Stock Rally Fizzles in Europe and Asia--Update

August 23 2017 - 5:24AM

Dow Jones News

By Riva Gold and Ese Erheriene

-- Dow poised to edge lower after best day since April

-- Mexican peso under pressure after Trump comments

-- WPP pulls down media shares in Europe

A rally in global stocks stalled Wednesday after the Dow Jones

Industrial Average's biggest daily advance since April.

Futures suggested the Dow would open 32 points lower after Asian

shares reversed early gains to end little changed. The Stoxx Europe

600 edged down 0.3% morning trading, following its best session in

over a week.

The media sector led declines in Europe as shares of WPP PLC,

the world's largest advertising company, fell 10.5% after it

lowered its forecast for the full year, reflecting a wider slowdown

in industries such as consumer goods and retail.

Some analysts attributed Wednesday's muted trading to comments

from U.S. President Donald Trump on Tuesday threatening to shut

down the government to secure funding for a wall on the southwest

border.

"Finding support amongst Republicans to approve potentially

billions of dollar to fund construction of a controversial wall is

likely to prove difficult," strategists at Rabobank wrote in a

note.

The Mexican peso, among the year's best-performing currencies,

was down 0.6% against the dollar, while market havens including

gold and the Japanese yen drew modest support.

Analysts also pointed to nervousness ahead of a central banking

conclave in Jackson Hole, Wyo., beginning Thursday, where investors

are eyeing any clues about monetary policy in the U.S. and

eurozone.

Still, many investors noted that recent jitters have come in

thin summer trading and U.S. stocks remain close to record highs.

The Dow added nearly 200 points on Tuesday as shares rebounded from

a recent bout of risk aversion triggered by geopolitical concerns

and escalating uncertainty around policy from the White House.

"With valuations elevated here, the market is going to be more

vulnerable to short-term negative news and negative shocks," said

Katie Nixon, chief investment officer at Northern Trust Wealth

Management.

"But unless something really impacts the economy, it's unlikely

that the market impact will be long-lasting," she said, given the

current state of growth and corporate earnings.

European Central Bank President Mario Draghi largely avoided

policy questions in a speech Wednesday but yields on 10-year German

government bonds climbed to 0.408% from 0.397% after his remarks.

Yields move inversely to prices.

The euro was up 0.2% at $1.1780 after data also showed an

unexpected jump in German manufacturing data.

Earlier, Japan's Nikkei Stock Average rose as much as 0.9% from

a four-month closing low but pared gains to 0.3% as the yen

rebounded against the dollar.

Australia's stock benchmark shed early gains as losses deepened

among shares of utilities companies. The S&P/ASX 200 was off

0.2%.

The Shanghai Composite Index was down 0.1%, ending a four-day

rally, with steel and precious-metals stocks the biggest decliners

amid a 5% pullback in iron-ore and steel-rebar futures. The

country's steel association late Tuesday said it saw limited room

for further price gains after a recent rally.

Trading in Hong Kong was halted as Typhoon Hato passed by the

city.

Nick Kostov and Yifan Xie contributed to this article.

Write to Riva Gold at riva.gold@wsj.com and Ese Erheriene at

ese.erheriene@wsj.com

(END) Dow Jones Newswires

August 23, 2017 05:09 ET (09:09 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

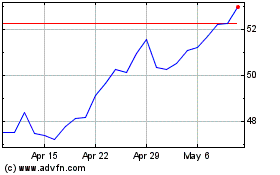

WPP (NYSE:WPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

WPP (NYSE:WPP)

Historical Stock Chart

From Apr 2023 to Apr 2024