Global Ship Lease, Inc. (NYSE:GSL), a containership charter owner,

announced today its unaudited results for the three months and six

months ended June 30, 2017.

Second Quarter and Year To Date Highlights -

Reported operating revenues of $40.3 million for the second quarter

2017. Revenue for the six months ended June 30, 2017 was $79.9

million

- Reported net income available to common shareholders of $6.8

million for the second quarter 2017. For the six months ended

June 30, 2017, net income was $13.6 million

- Generated $28.1 million of Adjusted EBITDA(1) for the second

quarter 2017. Adjusted EBITDA for the six months ended June

30, 2017 was $56.1 million

- Normalized net income(1) was $7.3 million for second quarter

2017. Normalized net income was $14.1 million for the six months

ended June 30, 2017

- Purchased and cancelled on April 21, 2017, $19.5 million

principal amount 10.0% First Priority Secured Notes due 2019.

Net debt to last 12 months Adjusted EBITDA was 3.1 times at June

30, 2017, down from 3.3 times at December 31, 2016

Ian Webber, Chief Executive Officer of Global Ship Lease,

stated, “During the second quarter of 2017, we remained focused on

generating strong cashflows from stable, fixed-rate contracts with

industry-leading counterparties. The value and consistency of this

core strategy was once again evident in our financial results for

the quarter.”

Mr. Webber added, “Looking forward, we expect continued firming

in the charter market over time, driven by discipline in the

placement of new orders, an orderbook heavily skewed towards the

largest vessels, elevated scrapping consisting almost entirely of

the mid-sized and smaller vessel classes where we focus, and better

than expected demand growth. We remain encouraged by the

upward movement of the spot charter market throughout 2017 and

believe that this should benefit those of our vessels due to become

open later this year and early next. By continuing to maximize

vessel utilization with top-tier counterparties, actively manage

costs, and opportunistically pursue further deleveraging of our

stable balance sheet, we believe that Global Ship Lease is well

positioned to create long-term value for our shareholders amidst an

improving market environment.”

SELECTED FINANCIAL DATA – UNAUDITED

(thousands of U.S. dollars)

| |

Three |

Three |

Six |

Six |

| |

months ended |

months

ended |

months ended |

months ended |

| |

June 30, 2017 |

June

30, 2016 |

June 30, 2017 |

June

30, 2016 |

| |

|

|

|

|

|

Revenue |

40,259 |

41,333 |

79,901 |

83,943 |

| Operating

Income |

18,531 |

17,921 |

36,965 |

36,306 |

| Net Income

for Common Shareholders |

6,824 |

6,043 |

13,618 |

10,600 |

| Adjusted

EBITDA (1) |

28,072 |

28,798 |

56,106 |

58,118 |

| Normalized

Net Income (1) |

7,344 |

5,632 |

14,138 |

11,061 |

| |

|

|

|

|

(1) Adjusted EBITDA and Normalized net income are non-US

Generally Accepted Accounting Principles (US GAAP) measures, as

explained further in this press release, and are considered by

Global Ship Lease to be useful measures of its performance.

Reconciliations of such non-GAAP measures to the interim unaudited

financial information are provided in this Earnings Release.

Revenue and Utilization The 18-vessel fleet generated revenue

from fixed-rate, mainly long-term time, charters of $40.3 million

in the three months ended June 30, 2017, down $1.0 million (or

2.6%) on revenue of $41.3 million for the comparative period in

2016, due mainly to reduced revenue as a consequence of the

amendments to the charters of Marie Delmas and Kumasi effective

August 1, 2016, offset by an overall reduction in offhire from a

total of 53 days in the three months ended June 30, 2016 to 42 days

in the 2017 period. There were 1,638 ownership days in the

quarter, the same as in the comparative period in 2016. The 42 days

of offhire in the three months ended June 30, 2017 were

attributable to 15 days for scheduled dry-dockings and 27 days

unplanned offhire, primarily related to a vessel grounding in late

March, giving an overall utilization of 97.4%. The affected vessel

underwent repairs and was successfully returned to service. In the

comparative period of 2016, there were 51 days of planned offhire

for scheduled dry-dockings and two days of unplanned offhire,

giving a utilization of 96.8%.

For the six months ended June 30, 2017, revenue was $79.9

million, down $4.0 million (or 4.8%) on revenue of $83.9 million in

the comparative period, mainly due to the amendments to the

charters of Marie Delmas and Kumasi effective August 1, 2016 and an

increase in offhire to a total of 92 days in the six months ended

June 30, 2017 from 53 in the comparative period.

The table below shows fleet utilization for the three and six

months ended June 30, 2017 and 2016, and for the years ended

December 31, 2016, 2015, 2014 and 2013.

| |

|

|

|

|

|

|

|

|

|

| |

Three months ended |

Six months ended |

|

|

|

| |

June 30, |

June 30, |

June 30, |

June 30, |

|

Dec 31, |

Dec 31, |

Dec 31, |

Dec 31, |

| Days |

2017 |

|

2016 |

|

2017 |

|

2016 |

|

|

2016 |

|

2015 |

|

2014 |

|

2013 |

|

| |

|

|

|

|

|

|

|

|

|

| Ownership days |

1,638 |

|

1,638 |

|

3,258 |

|

3,276 |

|

|

6,588 |

|

6,893 |

|

6,270 |

|

6,205 |

|

| Planned offhire -

scheduled dry-dock |

(15 |

) |

(51 |

) |

(62 |

) |

(51 |

) |

|

(100 |

) |

(9 |

) |

(48 |

) |

(21 |

) |

| Unplanned offhire |

(27 |

) |

(2 |

) |

(30 |

) |

(2 |

) |

|

(3 |

) |

(7 |

) |

(12 |

) |

(7 |

) |

| Idle time |

0 |

|

0 |

|

0 |

|

0 |

|

|

0 |

|

(13 |

) |

(64 |

) |

0 |

|

| Operating days |

1,596 |

|

1,585 |

|

3,166 |

|

3,223 |

|

|

6,485 |

|

6,864 |

|

6,146 |

|

6,177 |

|

| |

|

|

|

|

|

|

|

|

|

| Utilization |

97.4 |

% |

96.8 |

% |

97.2 |

% |

98.4 |

% |

|

98.4 |

% |

99.6 |

% |

98.0 |

% |

99.5 |

% |

In the three months ended June 30, 2017, we completed one

regulatory dry-docking. There have been a total of four regulatory

dry-dockings year to date. One further regulatory dry-docking is

scheduled in 2017. Two dry-dockings were completed in the

three months ended June 30, 2016, and one further dry-docking was

substantially completed. There were a total of six

dry-dockings in 2016.

Vessel Operating Expenses Vessel operating expenses, which

include costs of crew, lubricating oil, spares and insurance, as

well as bunker fuel when a vessel is offhire or without a charter,

were $10.9 million for the three months ended June 30, 2017.

The average cost per ownership day in the quarter was $6,635,

compared to $6,909 for the comparative period, down $274 or

4.0%. The reductions occurred across several cost categories,

most prominently from lower consumption of lubricating oil, reduced

insurance costs on renewals and lower expenditure on repairs and

maintenance.

For the six months ended June 30, 2017, vessel operating

expenses were $21.3 million, or an average of $6,531 per day,

compared to $22.7 million in the comparative period, or $6,935 per

day.

Depreciation Depreciation for the three months ended June 30,

2017 was $9.5 million, compared to $10.9 million in the second

quarter 2016, with the reduction being due to the effect of lower

book values for a number of vessels following impairment write

downs taken in the third and fourth quarters 2016.

Depreciation for the six months ended June 30, 2017 was $19.1

million, compared to $21.8 million in the comparative period, with

the reduction being due to the reason noted above.

General and Administrative Costs General and administrative

costs were $1.3 million in the three months ended June 30, 2017,

the same as in the second quarter of 2016.

For the six months ended June 30, 2017, general and

administrative costs were $2.6 million, compared to $3.3 million in

the comparative period in 2016, which includes higher legal and

professional fees in the three months ended March 31, 2016.

Other Operating Income

Other operating income in the three months ended June 30, 2017

was $6,000, compared to $63,000 in the second quarter of 2016.

For the six months ended June 30, 2017, other operating income

was $48,000, compared to $144,000 in the comparative

period.

Adjusted EBITDA

As a result of the above, Adjusted EBITDA was $28.1 million for

the three months ended June 30, 2017, down from $28.8 million for

the three months ended June 30, 2016.

Adjusted EBITDA for the six months ended June 30, 2017 was $56.1

million, compared to $58.1 million for the comparative period.

Interest Expense Debt at June 30, 2017 comprised amounts

outstanding on our Notes, the revolving credit facility and the

secured term loan.

Interest expense for the three months ended June 30, 2017, was

$11.0 million, compared to $11.1 million for the three months ended

June 30, 2016. The reduction of $1.0 million interest paid on

our 10.0% Notes on lower amounts outstanding was offset by $0.5

million charges, including premium paid, associated with the excess

cashflow offer which retired $19.5 million principal amount of our

10% Notes on April 21, 2017, whereas second quarter 2016 included a

$0.5 million gain realized in May 2016 on the purchase in the open

market of $4.2 million principal amount of the

Notes.

For the six months ended June 30, 2017, interest expense was

$22.0 million, compared to $24.2 million for the six months ended

June 30, 2016. The reduction is mainly due to lower interest

on the lower amount outstanding of our 10% Notes.

Interest income for the three months ended June 30, 2017 was

$0.1 million, compared to $38,000 in the comparative quarter in

2016.

Interest income for the six months ended June 30, 2017 was $0.2

million, compared to $0.1 million in the comparative period in

2016.

Taxation

Taxation for the three months ended June 30, 2017 was $6,000,

compared to $9,000 in the second quarter of 2016.

Taxation for the six months ended June 30, 2017 was $16,000,

compared to $15,000 for the comparative period in 2016.

Earnings Allocated to Preferred SharesThe Series B preferred

shares, issued on August 20, 2014, carry a coupon of 8.75%, the

cost of which for the three months ended June 30, 2017 was $0.8

million, the same as in the comparative period. The cost was

$1.5 million in the six months ended June 30, 2017, again the same

as in the comparative period.

Net Income Available to Common Shareholders

Net income available to common shareholders for the three months

ended June 30, 2017 was $6.8 million, compared to $6.0 million in

the second quarter 2016.

Normalized net income, which excludes the premium paid on the

purchase of our 10% Notes in April 2017 under the excess cashflow

offer and associated charges, was $7.3 million for the three months

ended June 30, 2017, compared to $5.6 million in the second quarter

of 2016.

Net income available to common shareholders was $13.6 million

for the six months ended June 30, 2017, compared to $10.6 million

in the comparative period. Normalized net income for the six

months ended June 30, 2017, was $14.1 million. Normalized net

income for the six months ended June 30, 2016 which excludes the

gain on the purchase of 10% Notes in May 2016 and the premium

associated with the tender offer for 10% Notes completed in March

2016, and associated charges, was $11.1 million.

Fleet

The following table provides information about the on-the-water

fleet of 18 vessels as at June 30, 2017. 15 vessels are chartered

to CMA CGM, and three are chartered to OOCL.

| |

|

|

|

Remaining |

Earliest |

Daily |

| |

|

|

|

Charter |

Charter |

Charter |

|

Vessel |

Capacity |

Year |

Purchase |

Term (2) |

Expiry |

Rate |

|

Name |

in TEUs (1) |

Built |

by GSL |

(years) |

Date |

$ |

| CMA CGM Matisse |

2,262 |

1999 |

Dec

2007 |

2.50 |

Sept

21, 2019 |

15,300 |

| CMA CGM Utrillo |

2,262 |

1999 |

Dec

2007 |

2.50 |

Sept

11, 2019 |

15,300 |

| Delmas Keta |

2,207 |

2003 |

Dec

2007 |

0.50 |

Sept

20, 2017 |

18,465 |

| Julie Delmas |

2,207 |

2002 |

Dec

2007 |

0.50 |

Sept

11, 2017 |

18,465 |

| Kumasi |

2,207 |

2002 |

Dec

2007 |

1.50 -

3.50(3) |

Nov

16, 2018 |

13,000(3) |

| Marie Delmas |

2,207 |

2002 |

Dec

2007 |

1.50 -

3.50(3) |

Nov

16, 2018 |

13,000(3) |

| CMA CGM La Tour |

2,272 |

2001 |

Dec

2007 |

2.50 |

Sept

20, 2019 |

15,300 |

| CMA CGM Manet |

2,272 |

2001 |

Dec

2007 |

2.50 |

Sept

7, 2019 |

15,300 |

| CMA CGM Alcazar |

5,089 |

2007 |

Jan

2008 |

3.50 |

Oct

18, 2020 |

33,750 |

| CMA CGM Château

d’If |

5,089 |

2007 |

Jan

2008 |

3.50 |

Oct

11, 2020 |

33,750 |

| CMA CGM Thalassa |

11,040 |

2008 |

Dec

2008 |

8.50 |

Oct 1,

2025 |

47,200 |

| CMA CGM Jamaica |

4,298 |

2006 |

Dec

2008 |

5.50 |

Sept

17, 2022 |

25,350 |

| CMA CGM Sambhar |

4,045 |

2006 |

Dec

2008 |

5.50 |

Sept

16, 2022 |

25,350 |

| CMA CGM America |

4,045 |

2006 |

Dec

2008 |

5.50 |

Sept

19, 2022 |

25,350 |

| CMA CGM Berlioz |

6,621 |

2001 |

Aug

2009 |

4.25 |

May

28, 2021 |

34,000 |

| OOCL Tianjin |

8,063 |

2005 |

Oct

2014 |

0.50 |

Oct

28, 2017 |

34,500 |

| OOCL Qingdao |

8,063 |

2004 |

Mar

2015 |

0.75 |

Mar

11, 2018 |

34,500 |

| OOCL Ningbo |

8,063 |

2004 |

Sep

2015 |

1.25 |

Sep

17, 2018 |

34,500 |

| (1) Twenty-foot Equivalent Units. |

|

|

|

|

|

| (2) As at June 30, 2017. Plus or minus 90 days,

other than (i) OOCL Tianjin which is between October 28, 2017 and

January 28, 2018, (ii) OOCL Qingdao which is between March 11, 2018

and June 11, 2018, and (iii) OOCL Ningbo which is between September

17, 2018 and December 17, 2018, all at charterer’s option.

(3) The charters for Kumasi and Marie Delmas were amended in

July 2016. The charter rate is $13,000 per day until

September 14, 2017 for Marie Delmas and September 21, 2017 for

Kumasi. Thereafter, the daily rate is $9,800. The

earliest possible re-delivery date is shown in the table, taking

account of the Company exercising its option to extend the charters

through December 31, 2018 plus or minus 45 days. The Company

has two further consecutive options to extend the charters, at

$9,800 per day, which, if exercised, would extend the earliest

re-delivery date to October 2, 2020. |

Conference Call and Webcast Global Ship Lease

will hold a conference call to discuss the Company's results for

the three months ended June 30, 2017 today, Monday July 31, 2017 at

10:30 a.m. Eastern Time. There are two ways to access the

conference call:

(1) Dial-in: (877) 445-2556 or (908)

982-4670; Passcode: 56081709

Please dial in at least 10 minutes prior to 10:30 a.m. Eastern

Time to ensure a prompt start to the call. (2) Live Internet

webcast and slide presentation: http://www.globalshiplease.com

If you are unable to participate at this time, a

replay of the call will be available through Wednesday, August 16,

2017 at (855) 859-2056 or (404) 537-3406. Enter the code 56081709

to access the audio replay. The webcast will also be archived on

the Company’s website: http://www.globalshiplease.com.

Annual Report on Form 20F

Global Ship Lease, Inc has filed its Annual Report for 2016 with

the Securities and Exchange Commission. A copy of the report

can be found under the Investor Relations section (Annual Reports)

of the Company’s website at

http://www.globalshiplease.com Shareholders may request

a hard copy of the audited financial statements free of charge by

contacting the Company at info@globalshiplease.com or by writing to

Global Ship Lease, Inc, care of Global Ship Lease Services Limited,

Portland House, Stag Place, London SW1E 5RS or by telephoning +44

(0) 207 869 8806.

About Global Ship Lease

Global Ship Lease is a containership charter owner. Incorporated

in the Marshall Islands, Global Ship Lease commenced operations in

December 2007 with a business of owning and chartering out

containerships under mainly long-term, fixed-rate charters to top

tier container liner companies.Global Ship Lease owns 18 vessels

with a total capacity of 82,312 TEU and an average age, weighted by

TEU capacity, at June 30, 2017 of 12.5 years. All 18 vessels are

currently fixed on time charters, 15 of which are with CMA CGM. The

average remaining term of the charters at June 30, 2017 is 3.1

years or 3.5 years on a weighted basis.

Reconciliation of Non-U.S. GAAP Financial Measures

A. Adjusted EBITDA

Adjusted EBITDA represents net income before interest income and

expense including amortization of deferred finance costs, realized

and unrealized gain (loss) on derivatives, income taxes,

depreciation and amortization. Adjusted EBITDA is a non-US

GAAP quantitative measure used to assist in the assessment of the

Company's ability to generate cash from its operations. We

believe that the presentation of Adjusted EBITDA is useful to

investors because it is frequently used by securities analysts,

investors and other interested parties in the evaluation of

companies in our industry. Adjusted EBITDA is not defined in

US GAAP and should not be considered to be an alternate to Net

income or any other financial metric required by such accounting

principles.

ADJUSTED EBITDA - UNAUDITED

| (thousands of U.S.

dollars) |

|

| |

|

Three |

Three |

Six |

Six |

| |

|

months |

months |

months |

months |

| |

|

ended |

ended |

ended |

ended |

| |

|

June 30, |

June 30, |

June 30, |

June 30, |

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

|

| |

|

|

|

|

|

| Net income

available to Common Shareholders |

6,824 |

|

6,043 |

|

13,618 |

|

10,600 |

|

| |

|

|

|

|

|

| Adjust: |

Depreciation |

9,541 |

|

10,877 |

|

19,141 |

|

21,812 |

|

| |

Interest

income |

(90 |

) |

(38 |

) |

(183 |

) |

(82 |

) |

| |

Interest

expense |

11,026 |

|

11,142 |

|

21,983 |

|

24,242 |

|

| |

Income

tax |

6 |

|

9 |

|

16 |

|

15 |

|

| |

Earnings

allocated to preferred shares |

765 |

|

765 |

|

1,531 |

|

1,531 |

|

| |

|

|

|

|

|

| Adjusted

EBITDA |

28,072 |

|

28,798 |

|

56,106 |

|

58,118 |

|

B. Normalized net income

Normalized net income represents net income adjusted for the

premium paid on the tender offer together with the related

accelerated amortization of deferred financing costs and original

issue discount. Normalized net income is a non-GAAP quantitative

measure which we believe will assist investors and analysts who

often adjust reported net income for non-operating items that do

not affect operating performance or operating cash generated.

Normalized net income is not defined in US GAAP and should not be

considered to be an alternate to net income or any other financial

metric required by such accounting principles.

| NORMALIZED NET INCOME

- UNAUDITED |

|

|

|

| (thousands

of U.S. dollars) |

|

| |

|

Three |

Three |

Six |

Six |

| |

|

months |

months |

months |

months |

| |

|

ended |

ended |

ended |

ended |

| |

|

June

30, |

June 30, |

June

30, |

June 30, |

| |

|

2017 |

2016 |

|

2017 |

2016 |

|

| |

|

|

|

|

|

| Net income

available to Common Shareholders |

6,824 |

6,043 |

|

13,618 |

10,600 |

|

| |

|

|

|

|

|

| Adjust: |

Gain on purchase of

Notes |

--- |

(452 |

) |

--- |

(452 |

) |

| |

Premium paid on tender

offer for Notes |

390 |

--- |

|

390 |

533 |

|

| |

Accelerated write off

of deferred financing charges related to purchase and tender

offer |

61 |

10 |

|

61 |

90 |

|

| |

Accelerated write off

of original issue discount related to purchase and tender

offer |

69 |

31 |

|

69 |

290 |

|

| |

|

|

|

|

|

| Normalized

net income |

7,344 |

5,632 |

|

14,138 |

11,061 |

|

Safe Harbor Statement This communication

contains forward-looking statements. Forward-looking statements

provide Global Ship Lease's current expectations or forecasts of

future events. Forward-looking statements include statements about

Global Ship Lease's expectations, beliefs, plans, objectives,

intentions, assumptions and other statements that are not

historical facts. Words or phrases such as "anticipate," "believe,"

"continue," "estimate," "expect," "intend," "may," "ongoing,"

"plan," "potential," "predict," "project," "will" or similar words

or phrases, or the negatives of those words or phrases, may

identify forward-looking statements, but the absence of these words

does not necessarily mean that a statement is not forward-looking.

These forward-looking statements are based on assumptions that may

be incorrect, and Global Ship Lease cannot assure you that these

projections included in these forward-looking statements will come

to pass. Actual results could differ materially from those

expressed or implied by the forward-looking statements as a result

of various factors. The risks and uncertainties include, but are

not limited to:

• future operating or financial results; •

expectations regarding the strength of future growth of the

container shipping industry, including the rates of annual demand

and supply growth; • the financial condition of CMA CGM (the

company’s principal charterer and main source of operating revenue)

and other charterers and their ability to pay charterhire in

accordance with the charters;• the overall health and

condition of the U.S. and global financial markets;• Global

Ship Lease’s financial condition and liquidity, including its

ability to obtain additional financing to fund capital

expenditures, vessel acquisitions and for other general corporate

purposes and its ability to meet its financial covenants and repay

its borrowings; • Global Ship Lease’s expectations

relating to dividend payments and forecasts of its ability to make

such payments including the availability of cash and the impact of

constraints under its first priority secured notes; • future

acquisitions, business strategy and expected capital spending;

• operating expenses, availability of key employees, crew,

number of off-hire days, dry-docking and survey requirements, costs

of regulatory compliance, insurance costs and general and

administrative costs; • general market conditions and

shipping industry trends, including charter rates and factors

affecting supply and demand; • assumptions regarding interest

rates and inflation; • change in the rate of growth of global

and various regional economies; • risks incidental to vessel

operation, including piracy, discharge of pollutants and vessel

accidents and damage including total or constructive total loss;

• estimated future capital expenditures needed to preserve

Global Ship Lease’s capital base; • Global Ship Lease’s

expectations about the availability of vessels to purchase, the

time that it may take to construct new vessels, or the useful lives

of its vessels; • Global Ship Lease’s continued ability to

enter into or renew charters including the re-chartering of vessels

on the expiry of existing charters, or to secure profitable

employment for its vessels in the spot market; • the

continued performance of existing charters; • Global Ship

Lease’s ability to capitalize on management’s and directors’

relationships and reputations in the containership industry to its

advantage; • changes in governmental and classification

societies’ rules and regulations or actions taken by regulatory

authorities; • expectations about the availability of

insurance on commercially reasonable terms; • unanticipated

changes in laws and regulations; and• potential liability

from future litigation.

Forward-looking statements are subject to known and unknown

risks and uncertainties and are based on potentially inaccurate

assumptions that could cause actual results to differ materially

from those expected or implied by the forward-looking statements.

Global Ship Lease's actual results could differ materially from

those anticipated in forward-looking statements for many reasons

specifically as described in Global Ship Lease's filings with the

SEC. Accordingly, you should not unduly rely on these

forward-looking statements, which speak only as of the date of this

communication. Global Ship Lease undertakes no obligation to

publicly revise any forward-looking statement to reflect

circumstances or events after the date of this communication or to

reflect the occurrence of unanticipated events. You should,

however, review the factors and risks Global Ship Lease describes

in the reports it will file from time to time with the SEC after

the date of this communication.

| Global Ship Lease, Inc. |

| |

| Interim Unaudited Consolidated

Statements of Income |

| |

| (Expressed in thousands of U.S. dollars except share

data) |

|

|

| |

|

Three months ended June 30, |

Six months ended June 30, |

| |

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Operating

Revenues |

|

|

|

|

|

| Time charter

revenue |

|

$ |

9,341 |

|

|

$ |

9,341 |

|

|

$ |

18,578 |

|

|

$ |

18,678 |

|

| Time charter revenue –

related party |

|

|

30,918 |

|

|

|

31,992 |

|

|

|

61,323 |

|

|

|

65,265 |

|

| |

|

|

|

|

|

| |

|

|

40,259 |

|

|

|

41,333 |

|

|

|

79,901 |

|

|

|

83,943 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Operating

ExpensesVessel operating expenses |

|

|

10,468 |

|

|

|

10,917 |

|

|

|

20,478 |

|

|

|

21,919 |

|

| Vessel operating

expenses – related party |

|

|

400 |

|

|

|

400 |

|

|

|

800 |

|

|

|

800 |

|

| Depreciation |

|

|

9,541 |

|

|

|

10,877 |

|

|

|

19,141 |

|

|

|

21,812 |

|

| General and

administrative |

|

|

1,325 |

|

|

|

1,281 |

|

|

|

2,565 |

|

|

|

3,250 |

|

| Other operating

income |

|

|

(6 |

) |

|

|

(63 |

) |

|

|

(48 |

) |

|

|

(144 |

) |

| |

|

|

|

|

|

| Total operating

expenses |

|

|

21,728 |

|

|

|

23,412 |

|

|

|

42,936 |

|

|

|

47,637 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Operating

Income |

|

|

18,531 |

|

|

|

17,921 |

|

|

|

36,965 |

|

|

|

36,306 |

|

| |

|

|

|

|

|

| Non Operating

Income (Expense) |

|

|

|

|

|

| Interest income |

|

|

90 |

|

|

|

38 |

|

|

|

183 |

|

|

|

82 |

|

| Interest expense |

|

|

(11,026 |

) |

|

|

(11,142 |

) |

|

|

(21,983 |

) |

|

|

(24,242 |

) |

| |

|

|

|

|

|

| |

|

|

|

|

|

| Income before

Income Taxes |

|

|

7,595 |

|

|

|

6,817 |

|

|

|

15,165 |

|

|

|

12,146 |

|

| |

|

|

|

|

|

| Income taxes |

|

|

(6 |

) |

|

|

(9 |

) |

|

|

(16 |

) |

|

|

(15 |

) |

| |

|

|

|

|

|

| Net

Income |

|

$ |

7,589 |

|

|

$ |

6,808 |

|

|

$ |

15,149 |

|

|

$ |

12,131 |

|

| |

|

|

|

|

|

| Earnings allocated to

Series B Preferred Shares |

|

|

(765 |

) |

|

|

(765 |

) |

|

|

(1,531 |

) |

|

|

(1,531 |

) |

| |

|

|

|

|

|

| Net Income

available to Common Shareholders |

|

$ |

6,824 |

|

|

$ |

6,043 |

|

|

$ |

13,618 |

|

|

$ |

10,600 |

|

| Earnings per

Share |

|

|

|

|

|

| Weighted average number

of Class A common shares outstanding |

|

|

|

|

|

| Basic

(including RSUs without service conditions)Diluted |

|

|

47,975,60947,975,609 |

|

47,850,10747,956,959 |

|

47,975,60947,975,609 |

|

47,845,84247,888,279 |

| Net income per Class A

common share |

|

|

|

|

|

| Basic

(including RSUs without service conditions) |

|

$ |

0.14 |

$ |

0.13 |

$ |

0.28 |

$ |

0.22 |

|

Diluted |

|

$ |

0.14 |

$ |

0.13 |

$ |

0.28 |

$ |

0.22 |

| Weighted average number

of Class B common shares outstanding Basic and diluted |

|

|

7,405,956 |

|

7,405,956 |

|

7,405,956 |

|

7,405,956 |

| Net income per Class B

common share Basic and diluted |

|

$ |

0.00 |

$ |

0.00 |

$ |

0.00 |

$ |

0.00 |

| Global Ship Lease, Inc. |

| |

| Interim Unaudited Consolidated Balance

Sheets |

| |

| (Expressed in thousands of U.S. dollars) |

| |

|

June 30,2017 |

|

December 31,2016 |

| |

|

|

|

|

| Assets

|

|

|

|

|

| Cash and cash

equivalents |

|

$ |

59,432 |

|

|

$ |

54,243 |

|

| Accounts

receivable |

|

|

15 |

|

|

|

29 |

|

| Due from related

party |

|

|

862 |

|

|

|

906 |

|

| Prepaid expenses |

|

|

1,098 |

|

|

|

1,146 |

|

| Other receivables |

|

|

182 |

|

|

|

52 |

|

| Inventory |

|

|

674 |

|

|

|

553 |

|

| |

|

|

|

|

| Total current

assets |

|

|

62,263 |

|

|

|

56,929 |

|

| |

|

|

|

|

| |

|

|

|

|

| Vessels in

operation |

|

|

703,993 |

|

|

|

719,110 |

|

| Other fixed assets |

|

|

13 |

|

|

|

7 |

|

| Intangible assets |

|

|

11 |

|

|

|

16 |

|

| Other long term

assets |

|

|

140 |

|

|

|

195 |

|

| |

|

|

|

|

| Total non-current

assets |

|

|

704,157 |

|

|

|

719,328 |

|

| |

|

|

|

|

| Total

Assets |

|

$ |

766,420 |

|

|

$ |

776,257 |

|

| |

|

|

|

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

| |

|

|

|

|

|

Liabilities |

|

|

|

|

| Current portion of long

term debt |

|

|

27,512 |

|

|

|

31,026 |

|

| Intangible liability –

charter agreements |

|

|

1,788 |

|

|

|

1,807 |

|

| Deferred revenue |

|

|

2,698 |

|

|

|

1,940 |

|

| Accounts payable |

|

|

791 |

|

|

|

963 |

|

| Due to related

party |

|

|

1,817 |

|

|

|

1,315 |

|

| Accrued expenses |

|

|

11,034 |

|

|

|

11,664 |

|

| |

|

|

|

|

| Total current

liabilities |

|

|

45,640 |

|

|

|

48,715 |

|

| |

|

|

|

|

| |

|

|

|

|

| Long term debt |

|

|

369,355 |

|

|

|

388,847 |

|

| Intangible liability –

charter agreements |

|

|

8,897 |

|

|

|

9,782 |

|

| Deferred tax

liability |

|

|

17 |

|

|

|

20 |

|

| |

|

|

|

|

| Total long term

liabilities |

|

|

378,269 |

|

|

|

398,649 |

|

| |

|

|

|

|

| |

|

|

|

|

| Total

Liabilities |

|

$ |

423,909 |

|

|

$ |

447,364 |

|

| |

|

|

|

|

| Commitments and

contingencies |

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

| Stockholders’

Equity |

|

|

|

|

| Class A Common stock –

authorized214,000,000 shares with a $0.01 par value; 47,575,609

shares issued and outstanding (2016 – 47,575,609) |

|

$ |

476 |

|

|

$ |

476 |

|

| Class B Common stock –

authorized20,000,000 shares with a $0.01 par value;7,405,956 shares

issued and outstanding (2016 – 7,405,956) |

|

|

74 |

|

|

|

74 |

|

| Series B Preferred

shares – authorized16,100 shares with $0.01 par value;14,000 shares

issued and outstanding (2016 – 14,000) |

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

| Additional paid in

capital |

|

|

386,708 |

|

|

|

386,708 |

|

| (Accumulated

deficit) |

|

|

(44,747 |

) |

|

|

(58,365 |

) |

| |

|

|

|

|

| Total

Stockholders’ Equity |

|

|

342,511 |

|

|

|

328,893 |

|

| |

|

|

|

|

| Total

Liabilities and Stockholders’ Equity |

|

$ |

766,420 |

|

|

$ |

776,257 |

|

| |

|

|

|

|

| Global Ship Lease, Inc. |

|

|

| Interim Unaudited Consolidated Statements of

Cash Flows |

| |

| (Expressed in thousands of U.S. dollars) |

| |

|

|

|

| |

|

Three months ended June 30, |

Six months ended June 30, |

| |

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Cash Flows from

Operating Activities |

|

|

|

|

|

| Net income |

|

$ |

7,589 |

|

|

$ |

6,808 |

|

|

$ |

15,149 |

|

|

$ |

12,131 |

|

| |

|

|

|

|

|

| Adjustments to

Reconcile Net income to Net Cash Provided by Operating

Activities |

|

|

|

|

|

| Depreciation |

|

|

9,541 |

|

|

|

10,877 |

|

|

|

19,141 |

|

|

|

21,812 |

|

| Amortization of

deferred financing costs |

|

|

885 |

|

|

|

820 |

|

|

|

1,775 |

|

|

|

1,772 |

|

| Amortization of

original issue discount |

|

|

343 |

|

|

|

334 |

|

|

|

625 |

|

|

|

916 |

|

| Amortization of

intangible liability |

|

|

(452 |

) |

|

|

(530 |

) |

|

|

(904 |

) |

|

|

(1,059 |

) |

| Share based

compensation |

|

|

- |

|

|

|

82 |

|

|

|

- |

|

|

|

115 |

|

| Gain on repurchase of

secured notes |

|

|

- |

|

|

|

(452 |

) |

|

|

- |

|

|

|

(452 |

) |

| Decrease (increase) in

accounts receivable and other assets |

|

|

382 |

|

|

|

151 |

|

|

|

(199 |

) |

|

|

(398 |

) |

| Decrease (increase) in

inventory |

|

|

(73 |

) |

|

|

40 |

|

|

|

(121 |

) |

|

|

74 |

|

| Increase (decrease) in

accounts payable and other liabilities |

|

|

8,800 |

|

|

|

8,896 |

|

|

|

(748 |

) |

|

|

(1,285 |

) |

| (Decrease) increase in

unearned revenue |

|

|

330 |

|

|

|

(104 |

) |

|

|

758 |

|

|

|

(208 |

) |

| Increase in related

party balances |

|

|

580 |

|

|

|

347 |

|

|

|

628 |

|

|

|

1,063 |

|

| Unrealized foreign

exchange (gain) loss |

|

|

- |

|

|

|

(58 |

) |

|

|

6 |

|

|

|

(28 |

) |

| |

|

|

|

|

|

| Net Cash

Provided by Operating Activities |

|

|

27,925 |

|

|

|

27,211 |

|

|

|

36,110 |

|

|

|

34,453 |

|

| |

|

|

|

|

|

| Cash Flows from

Investing Activities |

|

|

|

|

|

| Cash paid for vessel

improvements |

|

|

(100 |

) |

|

|

- |

|

|

|

(100 |

) |

|

|

- |

|

| Cash paid in respect of

sale of vessels |

|

|

- |

|

|

|

(97 |

) |

|

|

- |

|

|

|

(254 |

) |

| Cash paid for other

assets |

|

|

(8 |

) |

|

|

- |

|

|

|

(8 |

) |

|

|

(1 |

) |

| Cash paid for

drydockings |

|

|

(2,211 |

) |

|

|

(948 |

) |

|

|

(3,931 |

) |

|

|

(948 |

) |

| |

|

|

|

|

|

| Net Cash Used

in Investing Activities |

|

|

(2,319 |

) |

|

|

(1,045 |

) |

|

|

(4,039 |

) |

|

|

(1,203 |

) |

| |

|

|

|

|

|

| Cash Flows from

Financing Activities |

|

|

|

|

|

| Repurchase of secured

notes |

|

|

(19,501 |

) |

|

|

(3,748 |

) |

|

|

(19,501 |

) |

|

|

(30,410 |

) |

| Proceeds from drawdown

of revolving credit facility |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Deferred financing

costs incurred |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Repayment of credit

facilities |

|

|

(2,925 |

) |

|

|

(1,925 |

) |

|

|

(5,850 |

) |

|

|

(4,650 |

) |

| Series B Preferred

Shares – dividends paid |

|

|

(765 |

) |

|

|

(765 |

) |

|

|

(1,531 |

) |

|

|

(1,531 |

) |

| |

|

|

|

|

|

| Net Cash Used

in Financing Activities |

|

|

(23,191 |

) |

|

|

(6,438 |

) |

|

|

(26,882 |

) |

|

|

(36,591 |

) |

| |

|

|

|

|

|

| Net Increase

(decrease) in Cash and Cash Equivalents |

|

|

2,415 |

|

|

|

19,728 |

|

|

|

5,189 |

|

|

|

(3,341 |

) |

| Cash and Cash

Equivalents at Start of Period |

|

|

57,017 |

|

|

|

30,522 |

|

|

|

54,243 |

|

|

|

53,591 |

|

| |

|

|

|

|

|

| Cash and Cash

Equivalents at End of Period |

|

$ |

59,432 |

|

|

$ |

50,250 |

|

|

$ |

59,432 |

|

|

$ |

50,250 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Supplemental

information |

|

|

|

|

|

| |

|

|

|

|

|

| Total interest

paid |

|

$ |

746 |

|

|

$ |

725 |

|

|

$ |

19,678 |

|

|

$ |

22,232 |

|

| |

|

|

|

|

|

| Income tax paid |

|

$ |

10 |

|

|

$ |

10 |

|

|

$ |

24 |

|

|

$ |

26 |

|

| |

|

|

|

|

|

CONTACT:

Investor and Media Contact:

The IGB Group

Bryan Degnan

646-673-9701

or

Leon Berman

212-477-8438

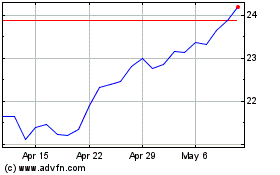

Global Ship Lease (NYSE:GSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

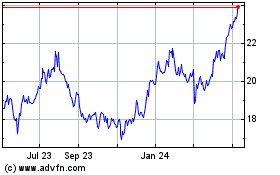

Global Ship Lease (NYSE:GSL)

Historical Stock Chart

From Apr 2023 to Apr 2024