Current Report Filing (8-k)

March 19 2018 - 5:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_______________________________________________________________________________________________________________________________________________________________________________________________________

FORM 8-K

|

|

|

|

|

CURRENT REPORT

|

|

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

|

|

|

|

|

|

|

|

|

|

Date of Report (Date of earliest event reported):

|

March 13, 2018

|

|

|

|

|

|

NACCO INDUSTRIES, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

DELAWARE

|

1-9172

|

34-1505819

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

5875 LANDERBROOK DRIVE, SUITE 220, CLEVELAND, OHIO

|

44124-4069

|

|

(Address of principal executive offices)

|

(Zip code)

|

|

|

|

|

|

(440) 229-5151

|

|

(Registrant's telephone number, including area code)

|

|

|

|

|

|

N/A

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter):

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On March 13, 2018, the Compensation Committee (the “Committee”) of the Board of Directors of NACCO Industries, Inc. (“NACCO”) approved the participation of the following named executive officers in the NACCO Industries, Inc. Executive Long-Term Incentive Compensation Plan (Amended and Restated Effective March 1, 2017), referred to as the NACCO Long-Term Equity Plan, and the NACCO Industries, Inc. Annual Incentive Compensation Plan (Effective September 28, 2012), referred to as the NACCO Short-Term Plan, with the following target award values for the performance period of January 1, 2018 through December 31, 2018:

Named Executive Officer

Short-Term Plan Target

Long-Term Equity Plan Target

(1)

J.C. Butler, Jr. 90% of salary midpoint 195.50% of salary midpoint

Elizabeth I. Loveman 35% of salary midpoint 40.25% of salary midpoint

Carroll L. Dewing 45% of salary midpoint 57.50% of salary midpoint

John D. Neumann 45% of salary midpoint 57.50% of salary midpoint

Harry B. Tipton, III 40% of salary midpoint 51.75% of salary midpoint

The Committee approved the performance criteria and weightings shown in the tables below for determining final incentive compensation payments for the named executive officers under the NACCO Short-Term Plan (payout in cash from 0% to 150%) and NACCO Long-Term Equity Plan (payout in a combination of cash and stock from 0% to 200%) for the performance period. Calculation of the final incentive compensation payments under the plans is subject to adjustment for certain items, and subject to the Committee’s ability to exercise discretion to increase, decrease or modify awards, as previously disclosed.

2018 Performance Criteria for NACCO Short-Term Plan:

|

|

|

|

|

|

NACCO and The North American Coal Corporation (“NACoal”)

|

Weight

|

|

NACCO Consolidated Operating Profit vs. Annual Operating Plan

|

50%

|

|

Mississippi Lignite Mining Company (“MLMC”) return on total capital employed (“ROTCE”) vs. Annual Operating Plan

|

10%

|

|

Centennial Natural Resources, LLC (“Centennial”) Pre-Tax Cash Flows vs. Annual Operating Plan

|

5%

|

|

Project Focus List vs. Target

|

35%

|

|

|

100%

|

The NACCO Consolidated Operating Profit measure excludes MLMC and Centennial results because those are separate factors under the NACCO Short-Term Plan.

2018 Performance Metrics for NACCO Long-Term Equity Plan:

|

|

|

|

|

|

NACCO and NACoal

|

Weight

|

|

NACCO Consolidated ROTCE vs. Annual Operating Plan

|

70%

|

|

Special Project Award vs. Target

|

30%

|

|

|

100%

|

|

|

|

|

(1)

|

The amounts shown include a 15% increase from the Hay-recommended long-term plan target awards that the Compensation Committee applies each year to account for the immediately taxable nature of the NACCO Long-Term Equity Plan awards.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

March 19, 2018

|

|

NACCO INDUSTRIES, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Sarah E. Fry

|

|

|

|

Name:

|

Sarah E. Fry

|

|

|

|

Title:

|

Associate General Counsel and Assistant Secretary

|

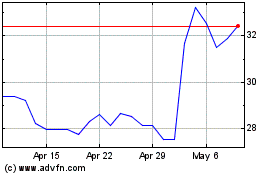

NACCO Industries (NYSE:NC)

Historical Stock Chart

From Mar 2024 to Apr 2024

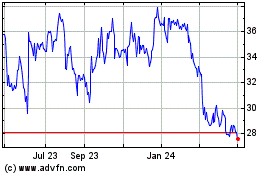

NACCO Industries (NYSE:NC)

Historical Stock Chart

From Apr 2023 to Apr 2024