RBS Snaps Losing Streak, But U.S. Settlement Looms -- Earnings Review

February 23 2018 - 5:51AM

Dow Jones News

By Adam Clark

Royal Bank of Scotland Group PLC (RBS.LN) released its

fourth-quarter and 2017 results on Friday at 0700 GMT. Here's what

we watched:

PROFIT: RBS posted a fourth-quarter operating loss of 583

million pounds ($811.5 million) compared with a GBP4.06 billion

loss in the same period in 2016.

This left RBS with a 2017 operating profit of GBP2.24 billion,

swinging from a GBP4.08 billion loss the prior year. On a net

basis, RBS made a GBP752 million profit compared with a GBP6.96

billion loss in 2016.

REVENUE: RBS's total income for the fourth-quarter was GBP3.06

billion, and GBP13.13 billon for 2017 as a whole.

Analysts expected fourth-quarter income of GBP2.92 billion,

according to a FactSet consensus of four estimates. Total income

for 2017 was projected at GBP12.96 billion by a FactSet poll of 17

analysts.

U.S. SETTLEMENT AHEAD: RBS posted its first profit in 10 years,

largely because it reduced the money paid for conduct and

litigation charges. However, RBS didn't set aside any more money

for a settlement with the U.S. Department of Justice over alleged

historic misselling of mortgage-backed securities. The looming

final settlement continues to block RBS from making distributions

to shareholders.

RESTRUCTURING COSTS: RBS said accelerated restructuring means it

intends to increase investment and innovation spending. The bank

said it expects to incur cumulative restructuring charges of about

GBP2.5 billion across 2018 and 2019, up from previous guidance of

about GBP1.0 billion. RBS also said the pace at which it is cutting

operating costs will be "materially lower" in 2018, after adjusted

operating expenses fell by GBP810 million in 2017.

CAPITAL STRENGTH: RBS's Common Equity Tier 1 ratio--a key

measure of financial resilience--climbed to 15.9% at the end of

2017, from 13.4% at the end of 2016, as the bank continued to cut

risk-weighted assets. RBS said it will look to keep its CET1 ratio

ahead of its 13% target, with an eye to absorbing costs such as the

U.S. settlement, future pension contributions and regulatory

requirements.

Write to Adam Clark at adam.clark@dowjones.com;

@AdamDowJones

(END) Dow Jones Newswires

February 23, 2018 05:36 ET (10:36 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

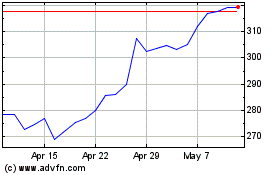

Natwest (LSE:NWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Natwest (LSE:NWG)

Historical Stock Chart

From Apr 2023 to Apr 2024