, visit

https://www.mufg.jp/english

.

2

On April 1, 2018 the name of MUFG’s commercial bank changed from “The Bank of Tokyo-Mitsubishi

UFJ, Ltd.” to “MUFG Bank, Ltd.” Many of the bank’s overseas subsidiaries followed suit on the same day, but branches and subsidiaries in some countries will carry out the name change at a later date. MUFG’s New York Stock

Exchange ticker symbol also changed to “MUFG.”

For more information regarding overseas subsidiaries, visit

http://www.bk.mufg.jp/global/newsroom/announcements/pdf/201803_namechange.pdf

Press contact:

Kana Nagamitsu

Public Relations Division

Tokyo/Head Office

Mitsubishi UFJ Financial Group, Inc.

T

+81-3-3240-7651

E

kana_nagamitsu@mufg.jp

|

|

|

This press release contains forward-looking statements regarding estimates, forecasts, etc. in relation to the results of operations, financial conditions and

other general management of MUFG and/or the group as a whole (the “forward-looking statements”). The forward-looking statements are made based upon, among other things, MUFG’s current estimates, perceptions and evaluations. In

addition, in order for MUFG to adopt such estimates, forecasts, etc. regarding future events, certain assumptions have been made. Accordingly, the statements and assumptions are inherently not guarantees of future performance and may result in

inaccuracy from an objective point of view and in material differences from actual results. There exist a number of factors that might lead to uncertainties and risks. For the main matters that may be currently forecast, please see the most recent

Financial Highlights, the Annual Securities Report, Disclosure Book, and Annual Report, and other disclosures that MUFG has announced.

|

3

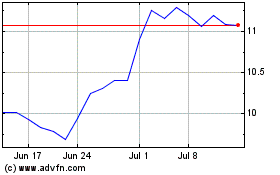

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

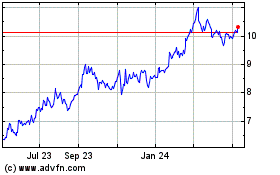

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024