El Paso Electric and City of El Paso Agree in Principle on Terms of Settlement for Texas Rate Case Docket No. 46831

September 19 2017 - 6:22PM

Business Wire

El Paso Electric Company (EPE) (NYSE: EE) today announced that

the City of El Paso approved, in principle, the settlement terms

for EPE's rate case pending in Docket No. 46831 before the Public

Utility Commission of Texas (PUCT). No party in the case has

indicated that it intends to oppose the proposed settlement.

Key terms of the proposed settlement include: (i) an annual

non-fuel base rate increase of $14.5 million; (ii) a return on

equity of 9.65%; (iii) a determination that all new plant in

service was prudent and used and useful and therefore is included

in rate base; and (iv) allowing EPE to recover reasonable rate case

expenses, subject to Commission Staff’s review and currently

estimated to be approximately $3.0 million, through a separate

surcharge over a three year period.

The settlement also establishes baseline revenue requirements

for transmission and distribution investment costs. The

establishment of such baseline revenue requirements will allow EPE

to file an application with the PUCT to adjust its rates to recover

the incremental costs for these investments periodically, with the

first such filing to be made no earlier than January 1, 2019. Texas

regulations allow a utility to recover its incremental investment

in transmission and distribution infrastructure not included in the

Company’s last general rate case proceeding before the PUCT. The

investment is recovered through separate mechanisms known as a

Transmission Cost Recovery Factor or Distribution Cost Recovery

Factor after a baseline of the level of investment and associated

cost has been established in a general rate proceeding.

The settlement also includes a minimum monthly charge of $30.00

for residential customers with distributed generation, such as

private rooftop solar. This charge is to recover the cost of grid

and customer-related services. This new monthly charge is only

applicable to customers that apply for interconnection after the

date of the issued final PUCT order in the rate case (Final Order).

The parties also agreed not to establish a separate rate class for

customers with private rooftop solar at this time.

Additionally, the proposed settlement allows for the annual

recovery of $2.1 million of nuclear decommissioning funding and

establishes annual depreciation expense that is approximately $1.9

million lower than the annual amount requested by EPE in its

initial filing.

Once the parties have agreed formally to the terms of the

settlement and executed the final documentation, the settlement

documents will be filed with the Administrative Law Judges, along

with a request that they return the case to the PUCT for approval.

A Final Order is anticipated to be issued in the fourth quarter of

2017. Regardless of when the Final Order is issued, the new rates

will relate back to consumption on or after July 18, 2017.

"A rate case is a complex process with many intervening parties

and interests represented," said Mary Kipp, El Paso Electric’s

President and Chief Executive Officer. "I am pleased the

regulatory process allows the opportunity for all involved parties

to work together and to collaboratively find solutions that are in

the best interests of our customers, community, and other

stakeholders. We continue to remain committed to meeting the

growing energy needs of our community in a smart, environmentally

responsible, and cost-effective way.”

On February 13, 2017, EPE filed a request for an increase in

annual non-fuel base revenues of approximately $42.5 million with

the City of El Paso, other incorporated municipalities in its Texas

service territory and the PUCT. EPE filed a motion to sever the

estimated rate case expenses into a separate hearing on May 30,

2017, and modified the requested increase to $39.2 million. The

actual level of rate case expenses approved for recovery is subject

to PUCT Staff review, which is expected to be completed prior to

the issuance of a Final Order by the PUCT.

El Paso Electric Company is a regional electric utility

providing generation, transmission and distribution service to

approximately 416,000 retail and wholesale customers in a 10,000

square mile area of the Rio Grande valley in west Texas and

southern New Mexico.

Safe Harbor

This news release includes statements that may constitute

forward-looking statements made pursuant to the safe harbor

provisions within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Forward-looking statements often involve risks

and uncertainties that could cause actual results to differ

materially from such forward-looking statements. Risks and factors

that could cause or contribute to such differences include, but are

not limited to: (i) a breakdown in settlement discussions with the

parties in EPE’s Texas rate case; (ii) EPE’s inability to reach

final agreement with the intervenors in EPE’s Texas rate case;

(iii) increased prices for fuel and purchased power and the

possibility that regulators may not permit EPE to pass through all

such increased costs to customers or to recover previously incurred

fuel costs in rates; (iv) full and timely recovery of capital

investments and operating costs through rates in Texas and New

Mexico; and (v) other factors detailed by EPE in its public filings

with the Securities and Exchange Commission (SEC). EPE's filings

are available from the SEC or may be obtained through EPE's

website, http://www.epelectric.com. Although EPE believes that the

expectations reflected in such forward-looking statements are

reasonable, no assurances can be given that these expectations will

prove to be correct. Any such forward-looking statement is

qualified by reference to these risks and factors. EPE cautions

that these risks and factors are not exclusive. The forward-looking

statements are subject to and involve risks, uncertainties and

assumptions and you should not place undue reliance on these

forward-looking statements. EPE does not undertake to update or

revise any forward-looking statement that may be made from time to

time by or on behalf of EPE except as required by law. If EPE does

update one or more forward-looking statements, there should be no

inference that EPE will make additional updates with respect to

these or other forward-looking statements.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170919006696/en/

El Paso Electric CompanyPublic Relations:Eddie Gutierrez,

915-543-5763eduardo.gutierrez@epelectric.comorInvestor

Relations:Lisa Budtke,

915-543-5947lisa.budtke@epelectric.comorRichard Gonzalez,

915-543-2236richard.gonzalez@epelectric.com

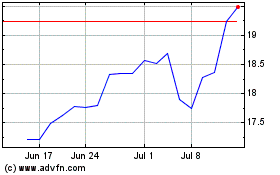

Excelerate Energy (NYSE:EE)

Historical Stock Chart

From Mar 2024 to Apr 2024

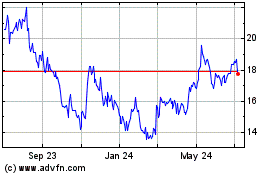

Excelerate Energy (NYSE:EE)

Historical Stock Chart

From Apr 2023 to Apr 2024