- Solid financial performance

- Sales of $2.8 billion, 6% above

prior-year quarter

- Strong operating cash flow, 25% of

sales

- Free cash flow of $0.4 billion, 8%

above prior-year quarter

- EPS of $1.41, up 1% vs. prior-year

quarter; adjusted EPS of $1.46, up 5%

- Continued focus on execution of our

core strategy

- Volume growth +3%, price attainment

+1% vs. prior-year quarter

- Project start-ups in China, Korea

and Canada

- Backlog $1.4 billion; includes new

project win in U.S. Gulf Coast

- Continued progress on merger with

Linde AG

- Signed definitive Business

Combination Agreement on June 1, 2017

Praxair, Inc. (NYSE: PX) reported second-quarter net income and

diluted earnings per share of $406 million and $1.41, respectively.

These results include transaction costs of $15 million after-tax,

or 5 cents of diluted earnings per share, related to the potential

Linde AG merger. Excluding this charge, adjusted net income and

diluted earnings per share were $421 million and $1.46,

respectively.

Praxair’s sales in the second quarter were $2,834 million, 6%

above the prior-year quarter. Excluding cost pass-through, sales

grew 4%, driven by higher volumes in North America, Europe and

Asia, including new project start-ups, and price attainment. Sales

growth was primarily led by electronics, chemicals, metals, energy

and food and beverage end-markets.

Reported operating profit in the second quarter was $604

million, 3% above the prior-year quarter. Excluding the current

quarter impact of transaction costs, adjusted operating profit was

$619 million, 5% above the prior-year quarter. Reported operating

profit as a percentage of sales was 21.3%. Adjusted operating

profit as a percentage of sales was 21.8%. EBITDA margin was 32.0%

and adjusted EBITDA margin was 32.5%.

The company generated strong second-quarter cash flow from

operations of $701 million, 25% of sales. After capital

expenditures of $325 million, free cash flow was $376 million, up

8% over the prior-year quarter. The company paid $225 million of

dividends.

Commenting on the financial results and business outlook,

Chairman and Chief Executive Officer Steve Angel said, “Our second

quarter results reflect Praxair employees’ ability to execute our

core strategy and deliver high-quality results. Adjusted operating

profit growth of 5% outpaced underlying sales growth of 4%, and

generated strong operating cash flow of 25% of sales.

“The second quarter continued to reflect broad-based demand

across all end-markets, but as anticipated, revealed further

weakness in South America. In addition, we added to our project

backlog another long-term on-site supply agreement with a

petrochemical customer in the U.S. Gulf Coast which will further

strengthen our network in the region. Including this new win, over

80% of our $1.4 billion project backlog now relates to the U.S.

Gulf Coast and we remain confident in our ability to win additional

projects.

“Furthermore, during the second quarter we announced the signing

of a business combination agreement between Praxair and Linde AG.

This was an important milestone toward creating significant value

for our stakeholders. We are currently working closely with

regulators and shareholders to obtain the appropriate approvals and

will provide a more detailed progress update in the coming

months.

“Looking ahead, we are taking a more measured view as we do not

anticipate significant underlying economic improvement in the

second half of the year. In the U.S., aggregate customer demand has

yet to match recent economic expectations and South America,

specifically Brazil, continues to face political challenges that

undermine the economy. Conversely, we expect Europe to remain

stable, Asia to moderately grow and new project start-ups to

contribute towards the latter part of the year. However, regardless

of the economy, Praxair’s relentless focus on operational

excellence and financial discipline will continue to deliver strong

cash flow and earnings per share for our shareholders.”

For the third quarter of 2017, Praxair expects diluted earnings

per share in the range of $1.40 to $1.46, excluding transaction

costs related to the potential merger.

For full-year 2017, Praxair expects adjusted diluted earnings

per share to be in the range of $5.63 to $5.75. This full-year

guidance excludes transaction costs related to the potential

merger. GAAP diluted earnings per share are expected to be in the

range of $5.56 to $5.68 which includes $0.07 per diluted share for

the first and second quarter transaction costs and excludes future

transaction costs related to the potential merger. Full-year

capital expenditures are expected to be approximately $1.4

billion.

Following is additional detail on second-quarter 2017 results by

segment.

In North America, second-quarter sales were $1,505 million, 4%

above the prior-year quarter excluding cost-pass through and

currency. Sales growth was driven primarily by stronger volumes to

chemical, manufacturing and electronic end-markets and higher

price. Operating profit was $378 million, 5% above the prior-year

quarter.

In Europe, second-quarter sales were $383 million, 8% above the

prior-year quarter. Excluding negative currency, sales grew 10%

from the prior-year due to higher volumes including project

start-ups, price and an acquisition primarily related to the carbon

dioxide business largely serving the food and beverage end-market.

Operating profit was $73 million.

In South America, second-quarter sales were $373 million, 4%

above the prior-year quarter. Excluding positive currency

translation and cost pass-through, sales were 3% below the

prior-year quarter due to lower volumes driven by continued weak

macro-economic conditions, largely in manufacturing. Operating

profit was $63 million.

Sales in Asia were $422 million in the quarter, up 7% from the

prior-year. Excluding a prior-year net divestiture, sales grew 11%

driven by higher volumes in China, India and Korea, primarily in

the electronics, metals and chemicals end-markets and price

attainment. Operating profit was $80 million, 19% above the

prior-year quarter.

Praxair Surface Technologies had second-quarter sales of $151

million as compared to $148 million in the prior-year quarter.

Excluding negative currency translation, sales were 4% above the

prior-year period driven by 2% volume growth, largely aerospace

coatings, and 2% growth from acquisitions. Operating profit was $25

million.

About Praxair

Praxair, Inc., a Fortune 300 company with 2016 sales of $11

billion, is a leading industrial gas company in North and South

America and one of the largest worldwide. The company produces,

sells and distributes atmospheric, process and specialty gases, and

high-performance surface coatings. Praxair products, services and

technologies are making our planet more productive by bringing

efficiency and environmental benefits to a wide variety of

industries, including aerospace, chemicals, food and beverage,

electronics, energy, healthcare, manufacturing, primary metals and

many others. More information about Praxair, Inc. is available at

www.praxair.com.

Adjusted amounts, EBITDA, free cash flow and after-tax return on

capital are non-GAAP measures. See the attachments for a summary of

non-GAAP reconciliations and calculations of non-GAAP measures.

Attachments: Summary Non-GAAP Reconciliations, Statements of

Income, Balance Sheets, Statements of Cash Flows, Segment

Information, Quarterly Financial Summary and Appendix: Non-GAAP

Measures.

A teleconference about Praxair’s second-quarter results is being

held this morning, July 27, 2017 at 11:00 am Eastern Time. The

number is (631) 485-4849 – Conference ID: 48847647. The call is

also available as a webcast live and on-demand at

www.praxair.com/investors. Materials to be used in the

teleconference are also available on the website.

Additional Information and Where to Find It

In connection with the proposed business combination between

Praxair, Inc. (“Praxair”) and Linde AG (“Linde”), Linde plc (“New

Holdco”) has filed a Registration Statement on Form S-4 (which

Registration Statement has not yet been declared effective) with

the U.S. Securities and Exchange Commission (“SEC”) that includes

(1) a proxy statement of Praxair that also constitutes a prospectus

for New Holdco and (2) an offering prospectus of New Holdco to be

used in connection with New Holdco’s offer to acquire Linde shares

held by U.S. holders. Once the Registration Statement is declared

effective by the SEC, Praxair will mail the proxy

statement/prospectus to its stockholders in connection with the

vote to approve the merger of Praxair and an indirect wholly-owned

subsidiary of New Holdco, and New Holdco will distribute the

offering prospectus to Linde shareholders in the United States in

connection with New Holdco’s offer to acquire all of the

outstanding shares of Linde. New Holdco will also file an offer

document with the German Federal Financial Supervisory Authority

(Bundesanstalt fuer Finanzdienstleistungsaufsicht) (“BaFin”). The

consummation of the proposed business combination is subject to

regulatory approvals and other customary closing conditions.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY

STATEMENT/PROSPECTUS AND THE OFFER DOCUMENT REGARDING THE PROPOSED

BUSINESS COMBINATION TRANSACTION AND PROPOSED OFFER BECAUSE THEY

CONTAIN IMPORTANT INFORMATION. You may obtain a free copy of

the proxy statement/prospectus and other related documents filed by

Praxair, Linde and New Holdco with the SEC on the SEC’s Web site at

www.sec.gov. The proxy statement/prospectus and other documents

relating thereto may also be obtained for free by accessing

Praxair’s Web site at www.praxair.com. Following approval of its

publication by the BaFin, the offer document will be made available

for free at New Holdco's website at www.lindepraxairmerger.com.

Furthermore, the offer document is expected to be made available at

BaFin's website for free at www.bafin.de.

This document is neither an offer to purchase nor a solicitation

of an offer to sell shares of New Holdco, Praxair or Linde. The

final terms and further provisions regarding the public offer will

be disclosed in the offer document after the publication has been

approved by the BaFin and in documents that will be filed with the

SEC. No money, securities or other consideration is being

solicited, and, if sent in response to the information contained

herein, will not be accepted. The information contained herein

should not be considered as a recommendation that any person should

subscribe for or purchase any securities.

No offering of securities shall be made except by means of a

prospectus meeting the requirements of the U.S. Securities Act of

1933, as amended, and applicable European and German regulations.

The distribution of this document may be restricted by law in

certain jurisdictions and persons into whose possession any

document or other information referred to herein come should inform

themselves about and observe any such restrictions. Any failure to

comply with these restrictions may constitute a violation of the

securities laws of any such jurisdiction. No offering of securities

will be made directly or indirectly, in or into any jurisdiction

where to do so would be inconsistent with the laws of such

jurisdiction.

Participants in Solicitation

Praxair, Linde, New Holdco and their respective directors and

executive officers may be deemed to be participants in the

solicitation of proxies from Praxair’s stockholders in respect of

the proposed business combination. Information regarding the

persons who are, under the rules of the SEC, participants in the

solicitation of the stockholders of Praxair in connection with the

proposed transaction, including a description of their direct or

indirect interests, by security holdings or otherwise, are set

forth in the proxy statement/prospectus filed with the SEC.

Information regarding the directors and executive officers of

Praxair is contained in Praxair’s Annual Report on Form 10-K for

the year ended December 31, 2016 and its Proxy Statement on

Schedule 14A, dated March 15, 2017, which are filed with the SEC

and can be obtained free of charge from the sources indicated

above.

Forward-looking Statements

This document contains “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. These statements are based on management’s

reasonable expectations and assumptions as of the date the

statements are made but involve risks and uncertainties. These

risks and uncertainties include, without limitation: the expected

timing and likelihood of the completion of the contemplated

business combination with Linde AG, including the timing, receipt

and terms and conditions of any required governmental and

regulatory approvals that could reduce anticipated benefits or

cause the parties to abandon the transaction; the occurrence of any

event, change or other circumstances that could give rise to the

termination of the business combination agreement; the ability to

successfully complete the proposed business combination and the

exchange offer, including satisfying closing conditions; the

success of the business following the proposed business

combination; the ability to successfully integrate the Praxair and

Linde businesses; the possibility that Praxair stockholders may not

approve the business combination agreement or that the requisite

number of Linde shares may not be tendered in the public offer; the

risk that the combined company may be unable to achieve expected

synergies or that it may take longer or be more costly than

expected to achieve those synergies; the performance of stock

markets generally; developments in worldwide and national economies

and other international events and circumstances; changes in

foreign currencies and in interest rates; the cost and availability

of electric power, natural gas and other raw materials; the ability

to achieve price increases to offset cost increases; catastrophic

events including natural disasters, epidemics and acts of war and

terrorism; the ability to attract, hire, and retain qualified

personnel; the impact of changes in financial accounting standards;

the impact of changes in pension plan liabilities; the impact of

tax, environmental, healthcare and other legislation and government

regulation in jurisdictions in which the company operates; the cost

and outcomes of investigations, litigation and regulatory

proceedings; the impact of potential unusual or non-recurring

items; continued timely development and market acceptance of new

products and applications; the impact of competitive products and

pricing; future financial and operating performance of major

customers and industries served; the impact of information

technology system failures, network disruptions and breaches in

data security; and the effectiveness and speed of integrating new

acquisitions into the business. These risks and uncertainties may

cause actual future results or circumstances to differ materially

from the GAAP or adjusted projections or estimates contained in the

forward-looking statements. The company assumes no obligation to

update or provide revisions to any forward-looking statement in

response to changing circumstances. The above listed risks and

uncertainties are further described in Item 1A (Risk Factors) in

the company’s latest Annual Report on Form 10-K filed with the SEC

and in the proxy statement/prospectus and the offering prospectus

included in the Registration Statement on Form S-4 (which

Registration Statement has not yet been declared effective) filed

by New Holdco with the SEC which should be reviewed carefully.

Please consider the company’s forward-looking statements in light

of those risks.

PRAXAIR, INC. AND SUBSIDIARIES SUMMARY NON-GAAP

RECONCILIATIONS (UNAUDITED)

The following adjusted amounts

are Non-GAAP measures and are intended to supplement investors'

understanding of the company's financial statements by providing

measures which investors, financial analysts and management use to

help evaluate the company's operating performance. Items which the

company does not believe to be indicative of on-going business

trends are excluded from these calculations so that investors can

better evaluate and analyze historical and future business trends

on a consistent basis. Definitions of these Non-GAAP measures may

not be comparable to similar definitions used by other companies

and are not a substitute for similar GAAP measures. See the

Non-GAAP reconciliations starting on page 11 for additional details

relating to the Non-GAAP adjustments. (Millions of dollars,

except per share amounts)

Sales Operating

Profit Net Income - Praxair, Inc. Diluted EPS

2017

2016

2017

2016

2017

2016

2017

2016

Quarter Ended

June 30

Reported GAAP Amounts $ 2,834 $ 2,665 $ 604 $ 588 $ 406 $ 399 $

1.41 $ 1.39 Transaction costs (a) - -

15 - 15 -

0.05 - Total adjustments -

- 15 - 15

- 0.05 - Adjusted amounts $

2,834 $ 2,665 $ 619 $ 588 $ 421

$ 399 $ 1.46 $ 1.39

Year To Date June

30

Reported GAAP Amounts $ 5,562 $ 5,174 $ 1,186 $ 1,142 $ 795 $ 755 $

2.76 $ 2.63 Transaction costs (a) - - 21 - 21 - 0.07 - Bond

redemption (b) - - -

- - 10 -

0.04 Total adjustments - -

21 - 21 10

0.07 0.04 Adjusted amounts $ 5,562 $

5,174 $ 1,207 $ 1,142 $ 816 $ 765

$ 2.83 $ 2.67 (a) Charges in the 2017 first

and second quarters for transaction costs related to the potential

Linde merger. (b) Charge to interest expense in the 2016 first

quarter related to a bond redemption.

PRAXAIR,

INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME

(Millions of dollars, except per share data)

(UNAUDITED)

Quarter Ended Year to Date June 30, June

30, 2017 2016 2017 2016

SALES $ 2,834 $ 2,665 $ 5,562 $ 5,174 Cost of sales 1,598

1,468 3,143 2,849 Selling, general and administrative 308 308 587

582 Depreciation and amortization 292 281 579 553 Research and

development 23 24 46 47 Transaction costs and other charges 15 - 21

- Other income (expense) - net 6 4

- (1 )

OPERATING PROFIT 604 588 1,186

1,142 Interest expense - net 38 44

79 109

INCOME BEFORE INCOME TAXES

AND EQUITY INVESTMENTS 566 544 1,107 1,033 Income taxes

157 146 306 279

INCOME BEFORE EQUITY INVESTMENTS 409 398 801 754 Income from

equity investments 11 11 23

21

NET INCOME (INCLUDING NONCONTROLLING

INTERESTS) 420 409 824 775 Less: noncontrolling interests

(14 ) (10 ) (29 ) (20 )

NET INCOME -

PRAXAIR, INC. $ 406 $ 399 $ 795 $ 755

PER SHARE DATA - PRAXAIR, INC. SHAREHOLDERS

Basic earnings per share $ 1.42 $ 1.40 $ 2.78 $ 2.64

Diluted earnings per share $ 1.41 $ 1.39 $ 2.76 $ 2.63 Cash

dividends $ 0.7875 $ 0.75 $ 1.575 $ 1.50

WEIGHTED AVERAGE

SHARES OUTSTANDING Basic shares outstanding (000's) 286,090

285,702 285,799 285,566 Diluted shares outstanding (000's) 288,535

287,727 288,067 287,426 Note: See page 5 for a

reconciliation to 2017 adjusted amounts which are Non-GAAP.

PRAXAIR, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Millions of dollars) (UNAUDITED)

June 30, December 31, 2017

2016 ASSETS Cash and cash equivalents $ 535 $ 524

Accounts receivable - net 1,791 1,641 Inventories 568 550 Prepaid

and other current assets 225 165

TOTAL CURRENT ASSETS 3,119 2,880 Property, plant and

equipment - net 11,806 11,477 Goodwill 3,182 3,117 Other

intangibles - net 568 583 Other long-term assets 1,290

1,275

TOTAL ASSETS $ 19,965 $

19,332

LIABILITIES AND EQUITY Accounts payable

$ 900 $ 906 Short-term debt 280 434 Current portion of long-term

debt 910 164 Other current liabilities 953 974

TOTAL CURRENT LIABILITIES 3,043 2,478 Long-term debt

8,177 8,917 Other long-term liabilities 2,475

2,485

TOTAL LIABILITIES 13,695 13,880

REDEEMABLE NONCONTROLLING INTERESTS 10 11

PRAXAIR,

INC. SHAREHOLDERS' EQUITY: Common stock 4 4 Additional paid-in

capital 4,076 4,074 Retained earnings 13,223 12,879 Accumulated

other comprehensive income (loss) (4,244 ) (4,600 ) Less: Treasury

stock, at cost (7,252 ) (7,336 ) Total Praxair, Inc.

Shareholders' Equity 5,807 5,021 Noncontrolling interests

453 420

TOTAL EQUITY 6,260

5,441

TOTAL LIABILITIES AND EQUITY $

19,965 $ 19,332

PRAXAIR, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Millions

of dollars) (UNAUDITED) Quarter Ended

Year to Date June 30, June 30, 2017

2016 2017 2016 OPERATIONS Net income -

Praxair, Inc. $ 406 $ 399 $ 795 $ 755 Noncontrolling interests

14 10 29 20

Net income (including noncontrolling interests) 420 409 824 775

Adjustments to reconcile net income to net cash provided by

operating activities: Transaction costs and other charges, net of

payments 11 - 17 - Depreciation and amortization 292 281 579 553

Accounts Receivable (46 ) (41 ) (95 ) (61 ) Inventory (3 ) (1 ) (5

) (8 ) Payables and accruals 18 14 (24 ) (63 ) Pension

contributions (3 ) (4 ) (6 ) (6 ) Deferred income taxes and other

12 48 121 69

Net cash provided by operating activities 701

706 1,411 1,259

INVESTING Capital expenditures (325 ) (357 ) (652 ) (680 )

Acquisitions, net of cash acquired (1 ) (262 ) (2 ) (325 )

Divestitures and asset sales 13 6

17 8 Net cash used for investing

activities (313 ) (613 ) (637 ) (997 )

FINANCING Debt increase (decrease) - net (132 ) 595

(305 ) 690 Issuances of common stock 44 26 70 60 Purchases of

common stock - (51 ) (11 ) (83 ) Cash dividends - Praxair, Inc.

shareholders (225 ) (214 ) (450 ) (428 ) Noncontrolling interest

transactions and other (71 ) (107 ) (84 )

(109 ) Net cash provided by (used for) financing activities

(384 ) 249 (780 ) 130 Effect of exchange rate changes on

cash and cash equivalents 12 4

17 28 Change in cash and cash

equivalents 16 346 11 420 Cash and cash equivalents,

beginning-of-period 519 221 524

147 Cash and cash equivalents,

end-of-period $ 535 $ 567 $ 535 $ 567

PRAXAIR,

INC. AND SUBSIDIARIES SEGMENT INFORMATION (Millions

of dollars) (UNAUDITED) Quarter

Ended Year to Date June 30, June 30,

2017 2016 2017 2016 SALES North

America $ 1,505 $ 1,411 $ 2,963 $ 2,764 Europe 383 355 739 675

South America 373 358 742 669 Asia 422 393 817 769 Surface

Technologies 151 148 301

297 Consolidated sales $ 2,834 $ 2,665 $ 5,562 $

5,174

OPERATING PROFIT North America $ 378 $ 359 $

735 $ 708 Europe 73 68 139 130 South America 63 70 127 125 Asia 80

67 155 130 Surface Technologies 25 24

51 49 Segment operating profit $ 619 $ 588 $ 1,207 $

1,142 Transaction costs and other charges (15 ) -

(21 ) - Total operating profit $ 604 $ 588 $

1,186 $ 1,142

PRAXAIR, INC. AND

SUBSIDIARIES QUARTERLY FINANCIAL SUMMARY (Millions of

dollars, except per share data) (UNAUDITED)

2017 (b) 2016 (c)

Q2 Q1 Q4 Q3 Q2 Q1 FROM

THE INCOME STATEMENT Sales $ 2,834 $ 2,728 $ 2,644 $ 2,716 $

2,665 $ 2,509 Cost of sales 1,598 1,545 1,478 1,533 1,468 1,381

Selling, general and administrative 308 279 272 291 308 274

Depreciation and amortization 292 287 285 284 281 272 Research and

development 23 23 23 22 24 23 Transaction costs and other charges

15 6 - 100 - - Other income (expense) - net 6

(6 ) 13 11 4 (5 )

Operating profit 604 582 - 599 497 588 554 Interest expense - net

38 41 38 43 44 65 Income taxes 157 149 152 120 146 133 Income from

equity investments 11 12 10

10 11 10 Net

income (including noncontrolling interests) 420 404 # 419 344 409

366 Less: noncontrolling interests (14 ) (15 )

(13 ) (5 ) (10 ) (10 ) Net income - Praxair,

Inc. $ 406 $ 389 $ 406 $ 339 $ 399

$ 356 PER SHARE DATA - PRAXAIR, INC.

SHAREHOLDERS Diluted earnings per share $ 1.41 $ 1.35 $ 1.41 $ 1.18

$ 1.39 $ 1.24 Cash dividends per share $ 0.7875 $ 0.7875 $ 0.75 $

0.75 $ 0.75 $ 0.75 Diluted weighted average shares outstanding

(000's) 288,535 287,384 287,956 288,195 287,727 286,665

ADJUSTED AMOUNTS (a) Operating profit $ 619 $ 588 $ 599 $

597 $ 588 $ 554 Operating margin 21.8 % 21.6 % 22.7 % 22.0 % 22.1 %

22.1 % Net Income $ 421 $ 395 $ 406 $ 405 $ 399 $ 366 Diluted

earnings per share $ 1.46 $ 1.37 $ 1.41 $ 1.41 $ 1.39 $ 1.28

FROM THE BALANCE SHEET Net debt (a) $ 8,832 $ 8,849 $ 8,991

$ 9,215 $ 9,389 $ 9,183 Capital (a) $ 15,102 $ 14,824 $ 14,443 $

14,864 $ 14,948 $ 14,607

FROM THE STATEMENT OF CASH

FLOWS Cash flow from operations $ 701 $ 710 $ 726 $ 788 $ 706 $

553 Cash flow provided by (used for) investing activities (313 )

(324 ) (410 ) (363 ) (613 ) (384 ) Cash flow provided by (used for)

financing activities (384 ) (396 ) (411 ) (362 ) 249 (119 ) Capital

expenditures 325 327 409 376 357 323 Acquisitions 1 1 18 20 262 63

Cash dividends 225 225 214 214 214 214

OTHER

INFORMATION After-tax return on capital (ROC) (a) 11.5 % 11.5 %

11.5 % 11.6 % 12.1 % 11.5 % Adjusted after-tax ROC (a) 12.1 % 12.0

% 12.0 % 12.1 % 12.2 % 12.4 % EBITDA (a) 907 881 894 791 880 836

EBITDA margin (a) 32.0 % 32.3 % 33.8 % 29.1 % 33.0 % 33.3 %

Adjusted EBITDA (a) $ 922 $ 887 $ 894 $ 891 $ 880 $ 836 Adjusted

EBITDA margin (a) 32.5 % 32.5 % 33.8 % 32.8 % 33.0 % 33.3 % Number

of employees 26,487 26,420 26,498 26,680 26,896 26,558

SEGMENT DATA SALES North America $ 1,505 $ 1,458 $ 1,397 $

1,431 $ 1,411 $ 1,353 Europe 383 356 351 366 355 320 South America

373 369 352 378 358 311 Asia 422 395 395 391 393 376 Surface

Technologies 151 150 149

150 148 149 Total sales $

2,834 $ 2,728 $ 2,644 $ 2,716 $ 2,665

$ 2,509 OPERATING PROFIT North America $ 378 $ 357 $

359 $ 363 $ 359 $ 349 Europe 73 66 71 72 68 62 South America 63 64

64 68 70 55 Asia 80 75 78 68 67 63 Surface Technologies 25

26 27 26 24

25 Segment operating profit 619 588 599 597

588 554 Transaction costs and other charges (15 ) (6

) - (100 ) - -

Total operating profit $ 604 $ 582 # $ 599 $

497 $ 588 $ 554 (a) Non-GAAP

measure, see Appendix. (b) 2017 includes (i) an after-tax

charge of $6 million ($0.02 per diluted share) in the first quarter

for transaction costs related to the potential Linde merger and

(ii) an after-tax charge of $15 million ($0.05 per diluted share)

in the second quarter for transaction costs related to the

potential Linde merger. (c) 2016 includes (i) a $16 million

charge to interest expense ($10 million after-tax, or $0.04 per

diluted share) in the first quarter related to the redemption of

the $325 million 5.20% notes due 2017, (ii) a pre-tax pension

settlement charge of $4 million ($3 million after-tax, or $0.01 per

diluted share) in the third quarter related to lump sum benefit

payments made from the U.S. supplemental pension plan, and (iii)

pre-tax charges of $96 million ($63 million after-tax and

non-controlling interests, or $0.22 per diluted share) in the third

quarter, primarily related to cost reduction actions.

PRAXAIR, INC. AND SUBSIDIARIES APPENDIX NON-GAAP

MEASURES (Millions of dollars, except per share data)

(UNAUDITED)

The following Non-GAAP measures

are intended to supplement investors’ understanding of the

company’s financial information by providing measures which

investors, financial analysts and management use to help evaluate

the company’s financial leverage, return on capital and operating

performance. Items which the company does not believe to be

indicative of on-going business trends are excluded from these

calculations so that investors can better evaluate and analyze

historical and future business trends on a consistent basis.

Definitions of these Non-GAAP measures may not be comparable to

similar definitions used by other companies and are not a

substitute for similar GAAP measures. Adjusted amounts exclude the

impacts of the 2017 first and second quarter transaction costs,

2016 third quarter cost reduction program and pension settlement,

2016 first quarter bond redemption, 2015 third quarter cost

reduction program and pension settlement, and 2015 second quarter

cost reduction program and other charges.

Adjusted

Amounts

Year-to-date June 30,

Second Quarter First Quarter Year Third

Quarter First Quarter Year Third Quarter

Second Quarter

2017 2017 2017 2016 2016

2016 2015 2015 2015

Adjusted

Operating Profit and Operating Profit Margin

Reported operating profit $ 1,186 $ 604 $ 582 $ 2,238 $ 497 $ 554 $

2,321 $ 594 $ 480 Add: Cost reduction program and other charges - -

- 96 96 - 165 19 146 Add: Pension settlement charge - - - 4 4 - 7 7

- Add: Transaction costs 21 15 6

- - - -

- - Total adjustments 21

15 6 100

100 - 172 26

146 Adjusted operating profit $ 1,207 $ 619

$ 588 $ 2,338 $ 597 $ 554 $

2,493 $ 620 $ 626 Reported percentage

change 4 % 3 % Adjusted percentage change 6 % 5 % Reported

sales $ 5,562 $ 2,834 $ 2,728 $ 10,534 $ 2,716 $ 2,509 $ 10,776 $

2,686 $ 2,738 Adjusted operating profit margin 21.7 % 21.8 % 21.6 %

22.2 % 22.0 % 22.1 % 23.1 % 23.1 % 22.9 %

Adjusted Interest

Expense - net

Reported interest expense - net $ 79 $ 38 $ 41 $ 190 $ 43 $ 65 $

161 $ 35 $ 40 Less: Bond redemption - -

- (16 ) - (16 ) -

- - Adjusted interest expense -

net $ 79 $ 38 $ 41 $ 174 $ 43 $

49 $ 161 $ 35 $ 40

Adjusted Income

Taxes

Reported income taxes $ 306 $ 157 $ 149 $ 551 $ 120 $ 133 $ 612 $

156 $ 131 Add: Cost reduction program and other charges - - - 28 28

- 39 6 33 Add: Bond redemption - - - 6 - 6 - - - Add: Pension

settlement charge - - - 1 1 - 2 2 - Add: Transaction costs -

- - - -

- - - -

Total adjustments - - -

35 29 6 41

8 33 Adjusted income taxes $ 306

$ 157 $ 149 $ 586 $ 149 $ 139

$ 653 $ 164 $ 164

Adjusted

Effective Tax Rate

Reported income before income taxes and equity investments $ 1,107

$ 566 $ 541 $ 2,048 $ 454 $ 489 $ 2,160 $ 559 $ 440 Add: Cost

reduction program and other charges - - - 96 96 - 165 19 146 Add:

Bond redemption - - - 16 - 16 - - - Add: Pension settlement charge

- - - 4 4 - 7 7 - Add: Transaction costs 21 15

6 - - -

- - - Total

adjustments 21 15 6

116 100 16 172

26 146 Adjusted income before

income taxes and equity investments $ 1,128 $ 581 $

547 $ 2,164 $ 554 $ 505 $ 2,332

$ 585 $ 586 Reported effective tax rate 27.6 %

27.7 % 27.5 % 26.9 % 26.4 % 27.2 % 28.3 % 27.9 % 29.8 % Adjusted

effective tax rate 27.1 % 27.0 % 27.2 % 27.1 % 26.9 % 27.5 % 28.0 %

28.0 % 28.0 %

Adjusted

Noncontrolling Interests

Reported noncontrolling interests $ 29 $ 14 $ 15 $ 38 $ 5 $ 10 $ 44

$ 12 $ 11 Add: Cost reduction program and other charges -

- - 5 5

- 1 - 1

Total adjustments - - -

5 5 - 1

- 1 Adjusted noncontrolling

interests $ 29 $ 14 $ 15 $ 43 $ 10

$ 10 $ 45 $ 12 $ 12

Adjusted Net

Income - Praxair, Inc.

Reported net income - Praxair, Inc. $ 795 $ 406 $ 389 $ 1,500 $ 339

$ 356 $ 1,547 $ 401 $ 308 Add: Cost reduction program and other

charges - - - 63 63 - 125 13 112 Add: Bond redemption - - - 10 - 10

- - - Add: Pension settlement charge - - - 3 3 - 5 5 - Add:

Transaction costs 21 15 6

- - - -

- - Total adjustments 21

15 6 76 66

10 130 18 112

Adjusted net income - Praxair, Inc. $ 816 $ 421

$ 395 $ 1,576 $ 405 $ 366 $

1,677 $ 419 $ 420 Reported percentage

change 5 % 2 % Adjusted percentage change 7 % 6 %

Adjusted Diluted

EPS

Reported diluted EPS $ 2.76 $ 1.41 $ 1.35 $ 5.21 $ 1.18 $ 1.24 $

5.35 $ 1.40 $ 1.06 Add: Cost reduction program and other charges -

- - 0.22 0.22 - 0.43 0.04 0.39 Add: Bond redemption - - - 0.04 -

0.04 - - - Add: Pension settlement charge - - - 0.01 0.01 - 0.02

0.02 - Add: Transaction costs 0.07 0.05

0.02 - - -

- - - Total adjustments

0.07 0.05 0.02

0.27 0.23 0.04 0.45

0.06 0.39 Adjusted diluted EPS $

2.83 $ 1.46 $ 1.37 $ 5.48 $ 1.41

$ 1.28 $ 5.80 $ 1.46 $ 1.45

Reported percentage change 5 % 1 % Adjusted percentage change 6 % 5

%

Cash Income Taxes

and Interest

Income taxes paid $ 585 $ 420 Interest paid, net of interest

capitalized and excluding bond redemption $ 173 $ 174

Full Year 2017

Diluted EPS Guidance

Full Year 2017 Low End High End 2017

GAAP diluted EPS guidance $ 5.56 $ 5.68 Add: Q1 and Q2 Transaction

costs (excludes future merger transaction costs) 0.07

0.07 2017 adjusted diluted EPS guidance $ 5.63

$ 5.75 2016 adjusted diluted EPS (see above for full year

reconciliation) $ 5.48 $ 5.48 Adjusted

percentage change 3 % 5 %

2017

2016 2015 Q2 Q1 Q4

Q3 Q2 Q1 Q4

Q3 Q2 Q1

Free Cash Flow

(FCF) - Free cash flow is a measure used by

investors, financial analysts and management to evaluate the

ability of a company to pursue opportunities that enhance

shareholder value. FCF equals cash flow from operations less

capital expenditures.

Operating cash flow $ 701 $ 710 $ 726 $ 788 $ 706 $ 553 $

791 $ 676 $ 710 $ 518 Less: capital expenditures (325 )

(327 ) (409 ) (376 )

(357 ) (323 ) (387 ) (405

) (352 ) (397 )

Free Cash Flow

$ 376 $ 383 $ 317

$ 412 $ 349 $ 230

$ 404 $ 271 $ 358

$ 121

Net Debt, Capital

and Debt-to-Capital Ratio - The debt-to-capital ratio is

a measure used by investors, financial analysts and management to

provide a measure of financial leverage and insights into how the

company is financing its operations.

Debt $ 9,367 $ 9,368 $ 9,515 $ 9,842 $ 9,956 $ 9,404 $ 9,231

$ 9,480 $ 9,313 $ 9,360 Less: cash and cash equivalents (535

) (519 ) (524 ) (627 )

(567 ) (221 ) (147 ) (136

) (136 ) (117 ) Net debt 8,832 8,849

8,991 9,215 9,389 9,183 9,084 9,344 9,177 9,243 Equity and

redeemable noncontrolling interests: Redeemable noncontrolling

interests 10 10 11 11 12 119 113 169 175 170 Praxair, Inc.

shareholders' equity 5,807 5,529 5,021 5,245 5,140 4,888 4,389

4,264 4,964 5,018 Noncontrolling interests 453

436 420 393

407 417 404

380 380 375

Total equity and redeemable noncontrolling interests 6,270

5,975 5,452

5,649 5,559 5,424

4,906 4,813 5,519

5,563 Capital $ 15,102 $ 14,824 $

14,443 $ 14,864 $ 14,948 $ 14,607 $ 13,990 $ 14,157 $ 14,696 $

14,806

Debt-to-capital 58.5 %

59.7 % 62.3 %

62.0 % 62.8

% 62.9 % 64.9

% 66.0 %

62.4 % 62.4 %

After-tax Return

on Capital and Adjusted After-tax Return on Capital

(ROC)- After-tax return on capital is a measure used by

investors, financial analysts and management to evaluate the return

on net assets employed in the business. ROC measures the after-tax

operating profit that the company was able to generate with the

investments made by all parties in the business (debt,

noncontrolling interests and Praxair, Inc. shareholders’

equity).

Reported net income - Praxair, Inc. $ 406 $ 389 $ 406 $ 339

$ 399 $ 356 $ 422 $ 401 $ 308 $ 416 Add: noncontrolling interests

14 15 13 5 10 10 9 12 11 12 Add: interest expense - net 38 41 38 43

44 65 42 35 40 44 Less: tax benefit on interest expense - net *

(11 ) (12 ) (10 ) (12 )

(12 ) (20 ) (12 )

(10 ) (11 ) (12 )

Net operating

profit after-tax (NOPAT) $ 447 $

433 $ 447 $ 375 $

441 $ 411 $ 461 $

438 $ 348 $ 460 Pre-tax

Adjustments: Add: Cost reduction program and other charges - - - 96

- - - 19 146 - Add: Pension settlement charge - - - 4 - - - 7 - -

Add: Transaction costs 15 6 - - - - - - - - Less: income taxes on

pre-tax adjustments - - -

(29 ) - -

- (8 ) (33 )

-

Adjusted NOPAT $ 462

$ 439 $ 447 $ 446

$ 441 $ 411 $ 461

$ 456 $ 461 $ 460

4-quarter trailing NOPAT $ 1,702 $ 1,696 $ 1,674 $ 1,688 $ 1,751 $

1,658 $ 1,707 $ 1,616 $ 1,700 $ 1,864 4-quarter trailing adjusted

NOPAT $ 1,794 $ 1,773 $ 1,745 $ 1,759 $ 1,769 $ 1,789 $ 1,838 $

1,879 $ 1,945 $ 1,996 Ending capital (see above) $ 15,102 $

14,824 $ 14,443 $ 14,864 $ 14,948 $ 14,607 $ 13,990 $ 14,157 $

14,696 $ 14,806 5-quarter average ending capital $ 14,836 $ 14,737

$ 14,570 $ 14,513 $ 14,480 $ 14,451 $ 14,587 $ 14,999 $ 15,460 $

15,777

After-tax ROC (4-quarter trailing NOPAT /

5-quarter average capital) 11.5 % 11.5

% 11.5 % 11.6 % 12.1

% 11.5 % 11.7 % 10.8

% 11.0 % 11.8 %

Adjusted after-tax ROC (4-quarter trailing adjusted NOPAT /

5-quarter average capital) 12.1 %

12.0 % 12.0 %

12.1 % 12.2 %

12.4 % 12.6 %

12.5 % 12.6

% 12.7 % * Tax benefit on

interest expense - net is generally presented using the reported

effective rate.

EBITDA, Adjusted

EBITDA, EBITDA Margin and Adjusted EBITDA Margin - These

measures are used by investors, financial analysts and management

to assess a company's profitability.

Reported net income - Praxair, Inc. $ 406 $ 389 $ 406 $ 339

$ 399 $ 356 $ 422 $ 401 $ 308 $ 416 Add: noncontrolling interests

14 15 13 5 10 10 9 12 11 12 Add: interest expense - net 38 41 38 43

44 65 42 35 40 44 Add: income taxes 157 149 152 120 146 133 163 156

131 162 Add: depreciation and amortization 292

287 285 284

281 272 275

276 278 277

EBITDA $ 907 $ 881 $

894 $ 791 $ 880 $

836 $ 911 $ 880 $

768 $ 911 Adjustments: Add: Cost

reduction program and other charges - - - 96 - - - 19 146 - Add:

Pension settlement charge - - - 4 - - - 7 - - Add: Transaction

costs 15 6 -

- - -

- - -

-

Adjusted EBITDA $

922 $ 887 $ 894 $

891 $ 880 $ 836 $

911 $ 906 $ 914 $

911 Reported sales 2,834 2,728 2,644 2,716 2,665

2,509 2,595 2,686 2,738 2,757

EBITDA margin 32.0

% 32.3 % 33.8 % 29.1

% 33.0 % 33.3 % 35.1

% 32.8 % 28.0 % 33.0

% Adjusted EBITDA margin 32.5 %

32.5 % 33.8 % 32.8 %

33.0 % 33.3 % 35.1 %

33.7 % 33.4 % 33.0 %

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170727005229/en/

Praxair, Inc.Media:Jason Stewart,

203-837-2448jason_stewart@praxair.comorInvestor:Juan Pelaez,

203-837-2213juan_pelaez@praxair.com

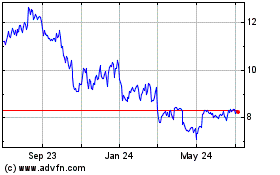

P10 (NYSE:PX)

Historical Stock Chart

From Mar 2024 to Apr 2024

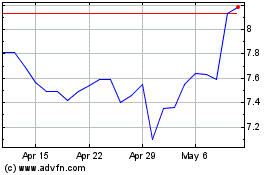

P10 (NYSE:PX)

Historical Stock Chart

From Apr 2023 to Apr 2024