UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

Form 11-K

___________________________________

FOR ANNUAL REPORTS OF EMPLOYEE STOCK PURCHASE,

SAVINGS AND SIMILAR PLANS PURSUANT TO SECTION 15(d) OF

THE SECURITIES EXCHANGE ACT 1934

(Mark One)

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2016

OR

|

|

|

|

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission file number 1-15967

___________________________________

|

|

|

|

|

|

A.

|

Full title of the plan and the address of the plan, if different from that of the issuer named below:

|

The Dun & Bradstreet Corporation 401(k) Plan

(Formerly known as the Profit Participation Plan of the Dun & Bradstreet Corporation)

|

|

|

|

|

|

B.

|

Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

|

The Dun & Bradstreet Corporation,

103 JFK Parkway, Short Hills, NJ 07078

|

|

|

|

|

The Dun & Bradstreet Corporation 401(k) Plan

Table of Contents

|

|

|

|

|

|

|

|

|

|

Page(s)

|

|

|

|

|

|

|

|

|

|

|

Financial Statements

|

|

|

|

|

|

|

|

Statement

of Changes in Net Assets Available for Benefits for the year ended December 31, 2016

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Schedule*

|

|

|

|

|

|

|

|

|

|

|

|

Signatures

|

|

|

|

|

|

|

|

Exhibit

|

|

|

|

Exhibit-23: CONSENT OF PRICEWATERHOUSECOOPERS LLP

|

|

|

|

|

|

|

|

*

|

Other Schedules required by Section 2520.103-10 of the Department of Labor's Rules and Regulations for Reporting and Disclosure under ERISA have been omitted because they are not applicable.

|

R

eport of Independent Registered Public Accounting Firm

To the Administrators of

The Dun & Bradstreet Corporation 401(k) Plan

In our opinion, the accompanying statements of net assets available for benefits and the related statement of changes in net assets available for benefits present fairly, in all material respects, the net assets available for benefits of The Dun & Bradstreet Corporation 401(k) Plan

(the “Plan”) as of December 31, 2016

and 2015, and the changes in net assets available for benefits for the year ended December 31, 2016 in conformity with accounting principles generally accepted in the United States of America. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

The supplemental schedule of

assets (held at end of year) as of December 31, 2016

has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974.

In our opinion, the schedule of

assets (held at end of year) is

fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ PricewaterhouseCoopers LLP

New York, New York

June 23, 2017

|

|

|

|

|

The Dun & Bradstreet Corporation 401(k) Plan

Statements of Net Assets Available for Benefits

As of December 31, 2016 and 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

(dollars in thousands)

|

2016

|

|

2015

|

|

Assets:

|

|

|

|

|

Investments at fair value (Note 3)

|

$

|

778,524

|

|

|

$

|

747,596

|

|

|

|

|

|

|

|

Investments at contract value (Note 2 and 5)

|

130,695

|

|

|

133,279

|

|

|

|

|

|

|

|

Receivables:

|

|

|

|

|

Notes receivable from participants (Note 1)

|

6,908

|

|

|

7,275

|

|

|

Total receivables

|

6,908

|

|

|

7,275

|

|

|

|

|

|

|

|

Total assets

|

916,127

|

|

|

888,150

|

|

|

|

|

|

|

|

Net assets available for benefits

|

$

|

916,127

|

|

|

$

|

888,150

|

|

See accompanying notes to the financial statements.

|

|

|

|

|

The Dun & Bradstreet Corporation 401(k) Plan

Statement of Changes in Net Assets Available for Benefits

Year Ended December 31, 2016

|

|

|

|

|

|

|

|

|

(dollars in thousands)

|

2016

|

|

Additions:

|

|

|

Additions to net investments attributed to:

|

|

|

Investment income:

|

|

|

Net appreciation in fair value of investments

|

$

|

46,679

|

|

|

Interest income

|

3,537

|

|

|

Dividend income

|

18,796

|

|

|

Total investment income

|

69,012

|

|

|

Contributions:

|

|

|

Participant

|

31,497

|

|

|

Employer

|

9,816

|

|

|

Rollovers

|

4,749

|

|

|

Total contributions

|

46,062

|

|

|

Total additions

|

115,074

|

|

|

Deductions:

|

|

|

Deductions from net assets attributed to:

|

|

|

Benefits paid to participants

|

97,157

|

|

|

Administrative expenses

|

722

|

|

|

Total deductions

|

97,879

|

|

|

|

|

|

Net increase in net assets available for benefits prior to transfers

|

17,195

|

|

|

Transfers in (Note 8)

|

10,782

|

|

|

Net increase

|

27,977

|

|

|

|

|

|

Net assets available for benefits:

|

|

|

Beginning of year

|

888,150

|

|

|

End of year

|

$

|

916,127

|

|

See accompanying notes to the financial statements.

|

|

|

|

|

The Dun & Bradstreet Corporation 401(k) Plan

Notes to Financial Statements

December 31, 2016 and 2015

|

1. Background and Plan Description

The Dun & Bradstreet Corporation (the “Company”) sponsors The Dun & Bradstreet Corporation 401(k) Plan, (the “Plan”), a defined contribution plan intended to be qualified under Sections 401(a) and 401(k) of the Internal Revenue Code of 1984 as amended (the “IRC”), and is offered to all eligible employees of the Company and its affiliates in the United States. The Plan was established for employees of the Company and is designed to help employees supplement their retirement income. The funding of the Plan is made through employee and Company contributions.

The following summary of major Plan provisions in effect for the Plan years 2016 and 2015 is provided for general information purposes only. Participants should refer to the Plan document for a more complete description of the Plan’s provisions. The Plan is a defined contribution plan and is subject to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”). The Plan has been amended to reflect the provisions of the Economic Growth and Tax Relief Reconciliation Act of 2001, the Pension Protection Act of 2006, and the Heroes Earnings Assistance and Relief Tax Act of 2008.

Eligibility

All active employees of the Company in the United States are immediately eligible to participate in the Plan on their date of hire. Newly hired employees, as well as employees who may be reemployed, who have not enrolled in the Plan within 60 days of their hire date, are automatically enrolled at a contribution rate of 3% of pre-tax eligible earnings in the default investment options under the Plan which are the age appropriate Vanguard Target Retirement Trust. A participant may opt out of the automatic enrollment by electing his or her own contribution rate or choosing not to participate in the 401(k) Plan within 60 days of their hire date. If an employee has an automatic enrollment date after June 1, 2014, the contribution rate will automatically increase 1% on each anniversary of the automatic enrollment date, up to a maximum of 7% of an employee’s annual compensation.

Contributions

Each eligible participant may contribute between 1% to 50% of their annual compensation (subject to the Internal Revenue Service (“IRS”) compensation limit of $265,000 in 2016 and 2015 to the Plan on a pre-tax and/or Roth basis, subject to an overall IRS limit ($18,000 in 2016 and in 2015). Additionally, an eligible participant may contribute between 1% to 16% of compensation to the Plan on a post-tax basis. The total pre-tax, Roth and post-tax contribution percentage cannot exceed 50% of compensation. In addition, participants age 50 and over have the ability to contribute up to an additional $6,000 in 2016 and 2015 in pre-tax and /or Roth contributions through the Plan’s catch-up contribution provisions. Catch-up contributions are not eligible for Company matching contributions. The total pre-tax, Roth, post-tax and catch-up contribution percentage cannot exceed 75% of compensation. Contributions are made to the Plan each payroll period by participants through payroll deductions and by the Company on behalf of participants. Contributions will be invested in the default age appropriate Vanguard Target Retirement Trust, if an employee fails to make an investment election.

The Company matches $0.50 per dollar of the first 7% of a participant’s eligible compensation, or a maximum employer match of 3.5%.

Participant Accounts

A separate account is established and maintained for each Plan participant. Contributions by the participant and the Company are invested in one or more of the Plan's investment funds as designated by the participant. Income earned, administrative expenses, and net appreciation or depreciation on Plan investments for a given fund is allocated in proportion to the participant’s account balance in that fund on a daily basis. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

Vesting

Participants are immediately vested in their contributions plus actual earnings on the contributions. The Plan provides for 100% vesting in the value of Company contributions plus actual earnings thereon to a participant’s Plan account at the end of three years of service. In addition, a participant becomes 100% vested in the value of Company contributions if actively employed and attains age 65, becomes totally and permanently disabled or dies.

|

|

|

|

|

The Dun & Bradstreet Corporation 401(k) Plan

Notes to Financial Statements

December 31, 2016 and 2015

|

Investment Options

The Plan allows participants to direct their contributions and the Company’s contributions to a variety of different investments offered by the Plan. At December 31, 2016, the Plan offered investments in the Dun & Bradstreet Corporation common stock fund, common /collective trust funds, mutual funds and a stable value fund.

The following is a summary of the investment options:

The

Dun & Bradstreet Corporation Common Stock Fund

is invested principally in the common stock of The Dun & Bradstreet Corporation, as well as to a lesser extent, short-term investments held in a Fidelity money market fund to provide liquidity for daily participant activity. Under the Plan document, participants cannot direct more than 50% of their current contribution or existing account balance into the Dun & Bradstreet Corporation Common Stock Fund.

The

Balanced Index Fund

is an investment portfolio which will invest approximately 60% of its assets in the Vanguard Institutional Index Fund Institutional Plus Shares and 40% in the Vanguard Total Bond Market Index Fund Institutional Shares. The Vanguard Institutional Index Fund Institutional Plus Shares tracks the S&P 500 index which contains 500 predominantly large U.S. based companies and represents more than 75% of the value of all publically-traded common stocks in the U.S. The Vanguard Total Bond Market Index Fund Institutional Shares tracks the Barclays Aggregate Bond Index. In November 2015, this replaced the

BlackRock Balanced Index Fund

which was invested approximately 60% in the BlackRock Equity Index Fund - Class T and approximately 40% in the BlackRock U.S. Debt Index Fund - Class K.

The

Vanguard Developed Markets Index Fund

is invested to match the total return of a diversified developed market index of non-US stocks. In November 2015, this replaced the

BlackRock EAFE Equity Index Fund Class T

which invested in stocks from certain countries outside the U.S.

The

Vanguard Institutional Index Fund Institutional Plus Shares

tracks the performance of the S&P 500 Index that measures the investment return of large-capitalization stocks. In November 2015, this replaced the

BlackRock Equity Index Fund Class T

which invested in the stocks included in the S&P 500 Index.

The

Vanguard Extended Market Index Fund

is invested in securities to match the total return of an equity index composed of mid and small cap stocks. In November 2015, this replaced the

Blackrock Extended Equity Market Fund Class K

which invested in the stocks that make up the Dow Jones U.S. Completion Total Stock Index.

The

Vanguard Total Bond Market Index Fund

Institutional Shares

seeks the performance of a broad, market weighted bond index.

The

Vanguard Target Retirement Trusts

including the Vanguard Target Retirement 2020, 2025, 2030, 2035, 2040, 2045, 2050, 2055 Trusts and the Vanguard Target Retirement Income Trust II

invest in several Vanguard funds, primarily low-cost index funds, to create a broadly diversified mix of stocks and bonds. Each trust seeks to provide capital appreciation and current income consistent with its asset allocation. The year in a Target Retirement Trust’s name is its target date, the approximate year in which an investor in the trust expects to retire and leave the work force.

The

BlackRock Small Cap Growth Equity Portfolio Institutional Class

invests at least 80% of its net assets in equity securities issued by U.S. small capitalization growth companies.

The

Fidelity Low-Priced Stock Fund

Class K

invests at least 80% of its assets in “low-priced” common stocks. Low-priced stocks are stocks that are priced at or below $35 per share at the time of investment.

Th

e Fidelity Diversified International Fund

Class K

is invested primarily in non-U.S. equity securities. The fund may invest in emerging markets, convertible securities and cash-equivalent investments.

The Fidelity Blue Chip Growth Fund

Class K

is invested in common stocks of well-known and established companies considered “blue chip” by the fund’s portfolio manager. The fund may also invest in companies believed to have above-average growth potential.

|

|

|

|

|

The Dun & Bradstreet Corporation 401(k) Plan

Notes to Financial Statements

December 31, 2016 and 2015

|

The JP Morgan Equity Income Fund Class R6

is invested in high quality U.S. companies to provide a large cap value strategy with an emphasis on quality and sustainable dividend yields. In November 2016, this replaced the Fidelity Equity- Income Fund Class K fund described below.

The Fidelity Equity-Income Fund

Class K

invested at least 80% of its assets in equity securities, primarily in income-producing equity securities which tend to lead to investments in large-cap stocks. The fund also invested in other types of equity and debt securities, including lower-quality debt securities.

The

Northern Small Cap Value Fund

invests at least 80% of its assets in equity securities of small capitalization companies with market capitalizations that are, at the time of purchase, within the range of the Russell 2000 Index. The fund primarily invests in the securities of U.S. issuers, but it may also invest to a limited extent in the securities of foreign issuers.

The

PIMCO Total Return Fund Institutional Class

is invested primarily in investment-grade bonds, including U.S. government, corporate, mortgage-backed and foreign bonds.

The

Victory

Munder Mid-Cap Core Growth

Fund Clas

s

Y

invests at least 80% of its assets in equity securities of mid-capitalization companies. The fund defines these as companies with a market capitalization similar to those represented by the S&P Mid-Cap 400 Index.

The

Wells Fargo Advantage Special Mid-Cap Value Fund

Class R6

invests at least 80% of its net assets in equity securities of medium capitalization companies, which the managers define as securities of companies with market capitalizations within the range of the Russell Mid Cap Index at the time of purchase. In November 2015, this replaced The

Perkins Mid Cap Value Fund Class I

fund which was invested in assets which are common stocks of mid-sized companies whose stock prices are believed to be undervalued.

The

Dun & Bradstreet Stable Value Fund

is an investment option that seeks to provide safety of principal and a stable credited rate of interest. Galliard Capital Management, (“Galliard”) the fund’s advisor, invests in guaranteed investment contracts (“GICs”) and synthetic GICs. The synthetic GICs are comprised of a high quality fixed income portfolio invested in fixed income funds and wrap contracts issued by highly rated financial institutions. These wrap contracts serve to stabilize the return of the fund by offsetting price fluctuations in the underlying fixed income portfolio.

Payment of Benefits

If a participant leaves the Company, the participant is entitled to receive the vested value of the account balance. If a participant’s vested account value is $1,000 or less, it will be automatically paid in a lump-sum payment. If the vested value of the account balance is greater than $1,000, a participant may request an immediate lump-sum payment, or a participant may choose to delay payment to a later date, but not beyond April 1 of the year after the participant reaches age 70½. If a lump-sum distribution is received, the participant may be eligible to roll it over into another employer plan or an Individual Retirement Account (“IRA”).

All participants who are no longer actively employed with the Company may elect to receive installment payments under the Plan. Installment payments can be paid monthly, quarterly and annually, for a period not to exceed 20 years.

A participant who has been called to active military duty for a period in excess of 30 days may request a distribution of his or her pre-tax and Roth 401(k) contributions under the Plan. Taking such withdrawal would prohibit the participant from making contributions under the Plan for a 6 month period following the date of distribution.

In the event of death of an employee, if a participant’s account benefits value is $1,000 or less it will be paid to the employee’s beneficiary in a lump-sum payment; if the account value is greater than $1,000, the employee’s beneficiary may request an immediate lump-sum payment or the beneficiary may choose to delay payment of the account balance until March 1 of the year following the death. If a participant commenced payment in the form of installments prior to death, the beneficiary will receive the remaining account balance in the form of installments with the same frequency as had been received, unless the beneficiary elects and requests to receive the entire remaining amount in a lump-sum payment.

|

|

|

|

|

The Dun & Bradstreet Corporation 401(k) Plan

Notes to Financial Statements

December 31, 2016 and 2015

|

Notes Receivable from Participants

Participants may obtain loans from the Plan, which are collateralized by the vested balance in their accounts. The Plan limits the total number and amount of loans outstanding at any time for each participant, to two loans. The minimum loan amount is $500 and the maximum is the lower of 50% of a participant’s vested account balance or $50,000, limited by existing outstanding loans. Additionally, a participant’s loan repayment amount cannot exceed 15% of his or her semi-monthly gross compensation. Interest rates applicable to Plan loans are based on the prime rate as reported in Reuters on the last business day of the month before the loan is processed plus 2%. At December 31, 2016 and 2015, interest on participant loans ranged between 4.25% and 9.75% and 5.25% and 10.25%, respectively. Interest income from notes receivable from participants amounted to $371,092 in 2016 and $379,355 in 2015. Delinquent loans are treated as distributions based upon the terms of the Plan document.

Forfeited Accounts

Amounts forfeited in 2016 by non-vested participants amounted to $1,263,225. $1,284,382, including the beginning of year balance was used to reduce Company contributions. Forfeited balances totaled $37,127 and $26,760 at December 31, 2016 and 2015. The December 31, 2016 amount will be used to reduce future Company contributions.

Administration of the Plan

Effective February 2015, the Compensation and Benefits Committee of the Board of Directors of the Company approved the addition of two new management committees, the Qualified Plans Committee and the Qualified Plans Administration Committee, to oversee the administration of the Plan. The Qualified Plans Committee is authorized to delegate certain administrative duties to one or more administrative service providers. The Qualified Plans Administration Committee has the exclusive right to determine all matters relating to eligibility, interpretation and operation of the Plan.

The Qualified Plans Administration Committee serves as the ERISA named fiduciary of the Plan. The Qualified Plans Administration Committee is responsible for the control and management of the operation and administration of the Plan. Members of the Qualified Plans Administration Committee are appointed by the Qualified Plans Committee.

The Qualified Plans Investment Committee retains responsibility for the investment of assets in the Plan. Plan investment decisions (i.e. fund selections) are made by the Qualified Plans Investment Committee. Members of the Qualified Plans Investment Committee are appointed by the Qualified Plans Committee.

Fidelity Management Trust Company (the “Trustee”) is the Trustee of the Plan and has custody of the Plan’s assets. Fidelity Workplace Services LLC is the record keeper.

The expenses of administering the Plan are paid by the Company except for investment management fees, which are charged to the Plan, and certain loan and withdrawal transaction fees, which are paid by the participant.

Plan Termination

The Compensation and Benefits Committee of the Board of Directors of the Company reserves the right to amend, modify, suspend or terminate the 401(k) Plan. While the Company has not expressed any intention to discontinue its contributions or to terminate the Plan, it is free to do so at any time subject to the provisions of ERISA and the IRC, which state that, in such event, all participants of the Plan shall be fully vested in the amounts credited to their accounts.

2. Summary of Significant Accounting Policies

Basis of Accounting

The financial statements of the Plan have been prepared in accordance with accounting principles generally accepted in the United States of America using the accrual basis of accounting.

Investments held by a defined contribution plan are required to be reported at fair value, except for fully benefit-responsive investment contracts. Contract value is the relevant measure for the portion of the net assets available for benefits of a defined contribution plan attributable to fully benefit-responsive investment contracts because contract value is the amount participants normally would receive if they were to initiate permitted transactions under the terms of the Plan.

|

|

|

|

|

The Dun & Bradstreet Corporation 401(k) Plan

Notes to Financial Statements

December 31, 2016 and 2015

|

Use of Estimates

The preparation of the Plan’s financial statements in conformity with accounting principles generally accepted in the United States of America requires Plan management to make estimates and assumptions that affect the reported amounts of assets and liabilities and changes in those assets and liabilities, and when applicable, disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Risks and Uncertainties

The Plan provides for various investment options in any combination of a Company stock fund, common/collective trusts, mutual funds, a stable value fund,

and short term investments. Investment securities, in general, are exposed to various risks, such as interest rate, liquidity, credit and overall market volatility.

Due to the level of risk associated with certain investment securities and the level of uncertainty related to changes in the value of investment securities, it is at least reasonably possible that changes in the values in the near term could materially affect the amounts reported in the Statements of Net Assets Available for Benefits and the Statement of Changes in Net Assets Available for Benefits, as well as participant account balances.

The Plan is exposed to credit loss in the event of non-performance by the companies with whom the investment contracts are placed. However, the Plan administrators do not anticipate non-performance by these companies.

Payment of Benefits

Benefit payments to participants are recorded when paid.

Investment Valuation and Investment Income

Investments are reported at fair value (except for fully benefit-responsive investment contracts, which are reported at contract value). Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The Qualified Plans Investment Committee determines the Plan’s valuation policies utilizing information provided by investment advisors, custodians, and insurance companies.

Purchases and sales of investments are recorded on a trade-date basis. Dividend income is recorded on the ex-dividend date. Interest income is recorded as earned on an accrual basis.

The Plan presents in the Statement of Changes in Net Assets Available for Benefits the net appreciation or depreciation in the fair value of its investments, which consists of realized gains and losses and the unrealized appreciation and depreciation on those investments held during the year.

3. Fair Value Measurements

ASC 820,

Fair Value Measurement and Disclosures,

defines fair value and establishes a framework for measuring fair value under current accounting pronouncements. ASC 820 provides a fair value hierarchy which gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). ASC 820 defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants at the measurement date.

The three levels of the fair value hierarchy under ASC 820 are described below as follows:

Level 1 - Inputs to the valuation methodology are unadjusted quoted prices available in active markets for identical investments that the Plan can access at the reporting date.

Level 2 - Inputs to the valuation methodology are other than quoted prices in active markets, which are either directly or indirectly observable as of the reporting date, and fair value can be determined through the use of models or other valuation methodologies. Inputs to the valuation methodology include quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in inactive markets; inputs other than quoted prices that are observable for the asset; and inputs that are derived principally from or corroborated by observable market data by correlation or other means.

|

|

|

|

|

The Dun & Bradstreet Corporation 401(k) Plan

Notes to Financial Statements

December 31, 2016 and 2015

|

If the asset has a specified (contractual) term, the Level 2 input must be observable for substantially the full term of the asset or liability.

Level 3 - Inputs to the valuation methodology that are unobservable and significant to the fair values for the asset or liability.

A financial instrument’s level or categorization within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement.

The following is a description of the valuation methodologies used for the investments measured at fair value, including the general classification of such investments pursuant to the valuation hierarchy. There have been no changes in the methodologies used and the Plan had no Level 3 investments at December 31, 2016 and 2015.

Dun & Bradstreet Corporation Common Stock Fund

The Dun & Bradstreet Corporation Common Stock Fund (the “Fund”) is an employer stock unitized fund. The Fund consists of Dun & Bradstreet Corporation common stock and a short-term cash component, which provides liquidity to meet the Fund's daily liquidity needs. The value of a unit in a unitized stock fund is the Net Asset Value (“NAV”) which is the value of the underlying common stock and the cash component held by the fund, divided by the number of units outstanding. The Dun & Bradstreet Corporation Common Stock Fund is classified within Level 1 of the valuation hierarchy.

Collective Investment Trusts

These investments are investment vehicles valued using the reported NAV. The NAV is based on the value of the underlying assets owned by the fund, minus its liabilities, and then divided by the number of shares outstanding. This asset category does not have any unfunded commitments or redemption restrictions.

Mutual Funds

These investments are public investment securities held by the Plan that are registered with the Securities and Exchange Commission and valued using the reported NAV. The NAV is based on the value of the underlying assets owned by the fund, minus its liabilities, and then divided by the number of shares outstanding. Mutual funds are classified within Level 1 of the valuation hierarchy because mutual funds are publicly traded and the NAV is quoted in active markets and may be redeemed daily.

Short Term Investment Funds (“STIF”)

These investments are collective trusts whose assets typically include cash, bank notes, corporate notes, government bills and various short-term debt instruments. They are valued at the reported NAV of $1. The short term funds are classified within Level 2 of the valuation hierarchy as the underlying investment inputs are observable.

The methods described above may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

The following table sets forth by level, within the fair value hierarchy, the Plan's assets at fair value as of December 31, 2016.

|

|

|

|

|

The Dun & Bradstreet Corporation 401(k) Plan

Notes to Financial Statements

December 31, 2016 and 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(dollars in thousands)

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

The Dun & Bradstreet Corporation Common Stock Fund

|

$

|

48,562

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

48,562

|

|

|

Mutual Funds

|

|

|

|

|

|

|

|

|

Growth Funds

|

522,122

|

|

|

—

|

|

|

—

|

|

|

522,122

|

|

|

Fixed Income Funds

|

71,764

|

|

|

—

|

|

|

—

|

|

|

71,764

|

|

|

Total Mutual Funds

|

593,886

|

|

|

—

|

|

|

—

|

|

|

593,886

|

|

|

Money Market Funds

|

—

|

|

|

8,028

|

|

|

—

|

|

|

8,028

|

|

|

Total

|

$

|

642,448

|

|

|

$

|

8,028

|

|

|

$

|

—

|

|

|

$

|

650,476

|

|

|

|

|

|

|

|

|

|

Other Investments Measured at Net Asset Value (a)

|

|

|

Common / Collective Trusts

|

|

|

Target Date Retirement Funds

|

127,977

|

|

|

Total Common / Collective Trusts

|

127,977

|

|

|

Total Other Investments Measured at Net Asset Value

|

$

|

127,977

|

|

|

Net Receivables

|

71

|

|

|

Total Investments at Fair Value

|

$

|

778,524

|

|

(a) In accordance with ASU No. 2015 - 07, certain investments that are measured at fair value using the NAV per share practical expedient have not been classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit a reconciliation of the fair value to the amounts presented in the Statement of Net Assets Available for Benefits.

There were no significant transfers among the levels of the fair value hierarchy during the year ended December 31, 2016.

The following table sets forth by level, within the fair value hierarchy, the Plan's assets at fair value as of December 31, 2015.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(dollars in thousands)

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

The Dun & Bradstreet Corporation Common Stock Fund

|

$

|

47,566

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

47,566

|

|

|

Mutual Funds

|

|

|

|

|

|

|

|

|

Growth Funds

|

514,867

|

|

|

—

|

|

|

—

|

|

|

514,867

|

|

|

Fixed Income Funds

|

71,288

|

|

|

—

|

|

|

—

|

|

|

71,288

|

|

|

Total Mutual Funds

|

586,155

|

|

|

—

|

|

|

—

|

|

|

586,155

|

|

|

Money Market Funds

|

—

|

|

|

10,170

|

|

|

—

|

|

|

10,170

|

|

|

Total

|

$

|

633,721

|

|

|

$

|

10,170

|

|

|

$

|

—

|

|

|

$

|

643,891

|

|

|

|

|

|

|

The Dun & Bradstreet Corporation 401(k) Plan

Notes to Financial Statements

December 31, 2016 and 2015

|

|

|

|

|

|

|

|

|

Other Investments Measured at Net Asset Value (a)

|

|

|

Common / Collective Trusts

|

|

|

Target Date Retirement Funds

|

103,793

|

|

|

Total Common / Collective Trusts

|

103,793

|

|

|

Total Other Investments Measured at Net Asset Value

|

$

|

103,793

|

|

|

Net Payables

|

(88

|

)

|

|

Total Investments at Fair Value

|

$

|

747,596

|

|

(a) In accordance with ASU No. 2015 - 07, certain investments that are measured at fair value using the NAV per share practical expedient have not been classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit a reconciliation of the fair value to the amounts presented in the Statement of Net Assets Available for Benefits.

There were no significant transfers among the levels of the fair value hierarchy during the year ended December 31, 2015.

4. Investments

Investments held by the Plan at December 31, 2016 and 2015 are summarized as follows:

|

|

|

|

|

|

|

|

|

|

|

|

(dollars in thousands)

|

2016

|

|

2015

|

|

At fair value:

|

|

|

|

|

Common Stock *

|

$

|

47,982

|

|

|

$

|

46,920

|

|

|

Common / Collective Trusts

|

127,977

|

|

|

103,793

|

|

|

Mutual Funds

|

593,886

|

|

|

586,155

|

|

|

Traditional GICs

|

34,102

|

|

|

—

|

|

|

Synthetic GICs

|

96,593

|

|

|

133,279

|

|

|

Short Term Investment Funds, Money Market Funds, Net Receivables

|

8,679

|

|

|

10,728

|

|

|

Total Investments held by the Plan

|

$

|

909,219

|

|

|

$

|

880,875

|

|

* Common Stock represents the Dun & Bradstreet Common Stock held within the Dun & Bradstreet Common Stock Fund which is valued at $48,562 and $47,566 as of December 31, 2016 and 2015 respectively.

5. Contracts with Insurance Companies

The Plan offers an investment in the Dun & Bradstreet Stable Value Fund (“Stable Value Fund”). The Dun & Bradstreet Stable Value Fund holds a portfolio of synthetic investment contracts. These contracts meet the fully benefit-responsive criteria and therefore are reported at contract value. Contract value is the relevant measure for fully benefit-responsive contracts because this is the amount received by participants if they were to initiate permitted transactions (for example, withdrawals) under the terms of the Plan. Contract value represents contributions made under each contract, plus earnings, less withdrawals and administrative expenses. Participants may ordinarily direct the withdrawal or transfer of all or a portion of their investment at contract value.

The Stable Value Fund invests in cash equivalents, traditional GICs issued by banks or insurance companies, and synthetic GICs. Synthetic GICs include security-backed contracts which are comprised of two components, an underlying fixed income portfolio that invests primarily in U.S. domestic fixed income securities (bonds) and a wrap contract issued by a financial institution to provide stability of principal and interest. The Stable Value Fund is invested in broadly diversified portfolios of fixed income securities including financial instruments issued by highly rated companies.

|

|

|

|

|

The Dun & Bradstreet Corporation 401(k) Plan

Notes to Financial Statements

December 31, 2016 and 2015

|

There are no reserves required against contract value for credit risk of the contract issuer or otherwise. Credited interest rates for fixed rate contracts are fixed for the duration of such contracts and depend upon market conditions when the contract is negotiated. For floating rate contracts, interest rates are reset each quarter.

The following represents the disaggregation of contract value investments between types of investment contracts held by the Plan at December 31, 2016 and 2015.

|

|

|

|

|

|

|

|

|

|

|

|

(dollars in thousands)

|

2016

|

|

2015

|

|

Traditional Investment Contracts

|

$

|

34,102

|

|

|

$

|

—

|

|

|

Synthetic Investment Contracts

|

96,593

|

|

|

133,279

|

|

|

Total

|

$

|

130,695

|

|

|

$

|

133,279

|

|

The difference between a synthetic investment contract and a traditional investment contract is that the Plan owns the underlying assets of the synthetic investment contract. A synthetic investment contract includes a wrapper contract, which is an agreement for the wrap issuer, such as a bank or insurance company, to make payment to the Plan in certain circumstances. The wrapper contract typically includes certain conditions and limitations on the underlying assets owned by the Plan. With traditional investment contracts, the Plan owns only the contract itself. Synthetic and traditional contracts are designed to accrue interest based on crediting rates established by the contract issuers.

The synthetic investment contracts held by the Plan include wrapper contracts that provide a guarantee that the credit rate will not fall below zero percent. Cash flow volatility (for example, timing of benefit payments) as well as asset underperformance can be passed through to the Plan through adjustment to future contract crediting rates. Formulas are provided in each contract that adjust renewal crediting rates to recognize the difference between the fair value and the book value of the underlying assets. Crediting rates are reviewed monthly for resetting.

Traditional investment contracts held by the Plan are considered guaranteed investment contracts. The contract issuer was contractually obligated to repay the principal and interest at a specified interest rate that was guaranteed by the Plan. The Plan's ability to receive amounts due in accordance with fully benefit-responsive contracts was dependent on the third-party issuer’s ability to meets its financial obligations. The issuer’s ability to meets its contractual obligations may be affected by future economic and regulatory developments.

Certain events limit the ability of the Plan to transact at contract value with the issuer. Such events include the following: (1) amendments to the Plan documents (including complete or partial Plan termination or merger with another plan), (2) changes to the Plan’s prohibition on competing investment options, (3) bankruptcy of the Plan sponsor or other Plan sponsor events (for example, divestitures or spin-offs of a subsidiary) that cause a significant withdrawal from the Plan, or (4) failure of the Plan or its trust to qualify for exemption from federal income taxes or any required prohibited transaction exemption under the Employee Retirement Income Security Act of 1974. The Plan administrators do not believe that the occurrence of any such value event, which would limit the Plan’s ability to transact at contract value with participants, is probable.

The investment contracts do not permit the insurance companies to terminate the agreement prior to the scheduled maturity date.

6. Tax Status

On May 31, 2013 the Company received a favorable determination letter from the IRS on the Plan which included all amendments made to the Plan and related Trust Document executed subsequent to the receipt of the prior determination letter. In IRS Announcement 2015-19, issued on July 21, 2015, the IRS said it is eliminating the staggered five-year determination remedial amendment cycles for individually designed tax-qualified retirement plans effective January 1, 2017.

The Plan administrators believe that the Plan is designed and is currently being operated in compliance with the applicable requirements of the IRC and, therefore, believe that the Plan is qualified and that the related trust is tax-

|

|

|

|

|

The Dun & Bradstreet Corporation 401(k) Plan

Notes to Financial Statements

December 31, 2016 and 2015

|

exempt. Participants will not be subject to income tax for contributions made on their behalf by the Company, nor on money earned by the Plan and credited to their account until such time as they withdraw their balance.

Accounting principles generally accepted in the United States of America require Plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. The Company has analyzed the tax positions by the Plan, and has concluded that as of December 31, 2016 and 2015, there are no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan has recognized no interest or penalties related to any uncertain tax positions. The Plan is subject to routine audits by taxing jurisdictions. The Company believes it is no longer subject to income tax examinations for years prior to 2013.

7. Related-Party Transactions

Certain Plan investments are in shares of mutual funds managed by Fidelity Management Trust Company. Fidelity Management Trust Company is the Trustee as defined by the Plan and, therefore, these transactions qualify as party-in-interest transactions. The following is the activity for the year ending December 31, 2016.

|

|

|

|

|

|

|

|

(dollars in thousands)

|

Fidelity Mutual Funds

|

|

Settled amount from purchases

|

$

|

22,420

|

|

|

Settled amount from sales

|

$

|

63,246

|

|

|

Dividends paid

|

$

|

4,695

|

|

|

Net appreciation

|

$

|

638

|

|

|

Total value on December 31, 2016

|

$

|

105,546

|

|

Fees paid by the Plan for Administrative expenses paid to the Trustee amounted to $324,209 for the year ended December 31, 2016.

The Plan invests in The Dun & Bradstreet Common Stock Fund. This qualifies as a party-in-interest transaction. The following is the activity for the year ending December 31, 2016.

|

|

|

|

|

|

|

|

(dollars in thousands)

|

The Dun & Bradstreet Common Stock Fund

|

|

Settled amount from purchases

|

$

|

8,785

|

|

|

Settled amount from sales

|

$

|

15,126

|

|

|

Dividends paid

|

$

|

804

|

|

|

Net appreciation

|

$

|

7,337

|

|

|

Total value on December 31, 2016

|

$

|

48,562

|

|

8. Transfers In

Effective January 1, 2016, eligible employees of Dun & Bradstreet NetProspex, Inc. (“NetProspex”) and Dun & Bradstreet Credibility Corp. (“Credibility Corp.”) became eligible to participate in the Plan. NetProspex and Credibility Corp were acquisitions of the Company in 2015. On February 1, 2016 assets were transferred into the 401(k) Plan amounting to $2,520,271 and $8,262,226 respectively, for NetProspex and Credibility Corp.

9. Subsequent Events

The Plan evaluates subsequent events and the evidence they provide about conditions existing at the date of the Statement of Net Assets Available for Benefits as well as conditions that arose after the Statement of Net Assets Available for Benefits date but before

the financial statements are issued. The effects of conditions that existed at the date of the Statement of Net Assets Available for

Benefits date are recognized in the financial statements. Events and

|

|

|

|

|

The Dun & Bradstreet Corporation 401(k) Plan

Notes to Financial Statements

December 31, 2016 and 2015

|

conditions arising after the Statement of Net Assets Available for

Benefits date but before the financial statements are issued are evaluated to determine if disclosure is required to keep the financial statements from being misleading. To the extent such events and conditions exist, disclosures are made regarding the nature of the events and the estimated financial effects for those events and conditions. Management has applied this guidance and determined that it had no effect on the Plan’s financial statements.

10. Reconciliation of Financial Statements to Form 5500

The accompanying financial statements present fully benefit-responsive contracts at contract value. The Form 5500 requires fully benefit-responsive contracts to be reported at fair value. Therefore, there is an adjustment from fair value to contract value for fully benefit-responsive contracts which represents a reconciling item.

The following is a reconciliation of Net Assets Available for Benefits from the Plan’s financial statements to the Form 5500:

|

|

|

|

|

|

|

|

|

|

|

|

(dollars in thousands)

|

December 31, 2016

|

|

December 31, 2015

|

|

Net assets available for benefits per financial statements:

|

$

|

916,127

|

|

|

$

|

888,150

|

|

|

Adjustment from contract value to fair value for fully benefit-responsive investment contracts

|

1,027

|

|

|

1,609

|

|

|

Net assets available for benefits per Form 5500:

|

$

|

917,154

|

|

|

$

|

889,759

|

|

The following is a reconciliation of the net increase in Net Assets Available for Benefits from the Plan’s financial statements to the Form 5500:

|

|

|

|

|

|

|

|

(dollars in thousands)

|

December 31, 2016

|

|

Net increase in net assets available for benefits per the financial statements:

|

$

|

27,977

|

|

|

Change in adjustment from contract value to fair value for fully benefit-responsive investment contracts

|

(582

|

)

|

|

Transfers in (Note 8)

|

$

|

(10,782

|

)

|

|

Net income per the Form 5500:

|

$

|

16,613

|

|

|

|

|

|

|

The Dun & Bradstreet Corporation 401 (k) Plan

Schedule H, Line 4i - Schedule of Assets (Held at End of Year)

December 31, 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

(b)

|

|

(c)

|

|

(d)

|

|

(e)

|

|

|

|

Identity of issue, borrower, lessor or similar party

|

|

Description of investment including maturity date, rate of interest, collateral, par or maturity value

|

|

Cost

|

|

Current Value

|

|

*

|

|

The Dun & Bradstreet Corporation Common Stock Fund

|

|

Common Stock and Money Market Funds

|

|

**

|

|

$

|

48,561,972

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vanguard Target Retirement Income Trust II

|

|

Common / Collective Trusts

|

|

**

|

|

19,835,454

|

|

|

|

|

Vanguard Target Retirement 2020 Trust II

|

|

Common / Collective Trusts

|

|

**

|

|

16,768,984

|

|

|

|

|

Vanguard Target Retirement 2025 Trust II

|

|

Common / Collective Trusts

|

|

**

|

|

21,477,264

|

|

|

|

|

Vanguard Target Retirement 2030 Trust II

|

|

Common / Collective Trusts

|

|

**

|

|

22,508,144

|

|

|

|

|

Vanguard Target Retirement 2035 Trust II

|

|

Common / Collective Trusts

|

|

**

|

|

17,525,126

|

|

|

|

|

Vanguard Target Retirement 2040 Trust II

|

|

Common / Collective Trusts

|

|

**

|

|

10,565,025

|

|

|

|

|

Vanguard Target Retirement 2045 Trust II

|

|

Common / Collective Trusts

|

|

**

|

|

9,891,194

|

|

|

|

|

Vanguard Target Retirement 2050 Trust II

|

|

Common / Collective Trusts

|

|

**

|

|

6,774,934

|

|

|

|

|

Vanguard Target Retirement 2055 Trust II

|

|

Common / Collective Trusts

|

|

**

|

|

2,631,282

|

|

|

|

|

|

|

|

|

|

|

127,977,407

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BlackRock Small Cap Growth Equity Portfolio Institutional Class

|

|

Mutual Funds

|

|

**

|

|

6,648,594

|

|

|

*

|

|

Fidelity Blue Chip Growth Fund - Class K

|

|

Mutual Funds

|

|

**

|

|

48,180,830

|

|

|

*

|

|

Fidelity Diversified International Fund - Class K

|

|

Mutual Funds

|

|

**

|

|

25,005,471

|

|

|

*

|

|

Fidelity Low-Priced Stock Fund - Class K

|

|

Mutual Funds

|

|

**

|

|

32,360,127

|

|

|

|

|

JPMorgan Equity Income Fund - Class R6

|

|

Mutual Funds

|

|

**

|

|

26,180,275

|

|

|

|

|

Northern Small Cap Value Fund

|

|

Mutual Funds

|

|

**

|

|

7,237,112

|

|

|

|

|

PIMCO Total Return Fund Institutional Class

|

|

Mutual Funds

|

|

**

|

|

44,213,574

|

|

|

|

|

Vanguard Institutional Index Fund Institutional Plus

|

|

Mutual Funds

|

|

**

|

|

229,357,368

|

|

|

|

|

Vanguard Extended Market Index Fund Institutional Shares

|

|

Mutual Funds

|

|

**

|

|

66,053,486

|

|

|

|

|

Vanguard Developed Markets Index Fund Institutional Shares

|

|

Mutual Funds

|

|

**

|

|

45,958,376

|

|

|

|

|

Vanguard Total Bond Market Index Fund Institutional Shares

|

|

Mutual Funds

|

|

**

|

|

27,550,973

|

|

|

|

|

Victory Munder Mid-Cap Core Growth Fund Class Y

|

|

Mutual Funds

|

|

**

|

|

25,490,553

|

|

|

|

|

Wells Fargo Advantage Special Mid Cap Value Fund - Class R6

|

|

Mutual Funds

|

|

**

|

|

9,649,527

|

|

|

|

|

|

|

|

|

|

|

593,886,266

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dun & Bradstreet Stable Value Fund - Insurance and Investment Contracts

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Traditional GIC

|

|

|

|

|

|

|

|

|

|

Metropolitan Life Insurance Company

|

|

Insurance Contract #35459 ADJ%12/31/2050

|

|

**

|

|

34,102,657

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Synthetic GICs

|

|

|

|

|

|

|

|

|

|

Transamerica Premier Life Insurance Company

|

|

Synthetic GIC # MDA00948TR ADJ% 12/31/2050

|

|

|

|

|

|

|

|

Underlying Assets

|

|

|

|

|

|

|

|

|

|

Galliard-Wells Fargo Fixed Income Fund A

|

|

Fixed Income Securities

|

|

**

|

|

12,471,472

|

|

|

|

|

Galliard-Wells Fargo Fixed Income Fund F

|

|

Fixed Income Securities

|

|

**

|

|

20,882,362

|

|

|

|

|

|

|

|

|

|

|

33,353,834

|

|

|

|

|

Prudential Insurance Company of America

|

|

Synthetic GIC #GA-62434 ADJ% 12/31/2040

|

|

|

|

|

|

|

|

Underlying Assets

|

|

|

|

|

|

|

|

|

|

Galliard-Wells Fargo Fixed Income Fund A

|

|

Fixed Income Securities

|

|

**

|

|

20,309,460

|

|

|

|

|

Galliard-Wells Fargo Fixed Income Fund F

|

|

Fixed Income Securities

|

|

**

|

|

12,861,303

|

|

|

|

|

|

|

|

|

|

|

33,170,763

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Dun & Bradstreet Corporation 401 (k) Plan

Schedule H, Line 4i - Schedule of Assets (Held at End of Year)

December 31, 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

American General Life Insurance Company

|

|

Synthetic GIC # 1629649 ADJ% 2/1/50

|

|

|

|

|

|

|

|

Underlying Assets

|

|

|

|

|

|

|

|

|

|

Galliard-Wells Fargo Fixed Income Fund D

|

|

Fixed Income Securities

|

|

**

|

|

19,452,248

|

|

|

|

|

Galliard-Wells Fargo Fixed Income Fund F

|

|

Fixed Income Securities

|

|

**

|

|

11,642,913

|

|

|

|

|

|

|

|

|

|

|

31,095,161

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wells Fargo Short-Term Investment Fund

|

|

Money Market Funds

|

|

**

|

|

8,027,566

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Value Dun & Bradstreet Stable Value Fund

|

|

|

|

|

|

139,749,981

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Receivables

|

|

|

|

|

|

71,295

|

|

|

|

|

Notes Receivable from Participants

|

|

Participants Loans (interest rates ranging from 4.25% - 9.75% and maturing through 2026)

|

|

|

|

6,907,651

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

|

|

$

|

917,154,572

|

|

|

*

|

|

Party In Interest Transactions

|

|

|

|

|

|

|

|

**

|

|

Not applicable as these are participant-directed transactions

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Qualified Plans Administration Committee of The Dun & Bradstreet Corporation has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

THE DUN & BRADSTREET CORPORATION 401 (k) PLAN

|

|

By:

|

|

/s/ Anthony Pietrontone, Jr.

|

|

|

|

Anthony Pietrontone, Jr.

|

|

|

|

Principal Accounting Officer and Corporate Controller,

The Dun & Bradstreet Corporation

|

|

|

|

|

|

|

|

By:

|

|

/s/ Roslynn Williams

|

|

|

|

Roslynn Williams

|

|

|

|

Chief People Officer,

The Dun & Bradstreet Corporation

|

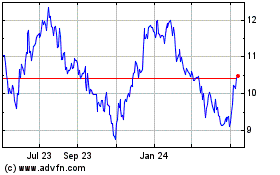

Dun and Bradstreet (NYSE:DNB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dun and Bradstreet (NYSE:DNB)

Historical Stock Chart

From Apr 2023 to Apr 2024