Rio Tinto Increases Share Buyback Plans After Jump in 1st-Half Net Profit -- Update

August 02 2017 - 4:20AM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Rio Tinto PLC (RIO) said it would buy back

a further $1 billion in shares this year, after the mining company

continued to reduce debt and recorded a jump in half-year

profit.

In all, Rio Tinto said Wednesday it would return $3 billion in

cash to shareholders, including the increase to a $500 million

buyback program started earlier in the year and a raised interim

dividend.

The U.K.-Australian company has benefited from higher prices for

its output, from coal to iron ore, which buoyed revenue and almost

doubled cash flow from its operations. It said it also met a target

of reducing cash costs by $2 billion six months earlier than

planned.

Net profit rose to $3.31 billion in the six months through June

from $1.71 billion a year earlier, while revenue increased 25% to

$19.32 billion from $15.5 billion. The improvement came despite

struggling production of iron ore and steelmaking coking coal over

the first half. Disruptive wet weather and rail maintenance in

Australia prompted Rio Tinto to scale back its full-year production

targets for the commodities.

However, mined copper output started to rebound in the second

quarter from a lengthy strike at a mine in Chile, while

thermal-coal production grew for the half year.

Net debt was cut by $2 billion over the six-month period to

$7.57 billion, taking gearing--a measure of a company's debt

relative to equity--to 13% from 17% at the end of December.

"We continue to have the strongest balance sheet in the sector,"

said Chief Executive Jean-Sebastien Jacques, who took the helm of

the mining company about a year ago.

Expectations grew in recent months that Rio Tinto would take the

lead over many of its peers in increasing returns to shareholders,

leveraging improved cash flow and higher commodity prices.

Mr. Jacques said Rio Tinto would pay a dividend of $1.10 a

share, the highest interim payout in the company's history, while

also buying back a total $1.5 billion in shares before

year-end.

"The entire team is working every day to ensure we generate as

much cash as we can," he said during a conference call. "The

momentum is there."

In May, Rio Tinto moved to further reduce debt, initiating a

bond-repurchase plan for up to $2.5 billion that followed on from a

series of bond redemptions and buybacks in 2016 valued at $7.5

billion.

In June, Rio Tinto backed offer from Yancoal Australia Ltd.

(YAL.AU) for its Australian coal unit, Coal & Allied Industries

Ltd. China-backed Yancoal offered an improved bid of $2.69 billion

to top a rival approach from Glencore PLC (GLEN.LN).

Rio Tinto will wait until the cash is in the bank before

deciding what to do with the proceeds, said Chief Financial Officer

Chris Lynch.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

August 02, 2017 04:05 ET (08:05 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

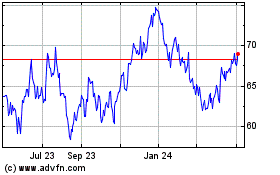

Rio Tinto (NYSE:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

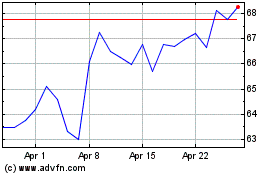

Rio Tinto (NYSE:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024