Current Report Filing (8-k)

September 19 2017 - 6:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant To Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): September 18, 2017

HealthSouth Corporation

(Exact Name of Registrant as Specified in its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

|

|

|

|

|

001-10315

|

63-0860407

|

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

|

|

3660 Grandview Parkway, Suite 200, Birmingham, Alabama 35243

(Address of Principal Executive Offices, Including Zip Code)

(205) 967-7116

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

¨

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934. Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

ITEM 8.01.

Other Events

.

During 2017, HealthSouth Corporation (the “Company”) has adopted new accounting guidance related to its share-based payment accounting and presentation. Therefore, in order to present previously provided financial information on a basis that is comparable to the basis on which the Company prepared and reported similar information in its Quarterly Reports on Form 10-Q for the quarterly periods ended June 30, 2017 and March 31, 2017 (the “2017 Quarterly Reports”), the Company has recast its previously issued annual financial statements and certain other financial information originally reported within its Annual Report on Form 10-K for the year ended December 31, 2016 (the “2016 Form 10-K”), filed on February 22, 2017, to reflect the following:

|

|

|

|

•

|

In March 2016, the FASB issued ASU 2016-09, “Improvements to Employee Share-Based Payment Accounting (Topic 718),” to simplify various aspects of share-based payment accounting and presentation. The new standard requires entities to record all of the tax effects related to share-based payments at settlement (or expiration) through the income statement. This change is required to be applied prospectively to all excess tax benefits and tax deficiencies resulting from settlements after the date of adoption of the ASU. The standard eliminates the requirement to delay recognition of a windfall tax benefit until it reduces current taxes payable. This change is required to be applied on a modified retrospective basis. In addition, all income tax-related cash flows resulting from share-based windfall tax benefits are required to be reported as operating activities on the statement of cash flows as opposed to the current presentation as an inflow from financing activities and an outflow from operating activities. Either prospective or retrospective transition of this provision is permitted. The standard also clarifies that all cash payments made to taxing authorities on the employees’ behalf for withheld shares should be presented as financing activities on the statement of cash flows on a retrospective basis. Finally, the standard allows entities to make an accounting policy election to either estimate forfeitures for each period or account for forfeitures as they occur. For the Company, this guidance was effective for its annual reporting period beginning January 1, 2017, including interim periods within that reporting period. As a result of the Company’s adoption of this guidance effective January 1, 2017, it now records tax benefits in excess of compensation cost (“windfalls”) to

Provision for income tax expense

in its consolidated statement of operations. In addition, the Company retrospectively applied the guidance governing presentation of windfalls and cash payments made to taxing authorities on the employees’ behalf for withheld shares on the statement of cash flows. The Company did not elect an accounting policy change to record forfeitures as they occur and thus will continue to estimate forfeitures at each period. Except for the adjustments above, the adoption of this guidance did not have a material impact on the Company’s consolidated financial statements. See the “Recent Accounting Pronouncements” section of Note 1,

Summary of Significant Accounting Policies

, of

the consolidated financial statements included as Exhibit 99.1 to this filing.

|

In addition, the Company exercised the early redemption option and subsequently retired all $320 million of its 2.00% Convertible Senior Subordinated Notes due 2043 (the “Convertible Notes”) in the second quarter of 2017. Substantially all of the holders elected to convert their Convertible Notes to shares of the Company’s common stock, which resulted in the issuance of 8.9 million shares from treasury stock. See the “Events Subsequent to Original Issuance of Financial Statements (Unaudited)” section of Note 9,

Long-term Debt

, of

the consolidated financial statements included as Exhibit 99.1 to this filing.

This Current Report on Form 8-K updates, where applicable, Items 7, 8, and the “Financial Statements” portion of 15 of the 2016 Form 10-K to reflect the recasting of the financial statements as described above. The recast financial statements contained in Exhibit 99.1 to this Current Report on Form 8-K do not represent a restatement of the Company’s previously issued financial statements that were included in the 2016 Form 10-K. No items of the 2016 Form 10-K other than those specifically identified above are being revised by this filing. Information in the 2016 Form 10-K is generally stated as of December 31, 2016, and this filing does not reflect any subsequent information or events other than the adoption of the accounting guidance and Convertible Notes transaction described above. Without limitation of the foregoing, this filing does not purport to update the Management’s Discussion and Analysis of Financial Condition and Results of Operations contained in the 2016 Form 10-K for any information, uncertainties, transactions, risks, events or trends occurring, or known, to management. More current information is contained in the Company’s 2017 Quarterly Reports and other filings with the United States Securities and Exchange Commission (the “SEC”). This Current Report on Form 8-K should be read in conjunction with the 2016 Form 10-K, the 2017 Quarterly Reports, and other filings with the SEC. The 2017 Quarterly Reports and other filings contain important information regarding events, developments, and updates to certain expectations of the Company that have occurred since the filing of the 2016 Form 10-K.

ITEM 9.01.

Financial Statements and Exhibits

.

(d) Exhibits

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

|

|

|

|

101

|

|

Sections of the HealthSouth Corporation Annual Report on Form 10-K for the year ended December 31, 2016, formatted in XBRL (eXtensible Business Reporting Language), submitted in the following files:

|

|

|

|

101.INS XBRL Instance Document

|

|

|

|

101.SCH XBRL Taxonomy Extension Schema Document

|

|

|

|

101.CAL XBRL Taxonomy Extension Calculation Linkbase Document

|

|

|

|

101.DEF XBRL Taxonomy Extension Definition Linkbase Document

|

|

|

|

101.LAB XBRL Taxonomy Extension Label Linkbase Document

|

|

|

|

101.PRE XBRL Taxonomy Extension Presentation Linkbase Document

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

HEALTHSOUTH CORPORATION

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ D

OUGLAS

E. C

OLTHARP

|

|

|

Name:

|

Douglas E. Coltharp

|

|

|

Title:

|

Executive Vice President and Chief Financial Officer

|

Dated: September 18, 2017

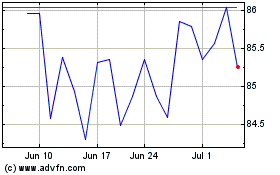

Encompass Health (NYSE:EHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

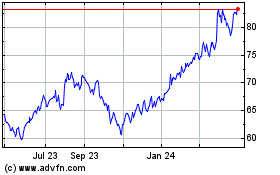

Encompass Health (NYSE:EHC)

Historical Stock Chart

From Apr 2023 to Apr 2024