Current Report Filing (8-k)

June 15 2017 - 4:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 15, 2017

OPKO Health, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

Delaware

|

|

001-33528

|

|

75-2402409

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

4400 Biscayne Blvd

Miami, Florida 33137

(Address of Principal Executive Offices) (Zip Code)

(305) 575-4100

Registrant’s telephone number, including area code

Not applicable

(Former

name or former address if changed since last report)

Check the appropriate box below

if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934(§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

|

ITEM 5.07. Submission

|

of Matters to a Vote of Security Holders.

|

On June 15, 2017, OPKO Health, Inc. (the

“Company”) held its 2017 Annual Meeting of Stockholders (the “Annual Meeting”). Below is a summary of the proposal and corresponding vote.

|

|

1.

|

All eight nominees were elected to the Board of Directors with each director receiving votes as follows:

|

|

|

|

|

|

|

|

|

|

|

|

Election of Directors

|

|

For

|

|

|

Withheld

|

|

|

Phillip Frost, M.D.

|

|

|

313,587,917

|

|

|

|

34,590,555

|

|

|

Jane H. Hsiao, Ph.D.

|

|

|

305,500,426

|

|

|

|

42,678,046

|

|

|

Steven D. Rubin

|

|

|

304,154,561

|

|

|

|

44,023,911

|

|

|

Richard M. Krasno, Ph.D.

|

|

|

344,682,759

|

|

|

|

3,495,713

|

|

|

Richard A. Lerner, M.D

|

|

|

286,997,023

|

|

|

|

61,181,449

|

|

|

John A. Paganelli

|

|

|

291,162,570

|

|

|

|

57,015,902

|

|

|

Richard C. Pfenniger, Jr.

|

|

|

333,531,789

|

|

|

|

14,646,683

|

|

|

Alice Lin-Tsing Yu, M.D., Ph.D.

|

|

|

296,686,376

|

|

|

|

18,792,096

|

|

|

|

2.

|

The approval, on a

non-binding

advisory basis, of the compensation of the named executive officers of the Company (“Say On Pay”) as disclosed in the Company’s Proxy

Statement for the Annual Meeting. The votes on this proposal were as follows:

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

316,825,919

|

|

30,329,801

|

|

1,022,752

|

|

|

3.

|

The selection of one year, on a

non-binding

advisory basis, as the frequency with which the stockholders are provided a

non-binding

advisory vote on Say on Pay in future years. The votes on this proposal were as follows:

|

|

|

|

|

|

|

|

|

|

1

Year

|

|

2 Years

|

|

3 Years

|

|

Abstain

|

|

309,086,990

|

|

692,622

|

|

37,254,593

|

|

1,144,267

|

Based on this result and in accordance with the previous recommendation of the Company’s Board of

Directors, the Company will hold a

non-binding,

advisory vote on Say On Pay every year.

There

were no broker

non-votes

for the proposals. No other matters were considered or voted upon at the meeting.

|

ITEM 7.01. Regulation

|

FD Disclosure.

|

On June 15, 2017, the Company held its Annual Meeting of

Stockholders. Copies of the presentations presented at the Annual Meeting are furnished with this Current Report on Form

8-K

as Exhibit 99.1.

Statements are made in the presentations which are not historical are forward-looking statements that reflect management’s current views

with respect to future events and performance and may include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions. Such statements are subject to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. The fact that these presentation materials are being furnished should not be deemed an admission as to the materiality of any information contained in the materials.

The information contained in Item 7.01 to this Current Report on Form

8-K

and Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall

it be deemed incorporated by reference in any filing by the Company under the Act, unless expressly stated otherwise.

|

ITEM 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

99.1

|

|

OPKO Presentation – 2017 Annual Meeting of Stockholders held June 15, 2017.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

OPKO Health, Inc.

|

|

|

|

|

|

|

Date: June 15, 2017

|

|

|

|

By

|

|

/s/ Adam Logal

|

|

|

|

|

|

Name:

|

|

Adam Logal

|

|

|

|

|

|

Title:

|

|

Senior. Vice President,

|

|

|

|

|

|

|

|

Chief Financial Officer

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

99.1

|

|

OPKO Presentation – 2017 Annual Meeting of Stockholders held June 15, 2017.

|

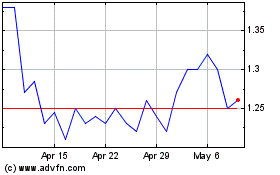

Opko Health (NASDAQ:OPK)

Historical Stock Chart

From Aug 2024 to Sep 2024

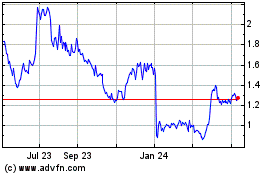

Opko Health (NASDAQ:OPK)

Historical Stock Chart

From Sep 2023 to Sep 2024