Enphase Energy, Inc. (NASDAQ:ENPH), a global energy technology

company and the world’s leading supplier of solar microinverters,

announced today financial results for the second quarter ended

June 30, 2017.

Enphase Energy reported total revenue for the second quarter of

2017 of $74.7 million, an increase of 36 percent compared to the

first quarter of 2017. During the second quarter of 2017,

Enphase sold approximately 224MW (DC) or 775,000 microinverters, an

increase in MW of 39 percent compared to the first quarter of 2017.

GAAP gross margin for the second quarter of 2017 was 18.1

percent and non-GAAP gross margin was 18.4 percent.

GAAP operating expenses for the second quarter of 2017 were

$22.8 million, a decrease of 22 percent compared to the first

quarter of 2017 and a decrease of 24 percent compared to the second

quarter of 2016. Non-GAAP operating expenses were $17.8 million, a

decrease of 12 percent compared to the first quarter of 2017 and a

decrease of 35 percent compared to the second quarter of 2016.

GAAP net loss for the second quarter of 2017 was $12.1

million, or a net loss of $0.14 per share, compared to a second

quarter of 2016 net loss of $16.7 million, or a net loss of $0.36

per share. On a non-GAAP basis, net loss in the second quarter of

2017 was $6.6 million, or a net loss of $0.08 per share, compared

to a second quarter of 2016 net loss of $13.9 million, or a net

loss of $0.30 per share.

The Company generated $1.0 million of cash in the second quarter

of 2017 and exited the quarter with a total cash balance of $31.0

million.

“The ongoing rollout of our sixth-generation IQ Microinverter

System continued to gain traction during the second quarter, and we

expect to fully transition our U.S. customer base to the IQ

platform by the end of the third quarter of 2017,” said Badri

Kothandaraman, COO of Enphase Energy. “In addition, we are

excited by the recent U.S. launch of our Enphase Energized™ AC

Modules that directly integrate the IQ Microinverter with the

module, creating an even simpler, more consolidated solution.”

“The actions we have taken over the past year to improve our

operational efficiency resulted in a 35 percent year-over-year

decrease in non-GAAP operating expenses,” said Bert Garcia, CFO of

Enphase Energy. “We believe the combination of operating expense

reduction, supply chain optimization and the transition to our

sixth-generation IQ Microinverter System will enable us to achieve

non-GAAP operating income profitability by the fourth quarter of

2017.”

Business Outlook

“We expect our revenue for the third quarter of 2017 to be

within a range of $72 million to $80 million,” stated Bert Garcia.

“We expect GAAP and non-GAAP gross margin for the third quarter to

be within a range of 18 percent to 21 percent. Non-GAAP gross

margin excludes approximately $200,000 of stock-based compensation

expense. We expect our GAAP operating expense for the third

quarter to be within a range of $22.5 million to $24.5 million and

non-GAAP operating expense to be within a range of $16.5 million to

$18.5 million, excluding an estimated $1.7 million of stock-based

compensation expense and approximately $4.3 million of additional

restructuring expense.”

Enphase Energy also announced today that Paul Nahi is stepping

down as president and CEO. Nahi’s final day with Enphase is today;

however, he will continue to assist Enphase as it transitions to a

new leader. The Company’s Board of Directors is conducting an

internal and external search for a permanent replacement, with the

intention to name a successor by August 31, 2017. In the interim,

the Board has created an Office of the CEO, consisting of Bert

Garcia, CFO, and Badri Kothandaraman, COO, to oversee and provide

leadership for the Company’s day-to day activities.

Use of Non-GAAP Financial Measures

The Company has presented certain non-GAAP financial measures in

this release. Generally, a non-GAAP financial measure is a

numerical measure of a company’s performance, financial position,

or cash flows that either exclude or include amounts that are not

normally excluded or included in the most directly comparable

measure calculated and presented in accordance with generally

accepted accounting principles in the United States of America, or

GAAP. Reconciliation of each non-GAAP financial measure to the most

directly comparable GAAP financial measure can be found in the

accompanying tables to this press release. Non-GAAP financial

measures presented by the Company include non-GAAP gross profit,

gross margin, operating expenses, income (loss) from operations,

net loss and net loss per share.

These non-GAAP financial measures do not reflect a comprehensive

system of accounting, differ from GAAP measures with the same

captions and may differ from non-GAAP financial measures with the

same or similar captions that are used by other companies. In

addition, these non-GAAP measures have limitations in that they do

not reflect all of the amounts associated with the Company’s

results of operations as determined in accordance with GAAP. As

such, these non-GAAP measures should be considered as a supplement

to, and not as a substitute for, or superior to, financial measures

calculated in accordance with GAAP. The Company uses these non-GAAP

financial measures to analyze its operating performance and future

prospects, develop internal budgets and financial goals, and to

facilitate period-to-period comparisons. Enphase believes that

these non-GAAP financial measures reflect an additional way of

viewing aspects of its operations that, when viewed with its GAAP

results, provide a more complete understanding of factors and

trends affecting its business.

As presented in the “Reconciliation of Non-GAAP Financial

Measures” tables in the accompanying press release, each of the

non-GAAP financial measures excludes one or more of the following

items for purposes of calculating non-GAAP financial measures to

facilitate an evaluation of the Company’s current operating

performance and a comparison to its past operating performance:

Stock-based compensation expense. The Company excludes

stock-based compensation expense from

its non-GAAP measures primarily because they

are non-cash in nature. Moreover, the impact of this expense

is significantly affected by the Company’s stock price at the time

of an award over which management has limited to no control.

Acquisition-related net charges (credits). These items include:

(1) revaluation of contingent consideration and its income tax

effects, which represent accounting adjustments to state contingent

consideration liabilities at their estimated fair value, and

(2) amortization of acquired intangibles, which consists of

customer relationships. These items relate to a specific prior

acquisition and are not reflective of the Company’s ongoing

financial performance.

Restructuring charges. The Company excludes restructuring

charges due to the nature of the expenses being unplanned and

arising outside the ordinary course of continuing operations. These

costs primarily consist of fees paid for restructuring-related

management consulting services, cash-based severance costs related

to workforce reduction actions, asset write-downs of property and

equipment and lease loss reserves, and other contract termination

costs resulting from restructuring initiatives.

Amortization of Debt Issuance Costs. The Company excludes

amortization of debt issuance costs because the costs do not

represent a cash outflow for the Company except in the period the

financing was secured and such amortization expense is not

reflective of the Company’s ongoing financial performance.

Conference Call Information

Enphase Energy will host a conference call for analysts and

investors to discuss its second quarter 2017 results and third

quarter 2017 business outlook today at 4:30 p.m. Eastern Time (1:30

p.m. Pacific Time). Open to the public, investors may access the

call by dialing 877-644-1284; participant passcode 53238137.

A live webcast of the conference call, together with accompanying

presentation slides, will also be accessible from the “Investor

Relations” section of the Company's website at

investor.enphase.com. Following the webcast, an archived version

will be available on the website for 30 days. In addition, an audio

replay of the conference call will be available by calling

855-859-2056; participant pass code 53238137 beginning

approximately one hour after the call.

Forward-Looking Statements

This press release contains forward-looking statements,

including statements related to Enphase Energy’s: rollout of its

sixth- and seventh-generation IQ Microinverter System and

transition plans; timing of achieving sustainable profitability;

and expected future financial performance. These forward-looking

statements are based on the Company’s current expectations and

inherently involve significant risks and uncertainties. Enphase

Energy’s actual results and the timing of events could differ

materially from those anticipated in such forward-looking

statements as a result of certain risks and uncertainties including

those risks described in more detail in the Company’s most recent

Annual Report on Form 10-K and other documents on file with the SEC

and available on the SEC’s website at www.sec.gov. Enphase Energy

undertakes no duty or obligation to update any forward-looking

statements contained in this release as a result of new

information, future events or changes in its expectations, except

as required by law.

A copy of this press release can be found on the investor

relations page of Enphase Energy's website at

investor.enphase.com.

About Enphase Energy, Inc.

Enphase Energy, a global energy technology company, delivers

smart, easy-to-use solutions that connect solar generation, storage

and management on one intelligent platform. The Company

revolutionized solar with its microinverter technology and produces

the world’s only truly integrated solar plus storage solution.

Enphase has shipped approximately 15 million microinverters, and

more than 661,000 Enphase systems have been deployed in more than

100 countries. For more information, visit www.enphase.com.

Enphase Energy®, the Enphase logo and other trademarks or

service names are the trademarks of Enphase Energy, Inc.

| |

| ENPHASE ENERGY, INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

| (In thousands, except per share

data) |

| (Unaudited) |

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| Net revenues |

$ |

74,704 |

|

|

$ |

79,185 |

|

|

$ |

129,455 |

|

|

$ |

143,306 |

|

| Cost of revenues |

61,157 |

|

|

65,049 |

|

|

108,861 |

|

|

117,410 |

|

| Gross profit |

13,547 |

|

|

14,136 |

|

|

20,594 |

|

|

25,896 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

| Research

and development |

7,947 |

|

|

13,091 |

|

|

17,552 |

|

|

26,157 |

|

| Sales and

marketing |

6,274 |

|

|

9,987 |

|

|

12,732 |

|

|

20,202 |

|

| General

and administrative |

4,964 |

|

|

6,846 |

|

|

10,797 |

|

|

14,413 |

|

|

Restructuring charges |

3,609 |

|

|

— |

|

|

10,856 |

|

|

— |

|

| Total

operating expenses |

22,794 |

|

|

29,924 |

|

|

51,937 |

|

|

60,772 |

|

| Loss from

operations |

(9,247 |

) |

|

(15,788 |

) |

|

(31,343 |

) |

|

(34,876 |

) |

| Other income (expense),

net: |

|

|

|

|

|

|

|

| Interest

expense |

(2,080 |

) |

|

(212 |

) |

|

(4,219 |

) |

|

(364 |

) |

| Other

income (expense) |

88 |

|

|

(379 |

) |

|

1,148 |

|

|

302 |

|

| Total

other income (expense), net |

(1,992 |

) |

|

(591 |

) |

|

(3,071 |

) |

|

(62 |

) |

| Loss before income

taxes |

(11,239 |

) |

|

(16,379 |

) |

|

(34,414 |

) |

|

(34,938 |

) |

| Provision for income

taxes |

(854 |

) |

|

(344 |

) |

|

(984 |

) |

|

(580 |

) |

| Net loss |

$ |

(12,093 |

) |

|

$ |

(16,723 |

) |

|

$ |

(35,398 |

) |

|

$ |

(35,518 |

) |

| Net loss per

share: |

|

|

|

|

|

|

|

| Basic and

diluted |

$ |

(0.14 |

) |

|

$ |

(0.36 |

) |

|

$ |

(0.44 |

) |

|

$ |

(0.77 |

) |

| Shares used in per

share calculation: |

|

|

|

|

|

|

|

| Basic and

diluted |

84,434 |

|

|

46,620 |

|

|

80,542 |

|

|

46,415 |

|

| ENPHASE ENERGY, INC. |

| CONDENSED CONSOLIDATED BALANCE

SHEETS |

| (In thousands) |

| (Unaudited) |

| |

| |

June 30, 2017 |

|

December 31, 2016 |

|

ASSETS |

|

|

|

| Current assets: |

|

|

|

| Cash and

cash equivalents |

$ |

30,953 |

|

|

$ |

17,764 |

|

| Accounts

receivable |

56,403 |

|

|

61,019 |

|

|

Inventory |

20,839 |

|

|

31,960 |

|

| Prepaid

expenses and other |

13,307 |

|

|

7,121 |

|

| Total

current assets |

121,502 |

|

|

117,864 |

|

| Property and equipment,

net |

29,351 |

|

|

31,440 |

|

| Goodwill |

3,664 |

|

|

3,664 |

|

| Intangibles, net |

668 |

|

|

945 |

|

| Other assets |

8,493 |

|

|

9,663 |

|

| Total

assets |

$ |

163,678 |

|

|

$ |

163,576 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| Current

liabilities: |

|

|

|

| Accounts

payable |

$ |

15,425 |

|

|

$ |

31,696 |

|

| Accrued

liabilities |

33,827 |

|

|

31,533 |

|

| Deferred

revenues |

8,142 |

|

|

6,411 |

|

|

Borrowings under revolving credit facility |

— |

|

|

10,100 |

|

| Current

portion of term loan |

5,951 |

|

|

3,032 |

|

| Total

current liabilities |

63,345 |

|

|

82,772 |

|

| Long-term

liabilities: |

|

|

|

| Deferred

revenues, noncurrent |

35,782 |

|

|

33,893 |

|

| Warranty

obligations, non-current |

23,581 |

|

|

22,818 |

|

| Other

liabilities |

1,969 |

|

|

2,025 |

|

| Term

loans, noncurrent |

41,385 |

|

|

20,768 |

|

| Total

liabilities |

166,062 |

|

|

162,276 |

|

| Stockholders’

equity: |

|

|

|

| Preferred

stock |

— |

|

|

— |

|

| Common

stock |

1 |

|

|

1 |

|

|

Additional paid-in capital |

283,717 |

|

|

252,126 |

|

|

Accumulated deficit |

(285,933 |

) |

|

(250,535 |

) |

|

Accumulated other comprehensive income (loss) |

(169 |

) |

|

(292 |

) |

| Total

stockholders’ equity |

(2,384 |

) |

|

1,300 |

|

| Total liabilities and

stockholders’ equity |

$ |

163,678 |

|

|

$ |

163,576 |

|

| ENPHASE ENERGY, INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

| (In thousands) |

| (Unaudited) |

| |

| |

Six Months Ended June 30, |

| |

2017 |

|

2016 |

| Cash flows from

operating activities: |

|

|

|

| Net

loss |

$ |

(35,398 |

) |

|

$ |

(35,518 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

Depreciation and amortization |

4,583 |

|

|

5,388 |

|

| Provision

for doubtful accounts |

707 |

|

|

1,331 |

|

| Asset

impairment and restructuring |

1,765 |

|

|

28 |

|

|

Amortization of debt issuance costs |

1,063 |

|

|

56 |

|

|

Stock-based compensation |

3,550 |

|

|

5,707 |

|

| Changes

in operating assets and liabilities: |

|

|

|

| Accounts

receivable |

3,910 |

|

|

(4,205 |

) |

|

Inventory |

11,121 |

|

|

1,505 |

|

| Prepaid

expenses and other assets |

(5,338 |

) |

|

(3,697 |

) |

| Accounts

payable, accrued and other liabilities |

(13,908 |

) |

|

14,857 |

|

| Deferred

revenues |

3,620 |

|

|

6,557 |

|

| Net cash

used in operating activities |

(24,325 |

) |

|

(7,991 |

) |

| Cash flows from

investing activities: |

|

|

|

| Purchases

of property and equipment |

(3,515 |

) |

|

(7,510 |

) |

| Purchases

of intangible assets |

— |

|

|

(678 |

) |

| Net cash

used in investing activities |

(3,515 |

) |

|

(8,188 |

) |

| Cash flows from

financing activities: |

|

|

|

| Proceeds

from issuance of common stock, net of issuance costs |

26,425 |

|

|

— |

|

| Proceeds

from term loan, net |

24,240 |

|

|

— |

|

| Proceeds

from borrowings under revolving credit facility |

— |

|

|

10,000 |

|

| Payments

under revolving credit facility |

(10,100 |

) |

|

(14,550 |

) |

| Payments

of deferred financing costs |

— |

|

|

(130 |

) |

|

Contingent consideration payment related to prior acquisition |

— |

|

|

(29 |

) |

| Proceeds

from issuance of common stock under employee stock plans |

170 |

|

|

809 |

|

| Net cash

provided by (used in) financing activities |

40,735 |

|

|

(3,900 |

) |

| Effect of

exchange rate changes on cash |

294 |

|

|

(130 |

) |

| Net increase (decrease)

in cash and cash equivalents |

13,189 |

|

|

(20,209 |

) |

| Cash and cash

equivalents—Beginning of period |

17,764 |

|

|

28,452 |

|

| Cash and cash

equivalents—End of period |

$ |

30,953 |

|

|

$ |

8,243 |

|

| ENPHASE ENERGY, INC. |

| RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES |

| (In thousands, except per share

data) |

| (Unaudited) |

|

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| Gross profit

(GAAP) |

|

$ |

13,547 |

|

|

$ |

14,136 |

|

|

$ |

20,594 |

|

|

$ |

25,896 |

|

|

Stock-based compensation |

|

211 |

|

|

305 |

|

|

449 |

|

|

612 |

|

| Gross profit

(Non-GAAP) |

|

$ |

13,758 |

|

|

$ |

14,441 |

|

|

$ |

21,043 |

|

|

$ |

26,508 |

|

| |

|

|

|

|

|

|

|

|

| Gross margin

(GAAP) |

|

18.1 |

% |

|

17.9 |

% |

|

15.9 |

% |

|

18.1 |

% |

|

Stock-based compensation |

|

0.3 |

% |

|

0.3 |

% |

|

0.4 |

% |

|

0.4 |

% |

| Gross margin

(Non-GAAP) |

|

18.4 |

% |

|

18.2 |

% |

|

16.3 |

% |

|

18.5 |

% |

| |

|

|

|

|

|

|

|

|

| Operating

expenses (GAAP) |

|

$ |

22,794 |

|

|

$ |

29,924 |

|

|

$ |

51,937 |

|

|

$ |

60,772 |

|

|

Stock-based compensation(1) |

|

(1,410 |

) |

|

(2,403 |

) |

|

(3,101 |

) |

|

(5,095 |

) |

|

Amortization of acquisition-related intangibles |

|

— |

|

|

(45 |

) |

|

— |

|

|

(90 |

) |

|

Restructuring charges |

|

(3,609 |

) |

|

— |

|

|

(10,856 |

) |

|

— |

|

| Operating

expenses (Non-GAAP) |

|

$ |

17,775 |

|

|

$ |

27,476 |

|

|

$ |

37,980 |

|

|

$ |

55,587 |

|

|

|

|

|

|

|

|

|

|

|

| (1)

Includes stock-based compensation as follows: |

|

|

|

|

|

|

|

|

| Research

and development |

|

$ |

636 |

|

|

$ |

980 |

|

|

$ |

1,387 |

|

|

$ |

2,106 |

|

| Sales and

marketing |

|

285 |

|

|

588 |

|

|

663 |

|

|

1,200 |

|

| General

and administrative |

|

489 |

|

|

835 |

|

|

1,051 |

|

|

1,789 |

|

|

Total |

|

$ |

1,410 |

|

|

$ |

2,403 |

|

|

$ |

3,101 |

|

|

$ |

5,095 |

|

| |

|

|

|

|

|

|

|

|

| Loss from

operations (GAAP) |

|

$ |

(9,247 |

) |

|

$ |

(15,788 |

) |

|

$ |

(31,343 |

) |

|

$ |

(34,876 |

) |

|

Stock-based compensation |

|

1,621 |

|

|

2,708 |

|

|

3,550 |

|

|

5,707 |

|

|

Amortization of acquisition-related intangibles |

|

— |

|

|

45 |

|

|

— |

|

|

90 |

|

|

Restructuring charges |

|

3,609 |

|

|

— |

|

|

10,856 |

|

|

— |

|

| Loss from

operations (Non-GAAP) |

|

$ |

(4,017 |

) |

|

$ |

(13,035 |

) |

|

$ |

(16,937 |

) |

|

$ |

(29,079 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss

(GAAP) |

|

$ |

(12,093 |

) |

|

$ |

(16,723 |

) |

|

$ |

(35,398 |

) |

|

$ |

(35,518 |

) |

|

Stock-based compensation |

|

1,621 |

|

|

2,708 |

|

|

3,550 |

|

|

5,707 |

|

|

Amortization of acquisition-related intangibles |

|

— |

|

|

45 |

|

|

— |

|

|

90 |

|

|

Restructuring, asset impairments and other charges |

|

3,609 |

|

|

— |

|

|

10,856 |

|

|

— |

|

| Non-cash

interest expense |

|

231 |

|

|

28 |

|

|

743 |

|

|

56 |

|

| Net loss

(Non-GAAP) |

|

$ |

(6,632 |

) |

|

$ |

(13,942 |

) |

|

$ |

(20,249 |

) |

|

$ |

(29,665 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss per

share (GAAP) |

|

$ |

(0.14 |

) |

|

$ |

(0.36 |

) |

|

$ |

(0.44 |

) |

|

$ |

(0.77 |

) |

|

Stock-based compensation |

|

0.02 |

|

|

0.06 |

|

|

0.04 |

|

|

0.13 |

|

|

Restructuring, asset impairments and other charges |

|

0.04 |

|

|

— |

|

|

0.14 |

|

|

— |

|

| Non-cash

interest expense |

|

— |

|

|

— |

|

|

0.01 |

|

|

— |

|

| Net loss per

share (Non-GAAP) |

|

$ |

(0.08 |

) |

|

$ |

(0.30 |

) |

|

$ |

(0.25 |

) |

|

$ |

(0.64 |

) |

|

|

|

|

|

|

|

|

|

|

| Shares used in

per share calculation (Non-GAAP) |

|

84,434 |

|

|

46,620 |

|

|

80,542 |

|

|

46,415 |

|

Contact

Christina Carrabino

Enphase Energy, Inc.

Investor Relations

ir@enphaseenergy.com

+1-707-763-4784 x7294

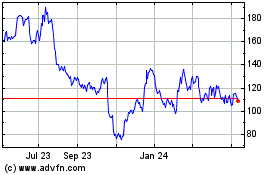

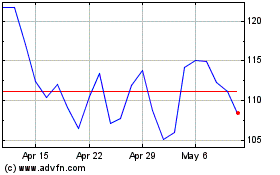

Enphase Energy (NASDAQ:ENPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Enphase Energy (NASDAQ:ENPH)

Historical Stock Chart

From Apr 2023 to Apr 2024