Altisource Portfolio Solutions S.A. (“Altisource” or the “Company”)

(NASDAQ:ASPS) today reported financial results for the second

quarter of 2017, reporting sequential growth in service revenue,

net income and earnings per share. Compared to the first

quarter of 2017, Altisource’s service revenue grew by 4% to $238.1

million, net income attributable to Altisource grew by 38% to $9.0

million and diluted earnings per share grew by 41% to $0.48.

Further, adjusted net income attributable to Altisource(1) of $16.5

million and adjusted diluted earnings per share(1) of $0.88

increased from the first quarter of 2017 by 25% and 28%,

respectively.

Compared to the first quarter of 2017, service

revenue growth was driven by 15% growth in non-Ocwen revenue.

Service revenue relating to Ocwen and its portfolio was flat as

growth from seasonality in the property inspection and preservation

business was offset by lower technology related revenue and fewer

delinquent loans. Each of the Company’s four initiatives

contributed to the 15% non-Ocwen revenue growth. Compared to

the second quarter of 2016, the 1% decline in service revenue was

primarily from the normal runoff of Ocwen’s portfolio and

Altisource Residential Corporation’s smaller portfolio of

non-performing loans and REO partially offset by growth in

referrals of higher fee property preservation services and growth

in home sales revenue in the buy-renovate-sell business which began

operations in the second half of 2016.

Compared to the first quarter of 2017, growth in

diluted earnings per share and adjusted diluted earnings per

share(1) was driven by service revenue growth, margin expansion in

the property preservation and REO sales businesses and a positive

second quarter income tax accrual adjustment. The second

quarter $3.9 million gain on the repurchase of debt ($0 in the

first quarter of 2017) was largely offset by other non-recurring

expenses relating to facility closures, litigation related costs

and severance. Compared to the second quarter of 2016,

diluted earnings per share and adjusted diluted earnings per

share(1) decreased 53% and 44%, respectively. These declines

were driven by higher investments to support the Company’s growth

initiatives and service revenue mix changes. Revenue mix

changes were the result of growth in the lower margin property

preservation and buy-renovate-sell businesses and revenue declines

in other higher margin businesses. Diluted earnings per share

and adjusted diluted earnings per share(1) were further impacted by

a higher effective tax rate in the second quarter of 2017 compared

to the second quarter of 2016.

“I am pleased with our solid second quarter 2017

financial results and our accomplishments since last quarter.

We continue to develop our four initiatives to build a diversified

and growing company. We also opportunistically purchased our

debt and equity at very attractive prices,” said Chief Executive

Officer William B. Shepro.

Mr. Shepro further commented, “As Ocwen and New

Residential Investment Corp. (“NRZ”) have previously disclosed,

they recently entered into agreements to transfer Ocwen’s remaining

interests in certain MSRs to NRZ with Ocwen continuing to service

these portfolios.(2) While Altisource has long-term

agreements in place to provide various fee-based services on an

exclusive basis to portfolios serviced by Ocwen, we believe there

are benefits to also establishing a relationship with NRZ. We

are actively negotiating long-term agreements with NRZ to be the

provider for downstream services. We are making good progress

and believe we are close to reaching agreement which we believe

would be beneficial for both parties. However, there can be no

assurance that we will be able to reach agreement on acceptable

terms in the near future or at all.”

Second Quarter 2017 Highlights

Include(3):

Servicer Solutions

- Grew non-Ocwen service revenue by 11% over the first quarter of

2017 and 9% over the second quarter of 2016

- Selected by a top 25 bank to provide REO asset management and

brokerage services

Origination Solutions

- Grew non-Ocwen service revenue by 12% over the first quarter of

2017 and 11% over the second quarter of 2016

- Recently signed an agreement with and began providing mortgage

underwriting services for a top 5 correspondent lender

Consumer Real Estate

Solutions

- Grew the number of home purchase and sale transactions to 222,

a 55% increase in unit transactions and an 82% increase in service

revenue over the first quarter of 2017

- Launched Owners.com Loans as part of our strategy to provide a

broader suite of services to customers

Real Estate Investor

Solutions

- Grew non-Ocwen service revenue by 25% over the first quarter of

2017 (a 4% decline compared to the second quarter of 2016)

- Sold 46 homes in the buy-renovate-sell program, generating 49%

revenue growth in this program over the first quarter of 2017, and

had 101 homes in inventory at June 30, 2017

Corporate

- Purchased $26.0 million of the Company’s senior secured term

loan at an average discount of 16.5%, generating a $3.9 million

gain

- Repurchased 416 thousand shares of Altisource’s common stock at

$19.17 per share

Second Quarter 2017 Results Compared to

First Quarter of 2017 and Second Quarter 2016

- Service revenue of $238.1 million, a 4% increase compared to

the first quarter 2017 and a 1% decrease compared to the second

quarter 2016

- Income before income taxes and non-controlling interests of

$12.2 million, a 25% increase compared to the first quarter 2017

and a 49% decrease compared to the second quarter 2016

- Pretax income attributable to Altisource(1) of $11.5 million, a

26% increase compared to the first quarter 2017 and a 51% decrease

compared to the second quarter 2016

- Adjusted pretax income attributable to Altisource(1) of $20.9

million, a 14% increase compared to the first quarter 2017 and a

42% decrease compared to the second quarter 2016

- Net income attributable to Altisource of $9.0 million, a 38%

increase compared to the first quarter 2017 and a 55% decrease

compared to the second quarter 2016

- Adjusted net income attributable to Altisource(1) of $16.5

million, a 25% increase compared to the first quarter 2017 and a

47% decrease compared to the second quarter 2016

- Diluted earnings per share of $0.48, a 41% increase compared to

the first quarter 2017 and a 53% decrease compared to the second

quarter 2016

- Adjusted diluted earnings per share(1) of $0.88, a 28% increase

compared to the first quarter 2017 and a 44% decrease compared to

the second quarter 2016

- Cash from operations of $30.9 million compared to cash used in

operations of $18.4 million in the first quarter of 2017 (primarily

driven by the $28.0 million net litigation settlement paid in the

first quarter 2017) and cash from operations of $40.4 million in

the second quarter 2016

________________________

| |

(1) |

This is a

non-GAAP measure that is defined and reconciled to the

corresponding GAAP measure herein. |

| |

(2) |

This

information is based on disclosures made by Ocwen and NRZ in their

filings with the Securities and Exchange Commission, including

their Second Quarter 2017 Form 10-Qs, Ocwen’s July 24, 2017 Form

8-K and NRZ’s July 27, 2017 Form 8-K. Altisource takes no

responsibility for the accuracy of any information provided in

filings made by Ocwen and NRZ. |

| |

(3) |

Applies to the

second quarter of 2017 unless otherwise indicated. |

Forward-Looking Statements

This press release contains forward-looking

statements that involve a number of risks and uncertainties.

These forward-looking statements include all statements that are

not historical fact, including statements about management’s

beliefs and expectations. These statements may be identified

by words such as “anticipate,” “intend,” “expect,” “may,” “could,”

“should,” “would,” “plan,” “estimate,” “seek,” “believe,”

“potential” and similar expressions. Forward-looking

statements are based on management’s beliefs as well as assumptions

made by and information currently available to management.

Because such statements are based on expectations as to the future

and are not statements of historical fact, actual results may

differ materially from what is contemplated by the forward-looking

statements. Altisource undertakes no obligation to update any

forward-looking statements whether as a result of new information,

future events or otherwise. The risks and uncertainties to

which forward-looking statements are subject include, but are not

limited to, Altisource’s ability to integrate acquired businesses,

retain key executives or employees, retain existing customers and

attract new customers, general economic and market conditions,

behavior of customers, suppliers and/or competitors, technological

developments, governmental regulations, taxes and policies,

availability of adequate and timely sources of liquidity and other

risks and uncertainties detailed in the “Forward-Looking

Statements,” “Risk Factors” and other sections of Altisource’s Form

10-K and other filings with the Securities and Exchange

Commission.

Webcast

Altisource will host a webcast at 11:00 a.m. EDT

today to discuss our second quarter results. A link to the

live audio webcast will be available on Altisource’s website in the

Investor Relations section. Those who want to listen to the

call should go to the website at least fifteen minutes prior to the

call to register, download and install any necessary audio

software. A replay of the conference call will be available

via the website approximately two hours after the conclusion of the

call and will remain available for approximately 30 days.

About Altisource

Altisource Portfolio Solutions S.A. is an

integrated service provider and marketplace for the real estate and

mortgage industries. Combining operational excellence with a

suite of innovative services and technologies, Altisource helps

solve the demands of the ever-changing market. Additional

information is available at www.Altisource.com.

| ALTISOURCE PORTFOLIO SOLUTIONS

S.A.CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME(in thousands, except per

share data)(unaudited) |

| |

|

|

|

|

| |

|

Three months ended June 30, |

|

Six months ended June 30, |

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

|

|

|

|

|

|

|

|

| Service revenue |

|

|

|

|

|

|

|

|

| Mortgage

Market |

|

$ |

198,414 |

|

|

$ |

197,479 |

|

|

$ |

393,387 |

|

|

$ |

385,564 |

|

| Real

Estate Market |

|

24,347 |

|

|

24,173 |

|

|

43,536 |

|

|

47,574 |

|

| Other

Businesses, Corporate and Eliminations |

|

15,346 |

|

|

19,672 |

|

|

31,023 |

|

|

42,466 |

|

| Total

service revenue |

|

238,107 |

|

|

241,324 |

|

|

467,946 |

|

|

475,604 |

|

| Reimbursable

expenses |

|

11,891 |

|

|

13,783 |

|

|

21,920 |

|

|

29,237 |

|

| Non-controlling

interests |

|

687 |

|

|

692 |

|

|

1,302 |

|

|

1,090 |

|

| Total revenue |

|

250,685 |

|

|

255,799 |

|

|

491,168 |

|

|

505,931 |

|

| Cost of revenue |

|

173,502 |

|

|

160,588 |

|

|

341,426 |

|

|

313,997 |

|

| Reimbursable

expenses |

|

11,891 |

|

|

13,783 |

|

|

21,920 |

|

|

29,237 |

|

| Gross profit |

|

65,292 |

|

|

81,428 |

|

|

127,822 |

|

|

162,697 |

|

| Selling, general and

administrative expenses |

|

52,470 |

|

|

54,207 |

|

|

100,171 |

|

|

107,823 |

|

| Income from

operations |

|

12,822 |

|

|

27,221 |

|

|

27,651 |

|

|

54,874 |

|

| Other income (expense),

net: |

|

|

|

|

|

|

|

|

| Interest

expense |

|

(5,465 |

) |

|

(5,988 |

) |

|

(11,263 |

) |

|

(12,529 |

) |

| Other

income (expense), net |

|

4,803 |

|

|

2,744 |

|

|

5,518 |

|

|

2,717 |

|

| Total

other income (expense), net |

|

(662 |

) |

|

(3,244 |

) |

|

(5,745 |

) |

|

(9,812 |

) |

| |

|

|

|

|

|

|

|

|

| Income before income

taxes and non-controlling interests |

|

12,160 |

|

|

23,977 |

|

|

21,906 |

|

|

45,062 |

|

| Income tax

provision |

|

(2,438 |

) |

|

(3,291 |

) |

|

(5,024 |

) |

|

(5,484 |

) |

| |

|

|

|

|

|

|

|

|

| Net income |

|

9,722 |

|

|

20,686 |

|

|

16,882 |

|

|

39,578 |

|

| Net income attributable

to non-controlling interests |

|

(687 |

) |

|

(692 |

) |

|

(1,302 |

) |

|

(1,090 |

) |

| |

|

|

|

|

|

|

|

|

| Net income attributable

to Altisource |

|

$ |

9,035 |

|

|

$ |

19,994 |

|

|

$ |

15,580 |

|

|

$ |

38,488 |

|

| |

|

|

|

|

|

|

|

|

| Earnings per

share: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.49 |

|

|

$ |

1.08 |

|

|

$ |

0.84 |

|

|

$ |

2.06 |

|

|

Diluted |

|

$ |

0.48 |

|

|

$ |

1.02 |

|

|

$ |

0.82 |

|

|

$ |

1.94 |

|

| |

|

|

|

|

|

|

|

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

18,335 |

|

|

18,437 |

|

|

18,497 |

|

|

18,646 |

|

|

Diluted |

|

18,836 |

|

|

19,604 |

|

|

19,069 |

|

|

19,822 |

|

| |

|

|

|

|

|

|

|

|

| Comprehensive

income: |

|

|

|

|

|

|

|

|

| Net

income |

|

$ |

9,722 |

|

|

$ |

20,686 |

|

|

$ |

16,882 |

|

|

$ |

39,578 |

|

| Other

comprehensive income (loss), net of tax: |

|

|

|

|

|

|

|

|

|

Unrealized gain (loss) on securities, net of income tax (provision)

benefit of $2,593, $3,249, $(2,132), $2,960 |

|

(6,981 |

) |

|

(7,871 |

) |

|

5,742 |

|

|

(7,172 |

) |

| |

|

|

|

|

|

|

|

|

| Comprehensive income,

net of tax |

|

2,741 |

|

|

12,815 |

|

|

22,624 |

|

|

32,406 |

|

| Comprehensive income

attributable to non-controlling interests |

|

(687 |

) |

|

(692 |

) |

|

(1,302 |

) |

|

(1,090 |

) |

| |

|

|

|

|

|

|

|

|

| Comprehensive income

attributable to Altisource |

|

$ |

2,054 |

|

|

$ |

12,123 |

|

|

$ |

21,322 |

|

|

$ |

31,316 |

|

| ALTISOURCE PORTFOLIO SOLUTIONS

S.A.SEGMENT FINANCIAL

INFORMATION(1)(in

thousands)(unaudited) |

| |

|

|

| |

|

Three months ended June 30, 2017 |

|

(in thousands) |

|

MortgageMarket |

|

Real EstateMarket |

|

OtherBusinesses,Corporate

andEliminations |

|

ConsolidatedAltisource |

| |

|

|

|

|

|

|

|

|

| Revenue |

|

|

|

|

|

|

|

|

| Service

revenue |

|

$ |

198,414 |

|

|

$ |

24,347 |

|

|

$ |

15,346 |

|

|

$ |

238,107 |

|

|

Reimbursable expenses |

|

11,094 |

|

|

783 |

|

|

14 |

|

|

11,891 |

|

|

Non-controlling interests |

|

687 |

|

|

— |

|

|

— |

|

|

687 |

|

| |

|

210,195 |

|

|

25,130 |

|

|

15,360 |

|

|

250,685 |

|

| Cost of revenue |

|

144,326 |

|

|

26,844 |

|

|

14,223 |

|

|

185,393 |

|

| Gross profit

(loss) |

|

65,869 |

|

|

(1,714 |

) |

|

1,137 |

|

|

65,292 |

|

| Selling, general and

administrative expenses |

|

29,805 |

|

|

5,551 |

|

|

17,114 |

|

|

52,470 |

|

| Income (loss) from

operations |

|

36,064 |

|

|

(7,265 |

) |

|

(15,977 |

) |

|

12,822 |

|

| Total other income

(expense), net |

|

102 |

|

|

— |

|

|

(764 |

) |

|

(662 |

) |

| |

|

|

|

|

|

|

|

|

| Income (loss) before

income taxes and non-controlling interests |

|

$ |

36,166 |

|

|

$ |

(7,265 |

) |

|

$ |

(16,741 |

) |

|

$ |

12,160 |

|

| |

|

Three months ended June 30, 2016 |

|

(in thousands) |

|

MortgageMarket |

|

Real EstateMarket |

|

OtherBusinesses,Corporate

andEliminations |

|

ConsolidatedAltisource |

| |

|

|

|

|

|

|

|

|

| Revenue |

|

|

|

|

|

|

|

|

| Service

revenue |

|

$ |

197,479 |

|

|

$ |

24,173 |

|

|

$ |

19,672 |

|

|

$ |

241,324 |

|

|

Reimbursable expenses |

|

13,129 |

|

|

631 |

|

|

23 |

|

|

13,783 |

|

|

Non-controlling interests |

|

692 |

|

|

— |

|

|

— |

|

|

692 |

|

| |

|

211,300 |

|

|

24,804 |

|

|

19,695 |

|

|

255,799 |

|

| Cost of revenue |

|

135,723 |

|

|

16,854 |

|

|

21,794 |

|

|

174,371 |

|

| Gross profit

(loss) |

|

75,577 |

|

|

7,950 |

|

|

(2,099 |

) |

|

81,428 |

|

| Selling, general and

administrative expenses |

|

31,141 |

|

|

5,620 |

|

|

17,446 |

|

|

54,207 |

|

| Income (loss) from

operations |

|

44,436 |

|

|

2,330 |

|

|

(19,545 |

) |

|

27,221 |

|

| Total other income

(expense), net |

|

74 |

|

|

4 |

|

|

(3,322 |

) |

|

(3,244 |

) |

| |

|

|

|

|

|

|

|

|

| Income (loss) before

income taxes and non-controlling interests |

|

$ |

44,510 |

|

|

$ |

2,334 |

|

|

$ |

(22,867 |

) |

|

$ |

23,977 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Effective January 1, 2017, our

reportable segments changed as a result of changes in our internal

organization. Prior year comparable period segment disclosures

have been restated to conform to the current year presentation.

| ALTISOURCE PORTFOLIO SOLUTIONS

S.A.SEGMENT FINANCIAL

INFORMATION(1)(in

thousands)(unaudited) |

| |

|

|

| |

|

Six months ended June 30, 2017 |

|

(in thousands) |

|

MortgageMarket |

|

Real EstateMarket |

|

OtherBusinesses,Corporate

andEliminations |

|

ConsolidatedAltisource |

| |

|

|

|

|

|

|

|

|

| Revenue |

|

|

|

|

|

|

|

|

| Service

revenue |

|

$ |

393,387 |

|

|

$ |

43,536 |

|

|

$ |

31,023 |

|

|

$ |

467,946 |

|

|

Reimbursable expenses |

|

20,229 |

|

|

1,657 |

|

|

34 |

|

|

21,920 |

|

|

Non-controlling interests |

|

1,302 |

|

|

— |

|

|

— |

|

|

1,302 |

|

| |

|

414,918 |

|

|

45,193 |

|

|

31,057 |

|

|

491,168 |

|

| Cost of revenue |

|

284,476 |

|

|

48,987 |

|

|

29,883 |

|

|

363,346 |

|

| Gross profit

(loss) |

|

130,442 |

|

|

(3,794 |

) |

|

1,174 |

|

|

127,822 |

|

| Selling, general and

administrative expenses |

|

58,487 |

|

|

9,876 |

|

|

31,808 |

|

|

100,171 |

|

| Income (loss) from

operations |

|

71,955 |

|

|

(13,670 |

) |

|

(30,634 |

) |

|

27,651 |

|

| Total other income

(expense), net |

|

112 |

|

|

— |

|

|

(5,857 |

) |

|

(5,745 |

) |

| |

|

|

|

|

|

|

|

|

| Income (loss) before

income taxes and non-controlling interests |

|

$ |

72,067 |

|

|

$ |

(13,670 |

) |

|

$ |

(36,491 |

) |

|

$ |

21,906 |

|

| |

|

Six months ended June 30, 2016 |

|

(in thousands) |

|

MortgageMarket |

|

Real EstateMarket |

|

OtherBusinesses, Corporate

andEliminations |

|

ConsolidatedAltisource |

| |

|

|

|

|

|

|

|

|

| Revenue |

|

|

|

|

|

|

|

|

| Service

revenue |

|

$ |

385,564 |

|

|

$ |

47,574 |

|

|

$ |

42,466 |

|

|

$ |

475,604 |

|

|

Reimbursable expenses |

|

28,047 |

|

|

1,139 |

|

|

51 |

|

|

29,237 |

|

|

Non-controlling interests |

|

1,090 |

|

|

— |

|

|

— |

|

|

1,090 |

|

| |

|

414,701 |

|

|

48,713 |

|

|

42,517 |

|

|

505,931 |

|

| Cost of revenue |

|

269,766 |

|

|

31,312 |

|

|

42,156 |

|

|

343,234 |

|

| Gross profit |

|

144,935 |

|

|

17,401 |

|

|

361 |

|

|

162,697 |

|

| Selling, general and

administrative expenses |

|

60,595 |

|

|

11,794 |

|

|

35,434 |

|

|

107,823 |

|

| Income (loss) from

operations |

|

84,340 |

|

|

5,607 |

|

|

(35,073 |

) |

|

54,874 |

|

| Total other income

(expense), net |

|

134 |

|

|

— |

|

|

(9,946 |

) |

|

(9,812 |

) |

| |

|

|

|

|

|

|

|

|

| Income (loss) before

income taxes and non-controlling interests |

|

$ |

84,474 |

|

|

$ |

5,607 |

|

|

$ |

(45,019 |

) |

|

$ |

45,062 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Effective January 1, 2017, our reportable segments

changed as a result of changes in our internal

organization. Prior year comparable period segment disclosures

have been restated to conform to the current year presentation.

| ALTISOURCE PORTFOLIO SOLUTIONS

S.A.CONSOLIDATED BALANCE

SHEETS(in thousands, except per share

data)(unaudited) |

|

|

|

|

|

|

|

June 30, 2017 |

|

December 31, 2016 |

| |

|

|

|

| ASSETS |

| Current assets: |

|

|

|

| Cash and

cash equivalents |

$ |

114,205 |

|

|

$ |

149,294 |

|

| Available

for sale securities |

53,628 |

|

|

45,754 |

|

| Accounts

receivable, net |

72,977 |

|

|

87,821 |

|

| Prepaid

expenses and other current assets |

49,419 |

|

|

42,608 |

|

| Total

current assets |

290,229 |

|

|

325,477 |

|

| |

|

|

|

| Premises and equipment,

net |

87,060 |

|

|

103,473 |

|

| Goodwill |

86,283 |

|

|

86,283 |

|

| Intangible assets,

net |

136,893 |

|

|

155,432 |

|

| Deferred tax assets,

net |

5,160 |

|

|

7,292 |

|

| Other assets |

11,003 |

|

|

11,255 |

|

| |

|

|

|

| Total assets |

$ |

616,628 |

|

|

$ |

689,212 |

|

| |

|

|

|

| LIABILITIES AND EQUITY |

| Current

liabilities: |

|

|

|

| Accounts

payable and accrued expenses |

$ |

75,162 |

|

|

$ |

83,135 |

|

| Accrued

litigation settlement |

— |

|

|

32,000 |

|

| Current

portion of long-term debt |

5,945 |

|

|

5,945 |

|

| Deferred

revenue |

9,886 |

|

|

8,797 |

|

| Other

current liabilities |

10,520 |

|

|

19,061 |

|

| Total

current liabilities |

101,513 |

|

|

148,938 |

|

| |

|

|

|

| Long-term debt, less

current portion |

439,486 |

|

|

467,600 |

|

| Other non-current

liabilities |

8,906 |

|

|

10,480 |

|

| |

|

|

|

| Commitments,

contingencies and regulatory matters |

|

|

|

| |

|

|

|

| Equity: |

|

|

|

| Common

stock ($1.00 par value; 100,000 shares authorized, 25,413 issued

and 18,034 outstanding as of June 30, 2017; 25,413 shares

authorized and issued and 18,774 outstanding as of

December 31, 2016) |

25,413 |

|

|

25,413 |

|

|

Additional paid-in capital |

110,078 |

|

|

107,288 |

|

| Retained

earnings |

341,926 |

|

|

333,786 |

|

|

Accumulated other comprehensive income (loss) |

3,997 |

|

|

(1,745 |

) |

| Treasury

stock, at cost (7,379 shares as of June 30, 2017 and 6,639

shares as of December 31, 2016) |

(416,342 |

) |

|

(403,953 |

) |

|

Altisource equity |

65,072 |

|

|

60,789 |

|

|

|

|

|

|

|

Non-controlling interests |

1,651 |

|

|

1,405 |

|

| Total

equity |

66,723 |

|

|

62,194 |

|

| |

|

|

|

| Total liabilities and

equity |

$ |

616,628 |

|

|

$ |

689,212 |

|

| ALTISOURCE PORTFOLIO SOLUTIONS

S.A.CONSOLIDATED STATEMENTS OF CASH

FLOWS(in

thousands)(unaudited) |

| |

|

| |

Six months ended June 30, |

| |

2017 |

|

2016 |

| |

|

|

|

| Cash flows from

operating activities: |

|

|

|

| Net income |

$ |

16,882 |

|

|

$ |

39,578 |

|

| Adjustments to

reconcile net income to net cash provided by operating

activities: |

|

|

|

|

Depreciation and amortization |

18,895 |

|

|

18,346 |

|

|

Amortization of intangible assets |

18,539 |

|

|

24,967 |

|

| Change in

the fair value of acquisition related contingent consideration |

16 |

|

|

193 |

|

|

Share-based compensation expense |

1,858 |

|

|

3,569 |

|

| Bad debt

expense |

2,890 |

|

|

1,041 |

|

| Gain on

early extinguishment of debt |

(3,937 |

) |

|

(5,464 |

) |

|

Amortization of debt discount |

156 |

|

|

201 |

|

|

Amortization of debt issuance costs |

433 |

|

|

557 |

|

| Deferred

income taxes |

— |

|

|

18 |

|

| Loss on

disposal of fixed assets |

2,798 |

|

|

9 |

|

| Changes

in operating assets and liabilities: |

|

|

|

| Accounts

receivable |

11,954 |

|

|

3,407 |

|

| Prepaid

expenses and other current assets |

(6,811 |

) |

|

(6,012 |

) |

| Other

assets |

523 |

|

|

447 |

|

| Accounts

payable and accrued expenses |

(10,637 |

) |

|

(4,454 |

) |

| Other

current and non-current liabilities |

(41,042 |

) |

|

(6,998 |

) |

| Net cash provided by

operating activities |

12,517 |

|

|

69,405 |

|

| |

|

|

|

| Cash flows from

investing activities: |

|

|

|

| Additions

to premises and equipment |

(5,658 |

) |

|

(12,441 |

) |

| Purchase

of available for sale securities |

— |

|

|

(48,219 |

) |

| Change in

restricted cash |

(271 |

) |

|

(10 |

) |

| Net cash used in

investing activities |

(5,929 |

) |

|

(60,670 |

) |

| |

|

|

|

| Cash flows from

financing activities: |

|

|

|

| Repayment

and repurchases of long-term debt |

(24,766 |

) |

|

(47,751 |

) |

| Proceeds

from stock option exercises |

765 |

|

|

986 |

|

| Purchase

of treasury shares |

(15,531 |

) |

|

(19,746 |

) |

|

Distributions to non-controlling interests |

(1,056 |

) |

|

(1,065 |

) |

| Payment

of tax withholding on issuance of restricted shares |

(1,089 |

) |

|

— |

|

| Net cash used in

financing activities |

(41,677 |

) |

|

(67,576 |

) |

| |

|

|

|

| Net decrease in cash

and cash equivalents |

(35,089 |

) |

|

(58,841 |

) |

| Cash and cash

equivalents at the beginning of the period |

149,294 |

|

|

179,327 |

|

| |

|

|

|

| Cash and cash

equivalents at the end of the period |

$ |

114,205 |

|

|

$ |

120,486 |

|

| |

|

|

|

| Supplemental cash flow

information: |

|

|

|

| Interest

paid |

$ |

10,787 |

|

|

$ |

11,694 |

|

| Income

taxes paid, net |

12,668 |

|

|

5,618 |

|

| |

|

|

|

| Non-cash investing and

financing activities: |

|

|

|

|

(Decrease) increase in payables for purchases of premises and

equipment |

$ |

(378 |

) |

|

$ |

1,369 |

|

| Increase

in payables for purchases of treasury shares |

3,042 |

|

|

— |

|

ALTISOURCE PORTFOLIO SOLUTIONS

S.A.NON-GAAP MEASURES(in

thousands, except per share

data)(unaudited)

Pretax income attributable to Altisource,

adjusted pretax income attributable to Altisource, adjusted net

income attributable to Altisource and adjusted diluted earnings per

share are non-GAAP measures used by management, existing

shareholders, potential shareholders and other users of our

financial information to measure Altisource’s performance and do

not purport to be alternatives to income before income taxes and

non-controlling interests, net income attributable to Altisource or

diluted earnings per share as measures of Altisource’s

performance. We believe these measures are useful to

management, existing shareholders, potential shareholders and other

users of our financial information in evaluating operating

profitability more on a continuing cost basis as they exclude

amortization expense related to acquisitions that occurred in prior

periods as well as the effect of more significant non-recurring

items from earnings. We believe these measures are also

useful in evaluating the effectiveness of our operations and

underlying business trends in a manner that is consistent with

management’s evaluation of business performance. Furthermore,

we believe the exclusion of more significant non-recurring items

enables comparability to prior period performance and trend

analysis.

It is management’s intent to provide non-GAAP

financial information to enhance the understanding of Altisource’s

GAAP financial information, and it should be considered by the

reader in addition to, but not instead of, the financial statements

prepared in accordance with GAAP. Each non-GAAP financial

measure is presented along with the corresponding GAAP measure so

as not to imply that more emphasis should be placed on the non-GAAP

measure. The non-GAAP financial information presented may be

determined or calculated differently by other companies. The

non-GAAP financial information should not be unduly relied

upon.

Pretax income attributable to Altisource is

calculated by deducting non-controlling interests from income

before income taxes and non-controlling interests. Adjusted

pretax income attributable to Altisource is calculated by adding

intangible asset amortization expense to pretax income attributable

to Altisource. Adjusted net income attributable to Altisource

is calculated by adding intangible asset amortization expense (net

of tax) to GAAP net income attributable to Altisource.

Adjusted diluted earnings per share is calculated by dividing net

income attributable to Altisource plus intangible asset

amortization expense (net of tax), by the weighted average number

of diluted shares.

| ALTISOURCE PORTFOLIO SOLUTIONS

S.A.NON-GAAP MEASURES(in

thousands, except per share

data)(unaudited) |

| |

|

|

|

|

|

|

Reconciliations of the non-GAAP measures to the corresponding GAAP

measures are as follows: |

| |

|

|

|

|

|

| |

Three months ended June 30, |

|

Three monthsended March 31, |

|

Six months ended June 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2017 |

|

2016 |

| |

|

|

|

|

|

|

|

|

|

| Income before income

taxes and non-controlling interests |

$ |

12,160 |

|

|

$ |

23,977 |

|

|

$ |

9,746 |

|

|

$ |

21,906 |

|

|

$ |

45,062 |

|

| |

|

|

|

|

|

|

|

|

|

|

Non-controlling interests |

(687 |

) |

|

(692 |

) |

|

(615 |

) |

|

(1,302 |

) |

|

(1,090 |

) |

| Pretax income

attributable to Altisource |

11,473 |

|

|

23,285 |

|

|

9,131 |

|

|

20,604 |

|

|

43,972 |

|

|

Intangible asset amortization expense |

9,393 |

|

|

12,756 |

|

|

9,146 |

|

|

18,539 |

|

|

24,967 |

|

| |

|

|

|

|

|

|

|

|

|

| Adjusted pretax income

attributable to Altisource |

$ |

20,866 |

|

|

$ |

36,041 |

|

|

$ |

18,277 |

|

|

$ |

39,143 |

|

|

$ |

68,939 |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable

to Altisource |

$ |

9,035 |

|

|

$ |

19,994 |

|

|

$ |

6,545 |

|

|

$ |

15,580 |

|

|

$ |

38,488 |

|

| |

|

|

|

|

|

|

|

|

|

|

Intangible asset amortization expense |

9,393 |

|

|

12,756 |

|

|

9,146 |

|

|

18,539 |

|

|

24,967 |

|

| Tax

benefit from intangible asset amortization |

(1,883 |

) |

|

(1,751 |

) |

|

(2,426 |

) |

|

(4,251 |

) |

|

(3,038 |

) |

|

Intangible asset amortization expense, net of tax |

7,510 |

|

|

11,005 |

|

|

6,720 |

|

|

14,288 |

|

|

21,929 |

|

| |

|

|

|

|

|

|

|

|

|

| Adjusted net income

attributable to Altisource |

$ |

16,545 |

|

|

$ |

30,999 |

|

|

$ |

13,265 |

|

|

$ |

29,868 |

|

|

$ |

60,417 |

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per

share |

$ |

0.48 |

|

|

$ |

1.02 |

|

|

$ |

0.34 |

|

|

$ |

0.82 |

|

|

$ |

1.94 |

|

| |

|

|

|

|

|

|

|

|

|

|

Intangible asset amortization expense, net of tax, per diluted

share |

0.40 |

|

|

0.56 |

|

|

0.35 |

|

|

0.75 |

|

|

1.11 |

|

| |

|

|

|

|

|

|

|

|

|

| Adjusted diluted

earnings per share |

$ |

0.88 |

|

|

$ |

1.58 |

|

|

$ |

0.69 |

|

|

$ |

1.57 |

|

|

$ |

3.05 |

|

| |

|

|

|

|

|

|

|

|

|

| Weighted average shares

outstanding - diluted |

18,836 |

|

|

19,604 |

|

|

19,304 |

|

|

19,069 |

|

|

19,822 |

|

__________________________

Note: Amounts may not add to the total due to rounding.

FOR FURTHER INFORMATION CONTACT:

Michelle D. Esterman

Chief Financial Officer

T: +352 2469 7950

E: Michelle.Esterman@altisource.lu

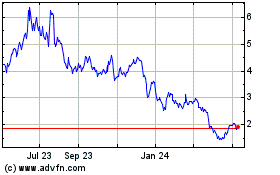

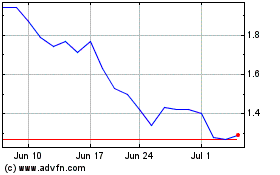

Altisource Portfolio Sol... (NASDAQ:ASPS)

Historical Stock Chart

From Apr 2024 to May 2024

Altisource Portfolio Sol... (NASDAQ:ASPS)

Historical Stock Chart

From May 2023 to May 2024