Report of Foreign Issuer (6-k)

December 05 2017 - 3:52PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2017

(Commission File No. 001-33356),

Gafisa S.A.

(Translation of Registrant's name into English)

Av. Nações Unidas No. 8501, 19th floor

São Paulo, SP, 05425-070

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ______ No ___X___

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ______ No ___X___

Indicate by check mark whether by furnishing the information contained in this Form,

the Registrant is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ______ No ___X___

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b):

N/A

GAFISA S.A.

CNPJ/MF n

°

01.545.826/0001-07

NIRE 35.300.147.952

Publicly-held Company

NOTICE TO THE MARKET

GAFISA S.A. (BOVESPA: GFSA3) (“

Gafisa

” or “

Company

”) informs that on this date paid to Caixa Econômica Federal (CEF) the last tranche of the 7

th

Issue of the Company’s Debentures, totaling R$157,522,342.50 million, including principal and interest.

The funds for such payment partially derive from anticipated refund referring to capital decrease of Construtora Tenda S.A. (“

Tenda”

), approved on December 14, 2016.

This event sets the last steps of the Company’s strategic plan which involved, in addition to the operational and corporate separation of Gafisa and Tenda, the sale of 70% interest in Alphaville. This new positioning allows the Company to rapidly respond to new business opportunities in its target market, also providing greater visibility of its operational performance.

Finally, these actions are in line with the Company’s strategy of reducing its current level of indebtedness, enhancing its capital structure strength and advancing the Company’s strategic and operational positioning in this new cycle of the real estate market.

São Paulo, December 5, 2017.

GAFISA S.A.

Carlos Calheiros

Chief Financial and Investor Relations Officer

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 5, 2017

|

Gafisa S.A.

|

|

|

|

|

|

By:

|

|

|

|

Name: Sandro Gamba

Title: Chief Executive Officer

|

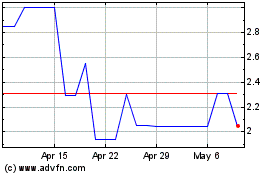

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Mar 2024 to Apr 2024

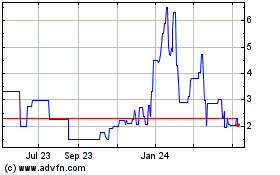

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Apr 2023 to Apr 2024