Higher Spending Benefits Mastercard -- WSJ

May 03 2018 - 3:02AM

Dow Jones News

By AnnaMaria Andriotis and Imani Moise

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 3, 2018).

Mastercard Inc. reported higher-than-expected profit and revenue

for the first quarter due to increased consumer spending and

confidence.

The company, which is the second-largest U.S. card network,

increased guidance for its 2018 revenue, a sign that it believes

the healthy economic environment will continue. It also increased a

key expense growth projection as the company accelerates

investments in several areas, including security.

Mastercard reported a profit of $1.49 billion, or $1.41 a share,

up from $1.08 billion, or $1 a share, a year earlier. On an

adjusted basis, earnings rose 49% to $1.50 a share from a year

earlier. Analysts surveyed by Thomson Reuters had expected

$1.25.

Shares climbed 3.5% to $186.80 in morning trading, higher than

the record closing price of $183.24 set in March. The stock has

gained 22.5% so far this year while the S&P 500 has inched 0.8%

lower.

Gross dollar volume, or the total value of all transactions on

credit, debit and prepaid cards processed by the company, rose 14%

to $1.4 trillion.

The payment giant said revenue jumped 31% to $3.58 billion,

topping the $3.25 billion forecast by analysts. The company's

top-line was helped by acquisitions and an increase in cardholders

using their cards outside of the country they are issued in.

Cross-border volume fee revenue increased 26% from a year prior.

The company also increased its organic net revenue growth guidance

to mid-teens percent growth for the year, up slightly from the

previous guidance.

The company is benefiting from a strong credit-card market as

consumers shift more of their spending to cards. Most large U.S.

banks that issue credit cards reported increases in credit-card

purchase volume in the first quarter.

Mastercard's finance chief, Martina Hund-Mejean, said on the

earnings call that cross-border volumes in April, through April 28,

grew 19% globally. That was down from the 21% cross-border volume

growth in the first quarter, in part due to the drop-off of issuers

allowing cryptocurrency wallet funding. Large U.S. issuers,

including Citigroup Inc, Bank of America Corp., and Capital One

Financial Corp., said during the first quarter that they would no

longer allow consumers to buy bitcoin with their credit cards.

Mastercard's operating expenses totaled $1.64 billion, up 35%

from a year prior, excluding special items relating to litigation

provisions. General and administrative expenses, which make up the

majority of the company's expenses, increased 36%. Advertising and

marketing expenses rose 32% to $224 million. Mastercard also

increased its organic expense growth guidance to high-single digit

percent growth from mid-single digits previously.

Following the earnings call, Mastercard said in a regulatory

filing that it took a $19 million charge in the first quarter

relating to settlements with U.K. merchants and a $70 million

charge resulting from settlements with more than 70 European

claimants.

Merchants "have filed or threatened litigation with respect to

interchange rates in Europe for purported damages exceeding $1

billion," the company said. Interchange fees are set by card

networks, including Mastercard, and paid by merchants to the banks

that issue cards when consumers shop with them. Merchants in the

U.S. and abroad have long argued that these fees, in particular

with credit cards, are too high.

Regarding its efforts to expand in China, Mastercard CEO Ajay

Banga said the company applied for a domestic license with a joint

venture and that it is waiting for clarity from the Chinese

government. The Wall Street Journal reported in April that

Mastercard had formed a partnership with three Chinese entities,

had applied with the central bank to conduct card-clearing and

settlement transactions in the country, and that its joint-venture

application hadn't yet been accepted by the People's Bank of

China.

Separately, Mr. Banga discussed his support for a move to a

single-pay button at online checkout. Visa and Mastercard said in

April they are planning a move toward a shared pay button on which

consumers can save their payment credentials. This would replace

the individual pay buttons that card networks have rolled out in

recent years.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com and

Imani Moise at imani.moise@wsj.com

(END) Dow Jones Newswires

May 03, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

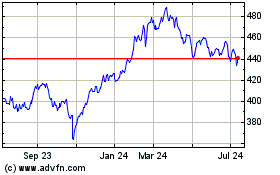

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

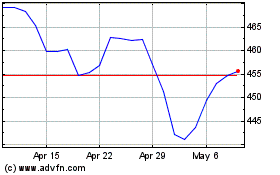

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024