Ericsson Posts Another Loss but Faint Signal of Recovery Emerges -- 2nd Update

October 20 2017 - 9:33AM

Dow Jones News

By Stu Woo

Telecommunications-equipment giant Ericsson AB reported another

quarter of falling sales and widening losses as it struggles to

compete with new Chinese players, but investors saw signs that a

monthslong turnaround effort was starting to bear fruit.

Ericsson on Friday reported a 6% fall in third-quarter revenue

to 47.8 billion Swedish kronor ($5.9 billion) and a wider net loss

4.3 billion kronor, compared with a 200 million kronor in the same

period last year. It was Ericsson's fourth straight quarter of

losses -- and the company warned its fourth-quarter performance

could be worse than expected.

"The general market conditions continue to be tough," Chief

Executive Borje Ekholm said.

But investors sent Ericsson stock up more than 4% after the

company said gross margins in its core network business improved to

31% from 28% in the third quarter compared with a year ago, after

adjusting for one-time costs related to restructuring.

Third-quarter sales for Ericsson's network business declined 1%

compared with a year earlier, less than the 6% Citi analyst Amit

Harchandani projected. "The strength came from where you would like

it to be seen, which is in the network products business," Mr.

Harchandani said. "It's not a spectacular set of results, but given

what we have seen from Ericsson recently... it was very

reassuring."

Telecommunications-equipment companies are facing an

industry-wide lull. Their primary customers are mobile carriers,

which have largely purchased all the gear they need for the current

generation of wireless networks, called 4G. The carriers aren't

expected to need equipment for the next generation, 5G, until 2019

at the earliest. Both Ericsson and Finnish rival Nokia Corp. issued

earnings warnings this year, citing the weak market.

In addition, Ericsson faces increased competition. Nokia in 2016

broadened the range of telecommunications equipment it sells by

acquiring Alcatel-Lucent, while wireless-carrier executives have

said that China's Huawei Technologies Co. offers comparable gear at

lower prices.

Huawei led the $161 billion-a-year telecom-equipment industry in

2016, with 20.5% of the market's revenue, according to Gartner Inc.

Ericsson was second with 14.7%, while Nokia was third with

14.4%

Mr. Ekholm, appointed as chief executive last October, has

rolled out a costly restructuring and turnaround plan. It involves

streamlining Ericsson's management team and focusing on its core

business of selling telecommunications equipment and services. It

is also considering selling its other businesses, such as one that

helps pay-TV broadcasters transmit video.

Mr. Ekholm said Friday that Ericsson remained committed to its

strategy.

Write to Stu Woo at Stu.Woo@wsj.com

(END) Dow Jones Newswires

October 20, 2017 09:18 ET (13:18 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

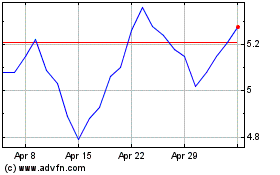

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

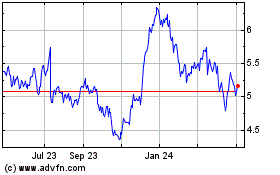

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Apr 2023 to Apr 2024