Nike Sales Climb, Despite Declines in North America

December 21 2017 - 5:33PM

Dow Jones News

By Sara Germano

Nike Inc. sales climbed in its most recent quarter even as

profit and revenue in its home market declined, as the sportswear

maker attempted to sell more directly to consumers instead of

through struggling sporting-goods chains and other

intermediaries.

For the period ended Nov. 30, Nike's profit fell 9% to $767

million, or 46 cents a share, from $842 million, or 50 cents a

share, a year earlier. Revenue rose 5% to $8.6 billion, though

sales in North America fell 5% to $3.5 billion.

Analysts polled by FactSet expected profit of $665 million, or

40 cents a share, on sales of $8.4 billion.

During a challenging year for sportswear companies, Nike has

attempted to increase its direct and online sales to customers and

lessen its reliance on retailers. It has also contended with a

resurgent rival, Adidas AG, whose sales have climbed in North

America.

Chief Executive Mark Parker said the company is preparing to

offer "new differentiated experiences" for shoppers over the next

six months.

Nike's results come about two months after it said it would

shake up its relationship with retailers, focusing on just 40 of

its nearly 30,000 accounts in the coming years as it devotes more

to online and direct sales. Some of the chains that sold Nike

products, like the Sports Authority, have liquidated in recent

years. Just in the past few months, Shiekh Shoes and Sports Zone,

two regional chains that derived most of their sales from Nike,

have filed for chapter 11 bankruptcy.

Over the summer, Nike agreed to sell products through Amazon.com

Inc. after holding out for years, a sign of the online retailer's

growing importance to big brands.

Selling directly to consumers has posed its own challenges.

Nike's website suffered technical problems on Black Friday, and

last month scores of customers complained on social media that they

weren't able to buy shoes from Nike's "The Ten" collection, a

collaboration with designer Virgil Abloh.

Danny Gallegos, a 26-year-old social-media marketer in Miami,

said he tried shopping via Nike's SNKRS app nearly a dozen times

this year and has yet to succeed in buying shoes. He's had better

luck with an Adidas app, Adidas Confirmed, where he scored one pair

of sneakers this year.

"My biggest question is whether or not it's a servers issue," he

said. "If so, shouldn't multibillion-dollar companies be able to

buy their way into a fix for that? What's the holdup?"

Shares were up less than 1 percent after hours.

--Lillian Rizzo and Katy Stech Ferek contributed to this

article.

Write to Sara Germano at sara.germano@wsj.com

(END) Dow Jones Newswires

December 21, 2017 17:18 ET (22:18 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

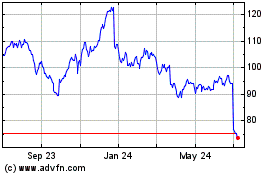

Nike (NYSE:NKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

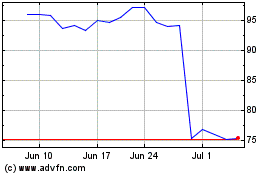

Nike (NYSE:NKE)

Historical Stock Chart

From Apr 2023 to Apr 2024