Glencore's $200 Million Predicament: How to Handle Payments to Individual Under U.S. Sanctions

February 20 2018 - 5:27PM

Dow Jones News

By Scott Patterson

Glencore PLC is grappling with a thorny problem: whether it can

pay a former partner placed under sanctions by the U.S.

government.

The Swiss mining giant will owe up to $200 million in royalty

payments over two years to Israeli billionaire Dan Gertler, on whom

the U.S. Treasury Department placed sanctions in December for

alleged corruption in the Democratic Republic of the Congo,

according to a report Tuesday by Resource Matters, a Brussels

nonprofit organization that focuses on corruption issues in

Africa.

Mr. Gertler is a friend of Congolese President Joseph Kabila,

according to the Treasury Department. Mr. Gertler was a close

partner with Glencore as it built a dominant position in copper and

cobalt in a country where few Western mining firms work.

Investors and analysts often pepper Glencore, which reports 2017

financial results on Wednesday, with questions about its political

risk in Congo. A Glencore subsidiary already faces an investigation

by Canadian securities regulators into previous royalty payments

made to a company owned by Mr. Gertler in Congo.

The subsidiary owes Mr. Gertler's companies royalty payments via

a circuitous route. The payments were initially owed to Gecamines,

the country's national mining company, but Gecamines has asked

Glencore to divert the payments to Mr. Gertler to pay back loans he

had made to the state company, according to Glencore, Gecamines and

Mr. Gertler.

The U.S. Treasury Department sanctions prohibit U.S. firms from

working with Mr. Gertler and a number of companies associated with

him. The Treasury accused Mr. Gertler of amassing a fortune through

"opaque and corrupt mining and oil deals."

A spokesman for Fleurette Group, Mr. Gertler's main company

working in Congo, declined to comment. In the past, Fleurette has

vigorously denied corruption charges from the U.S. government.

Glencore, which isn't accused of corruption, declined to comment

on payments it could owe Mr. Gertler. But Glencore said U.S.

sanctions on Mr. Gertler and the company's continuing financial

obligations to him present a challenge that it is still figuring

out.

"Glencore is still considering its position in relation to its

pre-existing contractual obligations to companies owned by Mr.

Gertler," the company said.

While Glencore is a Swiss company, U.S. sanctions are

significant because the company's extensive ties to the U.S.

financial system could be affected if it continued working with Mr.

Gertler. The company said it has suspended its ties to Mr. Gertler,

whose stake in two Congo mining operations Glencore bought out for

about $1 billion in January 2017.

The Treasury Department didn't respond to a request for

comment.

Glencore "is in limbo," said Elisabeth Caesens, director of

Resource Matters and the author of the report. "If it keeps paying

the royalties, it risks U.S. sanctions. If it stops, it risks

upsetting a businessman with strong political connections in the

Congo," she said.

Gecamines has declined to comment on the royalty payments and

its relationship with Mr. Gertler. The state-owned firm has

recently begun ramping up pressure on mining companies operating in

Congo, alleging that they have manipulated costs and production

figures, resulting in lower payment to the government.

The royalty payments to Mr. Gertler have been a recurring

problem for Glencore. The Wall Street Journal in July reported that

the Ontario Securities Commission is investigating more than $100

million in payments that one of Glencore's Congo copper-mining

subsidiaries made to Fleurette. The investigation stems from

payments that the subsidiary, Katanga Mining, was expected to make

to Gecamines, but instead diverted to Mr. Gertler's company.

Glencore has said the shift in payments, which began in 2013,

was done at the request of Gecamines. The money was shifted to Mr.

Gertler to pay back a $196 million loan that Fleurette made to

Gecamines in 2013.

The Ontario Securities Commission didn't respond to a request

for comment.

Mr. Gertler was also a central figure in a $412 million

settlement in September 2016 between the U.S. Justice Department

and the Securities and Exchange Commission with New York hedge fund

Och-Ziff Capital Management Group LLC. The Justice Department

alleged in a criminal case that Och-Ziff went into business with

Mr. Gertler despite a consultant's warning that he used political

connections in Congo to benefit himself and his associates.

Mr. Gertler hasn't been charged. His spokesman has denied the

Justice Department allegations. Congolese government officials

haven't responded to requests for comment. Daniel Och, chairman and

chief executive of Och-Ziff, has said the firm's conduct

scrutinized by the Justice Department was "inconsistent with our

core values."

Write to Scott Patterson at scott.patterson@wsj.com

(END) Dow Jones Newswires

February 20, 2018 17:12 ET (22:12 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

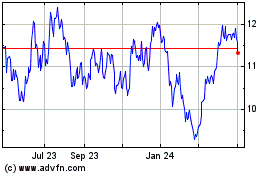

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Aug 2024 to Sep 2024

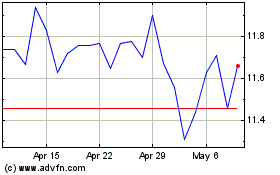

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Sep 2023 to Sep 2024