General Mills: Rising Supply-Chain Costs Weigh on Profit

March 21 2018 - 9:19AM

Dow Jones News

By Imani Moise

General Mills Inc. slashed its profit outlook for the current

fiscal year as the cereal and yogurt maker prepares to address

hefty supply-chain costs.

The maker of Cheerios and Hamburger Helper now expects

constant-currency operating profit to drop 5% to 6%, compared with

its previous expectation of being flat to down 1%. The company

still expects organic net sales to be in line with the previous

year.

Shares dropped 10% to $45.15 during premarket trading as the

downbeat outlook overshadowed higher-than-expected sales and profit

for the company's third quarter.

"Our primary goal this year has been to strengthen our top-line

performance while maintaining our efficiency," Chief Executive Jeff

Harmening said in prepared remarks. "I'm disappointed in our

results on the bottom line."

General Mills's cost of sales rose 5.7%, outpacing revenue

growth of 2.3%. The company attributed much of the rising costs to

higher freight rates and commodity prices.

The Minneapolis-based food conglomerate has launched initiatives

to mitigate the inflation, including increasing its number of

freight carriers and using different modes of transportation.

The company also reiterated plans to accelerate growth in key

businesses such as Häagen-Dazs ice cream and natural and organic

foods while shedding slower-growth businesses. Slowing sales in the

packaged-food industry have sparked a flurry of cost-cutting and

deal-making in recent years. Last month the company reached a deal

to buy Blue Buffalo Pet Products Inc. for about $8 billion to grab

a piece of the growing natural pet-food market.

Sales in its North American retail business rose 1% in its

latest quarter as growth in domestic snacks and baking products

offset continued declines in cereal and yogurt sales.

Overall for the quarter, the company reported a profit of $941.4

million, or $1.62 a share, up from $357.8 million, or 61 cents a

share, a year earlier. Excluding one-time items and special charges

such as a $504 million benefit related to recent tax law changes,

General Mills's adjusted per-share earnings rose to 79 cents from

72 cents a year earlier. Sales rose 2.3% to $3.88 billion with

organic sales rising 1%.

Analysts polled by Thomson Reuters had forecast adjusted

earnings of 78 cents a share on $3.78 billion in sales.

General Mills shares have fallen 17% over the past year through

Tuesday's close, while the S&P 500 has risen 14%.

Write to Imani Moise at imani.moise@wsj.com

(END) Dow Jones Newswires

March 21, 2018 09:04 ET (13:04 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

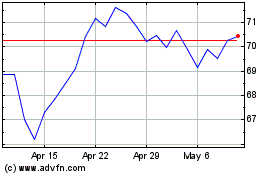

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

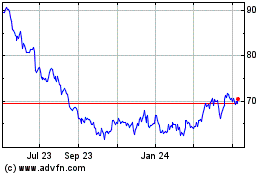

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024