UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

SCHEDULE

14A

(Rule 14A-101)

Proxy Statement

Pursuant to Section 14(a) of the

Securities Exchange

Act of 1934

(Amendment No. )

Filed by the Registrant

x

Filed by a Party other than the Registrant

¨

Check the appropriate box:

|

¨

|

|

Preliminary Proxy Statement

|

|

¨

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

¨

|

|

Definitive Proxy Statement

|

|

¨

|

|

Definitive Additional Materials

|

|

x

|

|

Soliciting Material Pursuant to §240.14a-12

|

CF CORPORATION

(Name of Registrant

as Specified In Its Charter)

(Name of Person(s)

Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the

appropriate box):

|

|

|

|

|

|

|

|

|

|

x

|

|

No fee required.

|

|

|

|

|

¨

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

¨

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

On July 17, 2017, CF Corporation issued the following press release.

CF Corporation and Fidelity & Guaranty

Life Report on Status of Merger

LAS VEGAS and DES MOINES, Iowa, July 17, 2017 /PRNewswire/

— CF Corporation (NASDAQ: CFCO) (“CF Corp.”) and Fidelity & Guaranty Life (NYSE: FGL) (“FGL”),

a leading provider of fixed indexed annuities and life insurance in the U.S., today reported on the status of their previously

announced merger transaction in which CF Corp. has agreed to acquire FGL for $31.10 per share in cash, or a total of

approximately $1.835 billion, plus the assumption of $405 million of existing debt.

Both CF Corp. and FGL are committed to close the merger as soon

as practicable and continue to expect the closing to occur in the fourth quarter of 2017, subject to receipt of required regulatory

approvals and satisfaction of the other closing conditions specified in the merger agreement.

The parties have been working closely together and continue

to make progress in securing the regulatory approvals required to close the transaction. On June 16, 2017, the Federal Trade

Commission granted early termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended.

FGL has filed its preliminary information statement with the

SEC and once finalized the information statement will be mailed to FGL’s shareholders. As previously disclosed, shortly following

execution of the merger agreement, a wholly-owned subsidiary of HRG Group, Inc., which holds 80.4% of the outstanding shares of

common stock of FGL, delivered a written consent approving and adopting the merger agreement. This written consent, which consent

may not be withdrawn, constituted approval of the merger by FGL’s shareholders and no further action by FGL’s shareholders

will be solicited in connection with the merger. Accordingly, FGL does not have the ability to terminate the merger agreement (and

the $50 million “Company Termination Fee” would not be applicable) if a third party were to make an offer to acquire

FGL.

In addition, CF Corp. has filed its preliminary proxy statement

with the SEC in connection with its upcoming shareholder vote to approve the merger and related matters. Certain of CF Corp.’s

investors that own approximately 18.7% of CF Corp.’s ordinary shares have entered into voting agreements to vote in favor

of the merger at the CF Corp. shareholder meeting.

Transaction Website

A website with additional information on the transaction can

be found here: www.cfcorpandfidelity.com.

About CF Corporation

CF Corporation’s primary objective is to build an enduring,

high quality business by using permanent capital, a core tenet of the CF Corp. structure. CF Corp. also has the largest individual

founder co-investment in a U.S. special purpose acquisition company, which results in alignment of interests with CF Corp.’s

investors.

About Fidelity & Guaranty Life

Fidelity & Guaranty Life, an insurance holding company,

helps middle-income Americans prepare for retirement. Through its subsidiaries, the company offers fixed annuity and life insurance

products distributed by independent agents through an established network of independent marketing organizations. For more information,

please visit www.fglife.com.

Forward-Looking Statements

This press release contains, and certain oral statements made

by representatives of CF Corp. and FGL, and their respective affiliates, from time to time may contain, “forward-looking

statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act

of 1995. CF Corp.’s and FGL’s actual results may differ from their expectations, estimates and projections and consequently,

you should not rely on these forward looking statements as predictions of future events. Words such as “expect,” “estimate,”

“project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,”

“may,” “will,” “could,” “should,” “believes,” “predicts,”

“potential,” “might” and “continues,” and similar expressions are intended to identify such

forward-looking statements. These forward-looking statements include, without limitation, CF Corp.’s and FGL’s expectations

with respect to future performance and anticipated financial impact of the business combination, the satisfaction of the closing

conditions to the business combination and the timing of the completion of the business combination. These forward-looking statements

involve significant risks and uncertainties that could cause actual results to differ materially from expected results. Most of

these factors are outside CF Corp.’s and FGL’s control and are difficult to predict. Factors that may cause such differences

include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination

of the merger agreement relating to the proposed business combination; (2) the outcome of any legal proceedings that may be instituted

against CF Corp. or FGL following the announcement of the merger agreement and the transactions contemplated therein; (3) the inability

to complete the business combination, including due to failure to obtain approval of the shareholders of CF Corp. or other conditions

to closing in the merger agreement; (4) delays in obtaining or the inability to obtain necessary regulatory approvals (including

approval from insurance regulators) required to complete the transactions contemplated by the merger agreement; (5) the occurrence

of any event, change or other circumstance that could give rise to the termination of the merger agreement or could otherwise cause

the transaction to fail to close; (6) the inability to obtain or maintain the listing of the post-acquisition company’s ordinary

shares on NASDAQ following the business combination; (7) the risk that the business combination disrupts current plans and operations

as a result of the announcement and consummation of the business combination; (8) the ability to recognize the anticipated benefits

of the business combination, which may be affected by, among other things, competition, the ability of the combined company to

grow and manage growth profitably and retain its key employees; (9) costs related to the business combination; (10) changes in

applicable laws or regulations; (11) the possibility that FGL or the combined company may be adversely affected by other economic,

business, and/or competitive factors; and (12) other risks and uncertainties identified in CF Corp.’s proxy statement relating

to the business combination, including those under “Risk Factors” therein, and in CF Corp.’s and FGL’s

other filings with the SEC. CF Corp. and FGL caution that the foregoing list of factors is not exclusive. CF Corp. and FGL caution

readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. CF Corp. and FGL

do not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any

forward-looking statements to reflect any change in its expectations

or any change in events, conditions or circumstances on which any such statement is based, subject to applicable law. The information

contained in any website referenced herein is not, and shall not be deemed to be, part of or incorporated into this press release.

No Offer or Solicitation

This press release is for informational purposes only and shall

not constitute an offer to sell or the solicitation of an offer to buy any securities pursuant to the proposed transactions or

otherwise, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful

prior to the registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be

made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Important Information for CF Corp. Investors and Shareholders

and FGL Stockholders

In connection with the proposed business combination, CF Corp.

has filed a preliminary proxy statement and will file a definitive proxy statement with the SEC. CF Corp.’s shareholders

and other interested persons are advised to read the preliminary proxy statement and, when available, any amendments thereto and

the definitive proxy statement and documents incorporated by reference therein as these materials will contain important information

about FGL, CF Corp. and the business combination. The description of the business combination contained herein is only a summary

and is qualified in its entirety by reference to the definitive agreements relating to the business combination, copies of which

have been filed by CF Corp. with the SEC as an exhibit to a Current Report on Form 8-K. When available, the definitive proxy statement

and other relevant materials will be mailed to shareholders of CF Corp. as of a record date to be established for voting on the

business combination. Shareholders may obtain copies of the preliminary proxy statement, the definitive proxy statement and other

documents filed with the SEC that will be incorporated by reference therein, without charge, once available, at the SEC’s

web site at www.sec.gov, or by directing a request to: CF Corporation, 1701 Village Center Circle, Las Vegas, Nevada 89134,

Attention: Douglas B. Newton, Chief Financial Officer (212) 355-5515 or by accessing CF Corp.’s website at www.cfcorpandfidelity.com.

In connection with the proposed merger transaction, FGL has

filed a preliminary information statement and will file a definitive information statement with the SEC. FGL’s stockholders

and other interested persons are advised to read the preliminary information statement and, when available, any amendments thereto

and the definitive information statement and documents incorporated by reference therein as these materials will contain important

information about FGL, CF Corp. and the merger transaction. The description of the merger transaction contained herein is only

a summary and is qualified in its entirety by reference to the definitive agreements relating to the merger transaction, copies

of which have been filed by FGL with the SEC as an exhibit to a Current Report on Form 8-K. When available, the definitive information

statement and other relevant materials will be mailed to stockholders of FGL as of a record date to be established. Stockholders

may obtain copies of the preliminary information statement, the definitive information statement and other documents filed with

the SEC that will be incorporated by reference therein, without charge, once available, at the SEC’s web site at www.sec.gov,

or by directing a request to: Fidelity & Guaranty Life, Two Ruan Center, 601

Locust Street, 14th Floor, Des Moines, Iowa 50309, Attention:

Investor Relations Department, Telephone: (515) 330-3307.

Participants in the CF Corp. Solicitation

CF Corp. and its directors and executive officers may be deemed

participants in the solicitation of proxies from CF Corp.’s shareholders with respect to the business combination. A list

of the names of those directors and executive officers and a description of their interests in CF Corp. is contained in CF Corp.’s

annual report on Form 10-K for the fiscal year ended December 31, 2016, which was filed with the SEC and is available free

of charge at the SEC’s web site at www.sec.gov, or by directing a request to CF Corporation, 1701 Village Center Circle, Las

Vegas, Nevada 89134, Attention: Douglas B. Newton, Chief Financial Officer (212) 355-5515. Additional information regarding

the interests of such participants will be contained in the definitive proxy statement for the business combination when available.

FGL and its directors and executive officers may also be deemed

to be participants in the solicitation of proxies from the shareholders of CF Corp. in connection with the business combination.

A list of the names of such directors and executive officers and information regarding their interests in the business combination

will be included in the definitive proxy statement for the business combination when available.

CF Corporation Contacts:

Douglas B. Newton, Chief Financial Officer

CF Corporation

212-355-5515

Jonathan Keehner / Andi Rose / Julie Oakes

Joele Frank, Wilkinson Brimmer Katcher

212-355-4449

FGL Contacts:

Investors:

Lisa Foxworthy-Parker

Fidelity & Guaranty Life

Investor.Relations@fglife.com

515-330-3307

Media:

Jamie Tully / David Millar

Sard Verbinnen & Co

212-687-8080

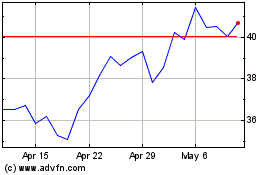

FGL (NYSE:FG)

Historical Stock Chart

From Mar 2024 to Apr 2024

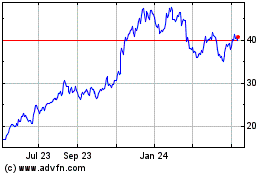

FGL (NYSE:FG)

Historical Stock Chart

From Apr 2023 to Apr 2024