Current Report Filing (8-k)

April 10 2018 - 4:52PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15 (d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 10, 2018

|

|

|

|

|

BABCOCK & WILCOX ENTERPRISES, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

DELAWARE

|

001-36876

|

47-2783641

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

13024 BALLANTYNE CORPORATE PLACE, SUITE 700

CHARLOTTE, NORTH CAROLINA

|

28277

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s Telephone Number, including Area Code:

(704) 625-4900

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

|

|

|

|

Item 2.02

|

Results of Operations and Financial Condition.

|

Babcock & Wilcox Enterprises, Inc. (the “

Company

”) is currently in the process of finalizing its financial results for the three months ended March 31, 2018. On April 10, 2018, the Company issued a press release announcing, among other things, information regarding performance through first quarter of 2018. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

|

|

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On April 10, 2018, the Company announced that Jenny L. Apker will retire as Senior Vice President and Chief Financial Officer of the Company, effective as of June 1, 2018, for health-related reasons. The retirement of Ms. Apker was not due to any disagreement with the Company on any matter relating to the Company’s operations, policies or practices. Ms. Apker will remain employed by the Company as a non-executive employee through August 31, 2018 to assist with the Company’s transition to a new Chief Financial Officer.

On April 10, 2018, the Company also announced that the Board of Directors (the “

Board

”) of the Company has appointed Joel K. Mostrom as the interim Chief Financial Officer of the Company, effective as of June 1, 2018 or such earlier date that Ms. Apker ceases to serve as the Chief Financial Officer of the Company.

Mr. Mostrom, age 61, has served as a Senior Director with Alvarez & Marsal North America, LLC, a global professional services firm (“

Alvarez & Marsal

”), since September 2009. Pursuant to an existing professional services agreement between the Company and Alvarez & Marsal, Mr. Mostrom will continue to receive his salary and benefits from Alvarez & Marsal. In connection with the appointment of Mr. Mostrom as interim Chief Financial Officer of the Company, the Company expects to pay Alvarez & Marsal an additional $130,000 per month under the professional services agreement.

Except as described above, there are no arrangements or understandings between Mr. Mostrom and any other persons pursuant to which Mr. Mostrom was named interim Chief Financial Officer of the Company. Mr. Mostrom does not have any family relationship with any of the Company’s directors or executive officers or any persons nominated or chosen by the Company to be a director or executive officer. Mr. Mostrom does not have any direct or indirect material interest in any transaction or proposed transaction required to be reported under Item 404(a) of Regulation S-K.

On April 10, 2018, the Company announced that it is extending the expiration date and amending certain other terms regarding the Company’s previously announced rights offering (“

Rights Offering

”), which commenced on March 19, 2018. Pursuant to the Rights Offering, the Company distributed one nontransferable subscription right (a “

Right

”) to purchase additional shares of common stock, par value $0.01 per share (the “

Common Shares

”), for each Common Share held as of 5:00 p.m., New York City time, on March 15, 2018 (the “

Rights Distribution Record Date

”).

Each Right now entitles holders to purchase 2.8

Common Shares at a price of $2.00 per share. The Rights may be exercised at any time during the subscription period, and the Rights will now expire if they are not exercised by 5:00 p.m., New York City time, on April 30, 2018, unless the Company further extends the Rights Offering. The Company expects to mail revised subscription certificates evidencing the Rights and a copy of the prospectus supplement for the Rights Offering to shareholders as of the Rights Distribution Record Date beginning on or about April 11, 2018.

On April 10, 2018, the Company issued a press release announcing updates to its 2018 guidance, as well as additional information regarding performance through first quarter of 2018. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference. On April 10, 2018, the Company also issued a press release regarding the amended terms of the Rights Offering, a copy of which is filed as Exhibit 99.2 hereto and is incorporated herein by reference.

This Current Report on Form 8-K shall not constitute an offer to sell or a solicitation of an offer to buy the securities, nor shall there be any offer, solicitation or sale of the securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful under the securities laws of such state or jurisdiction. The Rights Offering will be made only by means of a prospectus supplement, copies of which will be mailed to all eligible record date shareholders and can be accessed through the Securities and Exchange Commission’s website at www.sec.gov. A copy of the prospectus supplement may also be obtained from the information agent, D.F. King & Co., Inc., toll free at (800) 283-3192 or via email at bw@dfking.com. Additional

information regarding the rights offering is set forth in the Company’s prospectus supplement filed with the Securities and Exchange Commission.

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d)

Exhibits.

|

|

|

|

|

|

Exhibit

|

Description

|

|

|

Press Release Regarding Recent Developments and Revised 2018 Outlook

|

|

|

Press Release Regarding Amendments to Rights Offering

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

BABCOCK & WILCOX ENTERPRISES, INC.

|

|

|

|

|

|

|

|

|

|

|

|

April 10, 2018

|

By:

|

/s/ J. André Hall

|

|

|

|

|

J. André Hall

|

|

|

|

|

Senior Vice President, General Counsel and Corporate Secretary

|

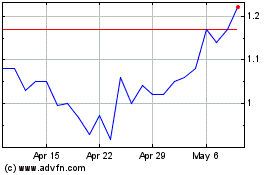

Babcock and Wilcox Enter... (NYSE:BW)

Historical Stock Chart

From Mar 2024 to Apr 2024

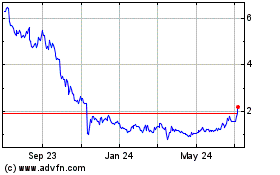

Babcock and Wilcox Enter... (NYSE:BW)

Historical Stock Chart

From Apr 2023 to Apr 2024