As filed with the Securities and Exchange Commission on June 9, 2017

Registration No. 333-210840

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Post-Effective Amendment No. 1 to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

INTERNATIONAL STEM CELL CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

2834

|

|

20-4494098

|

|

(State or other jurisdiction of

Incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code number)

|

|

(I.R.S. Employer

Identification No.)

|

5950 Priestly Drive

Carlsbad, CA 92008

(760) 940-6383

(Address and telephone number of principal executive offices)

MAHNAZ EBRAHIMI

Chief Financial Officer

5950 Priestly Drive

Carlsbad, CA 92008

(760) 653-1126

(Name, address and telephone number of agent for service)

Copies to:

DOUGLAS REIN

PATRICK O’MALLEY

DLA PIPER LLP (US)

4365 Executive Drive, Suite 1100

San Diego, CA 92121-2133

(858) 677-1443

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this registration statement, as determined by the selling stockholder.

If any of the securities being registered on this Form are to be offered o

n a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box.

☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☐

|

|

Accelerated filer

|

|

☐

|

|

|

|

|

|

|

Non-accelerated filer

|

|

☐

|

|

Smaller reporting company

|

|

☒

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

|

☐

|

|

|

|

|

If an emerging growth company, indicate by checkmark if the registrant has not elected to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. [ ]

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Explanatory Note

This Post-Effective Amendment No. 1 on Form S-1 to the Registration Statement on Form S-1 (Registration No. 333-210840) (the “Registration Statement”), which was declared effective by the Commission on May 9, 2016, is being filed to (i) revise the prospectus included herein to reflect the incorporation by reference herein of disclosures from previous filings with the Commission and to incorporate by reference herein information from future filings with the Commission, all as provided by to Item 12 of Form S-1, including changes adopted pursuant to Securities Act Release 33-10003 permitting the registrant to update disclosure in the prospectus included in the Registration Statement by incorporating its future filings with the Commission by reference herein, and (ii) remove from registration the shares issuable upon exercise of certain warrants that expired unexercised.

INTERNATIONAL STEM CELL CORPORATION

Up to 3,428,571 Shares of Common Stock

This prospectus relates to the resale of up to 3,428,571 shares of our common stock by the selling stockholders named herein. On March 9, 2016, we entered into a securities purchase agreement with Sabby Healthcare Master Fund, Ltd., Sabby Volatility Warrant Master Fund, Ltd. (together, the “Sabby Purchasers”), and Andrey Semechkin, the Company’s Chief Executive Officer and Co-Chairman (together, with the Sabby Purchasers, the “Purchasers”), pursuant to which we sold to the Purchasers (i) a total of 6,310 shares of our Series I-1 and Series I-2 Convertible Preferred Stock, par value $0.001 with a stated value of $1,000 per share (collectively, the “Series I Preferred Stock”), (ii) Series A Warrants (the “Series A Warrants”) to purchase up to 3,605,713 shares of common stock for a term of 5 years, (iii) Series B warrants (the “Series B Warrants”) to purchase up to 3,605,713 shares of common stock for a term of six months, and (iv) Series C warrants (the “Series C Warrants”, together with the Series A Warrants and the Series B Warrants, collectively, the “Warrants”) to purchase up to 3,605,713 shares of common stock for a term of twelve months. As a result of adjustment provisions applicable to the Series I Preferred Stock and the Warrants, the current exercise price of the Series A Warrants outstanding is $2.60 per share, which is subject to further adjustment. Pursuant to the terms of the registration rights agreement, as amended, we entered into with the Sabby Purchasers, we were required to register (a) 200% of the number of shares of common stock currently underlying the Series I-1 Preferred Stock, (b) 200% of the number of shares of common stock currently issuable upon exercise of the Series B Warrants and Series C Warrants held by the Sabby Purchasers, and (c) 100% of the shares of common stock currently issuable upon exercise of the Series A Warrants held by the Sabby Purchasers. The Series B Warrants and Series C Warrants held by the Sabby Purchasers expired unexercised, and those shares are removed from the registration statement of which this prospectus is a part. To the extent that one or more Purchasers elects to exercise their respective Warrants to acquire shares of our common stock, this prospectus may be used by the selling stockholders named under the section titled “Selling Stockholders” to resell their shares. We are not selling any securities under this prospectus and will not receive any of the proceeds from the sale of shares by any selling stockholder; however, we will receive proceeds upon exercise of the Warrants.

The selling stockholders may sell their respective shares of common stock described in this prospectus in a number of different ways and at varying prices. We provide more information about how the selling stockholders may resell their respective shares of our common stock in the section titled “Plan of Distribution” beginning on page 7. Each selling stockholder may be deemed to be an “underwriter” within the meaning of the Securities Act in connection with such sales within the meaning of the Securities Act of 1933, as amended, with respect to any shares resold under this prospectus by such selling stockholder. Although we will pay the expenses incurred in registering the shares, we will not be paying any underwriting discounts or commissions in connection with the resale of the shares.

We will pay the expenses incurred in registering the shares, including legal and accounting fees. See “Plan of Distribution.”

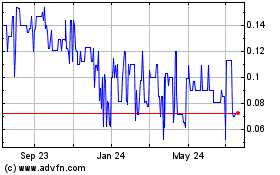

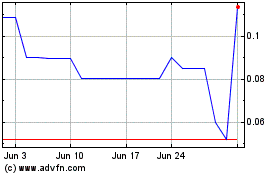

Our common stock is quoted on the OTC QB and trades under the symbol “ISCO”. The last reported sale price of our common stock on June 8, 2017 was $1.10 per share.

Investing in our securities involves a high degree of risk. Before buying any securities, you should read the discussion of material risks of investing in our common stock under the heading “

Risk Factors

” beginning on page 5 of this prospectus.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Our securities are not being offered in any jurisdiction where the offer is not permitted under applicable local laws.

The date of this prospectus is , 2017.

INTERNATIONAL STEM CELL

CORPORATION

TABLE OF CONTENTS

You should read this prospectus, together with additional information described under “Information Incorporated by Reference” and

“Where You Can Find More Information”.

About This Prospectus

You should rely only on the information contained in this prospectus provided to you in connection with this offering. We have not, and the Purchasers have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus is not an offer to sell, nor purchasers are seeking an offer to buy, securities in any state where the offer or solicitation is not permitted. The information contained in this prospectus is complete and accurate as of the date on the front cover of this prospectus. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date. Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus or that the information contained by reference to this prospectus is correct as of any time after its date. In this prospectus, references to “the Company,” “we,” “us,” and “our,” refer to International Stem Cell Corporation.

1

PROSPECTU

S SUMMARY

This summary provides an overview of selected information contained elsewhere in this prospectus, including in the documents incorporated by reference herein. Because it is a summary, it does not contain all of the information you should consider before investing in our securities. You should carefully read the entire prospectus and such incorporated documents carefully, including the information discussed under “Risk Factors” beginning on page 5 and our financial statements and the notes thereto that appear elsewhere in this prospectus.

Business Overview

International Stem Cell Corporation (sometimes referred to herein as “ISCO”, the “Company”, “we”, “us”, or “our”) is a clinical stage biotechnology company focused on therapeutic and biomedical product development with multiple long-term therapeutic opportunities and two revenue-generating businesses offering potential for increased future revenue.

We currently have no revenue generated from our principal operations in therapeutic and clinical product development

through research and development efforts

. We have generated revenue from our two commercial businesses,

cosmetic and research products, of a total of $7,165,000

for the year ended December 31, 2016.

Our products are based on multi-decade experience with human cell culture and a proprietary type of pluripotent stem cells, “human parthenogenetic stem cells” (“hpSCs”). Our hpSCs are comparable to human embryonic stem cells (“hESCs”) in that they have the potential to be differentiated into many different cells in the human body. However, the derivation of hpSCs does not require the use of fertilized eggs or the destruction of viable human embryos and also offers the potential for the creation of immune-matched cells and tissues that are less likely to be rejected following transplantation. ISCO scientists have created the first parthenogenetic, homozygous stem cell line that can be a source of therapeutic cells for hundreds of millions of individuals with minimal immune rejection after transplantation. We have facilities and manufacturing processes that we believe comply with the requirements of current Good Manufacturing Practice (GMP) standards as defined by the U.S. Code of Federal Regulations and promulgated by the Food and Drug Administration (“FDA”).

We are developing different cell types from our stem cells that may result in therapeutic products. We focus on applications where cell and tissue therapy is already proven but where there is an insufficient supply of functional cells or tissue. We believe that the most promising potential clinical applications of our technology are:

|

|

•

|

Neural stem cells for treatment of Parkinson’s disease and potentially other central nervous system disorders, such as traumatic brain injury, stroke and Alzheimer’s disease.

|

|

|

•

|

Liver cells (“hepatocytes”) that may be used to treat a variety of congenital and acquired liver diseases. Using the same precursor cell that leads to liver cells, it is also possible to create islet cells for potential treatment of diabetes.

|

|

|

•

|

Retinal cells and three-dimensional eye structures including corneal cells and tissue to treat degenerative retinal diseases, corneal blindness, and to accelerate corneal healing.

|

We have completed our IND-enabling preclinical studies on our most advanced program, the development of neural stem cells for the treatment of Parkinson’s disease and filed the regulatory submission to the Australian Therapeutics Goods Administration (“TGA”) and have started a phase I clinical trial in Australia. To-date, we have successfully transplanted ISC-hpNSC® cells into Parkinson’s disease patients and completed the first cohort in our ongoing clinical trials for Parkinson’s Disease.

Each of these product candidates will require extensive preclinical and clinical development and may require specific unforeseen licensing rights obtained at substantial cost before regulatory approval may be achieved and the products sold for therapeutic use.

Additionally, we are subject to various other risks; for example, our business is at an early stage of development and we may not develop therapeutic products that can be commercialized; we have a history of operating losses, do not expect to be profitable in the near future and our independent registered public accounting firm has expressed doubt as to our ability to continue as a going concern; and we will need additional capital to conduct our operations and develop our products and our ability to obtain the necessary funding is uncertain. Please see the heading “Risk Factors” beginning on page 5.

On December 16, 2014 we were named in Deloitte’s 2014 Technology Fast 500™ of the fastest growing companies in North America. International Stem Cell Corporation was ranked in 215th place in the overall list, which also included the technology, media, telecommunications and clean tech companies. Of the 47 biotechnology businesses on the list, we placed 21st and we were the only regenerative medicine company represented

March 2016 Transactions

On March 15, 2016, pursuant to a securities purchase agreement, dated as of March 9, 2016, with Sabby Healthcare Master Fund, Ltd., Sabby Volatility Warrant Master Fund, Ltd., and Andrey Semechkin, the Company’s Chief Executive Officer and Co-Chairman (together, the “Purchasers”), we sold in a private placement (the “Private Placement”) (i) an aggregate of 6,310 shares of Series I Convertible Preferred Stock, par value $0.001 with a stated value of $1,000 per share (the “Series I Preferred Stock”), (ii) Series A warrants (the “Series A Warrants”) to

2

purchase up to 3,605,713 shares of common stock exercisable immediately and having a term of 5 years,

(iii) Series B warrants (the “Series B Warrants”) to purchase up to 3,605,713 shares of common stock exercisable immediately and having a term of 6 months, (iv) Series C warrants (the “Series C Warrants”, together with the Series A Warrants, the Series B

Warrants, collectively, the “Warrants”) to purchase up to 3,605,713 shares of common stock exercisable immediately and having a term of 12 months.

The Series B Warrants and the Series C Warrants issued to the Sabby Purchasers have expired, and the shares i

ssuable upon exercise of those warrants are not included in the

registration statement of which this

prospectus is a part.

The conversion price of the Series I Preferred Stock is currently $1.75 per share, and the exercise price of the Series A Warrants i

s

currentl

y

$2.60

per share.

T

he exercise prices and the conversion price are subject to further adjustment. The aggregate initial gross proceeds received from this transaction (including cancellation of indebtedness) were $6.3 million.

The number of shares issuable upon conversion of the Series I Preferred Stock and exercise of the Warrants are adjustable in the event of stock splits, stock dividends, combinations of shares and similar transactions. The number of shares of common stock issuable upon conversion of the Series I Preferred Stock is also subject to antidilution provisions. Adjustments to the exercise price of the Series A Warrants do not affect the number of shares issuable upon exercise of the Series A Warrant. In addition, the Purchasers have been granted rights of participation in future offerings of our securities for eighteen months.

In connection with the Private Placement, we entered into a registration rights agreement with the Sabby Purchasers pursuant to which we are obligated to file a registration statement to register the resale of (i) 200% of the shares of Common Stock issuable upon conversion of the Series I-1 Preferred Stock, (ii) 200% of the shares issuable upon exercise of the Series B Warrants and Series C Warrants held by the Sabby Purchasers, and (ii) 100% of the shares of common stock issuable upon exercise of the Series A Warrants held by the Sabby Purchasers. In addition to the registration rights, the Sabby Purchasers are entitled to receive liquidated damages upon the occurrence of a number of events relating to filing, obtaining and maintaining an effective registration statement covering the shares underlying the Series I-1 Preferred Stock and their Warrants, subject to certain exceptions. The Series B Warrants and the Series C Warrants issued to the Sabby Purchasers expired unexercised and the shares issuable upon exercise of those warrants are no longer included in this prospectus.

Subject to certain ownership limitations with respect to the Series I-1 Preferred Stock, the Series I Preferred Stock is convertible at any time into shares of Common Stock at a current conversion price of $1.75 per share. The Series I Preferred Stock is non-voting, is only entitled to dividends in the event that dividends are paid on the Common Stock, and will not have any preferences over the Common Stock, except that the Series I Preferred Stock shall have preferential liquidation rights over the Common Stock. Other than the Series I-1 Preferred Stock having a beneficial ownership limitation, the Series I-1 Preferred Stock and Series I-2 Preferred Stock are substantially identical. The conversion price of the Series I Preferred Stock is subject to certain resets as set forth in the Certificates of Designation, including the date of the amendment to the certificate of incorporation with respect to any reverse stock split.

The Warrants are immediately exercisable and the exercise price of the Warrants is subject to certain reset adjustments as set forth in the forms of Warrant, including the date of amendment to the Company’s certificate of incorporation with respect to any reverse stock split.

H.C. Wainwright & Co. (the “Placement Agent”) acted as the exclusive placement agent for the Offering pursuant to a placement agency engagement letter, dated as of March 9, 2016 by and between the Placement Agent and the Company (the “Engagement Letter”). Upon the closing of the Offering, pursuant to the Engagement Letter, the Placement Agent received a placement agent fee of $200,000 and a warrant to purchase 342,856 shares of common stock, as well as the reimbursement of fees and expenses up to $50,000. Similar to the Series A Warrant, the placement agent warrant has a current exercise price of $1.75 per share, is immediately exercisable and will terminate five years after the date of issuance.

Recent Development

In 2016 Therapeutics Goods Administration (TGA) of Australia cleared a regulatory submission from CytoTherapeutics, our wholly owned subsidiary, to initiate a Phase I clinical trial, dose escalation trial using human parthenogenetic stem cells-derived neural stem cells (ISC-hpNSC) in patients with Parkinson’s disease. Since July 2016, all

patients in cohort 1 in our clinical trial for Parkinson's Disease were successfully transplanted with ISC-hpNSC

®

cells.

Corporate Information

Our principal executive office is located at 5950 Priestly Drive, Carlsbad, CA 92008, and our telephone number is (760) 940-6383. Our website address is

www.internationalstemcell.com

. No information found on our website is part of this prospectus. Also, this prospectus may include the names of various government agencies or the trade names of other companies. Unless specifically stated otherwise, the use or display by us of such other parties’ names and trade names in t

his prospectus is not intended to and does not imply a relationship with, or endorsement or sponsorship of us by, any of these other parties.

3

The Offering

This prospectus relates to the offer and resale of up to 3,428,571 shares of our common stock, par value $0.001 per share, by the selling stockholders named in this prospectus beginning on page 6.

|

|

|

|

|

|

|

|

|

Common stock offered by the selling stockholders

|

|

3,428,571 shares, consisting of:

|

|

|

|

|

|

|

• 1,142,857 shares issuable upon exercise of Series A Warrants

|

|

|

|

|

|

|

• 2,285,714 shares issuable upon conversion of the Series I-1 Preferred Stock (including shares we may issue pursuant to various conversion price resets in the Certificate of Designation for the Series I-1 Preferred Stock

|

|

|

|

|

Common stock outstanding as of March 31, 2017

|

|

3,984,905 shares

|

|

|

|

|

Common stock to be outstanding after giving effect to the total issuance of 3,022,857 shares remaining to be sold on exercise of the Warrants and conversion of the remaining shares of Series I-1 Preferred Stock

|

|

7,007,7602 shares (1)

|

|

|

|

|

Terms of the offering

|

|

The selling stockholders will determine when and how they will dispose of the common stock offered pursuant to this prospectus. For additional information concerning the offering, see “Plan of Distribution” beginning on page 7.

|

|

Use of proceeds

|

|

We will not receive any proceeds from the sale by selling stockholders in this offering of the shares of common stock issuable upon their exercise of Warrants. See “Use of Proceeds” of this prospectus.

|

|

|

|

|

OTC Markets (OTCQB) symbol

|

|

ISCO

|

|

|

|

|

Risk Factors

|

|

Investing in the securities involves substantial risks. See “Risk Factors” beginning on page 5 and in the documents incorporated by reference herein and other information included or incorporated by reference in this prospectus for a discussion of the factors you should consider before you decide to invest in shares of our common stock.

|

|

|

|

|

(1)

|

The number of shares of common stock shown above to be outstanding after this offering is based on the 3,984,905 shares outstanding as of March 31, 2017 and excludes, as of that date:

|

|

|

|

|

|

|

|

•

|

|

shares of common stock issuable upon exercise of outstanding stock options, including those options issued outside our stock option plans, at a weighted average exercise price of $12.23 per share;

|

|

|

|

|

|

|

|

•

|

|

4,001,469 shares of common stock reserved for issuance under various outstanding warrant agreements, at a weighted average exercise price of $2.94 per share;

|

|

|

|

|

|

|

|

•

|

|

5,601,552 additional shares of common stock reserved for issuance upon conversion of our outstanding shares of Series B, Series D, Series G, and Series I-2 Preferred Stock;

|

|

|

|

|

|

|

|

•

|

|

1,716,978 additional shares of common stock reserved for future issuance under our 2010 stock incentive plans.

|

Unless otherwise specifically stated, information throughout this prospectus does not assume the exercise of outstanding options or warrants to purchase shares of co

mmon stock or conversion of outstanding shares of preferred stock.

4

RISK FACTORS

Investing in our securities involves a high degree of risk. You should carefully consider and evaluate all of the information included and incorporated by reference or deemed to be incorporated by reference in this prospectus or the applicable prospectus supplement, including the risk factors incorporated by reference herein from our Annual Report on Form 10-K for the year ended December 31, 2016, as updated by annual, quarterly and other reports and documents we file with the SEC after the date of this prospectus and that are incorporated by reference herein or in the applicable prospectus supplement. Our business, results of operations or financial condition could be adversely affected by any of these risks or by additional risks and uncertainties not currently known to us or that we currently consider immaterial.

Risks Related to this Offering and Our Common Stock

The sale or issuance of our common stock to Purchasers may cause dilution and the sale of the shares of common stock acquired by Purchasers, or the perception that such sales may occur, could cause the price of our common stock to fall.

On March 9, 2016, we entered into the Securities Purchase Agreement with two institutional investors and Andrey Semechkin, the Company’s chief Executive Officer and Co-Chairman, pursuant to which the Purchasers purchased 6,310 shares of Series I Convertible Preferred Stock initially convertible into 3,605,713 shares of our common stock, in addition to Series A Warrants which are currently exercisable for 5 years from the date of issuance to purchase approximately 3.6 million shares of our common stock. The conversion price of the Preferred Stock and Warrants is subject to certain resets as set forth in the Certificates of Designation and Warrants, including the date of the amendment to the certificate of incorporation with respect to any reverse stock split. Depending on market liquidity at the time, sales of such shares may cause the trading price of our common stock to fall.

The Purchasers may ultimately convert all, some or none of the Series I Convertible Preferred Stock into shares of our common stock, exercise all, some or none of the Series A warrants into shares of our common stock. Such shares acquired by the Purchasers may be sold, as the Purchasers may sell all, some or none of those shares. Therefore, the conversion of the preferred stock and exercise of warrants by the Purchasers will result in substantial dilution to the interests of other holders of our common stock. Additionally, the conversion into a substantial number of shares of our common stock by the Purchasers, or the anticipation of such conversion, could make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise wish to effect sales.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Information in this prospectus contains forward-looking statements. These forward-looking statements can be identified by the use of words such as “believes,” “estimates,” “could,” “possibly,” “probably,” “anticipates,” “projects,” “expects,” “may,” or “should” or other variations or similar words. No assurances can be given that the future results anticipated by the forward-looking statements will be achieved. The following matters constitute cautionary statements identifying important factors with respect to those forward-looking statements, including certain risks and uncertainties that could cause actual results to vary materially from the future results anticipated by those forward-looking statements. A description of key factors that have a direct bearing on our results of operations is provided above under “Risk Factors” beginning on page 5 of this prospectus.

Additional information on factors that may affect our business and fi

nancial results can be found in our filings with the SEC. All forward-looking statements should be considered in light of these risks and uncertainties. We assume no responsibility to update forward-looking statements made in this prospectus.

USE OF PROCEEDS

This prospectus relates to shares of our common stock that may be offered and sold from time to time by the selling stockholders identified in the section of this prospectus entitled “Selling Stockholders”. We will not receive any of the proceeds from the sale of the securities by the selling stockholders. To the extent proceeds are received upon exercise of the Warrants, we intend to use any such proceeds for general corporate and working capital purposes.

5

SELLING ST

OCKHOLDERS

On March 15, 2016, Sabby Volatility Warrant Master Fund Ltd. and Sabby Healthcare Master Fund, Ltd., collectively referred to as the selling stockholders, acquired an aggregate of 2,000 shares of newly created Series I-1 Preferred Stock and Warrants for an aggregate purchase price of $2,000,000.

The Series I-1 Preferred Stock and the Warrants issued to Sabby Volatility Warrant Master Fund Ltd. and Sabby Volatility Master Fund, Ltd. contain exercise and conversion limitations providing that a holder thereof may not convert or exercise (as the case may be) to the extent that, if after giving effect to such conversion or exercise (as the case may be), the holder or any of its affiliates would beneficially own in excess of 4.99% of the outstanding shares of common stock immediately after giving effect to such conversion or exercise (as the case may be).

This prospectus relates to the resale by the selling stockholders from time to time of up to an aggregate of 3,428,571 shares that are issuable to the selling stockholders. Pursuant to a Registration Rights Agreement between us and the selling stockholders, this prospectus covers the resale of (i) 200% of the shares of Common Stock issuable upon conversion of the Series I -1 Preferred Stock, and (ii) 100% of the shares of Common Stock issuable upon exercise of the Series A Warrants. The Series B Warrants and Series C Warrants issued to the Sabby Purchasers expired unexercised, and the shares issuable upon exercise of those warrants are no longer included in this prospectus.

The table below, which was prepared based on information supplied to us by the selling stockholders, sets forth information regarding the beneficial ownership of outstanding shares of our common stock owned by the selling stockholders and the shares that they may sell or otherwise dispose of from time to time under this prospectus. Each of the selling stockholders, or their respective affiliates, transferees, donees or their successors, may resell, from time to time, all, some or none of the shares of our common stock covered by this prospectus, as provided in this prospectus under the section entitled “Plan of Distribution” and in any applicable prospectus supplement. However, we do not know when, in what amount, or at what specific prices the selling stockholders may offer their shares for sale under this prospectus, if any. Each selling stockholder’s percentage of ownership in the following table is based upon 2,814,910 shares of our common stock outstanding as of March 31, 2016.

Information concerning any of the selling stockholders may change from time to time, and any changed information will be presented in a prospectus supplement as necessary. Please carefully read the footnotes located below the table in conjunction with the information presented in the table.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling Stockholder

|

|

Shares

Beneficially

Owned

Before

this

Offering(1)

|

|

|

Percentage of

Outstanding

Shares

Beneficially

Owned Before

this Offering

|

|

|

Shares to be Sold in

this Offering (3)

|

|

|

Number

Of

Shares

Beneficially

Owned After

this

Offering(6)

|

|

|

Percentage of

Outstanding

Shares

Beneficially

Owned

After

this

Offering(6)

|

|

|

Sabby Volatility Warrant Master Fund, Ltd.

|

|

|

1,371,429

|

|

|

|

32.76

|

%(2)

|

|

|

1,371,429

|

(4)

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Sabby Healthcare Master Fund, Ltd.

|

|

|

2,057,142

|

|

|

|

42.22

|

%(2)

|

|

|

2,057,142

|

(5)

|

|

|

0

|

|

|

|

0.00

|

%

|

|

|

|

|

(1)

|

Includes all shares beneficially owned by the selling stockholders as of March 31, 2017.

|

|

(2)

|

The Series I-1 Preferred Stock and the Warrants contain exercise and conversion limitations providing that a holder thereof may not convert or exercise (as the case may be) to the extent that, if after giving effect to such conversion or exercise (as the case may be), the holder or any of its affiliates would beneficially own in excess of 4.99% of the outstanding shares of common stock immediately after giving effect to such conversion or exercise (as the case may be). Accordingly, the number of shares of common stock set forth in the table as being registered for a selling stockholder exceeds the number of shares of common stock that the selling stockholder could own beneficially at any given time through its ownership of the Series I-1 Preferred Stock and the Warrants. Sabby Management, LLC serves as the investment manager of this stockholder and shares voting and investment power with respect to these shares on behalf of this stockholder. As manager of Sabby Management, LLC, Hal Mintz also shares voting and investment power on behalf of this stockholder. Each of Sabby Management, LLC and Hal Mintz disclaim beneficial ownership over the securities covered by this prospectus except to the extent of their pecuniary interest therein.

|

|

(3)

|

We have assumed that each share of Series I-1 Preferred Stock is convertible into shares of common stock at a conversion price of $1.75 per share of common stock. Includes 200% of the shares of Common Stock issuable upon conversion of the Series I -1 Preferred Stock.

|

|

(4)

|

Includes 200% of 457,143 shares of Common Stock issuable upon conversion of Series I-1 Preferred Stock, and 100% of the 457,143 shares issuable upon exercise of the Series A Warrants held by the holder.

|

|

(5)

|

Includes 200% of 685,714 shares of Common Stock issuable upon conversion of Series I-1 Preferred Stock, and 100% of the 685,714 shares issuable upon exercise of the Series A Warrants held by the holder.

|

|

(6)

|

Assumes the sale of all shares of common stock registered pursuant to this prospectus, although the selling stockholders are under no obligation known to us to sell any shares of common stock at this time

.

|

6

PLAN OF DISTRIBUTION

Each Selling Stockholder (the “

Selling Stockholders

”) of the securities and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities covered hereby on the principal trading market or any other stock exchange, market or trading facility on which the securities are traded or in private transactions. These sales may be at fixed or negotiated prices. A Selling Stockholder may use any one or more of the following methods when selling securities:

|

|

|

|

|

|

|

•

|

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

|

|

|

|

|

•

|

|

block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

|

|

|

|

|

•

|

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

|

|

|

|

|

•

|

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

|

|

|

|

|

•

|

|

privately negotiated transactions;

|

|

|

|

|

|

|

|

•

|

|

settlement of short sales;

|

|

|

|

|

|

|

|

•

|

|

in transactions through broker-dealers that agree with the Selling Stockholders to sell a specified number of such securities at a stipulated price per security;

|

|

|

|

|

|

|

|

•

|

|

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

|

|

|

|

|

|

•

|

|

a combination of any such methods of sale; or

|

|

|

|

|

|

|

|

•

|

|

any other method permitted pursuant to applicable law.

|

The Selling Stockholders may also sell securities under Rule 144 under the Securities Act of 1933, as amended (the “

Securities Act

”), if available, rather than under this prospectus.

Broker-dealers engaged by the Selling Stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the Selling Stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or markdown in compliance with FINRA IM-2440.

In connection with the sale of the securities or interests therein, the Selling Stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The Selling Stockholders may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities to broker-dealers that in turn may sell these securities. The Selling Stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The Selling Stockholders and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. Each Selling Stockholder has informed the Company that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the securities.

The Company is required to pay certain fees and expenses incurred by the Company incident to the registration of the securities. The Company has agreed to indemnify the Selling Stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

Because Selling Stockholders may be deemed to be “underwriters” within the meaning of the Securities Act, they will be subject to the prospectus delivery requirements of the Securities Act including Rule 172 thereunder. In addition, any securities covered by this prospectus which qualify for sale pursuant to Rule 144 under the Securities Act may be sold under Rule 144 rather than under this prospectus. The Selling Stockholders have advised us that there is no underwriter or coordinating broker acting in connection with the proposed sale of the resale securities by the Selling Stockholders.

We agreed to keep this prospectus effective until the earlier of (i) the date on which the securities may be resold by the Selling Stockholders without registration and without regard to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for the Company to be in compliance with the current public information under Rule 144 under the Securities Act or any other rule of similar effect or (ii) all of the securities have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The resale securities will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in

7

certain states, the resale securities covered hereby may not be sold unless they have been registered or

qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the Selling Stockholders will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the common stock by the Selling Stockholders or any other person. We will make copies of this prospectus available to the Selling Stockholders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

LEGAL MATTERS

The validity of the issuance of securities offered by this prospectus has been passed upon for us by DLA Piper LLP (US), San Diego, California.

EXPERTS

Mayer Hoffman McCann P.C., our independent registered public accounting firm, has audited our balance sheets as of December 31, 2016 and 2015, and the related statements of operations, changes in stockholders’ equity and cash flows for each of the two years in the period ended December 31, 2016, as set forth in their report, which report expresses an unqualified opinion and includes an explanatory paragraph relating to our ability to continue as a going concern, and has been incorporated by reference in this registration statement in reliance on the report of Mayer Hoffman McCann P.C. given on their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file reports, proxy statements and other information with the SEC. Copies of our reports, proxy statements and other information may be inspected and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Copies of these materials can also be obtained by mail at prescribed rates from the Public Reference Room of the SEC, 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an internet site that contains reports, proxy and information statements and other information regarding International Stem Cell Corporation and other issuers that file electronically with the SEC. The address of the SEC internet site is www.sec.gov. In addition, we make available on or through our Internet site copies of these reports as soon as reasonably practicable after we electronically file or furnish them to the SEC. Our Internet site can be found at

www.internationalstemcell.com

.

INFORMATION INCORPORATED BY REFERENCE

We have elected to incorporate certain information by reference into this prospectus. By incorporating by reference, we can disclose important information to you by referring you to other documents we have filed or will file with the SEC. The information incorporated by reference is deemed to be part of this prospectus, except for information incorporated by reference that is superseded by information contained in this prospectus. This means that you must look at all of the SEC filings that we incorporate by reference to determine if any statements in the prospectus or any document previously incorporated by reference have been modified or superseded. This prospectus incorporates by reference the documents set forth below that we have previously filed with the SEC:

|

|

|

|

|

|

•

|

Our annual report on Form 10-K for the fiscal year ended December 31, 2016 filed with the SEC on March 31, 2017 that are incorporated therein;

|

|

|

|

|

|

|

•

|

The portions of our proxy statement on Schedule 14A for our Annual Meeting of Stockholders filed with the SEC on April 28, 2017 that are incorporated therein;

|

|

|

|

|

|

|

•

|

Our quarterly report on Form 10-Q for the quarter ended March 31, 2017, and

|

|

|

|

|

|

|

•

|

Our Current Reports on Form 8-K filed on January 18, 2017, February 28, 2017, March 22, 2017, June 6, 2017 and June 8, 2017.

|

We also incorporate by reference all documents we file in the future pursuant to Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934 after the date of the initial filing of the registration statement that contains this prospectus and prior to the termination of the offering (except in each case the information contained in such documents to the extent “furnished” and not “filed”).

8

You may obtain copies of these documents on the website maintained by the SEC at

http://www.sec.gov

, on our website at

www.interna

tionalstemcell.com

or from us without charge (other than exhibits to such documents, unless such exhibits are specifically incorporated by reference into such documents) by writing us at International Stem Cell Corporation, 5950 Priestly Drive, Carlsbad, C

A 92008

Any statement contained in a document incorporated or deemed to be incorporated by reference in this prospectus shall be deemed to be modified or superseded for the purposes of this prospectus to the extent that a statement contained herein or in any other subsequently filed document which also is or deemed to be incorporated by reference herein modifies or supersedes that statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

9

PART II

INFORMATION NOT REQUIRED IN THE PROSPECTUS

|

|

|

|

ITEM 13.

|

OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION

|

The following table sets forth the fees and expenses incurred or expected to be incurred by International Stem Cell Corporation in connection with the issuance and distribution of the common stock being registered hereby. All of the amounts shown are estimated except the SEC registration fee. Estimated fees and expenses can only reflect information that is known at the time of filing this registration statement and are subject to future contingencies, including additional expenses for future offerings.

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities and Exchange Commission registration fee

|

|

$

|

3,170

|

|

|

Transfer agent’s fees and expenses

|

|

$

|

—

|

|

|

Printing and engraving expenses

|

|

$

|

20,000

|

|

|

Legal fees and expenses

|

|

$

|

25,000

|

|

|

Accounting fees and expenses

|

|

$

|

15,000

|

|

|

Miscellaneous expenses

|

|

$

|

16,830

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

80,000

|

|

|

|

|

|

|

|

|

|

|

|

ITEM 14.

|

INDEMNIFICATION OF DIRECTORS AND OFFICERS

|

Section 145 of the Delaware General Corporation Law authorizes a court to award, or a corporation’s Board of directors to grant, indemnity to directors and officers in terms sufficiently broad to permit such indemnification under certain circumstances for liabilities (including reimbursement for expenses incurred) arising under the Securities Act.

As permitted by the Delaware General Corporation Law, the Company’s certificate of incorporation includes a provision to indemnify any and all persons it has power to indemnify under such law from and against any and all of the expenses, liabilities or other matters referred to in or covered by such law. In addition, the Company’s certificate of incorporation includes a provision whereby the Company shall indemnify each of the Company’s directors and officer in each and every situation where, under the Delaware General Corporation law the Company is not obligated, but is permitted or empowered to make such indemnification, except as otherwise set forth in the Company’s bylaws. The Company’s certificate of incorporation also includes a provision which eliminates the personal liabilities of its directors for monetary damages for breach of fiduciary duty as a director, except for liability (1) for any breach of the director’s duty of loyalty to the Company or its stockholders, (2) for acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law, (3) under Section 174 of the Delaware General Corporation Law or (4) for any transaction from which the director derived an improper personal benefit.

As permitted by the Delaware General Corporation Law, the Company’s bylaws provide that (1) it is required to indemnify its directors to the fullest extent permitted by the Delaware General Corporation Law and may, if and to the extent authorized by the Board of Directors, indemnify its officers, employees or agents and any other person whom it has the power to indemnify against liability, reasonable expense or other matters and (2) the Company shall advance expenses to its directors and officer who are entitled to indemnification, as incurred, to its directors and officers in connection with a legal proceeding, subject to limited exceptions.

|

|

|

|

ITEM 15.

|

RECENT SALES OF UNREGISTERED SECURITIES

|

During the three-year period preceding the date of the filing of this post-effective amendment to the registration statement, we have issued securities in the transactions described below without registration under the Securities Act.

(a) Issuance of stock for cash.

These securities were offered and sold by us in reliance upon exemptions from the registration statement requirements provided by Section 4(a)(2) of the Securities Act and/or Regulation D under the Securities Act as transactions by an issuer not involving a public offering.

On May 29, 2014, the Company issued 22,223 shares of common stock to two accredited investors, each of whom was an executive officer of the Company, for an aggregate of $500,000.

On June 26, 2014, the Company issued 36,667 shares of common stock to two accredited investors, each of whom was an executive officer of the Company, for an aggregate of $550,000.

On August 6, 2014, the Company issued 40,000 shares of common stock to two accredited investors, each of whom was an executive officer of the Company, for an aggregate of $600,000.

10

From August 29, 2014 through October 10, 2014, the Company issued 800 shares of common stock to three executive officers of the Company, for an aggregate of $12,000.

On September 10, 2014, the Company issued 29,630 shares of common stock to two accredited investors, each of whom serves on the board of directors and serves as executive officer for a total purchase price of $400,000.

On October 14, 2014, the Company issued a total of 2,500 shares of its Series H Convertible Preferred Stock, par value $0.001 with a stated value of $1,000 per share, convertible into 258,519 shares of common stock based upon an initial conversion price of $9.67, Series A Warrants to purchase up to 258,519 shares of common stock at an initial exercise price of $13.82 per share for a term of 5

1

⁄

2

years, Series B warrants to purchase up to 258,519 shares of common stock at an initial exercise price of $9.67 per share for a term of six months, and Series C warrants to purchase up to 258,519 shares of common stock at an initial exercise price of $9.67 per share for a term of twelve months, for total proceeds of $2,500,000. The securities were issued to four accredited investors, two of whom were executive officers and directors of the Company.

On March 15, 2016, the Company issued a total of 6,310 shares of its Series I Preferred stock, with a stated value of $1,000 per share, convertible into 3,605,713 shares of common stock based upon an initial conversion price of $1.75 per share, Series A Warrants to purchase up to 3,605,713 shares of common stock at an initial exercise price of $3.64 per share for a term of five years, Series B Warrants to purchase up to 3,605,713 shares of common stock at an initial exercise price of $1.75 per share for a term of six months, and Series C Warrants to purchase up to 3,605,713 shares of common stock at an initial exercise price of $1.75 per share for a term of twelve months. These securities were issued to three accredited investors, including our CEO and Co-Chairman and two institutional investors who had previously purchased securities from us, for total proceeds of $6,310,000.

(b) Issuances of stock on conversion of preferred stock.

From November 26, 2014 through August 7, 2015, holders of Series H-1 Preferred Stock converted 2,000 shares of preferred stock to 424,291 shares of common stock. On November 23, 2015, holders of Series H-2 Preferred Stock converted 500 shares of preferred stock to 278,816 shares of common stock. From May 10, 2016 through April 7, 2017, holders of Series I-1 Preferred Stock converted 390 shares of preferred stock to 222,857 shares of common stock. All of these transactions were exempt issuances pursuant to Section 3(a)(9) of the Securities Act.

(c) Issuances upon conversion or exercise of warrants.

From January 1, 2014 through December 8, 2016, we issued a total of 1,483,301 shares of common stock upon exercise or conversion of previously issued warrants. The issuances upon conversion were exempt from registration pursuant to Section 3(a)(9) of the Securities Act and the issuance upon exercise were exempt from registration pursuant to Section 4(a)(2) of the Securities Act.

(d) Issuance on exchange of warrants.

On June 16, 2014, the Company completed a series of exchange transactions with the holders of its Series A Warrants and Placement Agent Warrants that had been issued as part of a public offering consummated in July 2013. The Company issued a total of 297,772 shares of common stock to the warrant holders in exchange for the cancellation of warrants to purchase 243,699 shares of common stock and the placement agent warrants for purchase of 4,445 shares of common stock and warrants. These shares were issued in exchange for previously issued securities in a transaction exempt from registration pursuant to Section 3(a)(9) of the Securities Act.

A list of exhibits filed herewith is contained in the exhibit index that immediately precedes such exhibits. These exhibits are included with this filing.

The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement;

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

11

provided, however, that paragraphs (a)(1

)(i) and (a)(1)(ii) do not apply if the registration statement is on Form S-3 or Form S-8, and the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed by the registrant pursuant to Se

ction 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(5) The undersigned registrant hereby undertakes that, for the purposes of determining liability to any purchaser:

(i) If the registrant is relying on Rule 430B:

(A) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) (§ 230.424(b)(2), (b)(5), or (b)(7) of this chapter) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) (§ 230.415(a)(1)(i), (vii), or (x) of this chapter) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

The undersigned registrant hereby undertakes that:

(1) For purposes of determining any liability under the Securities Act of 1933, the information omitted from the form of prospectus filed as part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule 424(b) or under the Securities Act shall be deemed to be part of this registration statement as of the time it was declared effective.

(2) For the purpose of determining any liability under the Securities Act of 1933, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

12

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant has caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Carlsbad, California on, June 9, 2017.

|

|

|

|

|

|

|

|

|

|

|

|

|

INTERNATIONAL STEM CELL CORPORATION

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Mahnaz Ebrahimi

|

|

|

|

|

|

|

|

Mahnaz Ebrahimi

|

|

|

|

|

|

|

|

Chief Financial Officer

|

Pursuant to the requirements of the Securities Act, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature

:

|

|

Capacity

:

|

|

Date

:

|

|

|

|

|

|

/s/ Andrey Semechkin*

|

|

Chief Executive Officer and Director (Principal Executive Officer)

|

|

June 9, 2017

|

|

Andrey Semechkin

|

|

|

|

|

|

|

|

|

/s/ Mahnaz Ebrahimi

|

|

Chief Financial Officer

|

|

June 9, 2017

|

|

Mahnaz Ebrahimi

|

|

(Principal Financial and Accounting Officer)

|

|

|

|

|

|

|

|

/s/ Charles J. Casamento*

|

|

Director

|

|

June 9, 2017

|

|

Charles J. Casamento

|

|

|

|

|

|

|

|

|

|

/s/ Paul V. Maier*

|

|

Director

|

|

June 9, 2017

|

|

Paul V. Maier

|

|

|

|

|

|

|

|

|

|

/s/ Russell Kern*

|

|

Executive Vice President and Chief Scientific Officer and Director

|

|

June 9, 2017

|

|

Russell Kern

|

|

|

|

|

|

|

|

|

/s/ Donald A. Wright*

|

|

Co-Chairman and Director

|

|

June 9, 2017

|

|

Donald A. Wright

|

|

|

*By: /s/ Mahnaz Ebrahimi

Mahnaz Ebrahimi, Attorney in Fact

EXHIBIT INDEX

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

3.1

|

|

Certificate of Incorporation (incorporated by reference to Exhibit 3.4 of the Registrant’s Form 10-SB filed on April 4, 2006, File No. 000-51891).

|

|

|

|

|

|

3.2

|

|

Certificate of Amendment of Certificate of Incorporation (incorporated by reference to Exhibit 3.1 of the Registrant’s Preliminary Information Statement on Form 14C filed on December 29, 2006, File No. 000-51891).

|

|

|

|

|

|

3.3

|

|

Certificate of Amendment of Certificate of Incorporation (incorporated by reference to Exhibit 3.1 of the Registrant’s Form 8-K filed on June 4, 2012, File No. 000-51891).

|

|

|

|

|

|

3.4

|

|

Certificate of Amendment to Certificate of Incorporation (incorporated by reference to Exhibit 3.1 of the Registrant’s Form 8-K filed on December 5, 2014, File No. 000-51891).

|

|

|

|

|

|

3.5

|

|

Certificate of Amendment to Certificate of Incorporation (incorporated by reference to Exhibit 3.1 of the Registrant’s Form 8-K filed on July 28, 2015, File No. 000-51891).

|

|

|

|

|

|

3.6

|

|

Certificate of Amendment to Certificate of Incorporation (incorporated by reference to Exhibit 3.1 of the Registrant’s Form 8-K filed on May 19, 2017, File No. 000-51891).

|

|

|

|

|

|

3.7

|

|

Amended and Restated Bylaws of the Registrant (incorporated by reference to Exhibit 3.1 of the Registrant’s Form 8-K filed on May 6, 2011, File No. 000-51891).

|

|

|

|

|

|

4.1

|

|

Form of Specimen Common Stock Certificate (incorporated by reference to Exhibit 4.1 of the Registrant’s Form 10-KSB filed on April 9, 2007, File No. 000-51891).

|

|

|

|

|

|

4.2

|

|

Certification of Designation of Series B Preferred Stock (incorporated by reference to Exhibit 4.1 of the Registrant’s Form 8-K filed on May 12, 2008, File No. 000-51891).

|

|

|

|

|

|

4.3

|

|

Certification of Designation of Series D Preferred Stock (incorporated by reference to Exhibit 10.2 of the Registrant’s Form 8-K filed on January 5, 2009, File No. 000-51891).

|

|

|

|

|

|

4.4

|

|

Certificate of Designation of Series G Preferred Stock (incorporated by reference to Exhibit 3.1 of the Registrant’s Form 8-K filed on March 14, 2012, File No. 000-51891).

|

|

|

|

|

|

4.5

|

|

Form of Series A Warrant (incorporated by reference to Exhibit 4.7 of the Registrant’s Form 8-K filed on July 19, 2013, File No. 000-51891).

|

|

|

|

|

|

4.6

|

|

Form of Placement Agent Warrant (incorporated by reference to Exhibit 4.10 of the Registrant’s Form 8-K filed on July 19, 2013, File No. 000-51891).

|

|

|

|

|

|

4.7

|

|

Certificate of Preferences, Rights and Limitations of Series I-1 Convertible Preferred Stock (incorporated by reference to Exhibit 3.1 of the Registrant’s Form 8-K filed on March 10, 2016, File No. 000-51891).

|

|

|

|

|

|

4.8

|

|

Certificate of Preferences, Rights and Limitations of Series I-12 Convertible Preferred Stock (incorporated by reference to Exhibit 3.2 of the Registrant’s Form 8-K filed on March 10, 2016, File No. 000-51891).

|

|

|

|

|

|

4.9

|

|

Form of Series A Common Stock Purchase Warrant (incorporated by reference to Exhibit 4.1 of the Registrant’s Form 8-K filed on March 10, 2016, File No. 000-51891).

|

|

|

|

|

|

4.10

|

|

Form of Placement Agent Common Stock Purchase Warrant (incorporated by reference to Exhibit 4.4 of the Registrant’s Form 8-K filed on March 10, 2016, File No. 000-51891).

|

|

|

|

|

|

5.1

|

|

Opinion of DLA Piper LLP (US)**

|

|

|

|

|

|

10.1*

|

|

International Stem Cell Corporation 2006 Equity Participation Plan (incorporated by reference to Exhibit 10.15 of the Registrant’s Form 8-K filed on December 29, 2006, File No. 000-51891).

|

|

|

|

|

|

10.2*

|

|

Form of Stock Option Agreement for stock options granted outside of the 2006 Equity Participation Plan (incorporated by reference to Exhibit 10.19 of the Registrant’s Form 10-K filed on March 30, 2010, File No. 000-51891).

|

|

|

|

|

|

10.3

|

|

Cell Culture Automation Agreement dated May 13, 2010 (incorporated by reference to Exhibit 10.1 of the Registrant’s Form 8-K filed on May 19, 2010, File No. 000-51891).

|

|

|

|

|

|

10.4*

|

|

2010 Equity Participation Plan (incorporated by reference to Appendix A of the Registrant’s Schedule 14A filed April 18,2016, File No. 000-51891).

|

|

|

|

|

|

10.5

|

|

Standard Multi-Tenant Office Lease – Gross Agreement, dated as of February 19, 2011, by and between the Company and S Real Estate Holdings, LLC (incorporated by reference to Exhibit 10.1 of the Registrant’s Form 8-K filed February 28, 2011, File No. 000-51891).

|

|

|

|

|

|

10.6

|

|

Amendment to Standard Multi-Tenant Office Lease – Gross Agreement, dated as of March 3, 2016, by and between the Company and S Real Estate Holdings, LLC (incorporated by reference to Exhibit 10.9 of the Registrant’s Form 10-K filed March 30, 2016, File No. 000-51891).

|

|

|

|

|

|

10.7

|

|

Series G Preferred Stock Purchase Agreement dated March 9, 2012 (incorporated by reference to Exhibit 10.1 of the Registrant’s Form-8-K filed on March 15, 2012, File No. 000-51891).

|

|

|

|

|

|

10.8

|

|

Amended and Restated Investors Rights Agreement dated March 9, 2012 (incorporated by reference to Exhibit 10.2 of the Registrant’s Form 8-K filed on March 15, 2012, File No. 000-51891).

|

|

|

|

|

|

10.9

|

|

Management Rights Letter dated March 9, 2012 (incorporated by reference to Exhibit 10.3 of the Registrant’s Form 8-K filed on March 15, 2012, File No. 000-51891).

|

|

|

|

|

|

10.10

|

|

Dividend Waiver Agreement dated October 12, 2012 (incorporated by reference to Exhibit 10.29 of the Registrant’s Form S-1 filed on October 18, 2012, File No. 000-51891).

|

|

|

|

|

|

10.11

|

|

Form of Warrant Agreement for January 22, 2013 Purchase (incorporated by reference to Exhibit 10.2 of the Registrant’s Form 8-K filed on January 24, 2013, File No. 000-51891).

|

|

|

|

|

|

10.12

|

|

Amended and Restated License Agreement with Advanced Cell Technology, Inc. dated February 7, 2013 (ACT IP) (incorporated by reference to Exhibit 10.1 of the Registrant’s Amendment to Form 8-K filed on February 14, 2013, File No. 000-51891)

|

|

|

|

|

|

10.13

|

|

Amended and Restated License Agreement with Advanced Cell Technology, Inc. (UMass IP) (incorporated by reference to Exhibit 10.3 of the Registrant’s Amendment to Form 8-K filed on February 14, 2013, File No. 000-51891)

|

|

|

|

|

|

10.14

|

|

Amended and Restated License Agreement dated February 7, 2013 with Advanced Cell Technology, Inc. (Infigen IP) (incorporated by reference to Exhibit 10.2 of the Registrant’s Amendment to Form 8-K filed on February 14, 2013, File No. 000-51891)

|

|

|

|

|

|

10.15

|

|

Securities Purchase Agreement dated March 12, 2013 (incorporated by reference by Exhibit 10.1 of the Registrant’s Form 8-K filed March 14, 2013, File No. 000-51891).

|

|

|

|

|

|

10.16

|

|

Form of Common Stock Warrant Agreement for March 2013 Securities Purchase (incorporated by reference to Exhibit 10.2 of the Registrant’s Form 8-K filed March 14, 2013, File No. 000-51891).

|

|

|

|

|

|

10.17

|

|

Amendment, effective July 1, 2011, to Standard Multi-Tenant Office Lease with S Real Estate Holdings LLC (incorporated by reference to Exhibit 10.43 of the Registrant’s Form 10-K filed on March 26, 2013, File No. 000-51891).

|

|

|

|

|

|

10.18

|

|

Securities Purchase Agreement dated May 29, 2014 (incorporated by reference to Exhibit 10.1 of the Registrant’s Form 8-K filed on June 4, 2014, File No. 000-51891).

|

|

|

|

|

|

10.19

|

|

Form of Warrant Exchange Agreement (incorporated by reference to Exhibit 10.1 of the Registrant’s Form 8-K filed on June 12, 2014, File No. 000-51891).

|

|

|

|

|

|

10.20

|

|

Securities Purchase Agreement dated June 26, 2014 (incorporated by reference to Exhibit 10.1 of the Registrant’s Form 8-K filed on July 1, 2014, File No. 000-51891).

|

|

|

|

|

|

10.21

|

|