FedEx Pinched by Retail Shift During Holidays

March 21 2018 - 10:12AM

Dow Jones News

By Paul Ziobro

Some retailers gambled on slower shipping options during the

holidays, depriving FedEx Corp. of higher-priced express shipments

until the crunchtime before Christmas.

The move paid off for shippers, as FedEx's ground network

delivered more than 54 million packages a day earlier than

expected. But FedEx's express business, which had spent big on

aircraft and staffing anticipating higher volumes, posted a steep

drop in operating income in the latest quarter. The unit incurred

$170 million in extra costs during the December-to-February

quarter, including for added costs during the peak shipping

period.

"We saw customers stay in the ground system longer this year,"

Alan Cunningham, head of the express unit, said on an earnings call

Tuesday evening. Instead, there was a "more concentrated surge" in

express shipments in the final few days before Christmas.

The dynamic shows that FedEx is still trying to strike the right

balance between dialing up spending during the busiest time of year

and figuring out where and when the volume will come. During the

2016 holiday season, FedEx said a surge of packages from several

large shippers didn't arrive, hurting its bottom line due to

anticipated spending to handle the crush.

FedEx said investments to automate its ground network in recent

years have sped up service, which likely gave shippers more

confidence to use it during the 2017 holidays.

The performance of the ground business rescued FedEx's overall

performance. The Memphis-based company reported a slight drop in

operating income to $1 billion despite a 10% increase in revenue,

to $16.5 billion.

FedEx's income in its express business fell 24% to $424 million,

while the ground unit's profit surged by a similar percent to $634

million.

FedEx said it was able to pick up "significant business" among

small- and medium-size shippers last year as it chose not to copy

United Parcel Service Inc. in imposing surcharges on residential

packages delivered during the holidays. Those customers' accounts

tend to be more profitable for FedEx than large shippers, who can

demand better rates for shipping large amounts of volume.

FedEx did raise its profit outlook for the remainder of the

fiscal year, as it expects better margins during the final quarter,

which ends May 31. "The fourth quarter is going to be gangbusters,"

FedEx Chief Executive Fred Smith said.

Citi analyst Christian Weatherbee said the "not great" third

quarter results "should be trumped by a better outlook aiding

shares." He also notes that FedEx is lowering its capital spending

budget slightly for the year, which may signal that FedEx's

significant investments to upgrade its network may soon end.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

March 21, 2018 09:57 ET (13:57 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

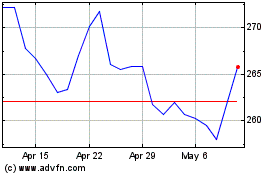

FedEx (NYSE:FDX)

Historical Stock Chart

From Aug 2024 to Sep 2024

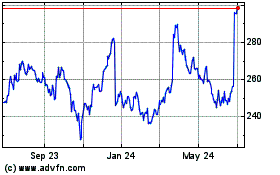

FedEx (NYSE:FDX)

Historical Stock Chart

From Sep 2023 to Sep 2024