Catalyst Pharmaceuticals, Inc. (Catalyst) (Nasdaq:CPRX), a

biopharmaceutical company focused on developing and commercializing

innovative therapies for people with rare debilitating

neuromuscular and neurological diseases, today reported financial

results for the second quarter ended June 30, 2017 and provided a

corporate update.

“We continue to make progress towards completion

of enrollment in our confirmatory Phase 3 trial of Firdapse® in

LEMS patients,” said Patrick J. McEnany, Chief Executive Officer of

Catalyst. “We look forward to receiving top-line results from our

Phase 3 trial, and assuming the trial is successful, to

resubmitting an NDA for Firdapse® for the treatment of LEMS before

the end of the year. We also remain committed to the development of

Firdapse® for other indications, including congenital myasthenic

syndromes and MuSK antibody positive myasthenia gravis.

Additionally, we expect to recommence our efforts to develop a

commercialization plan for Firdapse® before the end of the year so

as to be in a position to launch the product in 2018 if we are

successful in obtaining FDA approval to commercialize the

product."

Mr. McEnany continued: "We are also continuing

our efforts to seek a partner for the development of CPP-115 and

for our generic version of Sabril®. Although no agreements have

been entered into to date and there can be no assurance, we are

hopeful that we can bring these efforts to a successful conclusion

in the second half of 2017."

Q2 and Recent Highlights

- Joined the broad-market Russell 3000® Index, effective June

26

- Presented overview of CPP-115 program at the Antiepileptic Drug

and Device Trials XIV Symposium

- Received a 2017 Beacon Award for contributions in the Life

Sciences & Healthcare category

- Presentation by investigator of clinical data from the recently

completed proof of concept study of Firdapse for the treatment of

MuSK-MG at the 13th International Conference on Myasthenia Gravis

and Related Disorders in May 2017

- Ended the second quarter with $35.1 million in

cash and investments and no debt

Upcoming Milestones

- Complete enrollment in LEMS (LMS-003) and CMS (CMS-001)

clinical trials

- Expect top-line results from second Phase 3 trial for LEMS; and

NDA submission for Firdapse® in second-half 2017

- Define our regulatory path forward for the MuSK-MG

pivotal, multi-center trial

- Reinitiate pre-commercialization activities for a potential

2018 launch of Firdapse during second half 2017

- Expect top-line results from CMS trial in the first half of

2018

Second Quarter 2017 Financial Results

For the quarter ended June 30, 2017, Catalyst

reported a GAAP net loss of $3,879,901, or $0.05 per basic and

diluted share, compared to a GAAP net loss of $4,568,914, or $0.06

per basic and diluted share, for the same period in 2016. Excluding

the non-cash gain of $210,331 attributable to the change in fair

value of liability-classified warrants, Non-GAAP1 net loss was

$4,090,232 or $0.05 per basic and diluted share for the second

quarter of 2017. In comparison, Non-GAAP1 net loss for the second

quarter of 2016 was $4,721,697, or $0.06 per basic and diluted

share, which excludes non-cash gain of $152,783 attributable to the

change in fair value of liability-classified warrants.

For the six months ended June 30, 2017, Catalyst

reported a GAAP net loss of $8,847,030, or $0.11 per basic and

diluted share, as compared to a GAAP net loss of $9,955,151, or

$0.12 per basic and diluted share, for the same period in 2016.

Excluding non-cash expense of $186,904 attributable to the change

in fair value of liability-classified warrants, Non-GAAP1 net loss

was $8,660,126 or $0.10 per basic and diluted share for the first

six months of 2017. In comparison, Non-GAAP1 net loss for the first

six months of 2016 was $10,841,290, or $0.13 per basic and diluted

share, which excludes non-cash gain of $886,139 attributable to the

change in fair value of liability-classified warrants.

Research and development expenses for the second

quarter of 2017 were $2,451,751 compared to $2,508,897 in the

second quarter of 2016. For the six months ended June 30, 2017,

research and development expenses were $5,265,680 as compared to

$6,055,288 in the same period in 2016. Research and development

expenses for the first six months of 2017 continued to be

substantial as the Company continued its ongoing trials evaluating

Firdapse® for the treatment of LEMS and CMS. The Company expects

that costs related to research and development activities will

continue to be substantial throughout the balance of 2017 and into

2018 as it continues its clinical studies and trials and works to

resubmit an NDA for Firdapse®.

General and administrative expenses for the

second quarter of 2017 totaled $1,729,520 as compared to $2,305,555

in the second quarter of 2016. For the six months ended June 30,

2017, general and administrative expenses were $3,595,462 as

compared to $4,996,700 in the same period in 2016. The decrease

when compared to the same period in 2016 is primarily due to

decreased employee costs due to a reduction in headcount, and a

decrease in recruiting expenses and consulting costs for

pre-commercialization activities, as part of our initiatives to

conserve cash. The Company expects general and administrative

expenses, excluding pre-commercialization expenses, to remain

consistent for the balance of 2017. The Company also expects

pre-commercialization expenses (which are reported in G&A) to

increase in the second half of 2017 as the Company recommences its

efforts to develop a commercialization plan for Firdapse®.

As a development-stage biopharmaceutical

company, Catalyst had no revenues in either the second quarter of

2017 and 2016 or the first six months of 2017 and 2016.

At June 30, 2017, Catalyst had cash and cash

equivalents and short-term investments of $35.1 million and no

debt. Catalyst believes that its existing capital resources will be

sufficient to support its planned operations through at least the

next 12 months.

More detailed financial information and analysis

may be found in the Company's Quarterly Report on Form 10-Q, which

was filed with the Securities and Exchange Commission (SEC) on

August 9, 2017.

1 Statements made in this press release

include a non-GAAP financial measure. Such information is provided

as additional information and not as an alternative to Catalyst's

financial statements presented in accordance with generally

accepted accounting principles (GAAP). This non-GAAP financial

measure is intended to enhance an overall understanding of

Catalyst's current financial performance. Catalyst believes that

the non-GAAP financial measure presented in this press release

provides investors and prospective investors with an alternative

method for assessing Catalyst's operating results in a manner that

Catalyst believes is focused on the performance of ongoing

operations and provides a more consistent basis for comparison

between periods. The non-GAAP financial measure in this press

release excludes from the calculation of net loss the expense (or

the income) associated with the change in fair value of the

liability-classified warrants. Non-GAAP net loss per share is

calculated by dividing non-GAAP net loss by the weighted average

common shares outstanding.

Conference Call

Catalyst management will host an

investment-community conference call and webcast at 8:30 a.m.

EDT on Thursday, August 10th, 2017 to discuss the financial

results and provide a corporate update. Investors who wish to

participate in the conference call may do so by dialing (877)

407-8912 for domestic and Canadian callers or (201) 689-8059 for

international callers. Those interested in listening to the

conference call live via the internet may do so by visiting the

Investors page of the company's website

at www.catalystpharma.com and clicking on the webcast

link on the Investors home page. A webcast replay will be available

on the Catalyst website for 30 days following the call by visiting

the Investor page of the company's website

at www.catalystpharma.com.

About Catalyst

Pharmaceuticals

Catalyst Pharmaceuticals is a biopharmaceutical

company focused on developing and commercializing innovative

therapies for people with rare debilitating neuromuscular and

neurological diseases, including Lambert-Eaton myasthenic syndrome

(LEMS), congenital myasthenic syndromes (CMS), MuSK antibody

positive myasthenia gravis and infantile spasms. Firdapse® has

received Breakthrough Therapy Designation from the U.S. Food and

Drug Administration (FDA) for the treatment of LEMS and Orphan Drug

Designation for LEMS, CMS and myasthenia gravis. Firdapse is the

first and only approved drug in Europe for symptomatic treatment in

adults with LEMS.

Catalyst is also developing CPP-115 to treat

refractory infantile spasms, and possibly refractory Tourette's

Disorder. CPP-115 has been granted U.S. Orphan Drug Designation for

the treatment of infantile spasms by the FDA and has been granted

E.U. Orphan Medicinal Product Designation for the treatment of West

syndrome by the European Commission. In addition, Catalyst is

developing a generic version of Sabril® (vigabatrin).

Forward-Looking Statements

This press release contains forward-looking

statements. Forward-looking statements involve known and unknown

risks and uncertainties, which may cause Catalyst's actual results

in future periods to differ materially from forecasted results. A

number of factors, including whether the receipt of breakthrough

therapy designation for Firdapse will expedite the development and

review of Firdapse by the FDA or the likelihood that the product

will be found to be safe and effective, the timing of Catalyst's

second trial evaluating Firdapse for the treatment of LEMS and

whether the trial will be successful, whether Catalyst's

assumptions in its updated business plan will be accurate and the

impact of unanticipated events or delays in projected activities on

Catalyst's cash requirements and on Catalyst's ability to get to an

accepted NDA submission for Firdapse without the need for

additional funding, what clinical trials and studies will be

required before Catalyst can resubmit an NDA for Firdapse for the

treatment of CMS and whether any such required clinical trials and

studies will be successful, whether any NDA for Firdapse

resubmitted to the FDA will ever be accepted for filing, the timing

of any such NDA filing or acceptance, whether, if an NDA for

Firdapse is accepted for filing, such NDA will be given a priority

review by the FDA, whether Catalyst can successfully design and

complete a registration trial evaluating Firdapse for the treatment

of MuSK-MG that is acceptable to the FDA, whether any such future

trial evaluating Firdapse for the treatment of MuSK-MG will be

successful, whether Catalyst can obtain the funding required to

conduct such a trial, whether Firdapse will ever be approved for

commercialization, whether Catalyst will be the first company to

receive approval for amifampridine (3,4-DAP), giving it 5-year

marketing exclusivity for its product, whether CPP-115 will be

determined to be safe for humans, what additional testing will be

required before CPP-115 is "Phase 2 ready", whether CPP-115 will be

determined to be effective for the treatment of refractory

infantile spasms or possibly Tourette's Disorder or for any other

indications, whether Catalyst can successfully design and complete

a bioequivalence study of its version of vigabatrin compared to

Sabril that is acceptable to the FDA, whether any such

bioequivalence study the design of which is acceptable to the FDA

will be successful, whether any ANDA that Catalyst submits for a

generic version of Sabril will be accepted for filing, whether any

ANDA for Sabril accepted for filing by the FDA will be approved

(and the timing of any such approval), whether any of Catalyst's

product candidates will ever be approved for commercialization or

successfully commercialized, and those other factors described in

Catalyst's Annual Report on Form 10-K for the fiscal year 2016 and

its other filings with the U.S. Securities and Exchange Commission

(SEC), could adversely affect Catalyst. Copies of Catalyst's

filings with the SEC are available from the SEC, may be found on

Catalyst's website, or may be obtained upon request from Catalyst.

Catalyst does not undertake any obligation to update the

information contained herein, which speaks only as of this

date.

| CATALYST PHARMACEUTICALS, INC. |

| |

| STATEMENTS OF OPERATIONS

(unaudited) |

|

|

| |

|

For the Three

Months Ended June 30, |

|

For the Six MonthsEnded June

30, |

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating costs and

expenses: |

|

|

|

|

|

|

|

|

|

| Research

and development |

|

$ |

2,451,751 |

|

|

$ |

2,508,897 |

|

|

$ |

5,265,680 |

|

|

$ |

6,055,288 |

|

|

| General

and administrative |

|

|

1,729,520 |

|

|

|

2,305,555 |

|

|

|

3,595,462 |

|

|

|

4,996,700 |

|

|

| Total

operating costs and expenses |

|

|

4,181,271 |

|

|

|

4,814,452 |

|

|

|

8,861,142 |

|

|

|

11,051,988 |

|

|

| Loss from

operations |

|

|

(4,181,271 |

) |

|

|

(4,814,452 |

) |

|

|

(8,861,142 |

) |

|

|

(11,051,988 |

) |

|

| Other income, net |

|

|

91,039 |

|

|

|

92,755 |

|

|

|

201,016 |

|

|

|

210,698 |

|

|

| Change in fair value of

warrants liability |

|

|

210,331 |

|

|

|

152,783 |

|

|

|

(186,904 |

) |

|

|

886,139 |

|

|

| Loss

before income taxes |

|

|

(3,879,901 |

) |

|

|

(4,568,914 |

) |

|

|

(8,847,030 |

) |

|

|

(9,955,151 |

) |

|

| Provision for income

taxes |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

| Net

loss |

|

$ |

(3,879,901 |

) |

|

$ |

(4,568,914 |

) |

|

$ |

(8,847,030 |

) |

|

$ |

(9,955,151 |

) |

|

| Net loss per share –

basic and diluted |

|

$ |

(0.05 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.11 |

) |

|

$ |

(0.12 |

) |

|

| Weighted average

shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

outstanding – basic and diluted |

|

|

83,905,827 |

|

|

|

82,870,649 |

|

|

|

83,441,650 |

|

|

|

82,865,366 |

|

|

| CATALYST PHARMACEUTICALS, INC. |

| |

| CONDENSED BALANCE SHEETS |

| |

|

|

|

June 30,

2017 |

|

December 31, 2016 |

|

|

|

(unaudited) |

|

|

|

ASSETS |

|

|

|

|

| Current Assets: |

|

|

|

|

| Cash and

cash equivalents |

|

$ |

8,583,727 |

|

$ |

13,893,064 |

|

Short-term investments |

|

|

26,547,663 |

|

|

26,512,753 |

| Prepaid

expenses and other current assets |

|

|

621,558 |

|

|

1,047,944 |

| Total

current assets |

|

|

35,752,948 |

|

|

41,453,761 |

| Property

and equipment, net |

|

|

218,289 |

|

|

244,204 |

|

Deposits |

|

|

8,888 |

|

|

8,888 |

| Total

assets |

|

$ |

35,980,125 |

|

$ |

41,706,853 |

| |

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

| Current

Liabilities: |

|

|

|

|

| Accounts

payable |

|

$ |

692,345 |

|

$ |

933,176 |

| Accrued

expenses and other liabilities |

|

|

1,148,080 |

|

|

1,161,359 |

| Total

current liabilities |

|

|

1,840,425 |

|

|

2,094,535 |

| Accrued

expenses and other liabilities, non-current |

|

|

170,519 |

|

|

181,162 |

| Warrants

liability, at fair value |

|

|

-- |

|

|

122,226 |

| Total

liabilities |

|

|

2,010,944 |

|

|

2,397,923 |

| |

|

|

|

|

| Total stockholders’

equity |

|

|

33,969,181 |

|

|

39,308,930 |

| Total liabilities and

stockholders’ equity |

|

$ |

35,980,125 |

|

$ |

41,706,853 |

Investor Contact

Brian Korb

The Trout Group LLC

(646) 378-2923

bkorb@troutgroup.com

Media Contact

David Schull

Russo Partners

(212) 845-4271

david.schull@russopartnersllc.com

Company Contact

Patrick J. McEnany

Catalyst Pharmaceuticals

Chief Executive Officer

(305) 420-3200

pmcenany@catalystpharma.com

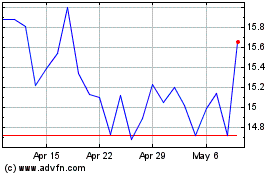

Catalyst Pharmaceuticals (NASDAQ:CPRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

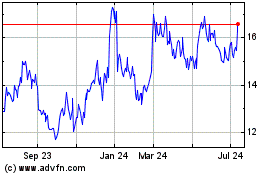

Catalyst Pharmaceuticals (NASDAQ:CPRX)

Historical Stock Chart

From Apr 2023 to Apr 2024