Securities Registration: Employee Benefit Plan (s-8)

July 19 2017 - 4:08PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on July 19, 2017

Registration No. 333-

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION

STATEMENT

Under

The Securities Act of 1933

PUMA

BIOTECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

|

77-0683487

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(IRS Employer

Identification No.)

|

10880 Wilshire Boulevard, Suite 2150

Los Angeles, California 90024

(Address of principal executive offices) (Zip code)

Puma Biotechnology, Inc. 2011 Incentive Award Plan

(Full title of the plan)

Alan H. Auerbach

President and Chief Executive Officer

Puma Biotechnology, Inc.

10880 Wilshire Boulevard, Suite 2150

Los Angeles, California 90024

(424) 248-6500

(Name and

address of agent for service)

(Telephone number, including area code, of agent for service)

Copy to:

B.

Shayne Kennedy

Latham & Watkins LLP

650 Town Center Drive, 20th Floor

Costa Mesa, California 92626

(714) 540-1235

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☒

|

|

Accelerated filer

|

|

☐

|

|

|

|

|

|

|

Non-accelerated filer

|

|

☐ (Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

☐

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Securities

to be Registered

|

|

Amount

to be

Registered(1)

|

|

Proposed

Maximum

Offering Price

Per Share(2)

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

Amount of

Registration Fee

|

|

Common Stock, par value $0.0001 per share

|

|

2,000,000 shares

|

|

$87.99

|

|

$175,980,000

|

|

$20,397

|

|

|

|

|

|

(1)

|

The Puma Biotechnology, Inc. 2011 Incentive Award Plan (the “Plan”) authorizes the issuance of shares of common stock, par value $0.0001 per share, of the registrant (the “Common Stock”), of which

2,000,000 shares are being registered hereunder, 4,000,000 shares have been registered previously on Form S-8 (Reg. No. 333-205117), 3,000,000 shares have been registered previously on Form S-8 (Reg. No. 333-196993) and another 3,529,412 shares have

been registered previously on Form S-8 (Reg. No. 333-181703). In accordance with Rule 416(a) of the Securities Act of 1933, as amended (the “Securities Act”), this registration statement will also cover any additional shares of Common

Stock that become issuable under the Plan by reason of any stock dividend, stock split, recapitalization or similar transaction effected which results in an increase in the number of outstanding shares of the registrant’s Common Stock.

|

|

(2)

|

Estimated in accordance with Rule 457(c) and 457(h) of the Securities Act solely for purposes of calculating the registration fee on the basis of the average of the high and low sale price per share of Common Stock, as

reported on the NASDAQ Global Select Market on July 12, 2017, which was $87.99 per share.

|

INTRODUCTION

On June 12, 2017, the stockholders of Puma Biotechnology, Inc. (the “Company”) approved an amendment to the Puma Biotechnology, Inc. 2011

Incentive Award Plan (the “Plan”) increasing the number of authorized shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), that may become issuable under the Plan by 2,000,000 shares. The

Company is filing this registration statement (this “Registration Statement”) on Form S-8 to register such additional shares.

PART I

INFORMATION

REQUIRED IN THE SECTION 10(a) PROSPECTUS

The information called for in Part I of Form S-8 is not being filed with or included in this Registration

Statement (by incorporation by reference or otherwise) in accordance with the rules and regulations of the Securities and Exchange Commission (the “Commission”). The Registrant will send or give the documents containing the information

specified in Part I of Form S-8 to Plan participants as specified by the Commission Rule 428(b)(1) under the Securities Act of 1933, as amended (the “Securities Act”).

PART II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

Registration of Additional Securities

The Company has previously registered 3,529,412 shares of Common Stock issuable under the Plan on the registration statement on Form S-8 (Reg.

No. 333-181703) filed with the Commission on May 25, 2012, 3,000,000 shares of Common Stock issuable under the Plan on the registration statement on Form S-8 (Reg. No. 333-196993) filed with the Commission on June 24, 2014 and

4,000,000 shares of Common Stock issuable under the Plan on the registration statement on Form S-8 (Reg. No. 333-205117) filed with the Commission on June 19, 2015 (the “Prior Registration Statements”). Under this Registration

Statement, the Company is registering an additional 2,000,000 shares of Common Stock issuable under the Plan. The contents of the Prior Registration Statements are incorporated by reference herein to the extent not modified or superseded hereby or

by any subsequently filed document that is incorporated by reference herein or therein. In addition, the description of the Company’s common stock contained in the Company’s Registration Statement on Form 8-A filed on December 30,

2016, and any subsequent amendment thereto filed for the purpose of updating such description is incorporated herein by reference.

Experts

The consolidated financial statements of the Company included in the Company’s Annual Report on Form 10-K for the year ended

December 31, 2016 and the effectiveness of the Company’s internal control over financial reporting as of December 31, 2016 have been audited by PKF, LLP (formerly PKF, Certified Public Accountants, A Professional Corporation), the

Company’s independent registered public accounting firm for the fiscal year ended December 31, 2016, as set forth in its report thereon, included therein, and incorporated herein by reference. Such consolidated financial statements are

incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

Item 6.

Indemnification of Directors and Officers.

Section 102(b)(7) of the General Corporation Law of the State of Delaware (the “DGCL”)

enables a corporation in its original certificate of incorporation or an amendment thereto to eliminate or limit the personal liability of a director for violations of the director’s fiduciary duty, except (1) for any breach of the

director’s duty of loyalty to the corporation or its stockholders, (2) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (3) pursuant to Section 174 of the DGCL, which

provides for liability of directors for unlawful payments of dividends or unlawful stock purchase or redemptions, or (4) for any transaction from which a director derived an improper personal benefit.

Section 145 of the DGCL provides that a corporation may indemnify any person, including an officer or

director, who is, or is threatened to be made, party to any threatened, pending or completed legal action, suit or proceeding, whether civil, criminal, administrative or investigative, other than an action by or in the right of such corporation, by

reason of the fact that such person was an officer, director, employee or agent of such corporation or is or was serving at the request of such corporation as a director, officer, employee or agent of another corporation or enterprise. The indemnity

may include expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit or proceeding, provided such officer, director, employee or

agent acted in good faith and in a manner he reasonably believed to be in, or not opposed to, the corporation’s best interest and, for criminal proceedings, had no reasonable cause to believe that his conduct was unlawful. A Delaware

corporation may indemnify any officer or director in an action by or in the right of the corporation under the same conditions, except that no indemnification is permitted without judicial approval if the officer or director is adjudged to be liable

to the corporation. Where an officer or director is successful on the merits or otherwise in the defense of any action referred to above, the corporation must indemnify him against the expenses that such officer or director actually and reasonably

incurred.

The Registrant’s second amended and restated certificate of incorporation and the Registrant’s second amended and restated bylaws

provide for indemnification of the officers and directors to the full extent permitted by applicable law.

Item 8. Exhibits.

See Exhibit Index attached to this Registration Statement.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the

requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Los Angeles, State of California, on the 19

th

day of July, 2017.

|

|

|

|

|

PUMA BIOTECHNOLOGY, INC.

|

|

|

|

|

By:

|

|

/s/ Alan H. Auerbach

|

|

|

|

Alan H. Auerbach

|

|

|

|

President and Chief Executive Officer

|

SIGNATURES AND POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below does hereby constitute and appoint Alan H. Auerbach and Charles R. Eyler,

and each of them, his true and lawful attorneys-in-fact and agents, each with full power of substitution and resubstitution, for him and in his name, place and stead, in any and all capacities, to sign any and all amendments, including

post-effective amendments, to this Registration Statement on Form S-8, and to file the same, with exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and

agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that

said attorneys-in-fact and agents, or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements

of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the date indicated.

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

/s/ Alan H. Auerbach

|

|

Chairman of the Board of Directors,

|

|

July 19, 2017

|

|

Alan H. Auerbach

|

|

President and Chief Executive Officer (Principal Executive Officer)

|

|

|

|

|

|

|

|

/s/ Charles R. Eyler

|

|

Senior Vice President, Finance and

|

|

July 19, 2017

|

|

Charles R. Eyler

|

|

Administration and Treasurer (Principal

Financial Officer and Principal Accounting Officer)

|

|

|

|

|

|

|

|

/s/ Jay M. Moyes

|

|

Director

|

|

July 19, 2017

|

|

Jay M. Moyes

|

|

|

|

|

|

|

|

|

|

/s/ Adrian M. Senderowicz

|

|

Director

|

|

July 19, 2017

|

|

Adrian M. Senderowicz

|

|

|

|

|

|

|

|

|

|

/s/ Troy E. Wilson

|

|

Director

|

|

July 19, 2017

|

|

Troy E. Wilson

|

|

|

|

|

|

|

|

|

|

/s/ Frank E. Zavrl

|

|

Director

|

|

July 19, 2017

|

|

Frank E. Zavrl

|

|

|

|

|

EXHIBIT INDEX

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Incorporation by Reference

|

|

Exhibit

No.

|

|

|

|

Description

|

|

Form

|

|

Exhibit

|

|

Filing Date

|

|

|

|

|

|

|

|

|

4.1

|

|

|

|

Second Amended and Restated Certificate of Incorporation, as filed with the Secretary of State of the State of Delaware on June 14, 2016

|

|

8-K

|

|

3.1

|

|

6/15/2016

|

|

|

|

|

|

|

|

|

4.2

|

|

|

|

Second Amended and Restated Bylaws of Puma Biotechnology, Inc.

|

|

8-K

|

|

3.1

|

|

5/8/2017

|

|

|

|

|

|

|

|

|

4.3

|

|

|

|

Form of Common Stock Certificate

|

|

S-1/A

|

|

4.1

|

|

2/1/2012

|

|

|

|

|

|

|

|

|

5.1

|

|

+

|

|

Opinion of Latham & Watkins LLP

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23.1

|

|

+

|

|

Consent of PKF, LLP (formerly PKF, Certified Public Accountants, A Professional Corporation)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23.2

|

|

+

|

|

Consent of Latham & Watkins LLP (included in Exhibit 5.1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24.1

|

|

+

|

|

Power of Attorney (included on signature page)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

99.1

|

|

|

|

Puma Biotechnology, Inc. 2011 Incentive Award Plan

|

|

8-K

|

|

10.4

|

|

10/11/2011

|

|

|

|

|

|

|

|

|

99.2

|

|

|

|

First Amendment to Puma Biotechnology, Inc. 2011 Incentive Award Plan

|

|

DEFR14A

|

|

Appendix A

|

|

6/4/2014

|

|

|

|

|

|

|

|

|

99.3

|

|

|

|

Second Amendment to Puma Biotechnology, Inc. 2011 Incentive Award Plan

|

|

DEF14A

|

|

Appendix A

|

|

4/30/2015

|

|

|

|

|

|

|

|

|

99.4

|

|

|

|

Third Amendment to Puma Biotechnology, Inc. 2011 Incentive Award Plan

|

|

8-K

|

|

10.1

|

|

6/14/2017

|

|

|

|

|

|

|

|

|

99.5

|

|

|

|

Fourth Amendment to Puma Biotechnology, Inc. 2011 Incentive Award Plan

|

|

8-K

|

|

10.2

|

|

6/14/2017

|

|

|

|

|

|

|

|

|

99.6

|

|

|

|

Form of Stock Option Grant Notice and Stock Option Agreement, issued pursuant to the 2011 Incentive Award Plan

|

|

10-K

|

|

10.5

|

|

3/29/2012

|

|

|

|

|

|

|

|

|

99.7

|

|

|

|

Form of Chief Executive Officer Stock Option Grant Notice and Stock Option Agreement, issued pursuant to the 2011 Incentive Award Plan

|

|

10-K

|

|

10.6

|

|

3/29/2012

|

|

|

|

|

|

|

|

|

99.8

|

|

|

|

Form of Performance Share Award Grant Notice and Performance Share Award Agreement, issued pursuant to the 2011 Incentive Award Plan

|

|

10-K

|

|

10.2(d)

|

|

3/3/2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

99.9

|

|

|

|

Form of Restricted Stock Unit Award Agreement, issued pursuant to the 2011 Incentive Award Plan

|

|

8-K

|

|

10.1

|

|

10/17/2016

|

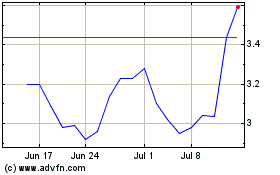

Puma Biotechnology (NASDAQ:PBYI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Puma Biotechnology (NASDAQ:PBYI)

Historical Stock Chart

From Apr 2023 to Apr 2024