FORM 6-K

U.S. SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

REPORT OF FOREIGN

PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE

SECURITIES

EXCHANGE ACT OF 1934

dated September 5,

2017

BRASILAGRO –

COMPANHIA BRASILEIRA DE PROPRIEDADES

AGRÍCOLAS

(Exact Name as

Specified in its Charter)

BrasilAgro

– Brazilian Agricultural Real Estate

Com

pany

U

(Translation of

Registrant’s Name)

1309

Av. Brigadeiro Faria Lima, 5th floor, São Paulo, São

Paulo 01452-002, Brazil

U

(Address of

principal executive offices)

Gustavo

Javier Lopez,

Chief

Administrative Officer and Investor Relations

Officer,

Tel.

+55 11 3035 5350, Fax +55 11 3035 5366,

ri@brasil-agro.com

1309

Av.

Brigadeiro

Faria Lima, 5

th

floor

São

Paulo, São Paulo 01452-002, Brazil

U

(

Name,

Telephone, E-mail and/or Facsimile number and Address of Company

Contact Person)

Indicate by check

mark whether the registrant files or will file annual reports under

cover Form 20-F or Form 40-F.

Form 20-F

☒

Form

40-F

☐

Indicate by check

mark if the registrant is submitting the Form 6-K in paper as

permitted by Regulation S-T

Rule 101(b)(1):

U

Indicate by check

mark if the registrant is submitting the Form 6-K in paper as

permitted by Regulation S-T

Rule 101(b)(7):

U

Indicate by check

mark whether by furnishing the information contained in this Form,

the registrant is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange

Act of 1934.

Yes

☐

No

☒

If

“Yes” is marked, indicate below the file number

assigned to the registrant in connection with Rule

12g3-2(b): Not applicable.

Management Message

São

Paulo, September 1

st

, 2017.

Dear

Shareholder,

In the

light of the Call Notice published on the date hereof, in reference

to the Ordinary and Extraordinary Shareholders’ Meeting, we

would like to underscore the importance of your participation in

said meetings, which will be held on October 2

nd

, 2017. It is

extremely important that we are able to decide the following at the

aforementioned Ordinary and Extraordinary Shareholders’

Meeting:

(1)

at the Annual

Ordinary Meeting:

(1.1.)

to

examine the

management accounts, analyze, discuss and vote on the

Company’s Financial Statements related to the fiscal year

ended on June 30

th

, 2017, including

the Independent Auditors’ opinion and the Fiscal Council

Report;

(1.2.)

to resolve on

the allocation of the financial result of the fiscal year ended on

June 30

th

,

2017 and the distribution of dividends;

(1.3.)

the determination of the number

of the members to comprise the Company’s Board of Directors,

as well as (i) the reelection of Messrs. Eduardo S. Elsztain,

Alejandro G. Elsztain, Saul Zang, João de Almeida Sampaio

Filho, Isaac Selim Sutton, Fabio Schuler de Medeiros and Ricardo de

Santos Freitas for sitting members of the Company’s Board of

Directors; (ii) election of Messrs. Carlos Blousson and Alejandro

Casaretto to the positions of sitting members of the Board of

Directors; and (iii) the election of Messrs. Carolina Zang and

Gastón Armando Lernoud to the positions of first and second

alternate members of the Board of Directors, respectively;

(1.4)

the reelection of

Messrs. Fabiano Nunes Ferrari, Ivan Luvisotto Alexandre and

Débora de Souza Morsch for sitting members of the

Company’s Fiscal Council, as well as the reelection of Mrs.

Daniela Gadben and the election of Messrs. Marcos Paulo Passoni and

Luciana Terezinha Simão Villela for alternate members of the

Company’s Fiscal Council;

(1.5)

to establish the Company’s

management annual overall compensation for the fiscal year

initiated on July 1

st

, 2017; and,

(2)

at the Extraordinary

Meeting:

(2.1.)

to resolve

on the Company’s proposal for Long-term Incentive Plan in

Shares (“

LTI

Plan

”), as provided for in article 20, item X, of the

Company’s Bylaws, in substitution to the Stock Option Plan

approved at the Extraordinary General Meeting held on November 14,

2008, which shall be canceled upon approval of the LTI

Plan.

Precisely

for this purpose, and by means hereof, we hereby provide you with

following supplemental and clarificatory information regarding the

matters on the agendas for the Ordinary and Extraordinary Meeting

to be held on October 2

nd

, 2017, as

follows:

1.

At Annual Ordinary

Meeting:

(1.1)

Financial

Statements

. The Management of Brasilagro recommends that you

vote in favor of approving the Management Report and the Financial

Statements along with the independent auditors’ and the

Fiscal Council’s reports for the year ended June 30, 2017,

which are available on the websites of the Company (

www.brasil-agro.com

),

the São Paulo Stock Securities, Commodities and Futures

Exchange– BM&FBOVESPA (

www.bmfbovespa.com.br

)

and the Brazilian Securities and Exchange Commission – CVM

(

www.cvm.gov.br

).

(1.2)

Allocation of the

financial result for the fiscal year ended June 30, 2017

.

The Management of BrasilAgro recommends that you vote to approve

the proposal to allocate the net income booked for the fiscal year

ended June 30, 2017, as follows:

|

Net

Profit at Year-End (after IR and CSLL deductions):

(-) Accumulated

losses:

|

$

R 27,309,809.81

|

|

Net

Income for the Year:

|

$

R 27,309,809.81

|

|

(-) Legal Reserve

(5%):

|

$

(R 1,365,490.49

)

|

|

Adjusted

Net Income:

|

$

R 25,944,319.32

|

|

Compulsory

Dividends (25%):

|

$

(R 6,486,079.83

)

|

|

Proposed Additional

Dividends (25%)

|

$

(R 6,486,079.83

)

|

|

Reserve for

Investment and Expansion (50%):

|

$

(R 12,972,159.66

)

|

LEGAL

RESERVE: Pursuant to article 193 of Law 6,404/76, five per cent

(5%) of Net Income, in the amount of one million, three hundred and

sixty-five thousand, four hundred and ninety Brazilian Reais and

forty-nine cents (R$ 1,365,490.49) shall be allocated to the

constitution of Legal Reserve.

DIVIDENDS:

Pursuant to article 36 of the Company’s Bylaws and to Article

202 of Law 6,404/76, the shareholders holding common shares issued

by the Company, shall be paid dividends in the total amount of

twelve million, nine hundred seventy-two thousand, one hundred and

fifty-nine Brazilian Reais and sixty-six cents (R$ 12,972,159.66),

corresponding to twenty-four cents (R$0.24) per share on

06.30.2017. The payment of dividends shall be carried out in up to

thirty (30) days counted as of the date of their statement. The

dividends shall be paid to those holding shareholding position at

the Company at the end of the date on which the Annual

Shareholders' Ordinary Meeting approving the financial statements

for the fiscal year ended on 06.30.2017 is held, it being

understood that, as of the following day, the Company’s

shares shall be traded “ex” dividends.

RESERVE

FOR INVESTMENT AND EXPANSION: The outstanding balance of the

Adjusted Net Income, pursuant to article 36, subparagraph (c), of

the Company’s By Laws, in the amount of twelve million, nine

hundred seventy-two thousand, one hundred and fifty-nine Brazilian

Reais and sixty-six cents (R$ 12,972,159.66), shall be allocated to

the Reserve for Investment and Expansion, whose purpose is the

carrying out of investments for development of the Company’s

activities, investments in properties and in the acquisition of new

properties aiming at the expansion of the Company’s

activities, in addition to investments in infrastructure for

expansion of the Company’s production capacity. The Reserve

for Investment and Expansion may be used to back the acquisition by

the Company the shares of its own issuance, subject to the terms

and conditions of the repurchase program of shares approved by the

Board of Directors.

We

would also like to mention that the currently proposed allocation

is clearly reflected in the Financial Statements drafted by the

Company’s management, which have already been widely

disclosed as required by applicable legislation.

1.3.

Determination

of the number of members to comprise the Company’s Board of

Directors, and the election of respective sitting members and

alternate members of the Board of Directors.

The Management

of Brasilagro recommends that the Board of Directors shall consist

of nine (9) members, as well as its shareholders vote in favor of

(i) the reelection of Messrs. Eduardo S. Elsztain, Alejandro G.

Elsztain, Saul Zang, João de Almeida Sampaio Filho, Isaac

Selim Sutton, Fabio Schuler de Medeiros and Ricardo de Santos

Freitas,

to the

positions of sitting members of the Board of Directors; (ii)

election of Messrs. Carlos Blousson and Alejandro Casaretto to the

positions of sitting members of the Board of Directors; and (iii)

the election of Messrs. Carolina Zang and Gastón Armando

Lernoud to the positions of first and second alternate members of

the Board of Directors, respectively, as originally proposed, for

unified mandates to end at the Annual Ordinary General Meeting that

approves the financial statements related to the Fiscal year ending

June 30, 2019.

1.4.

Reelection of

the sitting members and alternate members of the Company's Fiscal

Council, as well as the annual global compensation of the elected

members

. The Management of Brasilagro recommends that its

shareholders vote in favor of the re-election of Messrs Fabiano

Nunes Ferrari, Ivan Luvisotto Alexandre and Débora de Souza

Morsch for the positions of sitting members of the Fiscal Council,

as well as Marcos Paulo Passoni, Daniela Gadben and Luciana

Terezinha Simão Villela for the positions of alternate members

of the Fiscal Council, for unified mandates that shall end at the

Annual Ordinary General Meeting that approves the financial

statements related to the fiscal year ending June 30, 2018. The

Management of Brasilagro further recommends that the compensation

of the sitting members of the Fiscal Council of the Company is

equivalent to ten percent (10%) of that which, on average, is

ascribed to each director, not including benefits, representation

fees and profit sharing, besides mandatory reimbursement of travel

and accommodation expenses required for the performance of their

duties, as set forth in Law 6.404/76.

1.5.

Management’s

Compensation

. The Management of BrasilAgro recommends that

the annual global compensation of the Company’s managers for

the fiscal year started on July 1, 2017, is established at up to

eleven million Brazilian Reais (R$11,000,000.00), including all

benefits and any amounts for representation, with Board of

Directors having authority to subsequently set the individual

amounts to be paid to each director, taking into consideration

their duties, abilities, professional reputation and the market

value of their services.

2.

At Extraordinary

Meeting

:

2.1.

Long-term

Incentive Plan in Shares (“LTI Plan”).

The

Management of Brasilagro recommends the approval, by the

Shareholders, of the Company's proposed Long-Term Incentive Plan

(“

LTI

Plan

”) presented by the Company at the meeting of the

Board of Directors held on August 29, 2017, in substitution to the

Stock Option Plan approved at the Company's Extraordinary General

Meeting held on November 14, 2008, to be canceled in the same act

of approval by the Shareholders of the LTI Plan.

A

version of the aforementioned Plan is available at the Company

website (www.brasil-agro.com).

The

Meeting Call Notice in reference to the Ordinary and Extraordinary

General Meeting to be held on October 2

nd

, 2017, can also be

viewed on the websites of the Company (

www.brasil-agro.com

),

the São Paulo Stock Securities, Commodities and Futures

Exchange– BM&FBOVESPA (

www.bmfbovespa.com.br

)

and the Brazilian Securities and Exchange Commission – CVM

(

www.cvm.gov.br

).

As a

shareholder, you may exercise your right to vote at the

above-mentioned General Ordinary and Extraordinary

Shareholders’ Meeting by appearing in person at the

headquarters of

BrasilAgro –

Companhia Brasileira de Propriedades Agrícolas

, located

at Avenida Faria Lima No

1.309, fifth

floor, São Paulo, at 2.30 p.m. on October 2

nd

, 2017, or by means

of a duly designated legal proxy.

If you

have any questions or concerns, please contact us by phone at

(55-11)

3035-5374

or by e-mail at

ri@brasil-agro.com

.

|

André

Guillaumon

|

|

Gustavo

Javier Lopez

|

|

Chief

Executive Officer

|

|

Investor

Relations Officer

|

Eduardo

S. Elsztain

Chairman

of the Board of Directors

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this Report to be signed on its behalf by the

undersigned, thereunto duly authorized.

|

Date: September 5,

2017

|

|

|

|

|

|

|

BRASILAGRO – COMPANHIA BRASILEIRA DE PROPRIEDADES

AGRÍCOLAS

|

|

|

|

|

|

|

|

|

By:

|

/s/ André

Guillaumon

|

|

|

|

Name:

|

André

Guillaumon

|

|

|

|

Title:

|

Chief Executive Officer

and Operation Officer

|

|

Date: September

5

, 2017

|

|

|

|

By:

|

/s/ Gustavo Javier

Lopez

|

|

|

|

Name:

|

Gustavo Javier

Lopez

|

|

|

|

Title:

|

Chief Administrative Officer

and Investor Relations Officer

|

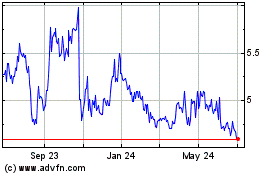

Brasilagro Cia Brasileir... (NYSE:LND)

Historical Stock Chart

From Mar 2024 to Apr 2024

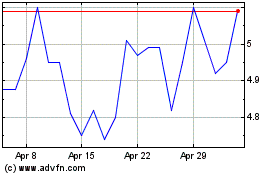

Brasilagro Cia Brasileir... (NYSE:LND)

Historical Stock Chart

From Apr 2023 to Apr 2024