Lennar, CalAtlantic Strike Deal to Create Largest U.S. Home Builder -- 4th Update

October 30 2017 - 6:03PM

Dow Jones News

By Chris Kirkham and Laura Kusisto

Lennar Corp. agreed to buy CalAtlantic Group Inc. for $5.7

billion, creating the country's largest home builder by revenue in

the latest affirmation of a U.S. economic expansion now in its

ninth year.

The proposal marks the largest merger of home builders since the

financial crisis, a milestone for the recovery of an industry that

was hard hit by the housing collapse last decade but has

contributed significantly to U.S. growth in recent years.

The deal would create a combined company with revenues of more

than $17 billion as of last year and a market cap of roughly $18

billion, based on Friday's closing share prices.

Major home builders are looking to control rising costs for

land, labor and materials as the U.S. housing market expansion

continues. Builders increasingly are focusing on first-time home

buyers purchasing less-expensive homes, which has put pressure on

profit margins.

Lennar Chief Executive Stuart Miller said the combination will

increase Lennar's presence in markets it already operates in and

allow it to be one of the top three home builders in 24 of the top

30 markets in the country.

On a conference call Monday, Lennar executives pointed out that

the two companies are already competing in many of the same

markets. With more scale, they said they can lower costs by

negotiating better deals with construction crews and suppliers.

"It should be no surprise that the more you buy, the less you

pay," said Lennar President Rick Beckwitt.

The companies expect the deal to generate $250 million in annual

cost savings by the 2019 fiscal year, and roughly $75 million in

fiscal 2018.

In acquiring CalAtlantic, Lennar will have access to a new

supply of developable land that can be built on quickly, which is

less risky than buying large tracts of undeveloped land that could

take years to get permits.

Analysts agree that a larger company will better be able to

navigate increasing construction costs, which have outpaced price

increases of new homes every quarter over the past three years,

according to data from John Burns Real Estate Consulting, which

tracks the industry.

Facing construction-labor shortages in many markets, builders

have to compete for the best crews. More scale means more steady

work for construction crews, which analysts said would give the

combined company an advantage in negotiations.

"The bigger you are, certainly the better-positioned you are in

that market," said Credit Suisse home building analyst Susan

Maklari. "You can say 'It's not worth leaving me and going to

another builder's site.'"

CalAtlantic itself was the product of a 2015 merger between two

other major home builders, Standard Pacific Corp. and Ryland Group

Inc.

Home builders struggled through the 2007-09 recession and the

early economic recovery as millions of Americans faced foreclosures

and unemployment. Single-family home construction has only recently

begun to surpass the prior 30-year average, but home builders over

the past year have reported a return of first-time buyers to the

market as economic conditions improve.

"We are starting to see an enabled home buyer, a home buyer that

is witnessing wage growth, and a mortgage market that is accepting

of home buyers coming back to market," said Lennar Chief Executive

Stuart Miller on a conference call about the deal on Monday.

The homeownership rate hit 63.7% in the second quarter, a jump

of nearly a full percentage point from a year earlier, according to

the Census Bureau. Younger households helped drive that

improvement: The homeownership rate for households headed by

someone under 35 years old jumped to 35.3% from 34.1% a year

earlier.

Still, these households are particularly price-sensitive,

placing additional pressure on builders to control costs and keep

the price of these homes at a level first-time buyers can afford.

Data in recent months has indicated a pull-back in first-time buyer

activity as prices have rise and inventory remains tight. New home

sales had their largest single-month increase since 1992 in

September, a sign of forward momentum in the market.

More home buyers means more sales for home builders, but it is

difficult to maintain the same kind of profit margins generated by

high-end luxury home sales that dominated the early years of the

economic recovery. Both Lennar and CalAtlantic have among the

highest gross profit margins in the industry, and Lennar executives

said they expect gross margins to remain above 22% following the

acquisition.

CalAtlantic shareholders will also have the option to exchange

all or a portion of their shares for cash, subject to a maximum

cash amount of $1.2 billion, or about 27% of CalAtlantic's market

value.

The deal is subject to approval by shareholders of both

companies, and is expected to close early next year.

CalAtlantic shares, up 42% since the beginning of the year,

closed Monday up 21%. Lennar shares were down 4% on the news.

--Cara Lombardo contributed to this article.

Write to Chris Kirkham at chris.kirkham@wsj.com and Laura

Kusisto at laura.kusisto@wsj.com

(END) Dow Jones Newswires

October 30, 2017 17:48 ET (21:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

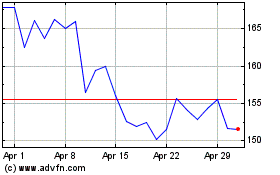

Lennar (NYSE:LEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lennar (NYSE:LEN)

Historical Stock Chart

From Apr 2023 to Apr 2024