Hudson Technologies Announces Closing of Acquisition of Airgas-Refrigerants, Inc.

October 10 2017 - 5:26PM

Business Wire

Hudson Technologies, Inc. (NASDAQ:HDSN) (“Hudson”) today

announced the closing of its acquisition of Airgas-Refrigerants,

Inc. (“ARI”), a subsidiary of Airgas, Inc., an Air Liquide company

and leading U.S. supplier of industrial gases. The transaction is

valued on a gross basis at approximately $220 million. ARI is a

leading refrigerant distributor and EPA certified reclaimer in the

U.S. ARI distributes, reclaims and packages refrigerant gases for a

variety of end uses.

The trailing twelve month revenue through June 30, 2017 for ARI

was approximately $142 million, and trailing 12 month pro forma

revenue of the combined business as of June 30, 2017 was

approximately $275 million. The acquisition is expected to be

accretive to earnings beginning one year following the close of the

transaction due to certain purchase price allocation adjustments,

primarily to inventory, which will impact Hudson’s 2018 Generally

Accepted Accounting Principles (“GAAP”) earnings per share.

Kevin J. Zugibe, Chairman and Chief Executive Officer of Hudson

Technologies commented, “We’re very pleased to have closed this

transformative acquisition which represents a milestone in our

Company’s history. The addition of ARI significantly strengthens

our leadership position in the refrigerant and reclamation industry

by enhancing our product offerings, increasing our geographic reach

and customer base and enhancing our sales and distribution

capabilities. This strategic combination considerably increases the

scale of our company which will allow us to better serve our

customers during the ongoing phase out of HCFC refrigerants and as

the industry continues its transition to next generation HFC

refrigerants, which have also been identified for future phase

down. We welcome ARI’s experienced management team and employees

and look forward to working together to serve our existing and new

customers with our expanded product and service capabilities.”

The acquisition was financed with available cash balances, plus

total borrowings of approximately $185 million under an enhanced

asset based lending facility of $150 million from PNC Bank and

under a new term loan from funds advised by FS Investments and

sub-advised by GSO Capital Partners LP of $105 million. No

additional Hudson equity was issued to finance this

transaction.

William Blair & Co. acted as Hudson’s exclusive financial

advisor for the transaction and the law firm of Wiggin and Dana LLP

served as the Company’s legal counsel.

About Hudson Technologies

Hudson Technologies, Inc. is a leading provider of innovative

and sustainable solutions for optimizing performance and enhancing

reliability of commercial and industrial chiller plants and

refrigeration systems. Hudson's proprietary RefrigerantSide®

Services increase operating efficiency, provide energy and cost

savings, reduce greenhouse gas emissions and the plant’s carbon

footprint while enhancing system life and reliability of operations

at the same time. RefrigerantSide® Services can be performed at a

customer's site as an integral part of an effective scheduled

maintenance program or in response to emergencies. Hudson also

offers SMARTenergy OPS®, which is a cloud-based Managed Software as

a Service for continuous monitoring, Fault Detection and

Diagnostics and real-time optimization of chilled water plants. In

addition, the Company sells refrigerants and provides traditional

reclamation services for commercial and industrial air conditioning

and refrigeration uses. For further information on Hudson, please

visit the Company's web site at www.hudsontech.com.

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995

Statements contained herein which are not historical facts

constitute forward-looking statements. These include statements

regarding management’s intentions, plans, beliefs, expectations or

forecasts for the future including, without limitation, Hudson’s

expectations with respect to the benefits, costs and other

anticipated financial impacts of the proposed ARI transaction;

future financial and operating results of the company; and the

company’s plans, objectives, expectations and intentions with

respect to future operations and services. Such forward-looking

statements involve a number of known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements. Such

factors include, but are not limited to, changes in the laws and

regulations affecting the industry, changes in the demand and price

for refrigerants (including unfavorable market conditions adversely

affecting the demand for, and the price of, refrigerants), the

Company's ability to source refrigerants, regulatory and economic

factors, seasonality, competition, litigation, the nature of

supplier or customer arrangements that become available to the

Company in the future, adverse weather conditions, possible

technological obsolescence of existing products and services,

possible reduction in the carrying value of long-lived assets,

estimates of the useful life of its assets, potential environmental

liability, customer concentration, the ability to obtain financing,

any delays or interruptions in bringing products and services to

market, the timely availability of any requisite permits and

authorizations from governmental entities and third parties as well

as factors relating to doing business outside the United States,

including changes in the laws, regulations, policies, and

political, financial and economic conditions, including inflation,

interest and currency exchange rates, of countries in which the

Company may seek to conduct business, the Company’s ability to

successfully integrate any assets it acquires from third parties

into its operations, and other risks detailed in the Company's 10-K

for the year ended December 31, 2016 and other subsequent filings

with the Securities and Exchange Commission. Examples of such risks

and uncertainties specific to the proposed ARI transaction include,

but are not limited to, the possibility that the expected benefits

will not be realized, or will not be realized within the expected

time period. The words "believe", "expect", "anticipate", "may",

"plan", "should" and similar expressions identify forward-looking

statements. Readers are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

the statement was made.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171010006704/en/

Investor Relations:Institutional Marketing Services

(IMS)John Nesbett/Jennifer Belodeau,

203-972-9200jnesbett@institutionalms.comorCompany:Hudson

Technologies, Inc.Brian F. Coleman, 845-735-6000President &

COObcoleman@hudsontech.com

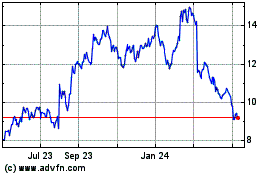

Hudson Technologies (NASDAQ:HDSN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hudson Technologies (NASDAQ:HDSN)

Historical Stock Chart

From Apr 2023 to Apr 2024