Report of Foreign Issuer (6-k)

June 14 2017 - 8:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2017

Commission File No.: 000-30668

NOVA MEASURING INSTRUMENTS LTD.

(Translation of registrant’s name into English)

Building 22 Weizmann Science Park, Rehovot

P.O.B 266

Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F

S

Form 40-F

£

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

EXPLANATORY NOTE

Following discussions with proxy advisors, the compensation committee and board of directors of Nova Measuring Instruments Ltd., or the Company, have determined to amend Proposal No. 3 detailed in the proxy statement, or the Proxy Statement, for the annual general meeting of the shareholders of the Company scheduled to be held on June 22, 2017

, or the Meeting.

The Proxy Statement was furnished to the Securities and Exchange Commission on Form 6-K on May 18, 2017.

Proposal No. 3, with respect to the approval of amendments to the employment terms of Mr. Eitan Oppenhaim, the President and Chief Executive Officer of the Company, is amended in its entirety to read as follows:

At the Meeting, the Company’s shareholders will be asked to approve the following amendments to Mr. Oppenhaim’s employment terms:

|

|

(i)

|

An increase of Mr. Oppenhaim’s monthly salary to NIS 120,000 from NIS 101,000 (same as proposed in the Proxy Statement furnished on Form 6-K on May 18, 2017); and

|

|

|

(ii)

|

A grant of 70,000 options and 30,000 restricted shares units to be made on July 1, 2017, in accordance with the following terms:

|

a. The options shall vest over a period of four (4) years, whereas a quarter (1/4) of such options shall vest on each anniversary of the grant, unless such options have been cancelled in accordance with the terms and conditions of the share incentive plan of the Company or the employment terms of Mr. Oppenhaim. The term of the options is seven (7) years. The exercise price of the options will be equal to the average closing price of the Company’s Shares on NASDAQ during the 30-trading day period preceding the date of grant.

b. The restricted share units shall vest over a period of three (3) years, whereas a third (1/3) of such restricted share units shall vest on each anniversary of the grant, provided that the Company exceeded the performance targets for vesting set by the compensation committee and board of directors of the Company, unless such restricted share units have been cancelled in accordance with the terms and conditions of the share incentive plan of the Company or the employment terms of Mr. Oppenhaim. In the event a portion of the restricted share units fails to vest,

such portion will be carried forward to the third vesting date and will vest if

the Company’s average annual return on equity based on net income during the previous three (3) years shall be no less than ten percent (10%)

.

All other employment terms shall remain unchanged.

The proposed amendments to the employment terms of the President and Chief Executive Officer of the Company were approved by the compensation committee and the Board,

while considering, among others, Mr. Oppenhaim’s performance and contribution to the Company in general (in particular during 2016, which represented a 4

th

consecutive year of growth in revenue to a record level of $163.9 million, as a result of customer diversification, organic and inorganic growth and successful implementation of ReVera acquisition, leading to record non-GAAP net income in 2016), his experience, a compensation survey provided to the members of the compensation committee and

the board of directors of the Company, the terms of our compensation policy adopted on August 2, 2016, or the Compensation Policy, and the ratio between the employer cost associated with the engagement of the President and Chief Executive Officer and the average and median employer cost associated with the engagement of the other employees of the Company

.

The employment terms of Mr. Oppenhaim following the proposed amendments are consistent with our Compensation Policy.

At the Meeting, it is proposed that the following resolution be adopted:

“

RESOLVED

, to approve the amendments to the terms of employment of Mr. Oppenhaim, the President and Chief Executive Officer of the Company, as set forth in the amendment to the Proxy Statement, date June 14, 2017.”

This report on Form 6-K is hereby incorporated by reference into the Registrant’s registration statements on Form S-8, filed with the Securities and Exchange Commission on the following dates: November 5, 2007 (File No. 333-147140), October 25, 2012 (File No. 333-184585) and March 6, 2015 (File No. 333-202550).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: June 14, 2017

|

|

NOVA MEASURING INSTRUMENTS LTD.

(Registrant)

By: /s/

Dror David

——————————————

Dror David

Chief Financial Officer

|

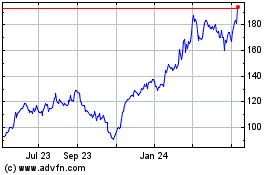

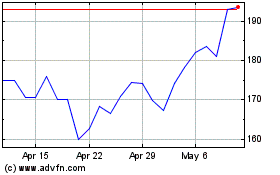

Nova (NASDAQ:NVMI)

Historical Stock Chart

From Aug 2024 to Sep 2024

Nova (NASDAQ:NVMI)

Historical Stock Chart

From Sep 2023 to Sep 2024