COMPENSATION DISCUSSION AND ANALYSIS

|

|

|

|

|

|

Executive

Compensation

|

|

37

|

Table of Contents

The

objectives of our executive compensation program are to align executive pay with stockholder value and to motivate executives to achieve our corporate goals. This CD&A describes the elements,

implementation, and 2017 results of our executive compensation program.

At

our 2017 Annual Meeting of Stockholders, we received 95% support for our say on pay proposal. As a result, we believe that our stockholders understand that our pay practices demonstrate our

commitment to pay for performance and that our compensation plans are designed to recognize the performance of the Company. We achieved many of our operational and financial goals in 2017, including

exceeding our Adjusted Free Cash Flow and Corporate Debt to Corporate EBITDA Ratio targets, despite the challenges in the markets in which we operate.

In

addition, during 2017, we announced a three-year, three-part plan, referred to as our Transformation Plan, which was designed to significantly strengthen earnings and cost competitiveness, lower

risk and volatility, and create significant shareholder value. In connection with our business strategy and incentive programs, the execution of our Transformation Plan produced the following

results:

-

•

-

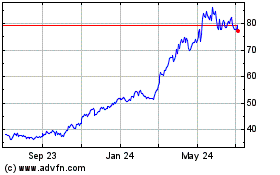

The #1 performing stock of the S&P 500 for 2017 with a 134% value increase.

-

•

-

Completed refinancings and $604 million of planned corporate debt reduction resulting in incremental annual interest savings of

$55 million.

-

•

-

Realized $150 million of cost savings for 2017, and $221 million of working capital improvements.

-

•

-

Announced $3 billion of asset sales representing approximately 90% of our asset sale target under our Transformation Plan.

-

•

-

On track to achieve our targeted 3.0x net debt to Adjusted EBITDA target.

-

•

-

Demonstrated another strong year with respect to safety in 2017, achieving top decile performance in our industry, matching the second best

safety year in our history.

The

achievements in 2017 resulted in payouts under the AIP as described in more detail in the section of this CD&A entitled "Annual Incentive Compensation", and our LTIP, as described in more detail

in the section of this CD&A entitled "Long-Term Incentive Compensation."

Consistent

with the objectives of our compensation program, the accomplishment of our corporate goals and the market performance of our common stock over the three-year performance period directly

impacted our compensation decisions and pay outcomes for 2017 as described below.

|

Our Compensation Committee approved modest increases to base salary for NEOs for 2017.

|

The

Compensation Committee approved modest increases, ranging from 2%-4%, to NEO 2017 base salary

compensation

for NEOs other than the CEO. The Compensation Committee evaluated the level of Mr. Gutierrez's base salary by comparing it to compensation benchmark data provided by Pay

Governance, the Compensation Committee's independent advisor. Following such evaluation at the end of Mr. Gutierrez's first year as CEO, Mr. Gutierrez received a 9.3% increase in base

salary for 2017.

|

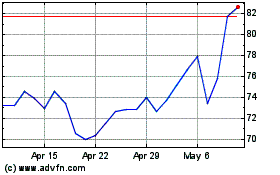

Due to the increase in TSR during the performance period ending January 2, 2018, our NEOs received a payout at 108% of target upon the vesting of their MSUs in 2018.

|

Our

compensation program ties a significant portion of our NEOs' overall compensation to the achievement of increases in TSR through our long-term compensation program. In accordance

with the intended design of our long-term compensation program, there was no payout of stock for MSU awards for the performance period ending January 2, 2017 (vesting January 2, 2017) as

a result of the decline in TSR during the performance period. However, there was an 8% increase in TSR over the three-year performance period ending January 2, 2018 (vesting January 2,

2018) and, as a result, MSUs vesting as of such date vested at 8% above target. In each case, MSUs represented two-thirds of long-term compensation value granted to our NEOs in 2014 and 2015.

|

The AIP performance metrics were exceeded during 2017, which resulted in payments to our NEOs at levels greater than target.

|

Our

Adjusted Free Cash Flow exceeded target, and our Corporate Debt to Corporate EBITDA Ratio greatly exceeded the maximum; however, Adjusted EBITDA did not meet target. Due to the

achievement of the AIP performance metrics, our NEOs received AIP bonuses at levels above target.

|

Performance-based equity was redesigned for 2017 to measure NRG's TSR performance relative to the TSR of a comparator group.

|

Consistent

with market practice, in 2017, we shifted performance-based equity from MSUs to RPSUs. For each of the January 2017 and January 2018 grants, NEOs received two-thirds of

their equity awards in RPSUs in lieu of MSUs. The quantity of shares received by NEOs upon the vesting of an RPSU will be a function of the Company's

performance ranked against the Performance Peer Group (as defined in Elements of Compensation—Relative Performance Stock Units). The Compensation Committee evaluated this comparator group

for an appropriate mix of industry-specific and market-influenced constituents, with a strong mathematical correlation to the Company's stock performance. RPSU awards granted in 2018 were updated to

limit the maximum award value that an NEO may receive to 6 times the fair market value of the target award, determined as of the date of grant.

|

|

|

|

|

38

|

|

Executive

Compensation

|

|

Table of Contents

|

Key Governance Features of Our Executive Compensation Program

|

Over

the past several years, we have modified our compensation programs and practices to incorporate several key governance features, adhering to the compensation best practices

described in the table below.

|

|

|

|

|

ü

WHAT WE DO:

|

|

X

WHAT WE DON'T DO:

|

|

Pay for Performance, including

delivering a majority of long-term incentive

compensation using performance-based equity

requiring above-median performance for vesting of long-term incentive

compensation awards at target and

using quantitative metrics to determine annual incentive compensation

awards

|

|

No excise tax gross-ups upon a change-in-control and no tax gross-ups on perquisites or benefits

|

|

|

|

|

|

Target our peer group median for total direct compensation

|

|

No pledging or hedging of the Company's stock by NEOs or directors

|

|

|

|

|

|

Require a double trigger for the vesting of equity upon a change in control

|

|

No employment agreements for executive officers with the exception of our CEO

|

|

|

|

|

|

Include clawback policies in our compensation plans

|

|

No guaranteed bonus payments for our NEOs

|

|

|

|

|

|

Maintain robust stock ownership guidelines for our NEOs

|

|

No supplemental executive retirement plans

|

|

|

|

|

|

Provide market-level retirement benefits and limited perquisites

|

|

No re-pricing of underwater stock options and no grants below 100% of fair market value

|

|

|

|

|

|

Engage an independent compensation consultant to advise us on matters surrounding our compensation plans

|

|

|

|

|

|

|

|

Prevent undue risk taking in our compensation practices and engage in robust risk monitoring

|

|

|

|

|

|

|

|

Effective for 2018, expanded our performance-based pay cap beyond our annual incentive to include performance

equity

|

|

|

|

|

|

|

NEO

compensation for 2017 consisted of (i) salary, earned and paid during the 2017 fiscal year, (ii) short-term incentive compensation pursuant to our AIP earned during

the 2017 fiscal year, (iii) RSU awards that were granted in January 2015 and vested at the end of the following three-year period, (iv) approximately one-third of RSUs that were granted

in January 2017 and vested on the one-year anniversary of the grant date and (v) MSU awards that were granted in January 2015, whose realized value in 2017 was based upon the Company's TSR

performance over the three-year performance period following the grant date.

The

Compensation Committee believes that in 2017, the Company's compensation of its NEOs was well aligned with our stock performance and our stockholder interests. Over the three-year performance

period ending January 2, 2018, there was an 8% increase in TSR. As a result, MSU awards that vested on January 2, 2018, were paid at 8% above target.

The

chart below illustrates our NEOs' realized pay for performance periods concluding at the end of 2017 versus target compensation.

|

|

|

|

|

|

Executive

Compensation

|

|

39

|

Table of Contents

|

|

|

|

|

1

|

|

Target Total Direct Compensation (TDC) includes: 2017 Base Salary, 2017 Target AIP Award, 2015 Target LTIP Award (includes RSUs and MSUs at grant-date fair value), and approximately one-third of RSUs granted on January 3, 2017 (at grant-date

fair value). Reflects Base Salary, Target AIP and approximately one-third of RSUs granted on January 3, 2017 for Mr. Gutierrez as Chief Executive Officer during the 2016 and 2017 fiscal years and Target Long-Term Incentive Compensation for

Mr. Gutierrez as Chief Operating Officer for a portion of the 2015 fiscal year, resulting in a higher amount of realized pay in comparison to target pay than other NEOs.

|

|

2

|

|

Realized TDC includes: 2017 Base Salary, 2017 Realized AIP Award, 2015 Realized LTIP Award (including RSUs at vesting-date value and MSUs that vested at 108% of target at vesting-date value), and 2017 Realized LTIP Award (approximately one-third of

the RSUs granted on January 3, 2017 at vesting-date value).

|

|

Executive Compensation Program

|

|

2017 Named Executive Officers

|

This

CD&A describes our executive compensation program for our NEOs in 2017. For 2017, the NEOs were:

|

|

|

|

|

NEO

|

|

2017 TITLE

|

|

Mauricio Gutierrez

|

|

President and Chief Executive Officer

|

|

|

|

|

|

Kirkland Andrews

|

|

Executive Vice President and Chief Financial Officer

|

|

|

|

|

|

John Chillemi

1

|

|

Executive Vice President, National Business Development

|

|

|

|

|

|

David R. Hill

2

|

|

Executive Vice President and General Counsel

|

|

|

|

|

|

Elizabeth Killinger

|

|

Executive Vice President and President, NRG Retail

|

|

|

|

|

|

|

|

|

|

1

|

|

Effective March 16, 2018, Mr. Chillemi will be stepping down from his position as Executive Vice President, National Business Development. Mr. Chillemi will remain with the Company in an advisory role for several months to support the

transition of certain development projects for the Company.

|

|

2

|

|

Effective March 16, 2018, Mr. Hill will be stepping down from his position as Executive Vice President and General Counsel. Mr. Hill will remain with the Company in an advisory role for several months to support the transition of

certain regulatory and government affairs matters.

|

|

|

|

|

|

40

|

|

Executive

Compensation

|

|

Table of Contents

|

Goals and Objectives of the Program

|

Our

Compensation Committee designs and implements an executive compensation program that:

-

•

-

closely aligns our executive compensation with stockholder value creation, avoiding plans that encourage executives to take excessive risk,

while driving long-term value to stockholders;

-

•

-

supports the Company's long-term business strategy, while rewarding our executive team for their individual accomplishments;

-

•

-

allows us to recruit and retain a top-tier executive team in a competitive industry and to motivate our executive team to achieve superior

performance for a sustained period; and

-

•

-

provides a competitive compensation opportunity while adhering to market standards for compensation.

The

Compensation Committee is responsible for the development and implementation of NRG's executive compensation program. The intent of our executive compensation program is to reward the achievement

of NRG's annual goals and objectives and the creation of long-term stockholder value.

The

Compensation Committee is committed to aligning executives' compensation with performance. The Compensation Committee's objectives are achieved through the use of both short-term and long-term

incentives. The Company currently targets pay at the median of our Compensation Peer Group (defined below). In addition, through the AIP, the NEOs are rewarded for achieving annual corporate and

individual goals. Our long-term incentive compensation program is designed to reward our NEOs for long-term TSR.

Pursuant

to its charter, the Compensation Committee is authorized to engage, at the expense of the Company, a compensation consultant to provide independent advice, support, and

expertise to assist the Compensation Committee in overseeing and reviewing our overall executive compensation strategy, structure, policies and programs, and to assess whether our compensation

structure establishes appropriate incentives for management and other key employees.

Pay

Governance, the Compensation Committee's independent compensation consultant since fiscal year 2015, assisted with executive and director pay decisions and worked with the Compensation Committee

to formulate the design of the executive compensation program for 2017.

Pay

Governance reported directly to the Compensation Committee and provided no other remunerated services to the Company. Pay Governance also provides services to the Compensation Committee of NRG

Yield, our majority-owned subsidiary, relating to its director compensation and executive pay decisions in 2017, and the design of its director compensation and executive compensation programs for

2018. Pay Governance does not provide services for any of our other affiliates. In accordance with SEC rules and requirements, the Company has affirmatively determined that no conflicts of interest

exist between the Company and Pay Governance (or any individuals working on the Company's account on behalf of Pay Governance).

|

|

|

|

|

|

Executive

Compensation

|

|

41

|

Table of Contents

|

Compensation Peer Group Analysis

|

Our 2017 Compensation Peer Group

The Compensation Committee, with support from its advisors, identifies the best possible comparator group within relevant industries. The Compensation

Committee performed a review of potential peer companies, considering factors such as industry, scope of operations, market value and relevance from a talent competition standpoint. In addition, a

peer of peer analysis was conducted to confirm the appropriateness of potential peer companies and to assess companies that NRG's peers use in their own peer groups. The Compensation Committee then

considered the overall reasonableness of the list of potential peer companies as a whole.

The

Compensation Committee aims to compare our executive compensation program to a consistent compensation peer group year-to-year, but given the dynamic nature of our industry and the companies that

comprise it, we annually examine the list for opportunities for improvement. In light of NRG's focus on its core generation and retail businesses, and with the assistance of Pay Governance, the

Compensation Committee identified a new peer group for compensation benchmarking purposes in 2017 (Compensation Peer Group). The updated Compensation Peer Group for 2017 is identified below.

|

|

|

|

|

|

|

|

|

COMPANY

|

|

NYSE TICKER

|

|

COMPANY

|

|

NYSE TICKER

|

|

The AES Corporation

|

|

AES

|

|

First Solar, Inc.

|

|

FSLR

|

|

|

|

|

|

|

|

|

|

American Electric Power Co., Inc.

|

|

AEP

|

|

NextEra Energy, Inc.

|

|

NEE

|

|

|

|

|

|

|

|

|

|

Calpine Corporation

|

|

CPN

|

|

Public Service Enterprise Group, Inc.

|

|

PEG

|

|

|

|

|

|

|

|

|

|

Dynegy Inc.

|

|

DYN

|

|

Talen Energy

|

|

TLN

|

|

|

|

|

|

|

|

|

|

Exelon Corporation

|

|

EXC

|

|

Vistra Energy Corp.

|

|

VST

|

|

|

|

|

|

|

|

|

We

use the median percentile of our Compensation Peer Group as a guidepost in establishing the targeted total direct compensation (cash and equity) levels for our NEOs. We expect

that, over time, targeted total direct compensation of our NEOs will continue to land near the median of our Compensation Peer Group, and actual pay in a given year will increase or decrease based on

the

achievement of defined performance-based compensation metrics.

While

a portion of our compensation is fixed, a significant percentage is risk-based and payable and/or realizable only if certain performance objectives are met. The following charts illustrate the

target percentage of annual fixed compensation, time-based compensation and performance-based compensation payable to our NEOs.

|

|

|

|

|

42

|

|

Executive

Compensation

|

|

Table of Contents

Base

salary compensates NEOs for their level of experience and position responsibilities and for the continued expectation of superior performance. Recommendations on increases to

base salary take into account, among other factors, the NEO's individual performance, the general contributions of the NEO to overall corporate performance, and the level of responsibility of the NEO

with respect to his or her specific position. For 2017, the base salary for each NEO was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

NAMED EXECUTIVE OFFICER

|

|

|

2017 ANNUALIZED

BASE SALARY ($)

|

|

|

PERCENTAGE INCREASE

OVER 2016 (%)

1

|

|

|

ACTUAL 2017 BASE

SALARY EARNINGS ($)

|

|

|

Mauricio Gutierrez

|

|

|

1,230,000

|

|

|

9.3

|

%

|

|

1,225,962

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kirkland Andrews

|

|

|

662,240

|

|

|

3.0

|

%

|

|

661,498

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John Chillemi

|

|

|

489,250

|

|

|

3.0

|

%

|

|

488,702

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

David R. Hill

|

|

|

520,000

|

|

|

4.0

|

%

|

|

519,231

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Elizabeth Killinger

|

|

|

520,200

|

|

|

2.0

|

%

|

|

519,808

|

|

|

|

|

|

|

1

|

|

As compared to the December 31, 2016 annualized base salary.

|

The

Compensation Committee approved modest increases to base salary for Executive Vice Presidents. The Compensation Committee also evaluated the level of Mr. Gutierrez's base salary and total

compensation by comparing it to compensation benchmark data provided by Pay Governance. Following such evaluation at the end of Mr. Gutierrez's first year as CEO, Mr. Gutierrez received

a 9.3% increase in base salary for 2017.

|

Annual Incentive Compensation

|

Overview

Annual incentive compensation awards (AIP bonuses) are made under our AIP. AIP bonuses are short-term compensation designed to compensate NEOs for meeting

annual individual and Company goals, both financial and non-financial. The annual incentive compensation opportunity is defined as a percentage of each NEO's annual base salary. AIP bonuses are

subject to the following requirements:

-

•

-

A threshold Adjusted Free Cash Flow performance metric (AIP Gate) is established for each plan year. For 2017, the AIP Gate was

$894 million, a level the Compensation Committee believes was appropriate for a minimally acceptable level of financial performance. If the AIP Gate is not achieved, no AIP bonuses are paid,

regardless of performance in any other metrics.

-

•

-

Performance metrics for 2017 once again included the Company's Corporate Debt to Corporate EBITDA Ratio, which was added in 2016 in response to

stockholder engagement in order to support the Company's near-term focus on debt reduction, as well as Adjusted Free Cash Flow and Adjusted EBITDA.

-

•

-

Adjusted Free Cash Flow, Adjusted EBITDA and Corporate Debt to Corporate EBITDA Ratio performance metrics were established at threshold, target

and maximum levels for purposes of determining the elements of the bonus that were based on financial performance. For 2017, the performance levels were:

|

|

|

|

|

|

|

|

|

|

|

|

|

PERFORMANCE METRIC

|

|

|

THRESHOLD

|

|

|

TARGET

|

|

|

MAXIMUM

|

|

|

Adjusted Free Cash Flow

|

|

$

|

894

|

|

$

|

1,219

|

|

$

|

1,523

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA

|

|

$

|

1,824

|

|

$

|

2,608

|

|

$

|

2,871

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate Debt to Corporate EBITDA Ratio

|

|

|

4.65x

|

|

|

4.15x

|

|

|

4.00x

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In

addition, each NEO is evaluated on his or her achievement of individual performance criteria, which include measures that NRG values in the leadership of the business. Such measures may include

safety, cost control, succession planning and staff development, and individual performance in furtherance of the Company's goals. Additional criteria may be chosen, as appropriate, and may change

from time to time throughout the year. For 2017, individual performance criteria were measured against the achievement of the 2017 components of the Transformation Plan, which included the realization

of annual cost savings of $250 million, executing asset sales of 322 MW for aggregate cash consideration of $150 million, reducing net corporate debt by $603 million and realizing

$175 million of working capital improvements and $44 million of one-time costs to achieve. The Compensation Committee assesses performance of each NEO relative to the performance

criteria applicable to each NEO and adjusts the total AIP bonus for each NEO within a range of plus or minus 20%, based on recommendations from the CEO for each NEO other than himself. The

Compensation Committee retains sole discretion under the AIP to reduce the amount of, or eliminate any, AIP bonuses that are otherwise payable under the AIP.

|

|

|

|

|

|

Executive

Compensation

|

|

43

|

Table of Contents

AIP Bonus Opportunity

The threshold, target and maximum AIP bonus opportunities for the NEOs for 2017, expressed as a percentage of base salary, were:

|

|

|

|

|

|

|

|

|

|

|

|

|

NAMED EXECUTIVE OFFICER

|

|

GATE NOT

MET (%)

|

|

THRESHOLD

(%)

1

|

|

TARGET

(%)

1

|

|

MAXIMUM

(%)

|

|

TARGET

AMOUNT

($)

|

|

Mauricio Gutierrez

|

|

0

|

|

62.5

|

|

125

|

|

250

|

|

1,537,500

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kirkland Andrews

|

|

0

|

|

50.0

|

|

100

|

|

200

|

|

662,240

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John Chillemi

|

|

0

|

|

37.5

|

|

75

|

|

150

|

|

366,938

|

|

|

|

|

|

|

|

|

|

|

|

|

|

David R. Hill

|

|

0

|

|

37.5

|

|

75

|

|

150

|

|

390,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Elizabeth Killinger

|

|

0

|

|

37.5

|

|

75

|

|

150

|

|

390,150

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

This assumes that each of the financial performance metrics and all other quantitative and qualitative goals are achieved at threshold or target levels, respectively.

|

2017 AIP Bonus Performance Criteria

The AIP bonus performance criteria applicable to all NEOs are based upon our 2017 corporate business strategy and individual performance. The table below sets

forth the 2017 AIP performance criteria and weighting applicable to all NEOs.

|

|

|

|

|

|

|

GOAL

|

|

|

WEIGHT

|

|

|

Adjusted Free Cash Flow (before growth)

1,2

|

|

|

35

|

%

|

|

|

|

|

|

|

|

Adjusted EBITDA

1,3

|

|

|

35

|

%

|

|

|

|

|

|

|

|

Corporate Debt to Corporate EBITDA Ratio

4

|

|

|

30

|

%

|

|

|

|

|

|

|

|

Overall Funding

|

|

|

100

|

%

|

|

|

|

|

|

|

|

Individual Performance Criteria Modifier

|

|

|

±

20

|

%

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

Our Statement of Operations and Statement of Cash Flows are found in Item 15—Consolidated Financial Statements to our Annual Report on Form 10-K.

|

|

2

|

|

Cash Flow from Operations, excluding changes in nuclear decommissioning trust liability and changes in collateral deposits supporting energy risk management activities, less maintenance and environmental capital expenditures (net of financings) and

including net payments to settle acquired derivatives that include financing elements and purchases and sales of emission allowances.

|

|

3

|

|

Net Income before Interest Expense, Income Tax, Depreciation and Amortization (EBITDA), as further adjusted for certain non-recurring items and to exclude mark-to-market movements of economic hedges since a portion of these forward sales and

purchases are not afforded cash flow hedge accounting treatment.

|

|

4

|

|

Corporate Debt is recourse debt to NRG and includes our term loan facility, senior notes, tax exempt bonds and any incremental debt that would either be secured or guaranteed by NRG's guarantor companies or its assets. Corporate EBITDA is defined as

Adjusted EBITDA (as defined above); less Adjusted EBITDA from non-guarantor companies and equity investments; plus cash distributions from non-guarantor companies and equity investments to the Company and any guarantor of the Company; plus non-cash

amortizations excluded by the credit agreement for our senior secured credit facility and the indentures for our senior notes, including equity compensation, nuclear fuel amortization and bad debt expenses.

|

2017 Bonuses

As noted above, with respect to AIP bonuses for 2017, the AIP Gate was $894 million, the Adjusted Free Cash Flow target was $1,219 million, the

Adjusted EBITDA goal was $2,608 million, and the Corporate Debt to Corporate EBITDA Ratio goal was 4.15x. For 2017, the AIP Gate was surpassed, the Adjusted Free Cash Flow was above target at

approximately $1,483 million, the Adjusted EBITDA was approximately $2,494 million, and the Corporate Debt to Corporate EBITDA Ratio achieved maximum at 3.36x.

The

AIP bonuses paid to each of the NEOs for 2017 were:

|

|

|

|

|

|

|

|

|

|

|

NAMED EXECUTIVE OFFICER

|

|

PERCENTAGE OF

ANNUAL BASE

SALARY (%)

|

|

PERCENT OF

TARGET

ACHIEVED (%)

|

|

INDIVIDUAL

PERFORMANCE

CRITERIA MODIFIER

(%)

|

|

ANNUAL

INCENTIVE

PAYMENT ($)

|

|

Mauricio Gutierrez

|

|

207

|

|

158

|

|

+5

|

|

2,550,713

|

|

|

|

|

|

|

|

|

|

|

|

Kirkland Andrews

|

|

174

|

|

158

|

|

+10

|

|

1,150,973

|

|

|

|

|

|

|

|

|

|

|

|

John Chillemi

|

|

118

|

|

158

|

|

0

|

|

579,761

|

|

|

|

|

|

|

|

|

|

|

|

David R. Hill

|

|

119

|

|

158

|

|

0

|

|

616,200

|

|

|

|

|

|

|

|

|

|

|

|

Elizabeth Killinger

|

|

119

|

|

158

|

|

0

|

|

616,437

|

|

|

|

|

|

|

|

|

|

|

Mr. Gutierrez

received a 5% modifier, and Mr. Andrews received a 10% modifier each based on the successful achievement of the 2017 components of the Transformation Plan.

|

|

|

|

|

44

|

|

Executive

Compensation

|

|

Table of Contents

|

Long-Term Incentive Compensation

|

We

believe that equity awards directly align our NEOs' interests with those of our stockholders. For our 2017 grants, we awarded to our NEOs a combination of performance-based RPSUs,

which are based on the Company's TSR performance relative to its peers, and time-based RSUs. To enhance our compensation program's focus on company performance, the large majority of long-term

incentive compensation (67%) was delivered using RPSUs. Although a critical component of our long-term design due to the retention aspects of the award, RSUs comprised only 33% of each NEO's grant

date award opportunity for the 2017 grant. We believe that our AIP appropriately focuses our executive team on shorter-term (one-year) financial metrics while our LTIP emphasizes long-term stockholder

value creation (i.e., three-year TSR performance).

Range of LTIP compensation

The aggregate value of equity awards granted to each NEO for fiscal year 2017 was reviewed relative to NEO compensation data from our Compensation Peer

Group. Pay Governance provided compensation benchmark data for the Compensation Peer Group, as well as for broader industry practice, to the Compensation Committee. Our practice is to issue annual

equity awards on the first trading day of the calendar year. For fiscal year 2017, the grant date was January 3, 2017. The closing price per share of the Company's stock on the grant

date was $12.30 per share.

Relative Performance Stock Units

Consistent with market practice, in 2017, we shifted performance-based equity from MSUs to RPSUs. Each RPSU represents the potential to receive one

share of common stock after the completion of three years of service from the date of grant based on the Company's TSR performance ranked against the TSR performance of a strongly correlated

comparator group (the Performance Peer Group). Relative measures are designed to compensate for externalities, ensuring the program

appropriately reflects management's impact on the Company's TSR by including peer companies and indices that are similarly impacted by market conditions.

The

payout of shares of common stock at the end of the three-year performance period will be based on the Company's TSR performance percentile rank, compared with the TSR performance of the

Performance Peer Group. To ensure a rigorous program design, the target-level payout (100% of shares granted) requires the Company to perform above median, in the 55

th

percentile.

To induce management to achieve greater than target-level performance in a down market, in the event that NRG's TSR performance declines by more than 15% over the performance period, target-level

payout (100% of shares granted) will require an even greater relative achievement at the 65

th

percentile performance. The Compensation Committee believes that this increased

performance requirement addresses the concern that a disproportionate award may be paid in the event that our relative performance is high, but absolute performance is low.

In

the event relative performance is below the 25

th

percentile, the award is forfeited. In the event relative performance is at the 25

th

percentile, the

quantity of shares paid out is equal to 25% of target. In the event relative performance is between the 25

th

percentile and the 55

th

percentile (or the

65

th

percentile if our TSR performance declines by more than 15% over the performance period), payout will be based on an interpolated calculation. In the event relative

performance reaches the 55

th

percentile (or the 65

th

percentile if our TSR performance declines by more than 15% over the performance period), 100% of the

target award will be paid. In the event relative performance is between the 55

th

percentile (or the 65

th

percentile if our TSR performance declines by more

than 15% over the performance period) and the 75

th

percentile, payout will be based on an interpolated calculation. In the event relative performance is at or above the

75

th

percentile, the quantity of shares paid out is equal to 200% of target. The table below illustrates the design of our RPSUs.

RPSU

awards granted in 2018 were updated to limit the maximum award value that an NEO may receive to 6 times the fair market value of the target award, determined as of the date of

grant.

Market Stock Units

Each MSU represents the potential to receive common stock after the completion of three years of service from the date of grant based on absolute NRG stock

price

|

|

|

|

|

|

Executive

Compensation

|

|

45

|

Table of Contents

change (plus dividends) versus the baseline. The number of shares of common stock to be paid as of the vesting date for each MSU is equal to the TSR Multiplier

times the target MSUs on the date of grant. The "TSR Multiplier" is the 20-trading day average closing price on the vesting date divided by the 20-trading day average closing price on the grant date,

taking into account any dividends issued during the performance period, presumed reinvested as of the ex-dividend date. To reinforce the importance of performance on MSU awards, the Compensation

Committee included a threshold level of TSR performance and a maximum level of TSR performance applicable to the TSR Multiplier. Another critical aspect of the importance of performance on the MSU

design is the "valuation premium" associated with the award, which causes an MSU to have greater realized value only if the Company's stock performs well above target and sustains that performance

over time. The TSR Multiplier thresholds and the valuation premium attributable to the awards are the features that tie the value of our MSU awards to NRG's performance. Payouts of stock for MSU

awards are based on TSR performance over the three-year performance period. In accordance with the intended design of our long-term compensation program, there was no payout of stock for MSU awards

with performance periods ending January 2, 2016 (vesting January 2, 2016) and January 2, 2017 (vesting January 2, 2017) as a result of the decline in TSR below the

performance threshold over their respective performance periods. However, there was an 8% increase in TSR over the three-year performance period ending January 2, 2018 (vesting

January 2, 2018) and, as a result, MSUs vesting as of such date vested at 8% above target.

Restricted Stock Units

Each RSU represents the right to receive one share of common stock after the completion of the applicable vesting period. The RSUs granted in 2017 vest

ratably, meaning that one-third of the award vests each year on the anniversary of the grant date, over a three-year period. Ratable vesting is more in line with peer practices, and represents a

change from the three-year cliff vesting approach that was applicable to previously issued RSU awards. Occasionally, the Compensation Committee will use alternate RSU vesting periods, but only on an

exception basis, such as for a new-hire with a specific skill set or to serve as an enhanced retention tool.

The

Company has a "clawback" policy with regard to awards made under the AIP and LTIP in the case of a material financial restatement, including a restatement that was the result of

employee misconduct, or in the case of fraud, embezzlement or other serious misconduct that was materially detrimental to the Company. The Compensation Committee retains discretion regarding

application of the policy. The policy is incremental to other remedies that are available to the Company. In addition to NRG's clawback policy, if the Company is required to restate its earnings as a

result of noncompliance with a financial reporting

requirement due to misconduct, under the Sarbanes-Oxley Act of 2002 (SOX), the CEO and the CFO would also be subject to a clawback, as required by SOX.

NEOs

participate in the same retirement, life insurance, health and welfare plans as other salaried employees of the Company. To generally support more complicated financial planning

and estate planning matters, NEOs are reimbursed for personal financial services up to $12,000 each year, not including the financial advisor's travel or out-of-pocket expenses. Additionally, pursuant

to the terms of his employment agreement entered into in December 2015, described in more detail in the section entitled "Employment Agreements" below, for 2017, Mr. Gutierrez may

receive additional benefits in the form of term life insurance with a death benefit of $7.75 million, and up to $10,000 for reimbursement of disability insurance premiums. We do not provide any

gross-ups on perquisites for executive officers.

|

Potential Severance and Change-in-Control Benefits

|

Mr. Gutierrez,

pursuant to his employment agreement, and the other NEOs, pursuant to the Company's 2009 Executive Change-in-Control and General Severance Plan (CIC Plan), are

entitled to severance payments and benefits in the event of termination of employment under certain circumstances, including following a change-in-control. We choose to pay severance and

change-in-control benefits to assist with career transitions of our executives as well as to create an environment that provides for an adequate business transition and knowledge transfer during times

of change.

Change-in-control

agreements are market practice among publicly-held companies. Most often, these agreements are utilized to encourage executives to remain with the company during periods of extreme

job uncertainty and to evaluate a potential transaction in an impartial manner. In order to enable a smooth transition during an interim period, change-in-control agreements provide a defined level of

security for the executive and the company, enabling a more seamless implementation of a particular acquisition or an asset sale or purchase, and subsequent integration.

Under

the CIC Plan, NEOs are entitled to a change-in-control benefit, which shall be limited to $1 less than the amount subject to the excise tax under Section 4999 of the Code, or the full

payment that is subject to the excise tax (which is then payable by the NEO), whichever is more favorable to the NEO.

For

a more detailed discussion, including the quantification of potential payments, please see the section entitled "Severance and Change-in-Control" following the executive compensation tables below.

|

|

|

|

|

46

|

|

Executive

Compensation

|

|

Table of Contents

|

Stock Ownership Guidelines

|

The

Compensation Committee and the Board require the CEO to hold NRG stock with a value equal to 6.0 times his base salary until his termination. All other NEOs are required, absent

a hardship, to hold NRG Stock with a value equal to 2.5 times their base salary until they separate from the Company. Personal holdings, vested awards and vested options with an exercise price that is

less than the current stock price count towards the ownership multiple. Although the NEOs are not required to make purchases of our common stock to meet their target ownership multiple, NEOs are

restricted from divesting any securities until such ownership multiples are attained, except in the event of a hardship or to make a required tax payment, and must maintain their ownership multiple

after any such transactions. The current stock ownership for NEOs as of March 1, 2018 is shown below, based on a share price of $26.92 on March 1, 2018:

|

|

|

|

|

|

|

NAMED EXECUTIVE OFFICER

|

|

TARGET

OWNERSHIP

MULTIPLE

|

|

ACTUAL

OWNERSHIP

MULTIPLE

|

|

Mauricio Gutierrez

|

|

6.0x

|

|

7.6x

|

|

|

|

|

|

|

|

Kirkland Andrews

|

|

2.5x

|

|

13.0x

|

|

|

|

|

|

|

|

John Chillemi

|

|

2.5x

|

|

2.9x

|

|

|

|

|

|

|

|

David R. Hill

|

|

2.5x

|

|

4.6x

|

|

|

|

|

|

|

|

Elizabeth Killinger

|

|

2.5x

|

|

5.7x

|

|

|

|

|

|

|

|

Tax and Accounting Considerations

|

Section 162(m)

of the Code precludes us, as a public company, from taking a tax deduction for individual compensation to any NEO in excess of $1 million, subject to

certain exemptions, including an exemption applicable during 2017 for performance-based compensation within the meaning of Section 162(m). The Tax Cuts and Jobs Act, enacted in

December 2017, amended certain aspects of Section 162(m) specifically affecting the exclusion of performance-based compensation from the $1 million limit in future years. The

Compensation Committee believes tax deductibility of compensation is an important consideration and, where possible, tries to preserve the deductibility of compensation to NEOs under

Section 162(m) where appropriate. For 2017, the Compensation Committee considered the implications and exemptions to such limitation. However, the Compensation Committee also believes

that it is important to retain flexibility in designing compensation programs, and as a result, has not adopted a policy that any particular amount of compensation must be deductible to NRG under

Section 162(m).

The

Compensation Committee also takes into account tax consequences to NEOs in designing the various elements of our compensation program, such as designing the terms of awards to defer immediate

income recognition in accordance with Section 409A of the Code. The Compensation Committee remains informed of and takes into account the accounting implications of its compensation programs.

However, the Compensation Committee approves programs based on their total alignment with our strategy and long-term goals.

|

|

|

|

|

|

Executive

Compensation

|

|

47

|

Table of Contents

Summary Compensation Table for

Fiscal Year Ended December 31, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME AND PRINCIPAL POSITION

|

|

|

YEAR

|

|

|

SALARY

($)

1

|

|

|

BONUS

($)

2

|

|

|

STOCK

AWARDS

($)

3

|

|

|

OPTION

AWARDS

($)

3

|

|

|

NON-EQUITY

INCENTIVE PLAN

COMPENSATION

($)

4

|

|

|

CHANGE IN

PENSION VALUE

AND

NONQUALIFIED

DEFERRED

COMPENSATION

EARNINGS

($)

|

|

|

ALL OTHER

COMPENSATION

($)

|

|

|

TOTAL

($)

|

|

|

Mauricio Gutierrez

President and Chief

|

|

|

2017

|

|

|

1,225,962

|

|

|

—

|

|

|

5,227,515

|

|

|

—

|

|

|

2,550,713

|

|

|

—

|

|

|

45,472

|

|

|

9,049,662

|

|

|

Executive Officer

|

|

|

2016

|

|

|

1,125,000

|

|

|

—

|

|

|

4,781,263

|

|

|

—

|

|

|

2,294,578

|

|

|

—

|

|

|

62,730

|

|

|

8,263,571

|

|

|

|

|

|

2015

|

|

|

664,624

|

|

|

—

|

|

|

1,285,914

|

|

|

—

|

|

|

525,613

|

|

|

—

|

|

|

26,763

|

|

|

2,502,914

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kirkland Andrews

Executive Vice

|

|

|

2017

|

|

|

661,498

|

|

|

—

|

|

|

1,324,493

|

|

|

—

|

|

|

1,150,973

|

|

|

—

|

|

|

22,868

|

|

|

3,159,832

|

|

|

President and Chief

|

|

|

2016

|

|

|

642,952

|

|

|

150,000

|

|

|

1,028,739

|

|

|

—

|

|

|

1,039,653

|

|

|

—

|

|

|

20,548

|

|

|

2,881,892

|

|

|

Financial Officer

|

|

|

2015

|

|

|

647,177

|

|

|

—

|

|

|

1,285,914

|

|

|

—

|

|

|

472,570

|

|

|

—

|

|

|

20,607

|

|

|

2,426,268

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John Chillemi

Executive Vice

|

|

|

2017

|

|

|

488,702

|

|

|

—

|

|

|

978,515

|

|

|

—

|

|

|

579,761

|

|

|

39,337

|

|

|

12,800

|

|

|

2,099,115

|

|

|

President, National

|

|

|

2016

|

|

|

475,001

|

|

|

75,000

|

|

|

760,010

|

|

|

—

|

|

|

549,872

|

|

|

21,521

|

|

|

15,035

|

|

|

1,896,439

|

|

|

Business Development

|

|

|

2015

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

David R. Hill

Executive Vice

|

|

|

2017

|

|

|

519,231

|

|

|

—

|

|

|

1,040,017

|

|

|

—

|

|

|

616,200

|

|

|

—

|

|

|

30,548

|

|

|

2,205,996

|

|

|

President and

|

|

|

2016

|

|

|

500,000

|

|

|

75,000

|

|

|

800,016

|

|

|

—

|

|

|

551,250

|

|

|

—

|

|

|

30,336

|

|

|

1,956,602

|

|

|

General Counsel

|

|

|

2015

|

|

|

499,294

|

|

|

—

|

|

|

1,000,003

|

|

|

—

|

|

|

275,625

|

|

|

—

|

|

|

30,215

|

|

|

1,805,137

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Elizabeth Killinger

Executive Vice

|

|

|

2017

|

|

|

519,808

|

|

|

—

|

|

|

1,040,423

|

|

|

—

|

|

|

616,437

|

|

|

—

|

|

|

18,750

|

|

|

2,195,418

|

|

|

President and

|

|

|

2016

|

|

|

504,634

|

|

|

—

|

|

|

927,010

|

|

|

—

|

|

|

618,502

|

|

|

—

|

|

|

18,550

|

|

|

2,068,696

|

|

|

President, Retail

|

|

|

2015

|

|

|

460,904

|

|

|

—

|

|

|

899,987

|

|

|

—

|

|

|

412,283

|

|

|

—

|

|

|

16,420

|

|

|

1,789,594

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

Reflects base salary earnings.

|

|

2

|

|

Represents discretionary income awarded to Messrs. Andrews, Chillemi and Hill based on exceptional achievements during the fiscal year, above and beyond the performance goals and metrics set forth under the AIP.

|

|

3

|

|

Reflects the grant date fair value determined in accordance with the Financial Accounting Standards Board Accounting Standards Codification Topic 718, Comparison—Stock Compensation. The assumptions made in these valuations are discussed in our

Annual Report on Form 10-K in Item 15—Consolidated Financial Statements. For performance-based RPSUs granted in 2017, if the maximum level of performance is achieved, the fair value will be approximately $7,004,855 for

Mr. Gutierrez, $1,774,824 for Mr. Andrews, $1,311,207 for Mr. Chillemi, $1,393,621 for Mr. Hill and $1,394,161 for Ms. Killinger.

|

|

4

|

|

The amounts shown in this column represent the AIP bonuses paid to the NEOs. Further information regarding the AIP bonuses is included in the "2017 Bonuses" section of this Proxy Statement.

|

The

amounts provided in the Non-Equity Incentive Plan Compensation column represent values earned under NRG's 2017, 2016 and 2015 AIP payable in March 2018, March 2017, and

March 2016, respectively. NEOs were provided the opportunity to earn a cash incentive payment based on the attainment of certain pre-established Company and individual goals for fiscal

years 2017, 2016 and 2015. The performance criteria and weight given to each NEO are described in detail in this CD&A. The dollar amounts in the table represent payouts for

actual 2017, 2016 and 2015 Company performance.

Only

one NEO, Mr. Chillemi, participated in the NRG Pension Plan for Non-Bargained Employees, which was closed to new employees hired on or after December 5,

2003. The value shown in the Change in Pension Value and Nonqualified Deferred Compensation Earnings column represents the 2017 year-over-year increase

in the value of the defined benefit pension plan.

The

amounts provided in the All Other Compensation column represent the additional benefits payable by NRG and include insurance benefits, the employer match under the Company's 401(k) plan, financial

counseling services up to $12,000, including the financial advisor's travel or out-of-pocket expenses, and the amount payable under NRG's all-employee discretionary contribution to the 401(k) plan.

The following table identifies the additional compensation for each NEO.

|

|

|

|

|

48

|

|

Executive

Compensation

|

|

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME

|

|

|

YEAR

|

|

|

LIFE

INSURANCE

REIMBURSEMENT

($)

|

|

|

DISABILITY

INSURANCE

($)

|

|

|

FINANCIAL

ADVISOR

SERVICES

($)

|

|

|

401(K)

EMPLOYER

MATCHING

CONTRIBUTION

($)

|

|

|

401(K)

DISCRETIONARY

CONTRIBUTION

($)

|

|

|

LEGAL

SERVICES

($)

|

|

|

TOTAL

($)

|

|

|

Mauricio Gutierrez

|

|

|

2017

|

|

|

4,952

|

|

|

9,794

|

|

|

12,052

|

|

|

10,724

|

|

|

7,950

|

|

|

—

|

|

|

45,472

|

|

|

|

|

|

2016

|

|

|

4,952

|

|

|

9,331

|

|

|

11,897

|

|

|

10,600

|

|

|

7,950

|

|

|

18,000

|

|

|

62,730

|

|

|

|

|

|

2015

|

|

|

—

|

|

|

—

|

|

|

11,869

|

|

|

7,094

|

|

|

7,800

|

|

|

—

|

|

|

26,763

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kirkland Andrews

|

|

|

2017

|

|

|

—

|

|

|

—

|

|

|

4,447

|

|

|

10,471

|

|

|

7,950

|

|

|

—

|

|

|

22,868

|

|

|

|

|

|

2016

|

|

|

—

|

|

|

—

|

|

|

2,117

|

|

|

10,481

|

|

|

7,950

|

|

|

—

|

|

|

20,548

|

|

|

|

|

|

2015

|

|

|

—

|

|

|

—

|

|

|

2,136

|

|

|

10,671

|

|

|

7,800

|

|

|

—

|

|

|

20,607

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John Chillemi

|

|

|

2017

|

|

|

—

|

|

|

—

|

|

|

2,000

|

|

|

10,800

|

|

|

—

|

|

|

—

|

|

|

12,800

|

|

|

|

|

|

2016

|

|

|

—

|

|

|

—

|

|

|

4,435

|

|

|

10,600

|

|

|

—

|

|

|

—

|

|

|

15,035

|

|

|

|

|

|

2015

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

David R. Hill

|

|

|

2017

|

|

|

—

|

|

|

—

|

|

|

12,000

|

|

|

10,598

|

|

|

7,950

|

|

|

—

|

|

|

30,548

|

|

|

|

|

|

2016

|

|

|

—

|

|

|

—

|

|

|

11,815

|

|

|

10,571

|

|

|

7,950

|

|

|

—

|

|

|

30,336

|

|

|

|

|

|

2015

|

|

|

—

|

|

|

—

|

|

|

11,815

|

|

|

10,600

|

|

|

7,800

|

|

|

—

|

|

|

30,215

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Elizabeth Killinger

|

|

|

2017

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

10,800

|

|

|

7,950

|

|

|

—

|

|

|

18,750

|

|

|

|

|

|

2016

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

10,600

|

|

|

7,950

|

|

|

—

|

|

|

18,550

|

|

|

|

|

|

2015

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

8,620

|

|

|

7,800

|

|

|

—

|

|

|

16,420

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Grants of Plan-Based Awards

for Fiscal Year Ended December 31, 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ESTIMATED POSSIBLE

PAYOUTS UNDER NON-EQUITY

INCENTIVE PLAN AWARDS

|

|

|

ESTIMATED FUTURE

PAYOUTS UNDER EQUITY

INCENTIVE PLAN AWARDS

|

|

|

ALL OTHER

STOCK AWARDS:

NUMBER OF

SHARES OF

STOCK

|

|

|

GRANT DATE

FAIR VALUE

OF STOCK

AND OPTION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME

|

|

AWARD TYPE

|

|

|

GRANT DATE

|

|

|

APPROVAL DATE

|

|

|

THRESHOLD

1

($)

|

|

|

TARGET

2

($)

|

|

|

MAXIMUM

3

($)

|

|

|

THRESHOLD

(#)

|

|

|

TARGET

(#)

|

|

|

MAXIMUM

(#)

|

|

|

OR UNITS

(#)

|

|

|

AWARDS

($)

4

|

|

|

Mauricio Gutierrez

|

|

AIP

|

|

|

—

|

|

|

—

|

|

|

768,750

|

|

|

1,537,500

|

|

|

3,075,000

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

|

|

RPSU

|

|

|

1/3/2017

|

|

|

11/20/2016

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

55,035

|

|

|

220,140

|

|

|

440,280

|

|

|

—

|

|

|

3,502,427

|

|

|

|

|

RSU

|

|

|

1/3/2017

|

|

|

11/20/2016

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

140,251

|

|

|

1,725,087

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kirkland Andrews

|

|

AIP

|

|

|

—

|

|

|

—

|

|

|

331,120

|

|

|

662,240

|

|

|

1,324,480

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

|

|

RPSU

|

|

|

1/3/2017

|

|

|

11/20/2016

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

13,944

|

|

|

55,777

|

|

|

111,554

|

|

|

—

|

|

|

887,412

|

|

|

|

|

RSU

|

|

|

1/3/2017

|

|

|

11/20/2016

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

35,535

|

|

|

437,081

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John Chillemi

|

|

AIP

|

|

|

—

|

|

|

—

|

|

|

183,469

|

|

|

366,938

|

|

|

733,875

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

|

|

RPSU

|

|

|

1/3/2017

|

|

|

11/20/2016

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

10,301

|

|

|

41,207

|

|

|

82,414

|

|

|

—

|

|

|

655,603

|

|

|

|

|

RSU

|

|

|

1/3/2017

|

|

|

11/20/2016

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

26,253

|

|

|

322,912

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

David R. Hill

|

|

AIP

|

|

|

—

|

|

|

—

|

|

|

195,000

|

|

|

390,000

|

|

|

780,000

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

|

|

RPSU

|

|

|

1/3/2017

|

|

|

11/20/2016

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

10,949

|

|

|

43,797

|

|

|

87,594

|

|

|

—

|

|

|

696,810

|

|

|

|

|

RSU

|

|

|

1/3/2017

|

|

|

11/20/2016

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

27,903

|

|

|

343,207

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Elizabeth Killinger

|

|

AIP

|

|

|

—

|

|

|

—

|

|

|

195,075

|

|

|

390,150

|

|

|

780,300

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

|

|

RPSU

|

|

|

1/3/2017

|

|

|

11/20/2016

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

10,953

|

|

|

43,814

|

|

|

87,628

|

|

|

—

|

|

|

697,081

|

|

|

|

|

RSU

|

|

|

1/3/2017

|

|

|

11/20/2016

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

27,914

|

|

|

343,342

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

Threshold non-equity incentive plan awards include annual incentive plan threshold payments, as presented in the CD&A.

|

|

2

|

|

Target non-equity incentive plan awards include annual incentive plan target payments, as presented in the CD&A.

|

|

3

|

|

Maximum non-equity incentive plan awards include annual incentive plan maximum payments, as presented in the CD&A.

|

|

4

|

|

The assumptions made in these valuations are discussed in our Annual Report on Form 10-K in Item 15—Exhibits, Financial Statement Schedules.

|

2017 Annual Incentive Plan

NEOs were provided the opportunity to earn an AIP bonus based on the attainment of certain pre-established Company and individual goals for fiscal year 2017.

The performance criteria and weight given to each are described in detail in the CD&A. The dollar amount of the possible AIP bonus payouts for achieving the threshold, target or maximum levels of