Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

x

Annual Report Pursuant to Section 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2016; or

o

Transition Report Pursuant to Section 15(d) of the Securities Exchange Act of 1934

For the transition period from to

Commission file number: 1-14446

TD 401(k) Retirement Plan

c/o TD Bank US Holding Company

One Portland Square

Portland, ME 04104

(Full title of the plan)

THE TORONTO-DOMINION BANK

(Name of issuer of the securities held pursuant to the plan)

P.O. BOX 1

TORONTO-DOMINION CENTRE

KING STREET WEST AND BAY STREET

TORONTO, ONTARIO M5K1A2

CANADA

(Address of principal executive offices)

Table of Contents

TD 401(k) Retirement Plan

Form 11-K

Years Ended December 31, 2016 and 2015

Contents

Table of Contents

|

|

Ernst & Young LLP

5 Times Square

New York, NY 10036

|

Tel: +1 212 773 3000

ey.com

|

Report of Independent Registered Public Accounting Firm

The Plan Administrator

TD 401(k) Retirement Plan

We have audited the accompanying statements of net assets available for benefits of TD 401(k) Retirement Plan as of December 31, 2016 and 2015, and the related statements of changes in net assets available for benefits for the years then ended. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. We were not engaged to perform an audit of the Plan’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of TD 401(k) Retirement Plan at December 31, 2016 and 2015, and the changes in its net assets available for benefits for the years then ended, in conformity with U.S. generally accepted accounting principles.

The accompanying supplemental schedule of assets (held at end of year) as of December 31, 2016, has been subjected to audit procedures performed in conjunction with the audit of TD 401(k) Retirement Plan’s financial statements. The information in the supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the information, we evaluated whether such information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the information is fairly stated, in all material respects, in relation to the financial statements as a whole.

|

|

|

|

|

June 22, 2017

|

A member firm of Ernst & Young Global Limited

1

Table of Contents

TD 401(k) Retirement Plan

Statements of Net Assets Available for Benefits

|

|

|

December 31,

|

|

|

|

|

2016

|

|

2015

|

|

|

Assets

|

|

|

|

|

|

|

Noninterest-bearing cash

|

|

$

|

117,878

|

|

$

|

25,609

|

|

|

Investments, at fair value (see Note 5)

|

|

2,314,495,526

|

|

2,043,061,004

|

|

|

Total investments

|

|

2,314,613,404

|

|

2,043,086,613

|

|

|

|

|

|

|

|

|

|

Notes receivable from participants

|

|

50,773,159

|

|

49,396,124

|

|

|

Employer core contributions receivable

|

|

50,638,165

|

|

47,359,562

|

|

|

Employer matching contributions receivable

|

|

1,919,906

|

|

2,450,953

|

|

|

Total receivables

|

|

103,331,230

|

|

99,206,639

|

|

|

|

|

|

|

|

|

|

Net assets available for benefits

|

|

$

|

2,417,944,634

|

|

$

|

2,142,293,252

|

|

See accompanying notes.

2

Table of Contents

TD 401(k) Retirement Plan

Statements of Changes in Net Assets Available for Benefits

|

|

|

Year Ended December 31,

|

|

|

|

|

2016

|

|

2015

|

|

|

Additions:

|

|

|

|

|

|

|

Additions to net assets attributed to:

|

|

|

|

|

|

|

Interest and dividends

|

|

$

|

81,763,811

|

|

$

|

82,857,954

|

|

|

Net appreciation (depreciation) in fair value of investments

|

|

115,819,286

|

|

(94,183,586

|

)

|

|

Net investment income (loss)

|

|

197,583,097

|

|

(11,325,632

|

)

|

|

|

|

|

|

|

|

|

Contributions:

|

|

|

|

|

|

|

Participant

|

|

104,619,897

|

|

89,434,495

|

|

|

Employer

|

|

101,569,250

|

|

92,665,606

|

|

|

Rollovers

|

|

19,015,095

|

|

13,877,729

|

|

|

Total contributions

|

|

225,204,242

|

|

195,977,830

|

|

|

Transfer of assets from TD Securities USA 401(k) Plan (See Note 1)

|

|

—

|

|

188,621,218

|

|

|

Other income

|

|

4,057,366

|

|

3,138,851

|

|

|

Total additions

|

|

426,844,705

|

|

376,412,267

|

|

|

|

|

|

|

|

|

|

Deductions:

|

|

|

|

|

|

|

Deductions from net assets attributed to:

|

|

|

|

|

|

|

Benefits paid to participants

|

|

150,816,357

|

|

152,392,550

|

|

|

Administrative expenses

|

|

376,966

|

|

230,462

|

|

|

Total deductions

|

|

151,193,323

|

|

152,623,012

|

|

|

|

|

|

|

|

|

|

Net increase in net assets available for benefits

|

|

275,651,382

|

|

223,789,255

|

|

|

|

|

|

|

|

|

|

Net assets available for benefits:

|

|

|

|

|

|

|

Beginning of year

|

|

2,142,293,252

|

|

1,918,503,997

|

|

|

End of year

|

|

$

|

2,417,944,634

|

|

$

|

2,142,293,252

|

|

See accompanying notes.

3

Table of Contents

TD 401(k) Retirement Plan

Notes to Financial Statements

December 31, 2016

1. Description of the Plan

The TD 401(k) Retirement Plan (the “Plan”) is a defined contribution plan sponsored by TD Bank US Holding Company (the “Company”), an indirect wholly-owned subsidiary of The Toronto-Dominion Bank. The following provides only general information about the Plan. Participants should refer to the Plan document for a more complete description of the Plan’s provisions. Capitalized terms used herein but not defined shall have the meaning attributed to them in the Plan document.

General

The Plan, which became effective October 1, 1985, as amended to allow hardship withdrawal distributions and loans from a participant’s core contribution account and transition account for the period beginning October 17, 2016 and ending December 17, 2016, and restated effective December 30, 2016, is a defined contribution plan subject to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”). Employees are eligible to contribute to the Plan on the first of the month following (or coincident with) completion of one month of service.

The TD Securities USA 401(k) Plan was and merged into and made a part of the Plan effective December 31, 2015. Total assets transferred into the Plan were $188.6 million which consisted of mutual funds, Toronto Dominion Bank stock, and loans to participants and were measured at fair value. Since both plans were administered by T. Rowe Price and had identical investment offerings, the merger of the two plans was an administrative change only.

Plan Administration

The Plan is administered by The Toronto-Dominion Bank (the “Plan Administrator”). The Plan Administrator has assigned the record-keeping, trustee and custodial responsibilities of the Plan to T. Rowe Price, who also serves as Trustee of the Plan.

Contributions

Participants may contribute to the Plan, on a pre-tax basis, up to 50% of their eligible compensation. Eligible compensation considered for this purpose meets the standards defined by the Internal Revenue Code (the “Code”) for safe harbor plans and includes, but is not limited to, regular earnings, overtime pay, commissions, bonuses and incentives. Participants may also roll over their account balances from a prior employers’ qualified defined benefit or defined contribution plan.

4

Table of Contents

TD 401(k) Retirement Plan

Notes to Financial Statements (continued)

1. Description of the Plan (continued)

Participants are eligible for Company matching contributions on the first of the month following (or coincident with) completion of twelve months of service. The Company match was designed to meet the standards for safe harbor treatment as defined by the Code. The Company matches 100% of participant contributions up to the first 3% of eligible compensation and 50% on the next 3% of eligible compensation. The Company matching contributions for 2016 and 2015 totaled $51.0 million and $46.0 million, respectively. Participants’ contributions are subject to Code limitation, which was $18,000 for 2016 and 2015. Catch-up contributions (within the meaning of Section 414(v) of the Code) can also be made by participants who reach age 50 during the plan year. Participants are only permitted to make catch-up contributions after they have already contributed the maximum amount for the year. The catch-up contribution limit was $6,000 in 2016 and 2015.

The Plan also includes an employer core contribution from the Company for all eligible employees. To be eligible for a core contribution, an employee must first complete a year of service with the Company and be at least 21 years of age. Once this requirement is met, a participant is eligible for an allocation for the plan year if they are employed on the first and last day of the year, and work at least 1,000 hours during the year. The core contribution is determined based on the sum of a participant’s age and years of service (both calculated in whole years on the first day of each year) in accordance with the following schedule:

|

Years of Age +Years of Service

|

|

Core Contribution

(Percentage of

Eligible

Compensation)

|

|

|

|

|

|

|

|

Less than 35

|

|

2.0

|

%

|

|

35 — 44

|

|

2.5

|

%

|

|

45 — 54

|

|

3.0

|

%

|

|

55 — 64

|

|

4.0

|

%

|

|

65 — 69

|

|

5.0

|

%

|

|

70 or more

|

|

6.0

|

%

|

5

Table of Contents

TD 401(k) Retirement Plan

Notes to Financial Statements (continued)

1. Description of the Plan (continued)

The core contributions for 2016 and 2015 were $50.6 million and $46.6 million, respectively. The core contributions were paid to the Plan in February 2017 and 2016, respectively.

Participant Accounts

Each participant’s account reflects the participant’s contributions, rollover, and Company contributions as well as earnings or losses on those contributions. The account has been reduced by withdrawals and any applicable direct expenses.

Vesting

Participant contributions, any safe harbor employer matching contributions, and any earnings thereon are immediately vested.

Participants whose employment is terminated for any reason other than death or becoming disabled prior to reaching Normal Retirement Age, as defined by the Plan, shall have a non- forfeitable interest in the value of their core and transition contributions, and any earnings thereon, in accordance with the following schedule:

|

Years of Service (as defined by the Plan)

|

|

Vested Percentage

|

|

|

|

|

|

|

|

Less than three years

|

|

0

|

%

|

|

Three or more years

|

|

100

|

%

|

Notwithstanding the foregoing, any prior Plan balances from merged plans shall continue to vest in accordance with their respective vesting schedules.

6

Table of Contents

TD 401(k) Retirement Plan

Notes to Financial Statements (continued)

1. Description of the Plan (continued)

Notes Receivable from Participants

Notes receivable from participants represent participant loans that are recorded at their unpaid principal balance plus any accrued but unpaid interest. Interest income on notes receivable from participants is recorded when it is earned. Related fees are recorded as administrative expenses and are expensed when they are incurred. No allowance for credit losses has been recorded as of December 31, 2016 or 2015. If a participant ceases to make loan repayments and the Plan Administrator deems the participant loan to be a distribution, the participant loan balance is reduced and a benefit payment is recorded.

Participants may borrow from their accounts, excluding balances related to core or transition contributions. The minimum amount that a participant may borrow is $1,000 and the maximum is equal to the lesser of $50,000 or 50% of the account balance. Loans must be paid over a period of up to five years (up to 15 years for the purchase of a principal residence). The loans are secured by the balance in the Participant’s account and bear interest at a fixed rate established by the Plan Administrator based on the Prime Rate as reported in The Wall Street Journal on the date that the loan application is processed. Interest rates range from 3.25% to 9.25% on loans outstanding at December 31, 2016 and 2015. Principal and interest are paid through payroll deductions.

Benefits

Participants may elect, at any time, to withdraw all or a portion of their account related to a rollover contribution, including earnings on those contributions. After attaining age 59½, participants may withdraw all or part of their total account balance. In the event of a qualifying hardship, participants may withdraw their participant contributions, rollover contributions, certain balances from prior Plans (as further defined in the Plan document), and related earnings.

Upon termination of employment or retirement, participants can elect to take a lump sum distribution or leave their account balance in the Plan. If the participant’s vested account balance is less than $1,000, the participant is paid a single lump sum equal to the value of his or her vested account. In the event of death, the balance in the participant’s account is paid to the designated beneficiary as provided by the Plan.

7

Table of Contents

TD 401(k) Retirement Plan

Notes to Financial Statements (continued)

1. Description of the Plan (continued)

Participant Investment Options

Each participant has the option of allocating employee and employer contributions into various investment options offered by the Plan. Investment options include mutual funds, a common collective trust fund (the T. Rowe Price Stable Value Common Trust Fund) and common shares of The Toronto-Dominion Bank. Effective January 1, 2014, a participant’s investment direction with respect to future contributions and the reinvestment of all or a portion of their account shall be subject to a 20 percent limitation on investment in the common shares of The Toronto-Dominion Bank.

Forfeitures

Amounts in which the Participant does not have a vested interest shall be forfeited by the Participant after five consecutive one-year breaks in service, as defined by the Plan document. At December 31, 2016 and 2015, forfeited non-vested accounts from terminated employees totaled $1,152,556 and $988,279, respectively, and were maintained in a separate account and are available to offset future employer contributions. For the years ended December 31, 2016 and 2015, employer contributions were reduced by $1,076,863 and $795,817, respectively, from forfeited accounts.

Voting Rights

Each participant is entitled to exercise voting rights attributable to The Toronto-Dominion Bank common shares allocated to his or her account and is notified by the transfer agent prior to the time that such rights are to be exercised. The Trustee is permitted to vote in the best interest of plan participants’ shares for which instructions have not been given by a participant.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”) and are presented on the accrual basis of accounting.

8

Table of Contents

TD 401(k) Retirement Plan

Notes to Financial Statements (continued)

2. Summary of Significant Accounting Policies (continued)

Reclassification

Certain amounts in the prior period have been reclassified to conform to the current year presentation.

Management Estimates

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and changes therein, and disclosures of contingent assets and liabilities. Actual results could differ from those estimates.

Investment Valuation and Income Recognition

Investments held by the Plan are stated at fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., an exit price). See Note 5 for further discussion of fair value measurements.

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on an accrual basis. Dividends are recorded as of the ex-dividend date. Net appreciation (depreciation) includes the Plan’s gains (losses) on investments bought and sold as well as held during the year.

Payment of Benefits

Benefit payments to participants are recorded when paid.

Administrative Expense

In accordance with the Plan provisions, all eligible administrative expenses may be paid by the Plan unless paid by the Company. Administrative expenses that were paid directly by the Plan totaled $376,966 and $230,462 for the years ended December 31, 2016 and 2015, respectively. Fees for recordkeeping services and investment management were paid by Plan participants indirectly through the Plan’s investment return.

9

Table of Contents

TD 401(k) Retirement Plan

Notes to Financial Statements (continued)

2. Summary of Significant Accounting Policies (continued)

Accounting Changes

There is no new guidance that significantly impacted the Plan for the year ended December 31, 2016, nor is any anticipated to have a significant impact on the Plan in future years.

3. Federal Income Tax Status

The Plan received a determination letter from the Internal Revenue Service dated October 27, 2014 stating that the Plan is qualified under Section 401(a) of the Code and, therefore, the related trust is exempt from taxation. A qualified Plan is required to operate in conformity with the Code to maintain its qualified status. The Plan Administrator believes the Plan is being operated in compliance with the applicable requirements of the Code and, therefore, believes that the Plan, as amended and restated, is qualified and the related trust is tax exempt.

Accounting principles generally accepted in the United States require plan management to evaluate uncertain tax positions taken by the Plan. The financial statement effects of a tax position are recognized when the position is more likely than not, based on the technical merits, to be sustained upon examination by the IRS. The plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2016, there are no uncertain positions taken or expected to be taken. The Plan has recognized no interest or penalties related to uncertain tax positions. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

4. Administration of Plan Assets

The Plan’s assets, which include The Toronto-Dominion Bank common shares, are held by the Trustee of the Plan. T. Rowe Price serves as the service provider and Trustee for the Plan. T. Rowe Price serves as a directed Trustee who will act based on direction of the Plan Administrator or participants, as appropriate.

Company contributions are held by the Trustee, who invests contributions received, reinvests interest and dividend income, and processes distributions to participants. Certain administrative functions are performed by officers or employees of the Company or its subsidiaries. No such officer or employee receives compensation from the Plan.

10

Table of Contents

TD 401(k) Retirement Plan

Notes to Financial Statements (continued)

5. Fair Value Measurements

US GAAP provides the framework for measuring fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., an exit price). That framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy under US GAAP are described below:

Level 1

Unadjusted quoted prices in active markets that are accessible to the reporting entity at the measurement date for identical assets and liabilities.

Level 2

Inputs other than quoted prices in active markets for identical assets and liabilities that are observable, either directly or indirectly, for substantially the full term of the asset or liability. Level 2 inputs include the following:

·

quoted prices for similar assets or liabilities in active markets

·

quoted prices for identical or similar assets or liabilities in markets that are not active

·

observable inputs other than quoted prices that are used in the valuation of the assets or liabilities (e.g., interest rate and yield curve quotes at commonly quoted intervals)

·

inputs that are derived principally from or corroborated by observable market data by correlation or other means. If the asset or liability has a specified (contractual) term, the Level 2 input must be observable for substantially the full term of the asset or liability.

Level 3

Unobservable inputs for the asset or liability that are supported by little or no market activity. Level 3 inputs include management’s own assessment about the assumptions that market participants would use in pricing the asset or liability (including assumptions about risk).

11

Table of Contents

TD 401(k) Retirement Plan

Notes to Financial Statements (continued)

5. Fair Value Measurements (continued)

The fair value measurement level of the asset or liability within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs.

The following is a description of the valuation methodologies used for assets measured at fair value. There have been no changes in the methodologies used at December 31, 2016 as compared to those used at December 31, 2015.

Common stocks

: Valued at the closing price reported on the active market on which the individual securities are traded.

Mutual funds

: Valued at the net asset value of shares held by the Plan at year end as reported in the active market.

The Common Collective Trust is reported by the issuer at fair value based on the value of the underlying investments divided by the number of units outstanding, less liabilities, to arrive at net asset value (“NAV”) per unit. NAV is used as a fair value practical expedient. There are no restrictions on redemptions from the collective trust.

The methods described above may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

12

Table of Contents

TD 401(k) Retirement Plan

Notes to Financial Statements (continued)

5. Fair Value Measurements (continued)

The following tables set forth by level, within the fair value hierarchy, the Plan’s assets at fair value as of December 31, 2016 and 2015. There were no changes between levels for the years ended December 31, 2016 and 2015:

|

|

|

Assets at Fair Value as of December 31, 2016

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mutual Funds

|

|

$

|

1,916,371,295

|

|

$

|

—

|

|

$

|

—

|

|

$

|

1,916,371,295

|

|

|

Common Stocks

|

|

160,254,362

|

|

—

|

|

—

|

|

160,254,362

|

|

|

Total assets in the fair value hierarchy

|

|

2,076,625,657

|

|

—

|

|

—

|

|

2,076,625,657

|

|

|

Investments measured at net asset value — Common Collective Trust

|

|

—

|

|

—

|

|

—

|

|

237,869,869

|

|

|

Investments at fair value

|

|

$

|

2,076,625,657

|

|

$

|

—

|

|

$

|

—

|

|

$

|

2,314,495,526

|

|

|

|

|

Assets at Fair Value as of December 31, 2015

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mutual Funds

|

|

$

|

1,712,438,942

|

|

$

|

—

|

|

$

|

—

|

|

$

|

1,712,438,942

|

|

|

Common Stocks

|

|

129,698,705

|

|

—

|

|

—

|

|

129,698,705

|

|

|

Total assets in the fair value hierarchy

|

|

1,842,137,647

|

|

—

|

|

—

|

|

1,842,137,647

|

|

|

Investments measured at net asset value — Common Collective Trust

|

|

—

|

|

—

|

|

—

|

|

200,923,357

|

|

|

Investments at fair value

|

|

$

|

1,842,137,647

|

|

$

|

—

|

|

$

|

—

|

|

$

|

2,043,061,004

|

|

6. Related-Party Transactions

The Plan owned 3,247,960 and 3,311,175 common shares of The Toronto-Dominion Bank valued at $160,254,362 and $129,698,705 at December 31, 2016 and 2015, respectively, from which the Plan received dividends of $5,356,996 and $4,977,374 for years ended December 31, 2016 and 2015, respectively. Certain Plan investments were managed and held in trust by T. Rowe Price during 2016 and 2015. Consequently, T. Rowe Price is a party-in-interest.

7. Risks and Uncertainties

The Plan and its participants invest in various investment securities. Investment securities, in general, are exposed to various risks, such as interest rate, credit and overall market volatility risk. Due to the level of risk associated with certain investment securities, it is probable that

13

Table of Contents

TD 401(k) Retirement Plan

Notes to Financial Statements (continued)

7. Risks and Uncertainties (continued)

changes in the value of investment securities will occur in the near term and such changes could materially affect participants’ account balances and the amounts reported in the statements of net assets available for benefits.

8. Plan Termination

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA, as amended. Upon discontinuance or termination, forfeitures shall be allocated to the accounts of participants on such date.

9. Reconciliation of Financial Statements to Form 5500

The following is a reconciliation of net investment income for the year ended December 31, 2016 per the financial statements to Form 5500:

|

|

|

2016

|

|

|

|

|

|

|

|

Net investment (loss) income per the financial statements

|

|

$

|

197,583,097

|

|

|

Add: Other income presented on financial statements

|

|

4,057,366

|

|

|

Net investment income per Form 5500

|

|

$

|

201,640,463

|

|

10. Subsequent Events

The Plan has evaluated subsequent events through the date the financial statements were available to be issued and there were no subsequent events requiring adjustments to the financial statements or disclosures, as stated herein.

14

Table of Contents

TD 401(k) Retirement Plan

Plan No. 003 EIN 01-0437984

Schedule H, Line 4i — Schedule of Assets

(Held at End of Year)

December 31, 2016

|

Party in

Interest

|

|

Identity of Issue

|

|

Number of Shares/Units

Description/Asset

|

|

Current Value

|

|

|

|

|

|

|

|

|

|

|

|

Mutual Funds:

|

|

|

|

|

|

|

|

|

*

|

|

TRP Blue Chip Growth Fund

|

|

Registered investment company 2,150,185 shares

|

|

$

|

156,124,940

|

|

|

|

|

Dodge & Cox Stock Fund

|

|

Registered investment company 1,286,071 shares

|

|

237,023,014

|

|

|

*

|

|

Epoch Global Equity Shareholder Yield Fund, Institutional

|

|

Registered investment company 772,094 shares

|

|

8,300,016

|

|

|

*

|

|

TDAM Core Bond Institutional

|

|

Registered investment company 236,002 shares

|

|

2,336,420

|

|

|

|

|

PIMCO Total Return Fund, Inst.

|

|

Registered investment company 5,383,318 shares

|

|

53,994,685

|

|

|

*

|

|

TRP Retirement Balanced Fund, Inv.

|

|

Registered investment company 618,417 shares

|

|

9,065,991

|

|

|

*

|

|

TRP Government Money

|

|

Registered investment company 512.818 shares

|

|

512,818

|

|

|

|

|

Vanguard Institutional Index Fund

|

|

Registered investment company 887,685 shares

|

|

180,936,756

|

|

|

|

|

Vanguard Total Bond Market Index, Institutional

|

|

Registered investment company 3,989,880 shares

|

|

42,492,222

|

|

|

|

|

Vanguard Development Markets Index Fund, Inst.

|

|

Registered investment company 2,089,299 shares

|

|

24,549,263

|

|

|

|

|

MFS Institutional International Equity Fund

|

|

Registered investment company 2,792,655 shares

|

|

56,579,181

|

|

|

*

|

|

TRP Retirement 2005 Fund

|

|

Registered investment company 757,846 shares

|

|

9,745,906

|

|

|

*

|

|

TRP Retirement 2010 Fund

|

|

Registered investment company 1,486,664 shares

|

|

25,793,629

|

|

|

*

|

|

TRP Retirement 2015 Fund

|

|

Registered investment company 4,814,909 shares

|

|

68,275,416

|

|

|

*

|

|

TRP Retirement 2020 Fund

|

|

Registered investment company 7,792,796 shares

|

|

159,050,966

|

|

|

*

|

|

TRP Retirement 2025 Fund

|

|

Registered investment company 13,048,264 shares

|

|

202,248,095

|

|

|

|

|

|

|

|

|

|

|

|

16

Table of Contents

TD 401(k) Retirement Plan

Plan No. 003 EIN 01-0437984

Schedule H, Line 4i — Schedule of Assets

(Held at End of Year)

December 31, 2016

|

Party in Interest

|

|

Identity of Issue

|

|

Number of Shares/Units

Description/Asset

|

|

Current Value

|

|

|

|

|

|

|

|

|

|

|

|

Mutual Funds:

|

|

|

|

|

|

|

|

|

*

|

|

TRP Retirement 2030 Fund

|

|

Registered investment company 9,039,918 shares

|

|

$

|

203,669,353

|

|

|

*

|

|

TRP Retirement 2035 Fund

|

|

Registered investment company 10,112,514 shares

|

|

164,732,857

|

|

|

*

|

|

TRP Retirement 2040 Fund

|

|

Registered investment company 5,259,971 shares

|

|

122,083,923

|

|

|

*

|

|

TRP Retirement 2045 Fund

|

|

Registered investment company 6,499,729 shares

|

|

101,525,761

|

|

|

*

|

|

TRP Retirement 2050 Fund

|

|

Registered investment company 4,334,370 shares

|

|

56,953,620

|

|

|

*

|

|

TRP Retirement 2055 Fund

|

|

Registered investment company 2,042,126 shares

|

|

26,894,805

|

|

|

*

|

|

TRP Retirement 2060 Fund

|

|

Registered investment company 343,359 shares

|

|

3,481,658

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock:

|

|

|

|

|

|

|

*

|

|

The Toronto-Dominion Bank

|

|

Common shares — 3,247,960 shares

|

|

160,254,362

|

|

|

|

|

|

|

|

|

|

|

|

Common Collective Trust:

|

|

|

|

|

|

|

*

|

|

TRP Stable Value Common Trust Fund

|

|

Common Collective Trust 237,869,869 units

|

|

237,869,869

|

|

|

|

|

|

|

|

|

2,314,495,526

|

|

|

|

|

|

|

|

|

|

|

|

**Notes receivable from participants

|

|

Loans granted to plan participants, varying maturities, interest rates from 3.25% to 9.25%, secured by, at a minimum, 50% of vested account balances

|

|

50,773,159

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

2,365,268,685

|

|

* Denotes party in interest

** FASB ASU 2010-25 does not consider notes receivable from participants to be investments, whereas the Form 5500 requires that notes receivable from participants be listed as investments.

Note: Cost information has not been included because all investments are participant directed.

17

Exhibit

|

Exhibit

|

|

|

|

Number

|

|

Description

|

|

23.1

|

|

Consent of Independent Registered Public Accounting Firm (filed herewith)

|

18

Table of Contents

Signature

The Plan

. Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on their behalf by the undersigned hereunto duly authorized.

|

|

TD 401(K) RETIREMENT PLAN

|

|

|

|

|

|

By:

|

/s/KATHLEEN G. HARMON

|

|

|

|

Kathleen G. Harmon

|

|

|

|

Plan Administrator

|

Date: June 22, 2017

19

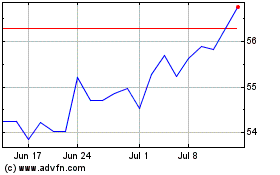

Toronto Dominion Bank (NYSE:TD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Toronto Dominion Bank (NYSE:TD)

Historical Stock Chart

From Apr 2023 to Apr 2024