-

Net cash used in operating and

investing activities was $36.3 million in the second quarter and

$76.5 million for the first six months of 2017; quarter-end cash

and restricted cash position of $475.8 million, provides funding to

advance diverse pipeline

-

Initiated, with Roche, the

global Phase 2 PASADENA study of PRX002/RG7935 in patients with

early Parkinson's disease, triggering a $30 million milestone

payment from Roche to Prothena

-

Completed enrollment in the

Phase 3 VITAL Amyloidosis Study evaluating NEOD001 in newly

diagnosed, treatment naïve patients with AL amyloidosis and cardiac

dysfunction

-

Strengthened management team

with appointments of Sarah Noonberg, MD, PhD as Chief Medical

Officer and Wagner Zago, PhD as Chief

Scientific Officer

DUBLIN, Ireland, Aug. 08, 2017 (GLOBE NEWSWIRE) --

Prothena Corporation plc (NASDAQ:PRTA), a late-stage clinical

biotechnology company focused on the discovery, development and

commercialization of novel protein immunotherapies, today reported

financial results for the second quarter and first six months of

2017. In addition, the Company provided an update on its R&D

programs.

"During the quarter, we achieved two important

milestones in our first-in-class protein immunotherapy pipeline,

completing enrollment of our Phase 3 VITAL Amyloidosis Study

evaluating NEOD001 in newly diagnosed, treatment naïve patients

with AL amyloidosis and cardiac dysfunction, and initiating the

Phase 2 PASADENA study of PRX002/RG7935 in patients with early

Parkinson's disease," said Gene Kinney, PhD, President and Chief

Executive Officer of Prothena. "We also appointed two exceptionally

talented leaders into key roles to further expand our ability to

advance our R&D pipeline. Looking ahead, we expect topline

results from our Phase 1b MAD study of PRX003 in patients with

psoriasis in October, and topline results from our Phase 2b PRONTO

study of NEOD001 in patients with AL amyloidosis in the second

quarter of 2018. With both the PRONTO and VITAL studies now fully

enrolled, our team is focused on activities to support registration

submissions for NEOD001."

Second Quarter 2017 and Recent

Highlights:

-

Initiated the Phase 2 PASADENA

study of PRX002/RG7935 in patients with early Parkinson's

disease, triggering a $30 million milestone payment from Roche to

Prothena. PASADENA is a global two-part clinical study that is

being conducted by Roche. The primary endpoint of this study is the

comparison of change from baseline in the Movement Disorder

Society-Unified Parkinson's Disease Rating Scale (MDS-UPDRS) total

score (parts 1, 2 and 3) at week 52 in each of the two treatment

groups vs. the placebo group.

-

Completed enrollment in the Phase 3 VITAL

Amyloidosis Study evaluating NEOD001 in newly diagnosed,

treatment naïve patients with AL amyloidosis and cardiac

dysfunction. The original target enrollment of 236 patients was

exceeded and 260 patients have been randomized into the study. The

VITAL study is a global, double-blind, placebo-controlled,

registrational study with an event-based composite primary endpoint

of all-cause mortality or cardiac hospitalizations as qualifying

events. Secondary endpoints include biomarker, quality of life and

functional measures.

-

In a late-breaking therapeutic strategies

session at the 13th International

Conference on Alzheimer's and Parkinson's Diseases (AD/PD), Dr.

Joseph Jankovic of Baylor College of Medicine presented clinical

data from the 80-patient Phase 1b multiple ascending dose

study of PRX002/RG7935 in patients with Parkinson's disease.

The positive results supported advancing PRX002/RG7935 into a Phase

2 study, PASADENA.

-

Appointed Sarah Noonberg, MD, PhD as

Chief Medical Officer to define and advance Prothena's product

pipeline and lead its clinical and medical organizations. Dr.

Noonberg has extensive drug development experience across several

therapeutic categories and has led large, global organizations

across several phases of drug development.

-

Appointed Wagner Zago, PhD as Chief

Scientific Officer to define and execute Prothena's research

strategy and advance its drug discovery pipeline. Dr. Zago had been

Prothena's Head of Research since 2015 and has led teams that have

advanced four programs based on novel mechanisms into clinical

development.

Upcoming Research and Development

Milestones

NEOD001 is a monoclonal

antibody for the potential treatment of AL amyloidosis:

PRX003 is a monoclonal

antibody for the potential treatment of inflammatory diseases,

including psoriasis and psoriatic arthritis:

PRX004 is a monoclonal

antibody for the potential treatment of ATTR amyloidosis:

Second Quarter and First Six

Months of 2017 Financial Results

Prothena reported a net loss of $17.7 million and

$53.1 million for the second quarter and first six months of 2017,

respectively, as compared to a net loss of $40.4 million and $68.0

million for the second quarter and first six months of 2016,

respectively. Net loss per share for the second quarter and first

six months of 2017 was $0.46 and $1.44, respectively, as compared

to a net loss per share of $1.18 and $1.99 for the second quarter

and first six months of 2016, respectively.

Prothena reported total revenue of $26.8 million

and $27.1 million for the second quarter and first six months of

2017, respectively, as compared to total revenue of $0.3 million

and $0.6 million for the second quarter and first six months of

2016, respectively. The increase in revenue for the second quarter

and first six months of 2017 was primarily due to achievement of a

clinical milestone from Roche of $30.0 million (of which $26.6

million was recognized as collaboration revenue and $3.4 million

was recognized as an offset to R&D expenses).

Research and development (R&D) expenses

totaled $34.0 million and $59.7 million for the second quarter and

first six months of 2017, respectively, as compared to $32.4

million and $52.9 million for the second quarter and first six

months of 2016, respectively. The increase in R&D expenses for

the second quarter and first six months of 2017 was primarily due

to higher clinical trial and personnel cost offset in part by lower

external expenses for product manufacturing. R&D expenses

included non-cash share-based compensation expense of $2.7 million

and $5.0 million for the second quarter and first six months of

2017, respectively, as compared to $1.8 million and $3.2 million

for the second quarter and first six months of 2016,

respectively.

General and administrative (G&A) expenses

totaled $10.9 million and $21.7 million for the second quarter and

first six months of 2017, respectively, as compared to $8.1 million

and $15.3 million for second quarter and first six months of 2016,

respectively. The increase in G&A expenses for the second

quarter was primarily due to increases in personnel costs. The

increase in G&A expenses for the first six months was primarily

due to increases in personnel, consulting and other expenses

partially offset by a gain recognized in the first quarter of 2017

from the assignment of our former South San Francisco facility

lease. G&A expenses included non-cash share-based compensation

expense of $3.9 million and $7.2 million in the second quarter and

first six months of 2017, respectively, as compared to $2.7 million

and $5.0 million in the second quarter and first six months of

2016, respectively.

Total non-cash share-based compensation expense

was $6.7 million and $12.3 million for the second quarter and first

six months of 2017, respectively, as compared to $4.5 million and

$8.3 million for the second quarter and first six months of 2016,

respectively.

As of June 30, 2017, Prothena had $475.8

million in cash, cash equivalents and restricted cash and no

debt.

As of July 21, 2017, Prothena had

approximately 38.3 million ordinary shares outstanding.

The Company expects the full year 2017 net cash

burn from operating and investing activities to be $160 to $170

million, which includes the milestone from Roche earned in the

second quarter of 2017 upon initiation of the Phase 2 study of

PRX002/RG7935, and to end the year with approximately $375 million

in cash, cash equivalents and restricted cash (mid-point). The

estimated full year 2017 net cash burn from operating and investing

activities is primarily driven by an estimated net loss of $177 to

$191 million, which includes an estimated $26 million of non-cash

share-based compensation expense.

About Prothena

Prothena Corporation plc is a global, late-stage

clinical biotechnology company establishing fully-integrated

research, development and commercial capabilities. Fueled by its

deep scientific understanding built over decades of research in

protein misfolding and cell adhesion - the root causes of many

serious or currently untreatable amyloid and inflammatory diseases

- Prothena seeks to fundamentally change the course of progressive

diseases associated with this biology. The Company's pipeline of

antibody therapeutic candidates targets a number of indications

including AL amyloidosis (NEOD001), Parkinson's disease and other

related synucleinopathies (PRX002/RG7935), inflammatory diseases,

including psoriasis and psoriatic arthritis (PRX003), and ATTR

amyloidosis (PRX004). The Company continues discovery of additional

novel therapeutic candidates where its deep scientific

understanding of disease pathology can be leveraged. For more

information, please visit the Company's website

at www.prothena.com

Forward-looking

Statements

This press release contains

forward-looking statements. These statements relate to, among other

things, the sufficiency of our funding to advance our diverse

pipeline; the timing of announcing topline results from the Phase

2b study of NEOD001; the timing of announcing topline results from

the Phase 1b study of PRX003; the timing of initiating clinical

development of PRX004; our expected net cash burn from operating

and investing activities for 2017 and cash balance at the end of

2017; and our estimated net loss and non-cash share-based

compensation expense for 2017. These statements are based on

estimates, projections and assumptions that may prove not to be

accurate, and actual results could differ materially from those

anticipated due to known and unknown risks, uncertainties and other

factors, including but not limited to the risks, uncertainties and

other factors described in the "Risk Factors" sections of our

Annual Report on Form 10-K filed with the Securities and Exchange

Commission (SEC) on February 27, 2017 and our subsequent Quarterly

Reports on Form 10-Q filed with the SEC. Prothena undertakes no

obligation to update publicly any forward-looking statements

contained in this press release as a result of new information,

future events or changes in Prothena's expectations.

PROTHENA CORPORATION

PLC

CONSOLIDATED STATEMENTS OF

OPERATIONS

(unaudited - amounts in thousands except per share

data)

| |

|

Three Months Ended

June 30, |

|

Six Months Ended

June 30, |

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| Collaboration

revenue |

|

$ |

26,812 |

|

|

$ |

333 |

|

|

$ |

27,071 |

|

|

$ |

598 |

|

| Total

revenue |

|

26,812 |

|

|

333 |

|

|

27,071 |

|

|

598 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

Research and development |

|

34,032 |

|

|

32,359 |

|

|

59,730 |

|

|

52,852 |

|

|

General and administrative |

|

10,912 |

|

|

8,134 |

|

|

21,744 |

|

|

15,316 |

|

| Total

operating expenses |

|

44,944 |

|

|

40,493 |

|

|

81,474 |

|

|

68,168 |

|

| Loss from

operations |

|

(18,132 |

) |

|

(40,160 |

) |

|

(54,403 |

) |

|

(67,570 |

) |

| Other

expense, net |

|

(856 |

) |

|

(96 |

) |

|

(1,630 |

) |

|

(26 |

) |

| Loss before income

taxes |

|

(18,988 |

) |

|

(40,256 |

) |

|

(56,033 |

) |

|

(67,596 |

) |

| Provision for (benefit

from) income taxes |

|

(1,287 |

) |

|

189 |

|

|

(2,948 |

) |

|

370 |

|

| Net

loss |

|

$ |

(17,701 |

) |

|

$ |

(40,445 |

) |

|

$ |

(53,085 |

) |

|

$ |

(67,966 |

) |

| Basic and diluted net

loss per share |

|

$ |

(0.46 |

) |

|

$ |

(1.18 |

) |

|

$ |

(1.44 |

) |

|

$ |

(1.99 |

) |

| Shares used to compute

basic and diluted net loss per share |

|

38,073 |

|

|

34,358 |

|

|

36,922 |

|

|

34,192 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

PROTHENA CORPORATION

PLC

CONSOLIDATED BALANCE SHEETS

(unaudited - amounts in thousands)

|

|

June 30, |

|

December 31, |

| |

2017 |

|

2016 |

| Assets |

|

|

|

| Cash and cash

equivalents |

$ |

471,729 |

|

$ |

386,923 |

| Other current

assets |

39,991 |

|

4,439 |

| Total

current assets |

511,720 |

|

391,362 |

| Property and

equipment, net |

55,843 |

|

56,452 |

| Restricted cash |

4,056 |

|

4,056 |

| Other assets |

7,381 |

|

8,106 |

| Total

non-current assets |

67,280 |

|

68,614 |

| Total

assets |

$ |

579,000 |

|

$ |

459,976 |

| Liabilities and Shareholders' Equity |

|

|

|

| Accrued research and

development |

$ |

20,799 |

|

$ |

19,073 |

| Other current

liabilities |

18,800 |

|

22,002 |

| Total

current liabilities |

39,599 |

|

41,075 |

| Non-current

liabilities: |

52,425 |

|

53,498 |

| Total

liabilities |

92,024 |

|

94,573 |

| Total shareholders'

equity |

486,976 |

|

365,403 |

| Total

liabilities and shareholders' equity |

$ |

579,000 |

|

$ |

459,976 |

Media & Investor Contact:

Ellen Rose, Head of Communications

650-922-2405, ellen.rose@prothena.com

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Prothena Corporation plc via Globenewswire

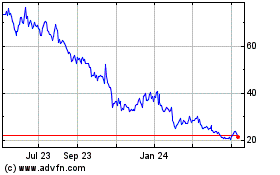

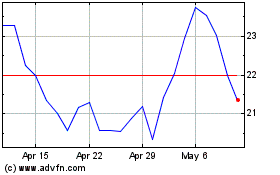

Prothena (NASDAQ:PRTA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Prothena (NASDAQ:PRTA)

Historical Stock Chart

From Apr 2023 to Apr 2024