Report of Foreign Issuer (6-k)

February 08 2018 - 3:32PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2018

(Commission File No. 001-33356),

Gafisa S.A.

(Translation of Registrant's name into English)

Av. Nações Unidas No. 8501, 19th floor

São Paulo, SP, 05425-070

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ______ No ___X___

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ______ No ___X___

Indicate by check mark whether by furnishing the information contained in this Form,

the Registrant is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ______ No ___X___

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b):

N/A

GAFISA S.A.

CNPJ/MF n°

01.545.826/0001-07

NIRE

35.300.147.952

Publicly-held Company

NOTICE TO SHAREHOLDERS

GAFISA S.A. (B3: GFSA3) (“

Company

”), complementing the information released on the Notice to Shareholders on December 20, 2017 (“

First Notice to Shareholders

”), and on January 24, 2018 (“

Second Notice to Shareholders

”), and due to the end on February 2, 2018, of term for subscription of unsubscribed shares during period to exercise the preemptive rights (“

First Period to Subscribe to Unsubscribed Shares

”), within the scope of capital increase approved at the Extraordinary Shareholders’ Meeting held on December 20, 2017 (“

Capital Increase

”), informs the following.

During period to exercise the preemptive right and the First Period to Subscribe to Unsubscribed Shares, sixteen million, three hundred, forty-nine thousand, seven hundred and thirty-five (16,349,735) non-par, registered, common shares were subscribed, at the issue price of fifteen Reais (R$15.00) per share, totaling two hundred, forty-five million, two hundred, forty-six thousand and twenty-five Reais (R$245,246,025.00). Considering total maximum number of shares of the Capital Increase, three million, six hundred, fifty thousand, two hundred and sixty-five (3,650,265) common shares issued by the Company have not been subscribed yet.

According to the Second Notice to Shareholders, these previously mentioned three million, six hundred, fifty thousand, two hundred and sixty-five (3,650,265) common shares may, therefore, be subscribed by shareholders, who, in the subscription list referring to the First Period to Subscribe to Unsubscribed Shares, expressed their interest in reserving unsubscribed shares (“

Second Period to Subscribe to Unsubscribed Shares

”), as follows:

1.

Issue Price per Share.

Fifteen Reais (R$15.00) per share, set out pursuant to Article 170, Paragraph 1, item II of Law No. 6.404/76, of which one centavo of Real (R$0.01) allocated to the capital stock and fourteen Reais and ninety-nine centavos (R$14.99) to the capital reserve, in accordance with Article 182, Paragraph 1, “a”, of Law No. 6.404/76.

2.

Method of Payment.

In cash, in Brazilian currency, upon subscription.

3.

Ratio and Term.

0.41189760540 new shares for each share subscribed in the First Period to Subscribe to Unsubscribed Shares. Notwithstanding the provisions in

the Notice to Shareholders released on January 24, 2018, due to Carnival holiday, the Company understood to be appropriate to extend the Second Period to Subscribe to Unsubscribed Shares, so that the subscription of unsubscribed shares may occur between February 9, 2018 (inclusive) and February 21, 2018 (inclusive).

The percentage to exercise the right to subscribe to unsubscribed shares corresponds to 41.189760540%, obtained by dividing the number of unsubscribed shares by total amount of shares subscribed by shareholders who expressed their interest in unsubscribed shares during the First Period to Subscribe to Unsubscribed Shares, multiplying the quotient by 100.

4.

Procedure for Subscription to Unsubscribed Shares.

The procedures to be observed to subscribe to unsubscribed shares are set out by Itaú Unibanco S.A. (“

Itaú

”), the financial institution liable for the bookkeeping of shares issued by the Company and by B3 S.A. – Brazil, Stock Exchange and OTC (“

B3

”), summarized below.

Shareholders whose shares are maintained in the records of Itaú and who wish to exercise their rights to subscribe to unsubscribed shares, within the term provided for herein, may visit any specialized branch of Itaú, identified in item 9 of the First Notice to Shareholders, bearing the documents listed in item 10 of the First Notice to Shareholders.

The shareholders whose shares are held in custody at B3’s Depositary Center shall exercise their subscription rights through their custody agents, observing the terms and operational procedures stipulated by B3.

The exercise of right to subscribe to unsubscribed shares shall occur by means of completion and signature of the subscription list. The signature of the subscription list shall represent irrevocable and irreversible will of the signatory to subscribe new shares, and the signatory shall irrevocably and irreversibly pay them in full upon signature.

5.

Partial Ratification.

Additional term shall not be granted to reconsider subscription decision in the event of partial ratification of the Capital Increase. However, in this case, shareholder shall be ensured with the conditional subscription right of the Capital Increase. In order to exercise such right, shareholder shall, upon subscription, indicate if, once implemented the condition provided for herein, intends to receive (i) 100% of shares subscribed by him or (ii) the amount corresponding to the ratio between the total number of shares effectively subscribed and the maximum number of shares originally approved to be issued in the Capital Increase, assuming, in the lack of manifestation, shareholder’s interest in receiving 100% of shares subscribed.

The shareholder whose condition to subscribe provided for in respective subscription list is not implemented, will receive the amount fully paid by him, without full or partial monetary restatement, as per option indicated in respective subscription list.

São Paulo, February 8, 2018.

GAFISA S.A.

Carlos Calheiros

Chief Financial and Investor Relations Officer

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: February 08, 2018

|

Gafisa S.A.

|

|

|

|

|

|

By:

|

|

|

|

Name: Sandro Gamba

Title: Chief Executive Officer

|

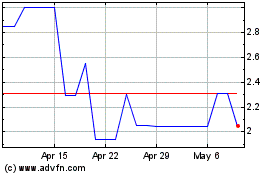

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Mar 2024 to Apr 2024

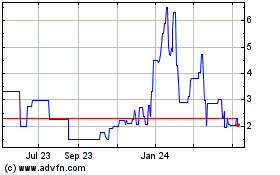

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Apr 2023 to Apr 2024