- Net income for the fourth quarter

and Fiscal 2017 was $26.5 million and $143.9 million, respectively,

compared to a net loss of $207.0 million and $187.1 million,

respectively, for the fourth quarter and Fiscal 2016

- Adjusted EBITDA for the fourth

quarter of Fiscal 2017 was $121.0 million and $380.8 million for

all of Fiscal 2017, compared to $154.0 million for the fourth

quarter of Fiscal 2016 and $424.1 million for Fiscal 2016

- Distributable Cash Flow for the

fourth quarter of Fiscal 2017 was $84.0 million and totaled $234.8

million for the year

- Growth capital expenditures and

other investments totaled approximately $84 million during the

fourth quarter, the majority of which was related to the

acquisition of the natural gas liquid terminals from Murphy Energy

Corporation

- Fiscal 2018 Adjusted EBITDA guidance

of approximately $500 million to $525 million and expected

distribution coverage of approximately 1.3x

NGL Energy Partners LP (NYSE:NGL) (“NGL” or the “Partnership”)

today reported net income for the quarter ended March 31, 2017

of $26.5 million, compared to a net loss for the quarter ended

March 31, 2016 of $207.0 million. Adjusted EBITDA was $121.0

million for the quarter ended March 31, 2017, a 21% year over

year decrease when compared to Adjusted EBITDA of $154.0 million

for the quarter ended March 31, 2016. Distributable Cash Flow

was $84.0 million for the quarter ended March 31, 2017,

compared to $122.5 million for the quarter ended March 31,

2016. Net income for the fiscal year ended March 31, 2017 was

$143.9 million with Adjusted EBITDA for the year of $380.8 million

compared to a net loss and Adjusted EBITDA of $187.1 million and

$424.1 million, respectively, for the year ended March 31,

2016.

“Our fourth quarter results were adversely impacted by one of

the warmest winters in the United States for the past 100 years

negatively impacting both Retail Propane and Liquids as well as a

decrease in Refined Products' results due to lower than historical

line space values. While neither of these items change our core

business strategies, we did adjust our expectations for the

upcoming fiscal year for the refined products and propane

businesses to account for the potential effects of similar events

occurring in the upcoming year,” stated Mike Krimbill, CEO of the

Partnership. “We had many positive accomplishments during fiscal

2017, including the scheduled startup of Grand Mesa Pipeline,

continued expansion of the Retail Propane, Water and Liquids

businesses and a restructuring of our balance sheet. We look

forward to fiscal 2018 and the continued growth of our

Partnership.”

Quarterly Results of Operations

The following table summarizes operating income (loss) by

operating segment for the three months ended March 31, 2017

and March 31, 2016 (in thousands):

Three Months Ended Three Months Ended

March 31, 2017 March 31, 2016 Crude Oil Logistics $

11,352 $ (53,434 ) Refined Products and Renewables 53,181 167,473

Liquids 10,160 23,353 Retail Propane 38,702 32,111 Water Solutions

(18,549 ) (357,973 ) Corporate and Other (20,392 )

(15,775 ) Total operating income (loss) $ 74,454 $ (204,245

)

The tables included in this release reconcile operating income

(loss) to Adjusted EBITDA for each of our operating segments.

Crude Oil Logistics

The Partnership’s Crude Oil Logistics segment generated Adjusted

EBITDA of $29.5 million during the quarter ended March 31,

2017, compared to Adjusted EBITDA of $16.9 million during the

quarter ended March 31, 2016. The Partnership’s Grand Mesa

Pipeline project commenced commercial operations on November 1,

2016 and contributed Adjusted EBITDA of approximately $26.6 million

during the fourth quarter. For fiscal 2018, the Partnership

anticipates Adjusted EBITDA related to this project to be

approximately $130 million based on current contracts and expected

walk-up volumes. The average contract term on the pipeline is

approximately nine years and all contracts are fee-based with

volume commitments, which step up in the second and third years of

operations.

The Crude Oil Logistics segment continued to be impacted by

increased competition due to lower production in the majority of

the basins across the United States. The Partnership’s quarterly

results were also impacted by the flattening of the contango curve

for crude oil during the quarter.

Refined Products and Renewables

The Partnership’s Refined Products and Renewables segment

generated Adjusted EBITDA of $12.2 million during the quarter ended

March 31, 2017, compared to Adjusted EBITDA of $52.3 million

during the quarter ended March 31, 2016. The results for the

quarter ended March 31, 2017 were negatively impacted by

decreased demand for diesel fuel, lower than expected results for

biodiesel and an extended decline in gasoline line space values on

the Colonial Pipeline.

Refined product barrels sold during the quarter ended

March 31, 2017 totaled approximately 37.1 million barrels, and

increased by approximately 9.3 million barrels compared to the same

period in the prior year, as a result of the increase in pipeline

capacity rights purchased over the previous year and an expansion

of our refined products operations. Renewable barrels sold during

the quarter ended March 31, 2017 were approximately 1.9

million, compared to approximately 1.7 million during the quarter

ended March 31, 2016.

Liquids

The Partnership’s Liquids segment generated Adjusted EBITDA of

$16.2 million during the quarter ended March 31, 2017,

compared to Adjusted EBITDA of $37.9 million during the quarter

ended March 31, 2016. The significantly warmer than normal

winter resulted in lower margin and lower wholesale demand from

retailers and our butane business continues to be negatively

impacted by lower margins, railcar costs and lower storage

utilization. Total product margin per gallon was $0.033 for the

quarter ended March 31, 2017, compared to $0.071 for the

quarter ended March 31, 2016. Propane volumes increased by

approximately 29.2 million gallons, or 6.9%, during the quarter

ended March 31, 2017 when compared to the quarter ended

March 31, 2016; however, these volumes were lower than

budgeted based on weather-related decreases to demand. Butane

volumes decreased by approximately 2.0 million gallons, or 1.8%,

during the quarter ended March 31, 2017 when compared to the

quarter ended March 31, 2016. Other Liquids volumes increased

by 3.7 million gallons, or 4.4%, during the quarter ended

March 31, 2017 when compared to the same period in the prior

year.

Retail Propane

The Partnership’s Retail Propane segment generated Adjusted

EBITDA of $48.9 million during the quarter ended March 31,

2017, compared to Adjusted EBITDA of $40.8 million during the

quarter ended March 31, 2016. Propane sold during the quarter

ended March 31, 2017 increased by approximately 9.4 million

gallons, or 15%, when compared to the quarter ended March 31,

2016, primarily due increased demand in the pacific northwest and

to acquisitions made during previous quarters. Distillates sold

during the quarter ended March 31, 2017 decreased by

approximately 0.4 million gallons when compared to the quarter

ended March 31, 2016. Total product margin per gallon was

$0.957 for the quarter ended March 31, 2017, compared to

$0.905 for the quarter ended March 31, 2016.

Water Solutions

The Partnership’s Water Solutions segment generated Adjusted

EBITDA of $18.1 million during the quarter ended March 31,

2017, compared to Adjusted EBITDA of $11.6 million during the

quarter ended March 31, 2016. The Partnership processed

approximately 536,000 barrels of water per day during the quarter

ended March 31, 2017, compared to approximately 479,000

barrels of water per day during the quarter ended March 31,

2016. The segment continued to benefit from the increased rig

counts in the basins in which it operates, particularly in the

Permian and DJ Basins. Revenues from recovered hydrocarbons totaled

$11.8 million for the quarter ended March 31, 2017, an

increase of $5.7 million over the prior year period related to

increased crude oil prices and volumes.

Corporate and Other

Adjusted EBITDA for Corporate and Other was a loss of $3.9

million during the quarter ended March 31, 2017, compared to a

loss of $5.5 million during the quarter ended March 31, 2016.

General and administrative expenses for the quarter ended

March 31, 2017 benefited from lower compensation expense and a

reduction in insurance costs.

Capitalization and Liquidity

In February 2017, the Partnership issued $500.0 million of

6.125% Senior Notes due 2025 and received net proceeds from the

issuance of $491.3 million, which were used to reduce the

outstanding balance on its revolving credit facility. Also in

February 2017, the Partnership issued 10,120,000 common units and

received net proceeds from the issuance of $222.5 million, which

were also used to reduce the outstanding balance on its revolving

credit facility. The Partnership amended and restated its revolving

credit facility during the quarter, which included extending the

maturity to October 2021. Total liquidity (cash plus available

capacity on the revolving credit facility) was approximately $874

million as of March 31, 2017.

Total long-term debt outstanding, excluding working capital

borrowings, was $2,149.0 million at March 31, 2017 compared to

$2,341.0 million at December 31, 2016, a decrease of $192.0

million. Working capital borrowings totaled $814.5 million at

March 31, 2017 compared to $875.5 million at December 31,

2016, a decrease of $61.0 million driven primarily by a reduction

in inventories during the quarter. Working capital borrowings,

which are fully secured by the Partnership’s net working capital,

are subject to a borrowing base and are excluded from the

Partnership’s debt compliance ratios.

Fiscal Year 2018 Guidance

For fiscal 2018, the Partnership expects to generate Adjusted

EBITDA of approximately $500 million to $525 million, which

includes Adjusted EBITDA for Grand Mesa Pipeline of approximately

$130 million. Distributable Cash Flow is expected to be between

$300 million and $325 million and would generate over $100 million,

or about 1.3x, distribution coverage at our current

annualized distribution rate, including distributions on the Class

A Preferred Units. The Partnership currently expects to spend

approximately $150 million to $200 million on growth capital

expenditures during fiscal 2018.

Fourth Quarter Conference Call Information

A conference call to discuss NGL’s results of operations is

scheduled for 11:00 am Eastern Time (10:00 am Central

Time) on Thursday, May 25, 2017. Analysts, investors, and

other interested parties may access the conference call by dialing

(800) 291-4083 and providing access code 22563375. An archived

audio replay of the conference call will be available for 7 days

beginning at 2:00 pm Eastern Time (1:00 pm Central Time)

on May 25, 2017, which can be accessed by dialing

(855) 859-2056 and providing access code 22563375.

Non-GAAP Financial Measures

NGL defines EBITDA as net income (loss) attributable to NGL

Energy Partners LP, plus interest expense, income tax expense

(benefit), and depreciation and amortization expense. NGL defines

Adjusted EBITDA as EBITDA excluding net unrealized gains and losses

on derivatives, lower of cost or market adjustments, gains and

losses on disposal or impairment of assets, gain on early

extinguishment of liabilities, revaluation of investments,

equity-based compensation expense, acquisition expense and other.

We also include in Adjusted EBITDA certain inventory valuation

adjustments related to our Refined Products and Renewables segment,

as discussed below. EBITDA and Adjusted EBITDA should not be

considered alternatives to net income, income before income taxes,

cash flows from operating activities, or any other measure of

financial performance calculated in accordance with GAAP, as those

items are used to measure operating performance, liquidity or the

ability to service debt obligations. NGL believes that EBITDA

provides additional information to investors for evaluating NGL’s

ability to make quarterly distributions to NGL’s unitholders, and

it is presented solely as a supplemental measure. NGL believes that

Adjusted EBITDA provides additional information to investors for

evaluating NGL’s financial performance without regard to NGL’s

financing methods, capital structure and historical cost basis.

Further, EBITDA and Adjusted EBITDA, as NGL defines them, may not

be comparable to EBITDA, Adjusted EBITDA, or similarly titled

measures used by other entities.

Other than for NGL’s Refined Products and Renewables segment,

for purposes of the Adjusted EBITDA calculation, NGL makes a

distinction between realized and unrealized gains and losses on

derivatives. During the period when a derivative contract is open,

NGL records changes in the fair value of the derivative as an

unrealized gain or loss. When a derivative contract matures or is

settled, NGL reverses the previously recorded unrealized gain or

loss and records a realized gain or loss. NGL does not draw such a

distinction between realized and unrealized gains and losses on

derivatives of NGL’s Refined Products and Renewables segment. The

primary hedging strategy of NGL’s Refined Products and Renewables

segment is to hedge against the risk of declines in the value of

inventory over the course of the contract cycle, and many of the

hedges are six months to one year in duration at inception. The

“inventory valuation adjustment” row in the reconciliation table

reflects the difference between the market value of the inventory

of NGL’s Refined Products and Renewables segment at the balance

sheet date and its cost. We include this in Adjusted EBITDA because

the unrealized gains and losses associated with derivative

contracts associated with the inventory of this segment, which are

intended primarily to hedge inventory holding risk and are included

in net income, also affect Adjusted EBITDA.

Distributable Cash Flow is defined as Adjusted EBITDA minus

maintenance capital expenditures, cash income taxes and cash

interest expense. Maintenance capital expenditures represent

capital expenditures necessary to maintain the Partnership’s

operating capacity. Distributable Cash Flow is a performance metric

used by senior management to compare cash flows generated by the

Partnership (excluding growth capital expenditures and prior to the

establishment of any retained cash reserves by the Board of

Directors) to the cash distributions expected to be paid to

unitholders. Using this metric, management can quickly compute the

coverage ratio of estimated cash flows to planned cash

distributions. This financial measure also is important to

investors as an indicator of whether the Partnership is generating

cash flow at a level that can sustain, or support an increase in,

quarterly distribution rates. Actual distribution amounts are set

by the Board of Directors.

Forward Looking Statements

This press release includes “forward-looking statements.” All

statements other than statements of historical facts included or

incorporated herein may constitute forward-looking statements.

Actual results could vary significantly from those expressed or

implied in such statements and are subject to a number of risks and

uncertainties. While NGL believes such forward-looking statements

are reasonable, NGL cannot assure they will prove to be correct.

The forward-looking statements involve risks and uncertainties that

affect operations, financial performance, and other factors as

discussed in filings with the Securities and Exchange Commission.

Other factors that could impact any forward-looking statements are

those risks described in NGL’s Annual Report on Form 10-K,

Quarterly Reports on Form 10-Q, and other public filings. You are

urged to carefully review and consider the cautionary statements

and other disclosures made in those filings, specifically those

under the heading “Risk Factors.” NGL undertakes no obligation to

publicly update or revise any forward-looking statements except as

required by law.

NGL provides Adjusted EBITDA guidance that does not include

certain charges and costs, which in future periods are generally

expected to be similar to the kinds of charges and costs excluded

from Adjusted EBITDA in prior periods, such as income taxes,

interest and other non-operating items, depreciation and

amortization, net unrealized gains and losses on derivatives, lower

of cost or market adjustments, gains and losses on disposal or

impairment of assets, equity-based compensation,

acquisition-related expense, revaluation of liabilities and items

that are unusual in nature or infrequently occurring. The exclusion

of these charges and costs in future periods will have a

significant impact on the Partnership’s Adjusted EBITDA, and the

Partnership is not able to provide a reconciliation of its

Adjusted EBITDA guidance to net income (loss) without unreasonable

efforts due to the uncertainty and variability of the nature and

amount of these future charges and costs and the Partnership

believes that such reconciliation, if possible, would imply a

degree of precision that would be potentially confusing or

misleading to investors.

About NGL Energy Partners LP

NGL Energy Partners LP is a Delaware limited partnership. NGL

owns and operates a vertically integrated energy business with five

primary businesses: Crude Oil Logistics, Water Solutions, Liquids,

Retail Propane and Refined Products and Renewables. NGL completed

its initial public offering in May 2011. For further

information, visit the Partnership’s website at www.nglenergypartners.com.

NGL ENERGY PARTNERS LP AND

SUBSIDIARIES

Consolidated Balance Sheets

(in Thousands, except unit

amounts)

(Unaudited)

March 31, December 31,

2017 2016 ASSETS CURRENT ASSETS: Cash and cash

equivalents $ 12,264 $ 28,927 Accounts receivable-trade, net of

allowance for doubtful accounts of $5,234 and $5,578, respectively

800,607 765,290 Accounts receivable-affiliates 6,711 20,008

Inventories 561,432 613,993 Prepaid expenses and other current

assets 103,193 134,485 Total current

assets 1,484,207 1,562,703 PROPERTY, PLANT AND EQUIPMENT,

net of accumulated depreciation of $375,594 and $348,136,

respectively 1,790,273 1,746,925 GOODWILL 1,451,716 1,462,116

INTANGIBLE ASSETS, net of accumulated amortization of $414,605 and

$388,517, respectively 1,163,956 1,164,749 INVESTMENTS IN

UNCONSOLIDATED ENTITIES 187,423 187,514 LOAN RECEIVABLE-AFFILIATE

3,200 2,700 OTHER NONCURRENT ASSETS 239,604

251,369 Total assets $ 6,320,379 $ 6,378,076

LIABILITIES AND EQUITY CURRENT LIABILITIES: Accounts

payable-trade $ 658,021 $ 650,886 Accounts payable-affiliates 7,918

22,917 Accrued expenses and other payables 207,125 196,033 Advance

payments received from customers 35,944 63,509 Current maturities

of long-term debt 29,590 33,501 Total

current liabilities 938,598 966,846 LONG-TERM DEBT, net of

debt issuance costs of $33,458 and $24,574, respectively, and

current maturities 2,963,483 3,216,505 OTHER NONCURRENT LIABILITIES

184,534 186,280 COMMITMENTS AND CONTINGENCIES CLASS A 10.75%

CONVERTIBLE PREFERRED UNITS, 19,942,169 and 19,942,169 preferred

units issued and outstanding, respectively 63,890 61,170 REDEEMABLE

NONCONTROLLING INTEREST 3,072 — EQUITY: General partner,

representing a 0.1% interest, 120,300 and 109,201 notional units,

respectively (50,529 ) (50,785 ) Limited partners, representing a

99.9% interest, 120,179,407 and 109,091,710 common units issued and

outstanding, respectively 2,192,413 1,969,113 Accumulated other

comprehensive loss (1,828 ) (97 ) Noncontrolling interests

26,746 29,044 Total equity 2,166,802

1,947,275 Total liabilities and equity $

6,320,379 $ 6,378,076

NGL ENERGY PARTNERS LP AND

SUBSIDIARIES

Consolidated Statements of

Operations

(in Thousands, except unit and per unit

amounts)

(Unaudited)

Three Months Ended Year Ended

March 31, March 31, 2017

2016 2017

2016 REVENUES: Crude Oil Logistics $ 505,142 $

362,292 $ 1,666,884 $ 3,217,079 Water Solutions 43,756 37,776

159,601 185,001 Liquids 529,504 332,975 1,439,088 1,194,479 Retail

Propane 172,978 135,179 413,109 352,977 Refined Products and

Renewables 2,596,534 1,456,756 9,342,702 6,792,112 Other 165

462 844 462 Total

Revenues 3,848,079 2,325,440 13,022,228 11,742,110 COST OF SALES:

Crude Oil Logistics 464,428 341,477 1,572,015 3,111,717 Water

Solutions 197 752 4,068 (7,336 ) Liquids 502,895 282,961 1,334,116

1,037,118 Retail Propane 85,570 60,340 191,589 156,757 Refined

Products and Renewables 2,545,527 1,391,448 9,219,721 6,540,599

Other 100 182 400

182 Total Cost of Sales 3,598,717 2,077,160 12,321,909

10,839,037 OPERATING COSTS AND EXPENSES: Operating 82,517 93,177

307,925 401,118 General and administrative 28,489 24,727 116,566

139,541 Depreciation and amortization 62,929 53,152 223,205 228,924

Loss (gain) on disposal or impairment of assets, net (5,744 )

317,726 (209,177 ) 320,766 Revaluation of liabilities 6,717

(36,257 ) 6,717 (82,673 )

Operating Income (Loss) 74,454 (204,245 ) 255,083 (104,603 ) OTHER

INCOME (EXPENSE): Equity in earnings of unconsolidated entities

1,358 2,113 3,084 16,121 Revaluation of investments — — (14,365 ) —

Interest expense (45,162 ) (34,540 ) (150,478 ) (133,089 ) Gain

(loss) on early extinguishment of liabilities, net (6,163 ) 28,532

24,727 28,532 Other income, net 1,902 2,634

27,762 5,575 Income (Loss)

Before Income Taxes 26,389 (205,506 ) 145,813 (187,464 ) INCOME TAX

BENEFIT (EXPENSE) 97 (1,479 ) (1,939 )

367 Net Income (Loss) 26,486 (206,985 ) 143,874

(187,097 ) LESS: NET (INCOME) LOSS ATTRIBUTABLE TO NONCONTROLLING

INTERESTS (741 ) 2,853 (6,832 )

(11,832 ) NET INCOME (LOSS) ATTRIBUTABLE TO NGL ENERGY PARTNERS LP

25,745 (204,132 ) 137,042 (198,929 ) LESS: DISTRIBUTIONS TO

PREFERRED UNITHOLDERS (9,184 ) — (30,142 ) — LESS: NET (INCOME)

LOSS ALLOCATED TO GENERAL PARTNER (52 ) 178

(232 ) (47,620 ) NET INCOME (LOSS) ALLOCATED TO

COMMON UNITHOLDERS $ 16,509 $ (203,954 ) $ 106,668 $

(246,549 ) BASIC INCOME (LOSS) PER COMMON UNIT $ 0.14 $

(1.94 ) $ 0.99 $ (2.35 ) DILUTED INCOME (LOSS) PER COMMON

UNIT $ 0.14 $ (1.94 ) $ 0.95 $ (2.35 ) BASIC WEIGHTED

AVERAGE COMMON UNITS OUTSTANDING 114,131,764

104,930,260 108,091,486 104,838,886

DILUTED WEIGHTED AVERAGE COMMON UNITS OUTSTANDING

120,198,802 104,930,260 111,850,621

104,838,886

EBITDA, ADJUSTED EBITDA AND DISTRIBUTABLE

CASH FLOW RECONCILIATION

(Unaudited)

The following table reconciles NGL’s net

income (loss) to NGL’s EBITDA, Adjusted EBITDA and Distributable

Cash Flow:

Three Months Ended Year Ended

March 31, March 31, 2017 2016

2017 2016 (in thousands) Net income

(loss) $ 26,486 $ (206,985 ) $ 143,874 $ (187,097 ) Less: Net

(income) loss attributable to noncontrolling interests (741

) 2,853 (6,832 ) (11,832 ) Net income

(loss) attributable to NGL Energy Partners LP 25,745 (204,132 )

137,042 (198,929 ) Interest expense 45,221 33,606 150,504 126,514

Income tax (benefit) expense (97 ) 1,480 1,939 (420 ) Depreciation

and amortization 66,837 55,165

238,583 217,893 EBITDA 137,706 (113,881 )

528,068 145,058 Net unrealized (gains) losses on derivatives (2,601

) 5,749 (3,338 ) 1,255 Inventory valuation adjustment (1) (33,184 )

21,559 7,368 24,390 Lower of cost or market adjustments (2,122 )

(13,257 ) (1,283 ) (5,932 ) (Gain) loss on disposal or impairment

of assets, net (5,744 ) 317,727 (209,213 ) 320,783 Loss (gain) on

early extinguishment of liabilities, net 6,163 (28,532 ) (24,727 )

(28,532 ) Revaluation of investments — — 14,365 — Equity-based

compensation expense (2) 13,243 6,104 53,102 58,816 Acquisition

expense (3) 232 1,131 1,771 2,002 Other (4) 7,306

(42,559 ) 14,687 (93,725 ) Adjusted

EBITDA 120,999 154,041 380,800 424,115 Less: Cash interest expense

28,810 28,419 117,912 117,185 Less: Cash income taxes 37 522 2,022

2,300 Less: Maintenance capital expenditures (5) 8,172

2,629 26,073 30,422

Distributable Cash Flow

$ 83,980 $ 122,471 $ 234,793 $ 274,208

____________

(1) Amount reflects the difference between the market value of

the inventory of NGL’s Refined Products and Renewables segment at

the balance sheet date and its cost. See “Non-GAAP Financial

Measures” section above for a further discussion.

(2) Equity-based compensation expense in the table above may

differ from equity-based compensation expense reported in the

footnotes to our consolidated financial statements included in our

Annual Report on Form 10-K. Amounts reported in the table

above include expense accruals for bonuses expected to be paid in

common units, whereas the amounts reported in the footnotes to our

consolidated financial statements only include expenses associated

with equity-based awards that have been formally granted.

(3) During the quarters and years ended March 31, 2017 and

2016, we incurred expenses related to legal and advisory costs

associated with acquisitions.

(4) The amount for the quarter ended March 31, 2017

represents non-cash operating expenses related to our Grand Mesa

Pipeline project. The amount for the year ended March 31, 2017

represents non-cash operating expenses related to our Grand Mesa

Pipeline project and also includes adjustments related to

noncontrolling interests. Amounts for the quarter and year ended

March 31, 2016 represent the non-cash valuation adjustment of

contingent consideration liabilities, offset by the cash payments,

related to royalty agreements acquired as part of acquisitions in

our Water Solutions segment, and amounts attributable to

noncontrolling interests.

(5) Excludes TLP maintenance capital expenditures of $0.2

million and $11.6 million during the quarter and year ended

March 31, 2016, respectively.

ADJUSTED EBITDA RECONCILIATION BY SEGMENT

Three Months Ended March 31, 2017 Crude

OilLogistics WaterSolutions

Liquids

RetailPropane

RefinedProductsandRenewables

CorporateandOther

Consolidated (in thousands) Operating income

(loss) $ 11,352 $ (18,549 ) $ 10,160 $ 38,702 $ 53,181 $ (20,392 )

$ 74,454 Depreciation and amortization 19,648 25,045 5,848 11,195

325 868 62,929 Amortization recorded to cost of sales 100 — 196 —

1,434 — 1,730 Net unrealized (gains) losses on derivatives (2,464 )

50 (23 ) (164 ) — — (2,601 ) Inventory valuation adjustment — — — —

(33,184 ) — (33,184 ) Lower of cost or market adjustments — — — —

(2,122 ) — (2,122 ) (Gain) loss on disposal or impairment of

assets, net (3,913 ) 6,398 (17 ) (191 ) (8,024 ) 3 (5,744 )

Equity-based compensation expense — — — — — 13,243 13,243

Acquisition expense — — — — — 232 232 Other income (expense), net

177 (785 ) 6 165 164 2,175 1,902 Adjusted EBITDA attributable to

unconsolidated entities 3,938 115 — (39 ) 432 — 4,446 Adjusted

EBITDA attributable to noncontrolling interest — (868 ) — (799 ) —

— (1,667 ) Other 664 6,717 —

— — — 7,381

Adjusted EBITDA $ 29,502 $ 18,123 $ 16,170

$ 48,869 $ 12,206 $ (3,871 ) $ 120,999

Three Months Ended March 31, 2016

Crude OilLogistics

WaterSolutions

Liquids

RetailPropane

RefinedProductsandRenewables

CorporateandOther

Consolidated (in thousands) Operating (loss)

income $ (53,434 ) $ (357,973 ) $ 23,353 $ 32,111 $ 167,473 $

(15,775 ) $ (204,245 ) Depreciation and amortization 9,267 24,779

4,356 9,281 4,041 1,428 53,152 Amortization recorded to cost of

sales 63 — 261 — 1,274 — 1,598 Net unrealized losses (gains) on

derivatives 5,337 1,922 (1,845 ) 335 — — 5,749 Inventory valuation

adjustment — — — — 21,559 — 21,559 Lower of cost or market

adjustments — — — — (13,257 ) — (13,257 ) Loss (gain) on disposal

or impairment of assets, net 52,837 380,759 11,785 (245 ) (127,410

) — 317,726 Equity-based compensation expense — — — — 15 5,786

5,801 Acquisition expense — — — — — 1,131 1,131 Other (expense)

income, net (293 ) 792 2 177 (1 ) 1,957 2,634 Adjusted EBITDA

attributable to unconsolidated entities 3,080 (90 ) — (38 ) 3,977 —

6,929 Adjusted EBITDA attributable to noncontrolling interest —

(867 ) — (786 ) (5,328 ) — (6,981 ) Other —

(37,755 ) — — — —

(37,755 ) Adjusted EBITDA $ 16,857 $ 11,567

$ 37,912 $ 40,835 $ 52,343 $ (5,473 ) $

154,041

OPERATIONAL DATA

(Unaudited)

Three Months Ended Year Ended

March 31, March 31, 2017 2016

2017 2016 (in thousands, except per day

amounts) Crude Oil Logistics: Crude oil sold (barrels)

9,374 11,300 34,212 67,211 Crude oil transported on owned pipelines

(barrels) 4,755 — 6,365 — Crude oil storage capacity - owned and

leased (barrels) (1) 7,024 6,115 Crude oil inventory (barrels) (1)

2,844 2,123

Water Solutions: Water processed (barrels

per day) Eagle Ford Basin 211,448 208,695 208,649 236,792 Permian

Basin 192,456 147,950 184,702 179,413 DJ Basin 85,845 78,589 68,253

107,353 Other Basins 46,254 43,844 40,185 45,949 Total 536,003

479,078 501,789 569,507 Solids processed (barrels per day) 4,319

3,533 3,056 3,149 Skim oil sold (barrels per day) 2,827 2,557 1,989

2,935

Liquids: Propane sold (gallons) 453,586 424,402

1,267,076 1,244,529 Butane sold (gallons) 108,728 110,768 456,586

483,206 Other products sold (gallons) 86,914 83,245 343,365 360,716

Liquids storage capacity - leased and owned (gallons) (1) 358,537

292,110 Propane inventory (gallons) (1) 48,351 56,584 Butane

inventory (gallons) (1) 9,438 14,629 Other products inventory

(gallons) (1) 6,426 6,297

Retail Propane: Propane

sold (gallons) 71,666 62,300 177,599 152,238 Distillates sold

(gallons) 12,496 12,929 30,001 30,674 Propane inventory (gallons)

(1) 8,180 7,314 Distillates inventory (gallons) (1) 1,148 1,223

Refined Products and Renewables: Gasoline sold

(barrels) 25,727 16,114 91,004 58,650 Diesel sold (barrels) 11,402

11,665 49,817 40,338 Ethanol sold (barrels) 1,414 1,106 4,605 4,199

Biodiesel sold (barrels) 465 545 2,413 1,595 Refined Products and

Renewables storage capacity - leased (barrels) (1) 9,419 7,188

Gasoline inventory (barrels) (1) 2,993 1,602 Diesel inventory

(barrels) (1) 1,464 2,059 Ethanol inventory (barrels) (1) 727 766

Biodiesel inventory (barrels) (1) 471 350

____________

(1) Information is presented as of March 31, 2017 or

March 31, 2016 in the year-to-date columns above.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170525005453/en/

NGL Energy Partners LPTrey Karlovich, 918-481-1119Chief

Financial Officer and Executive Vice PresidentTrey.Karlovich@nglep.com

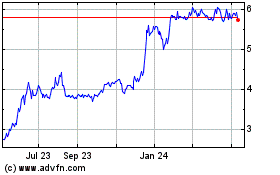

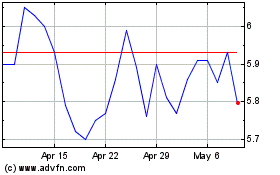

NGL Energy Partners (NYSE:NGL)

Historical Stock Chart

From Aug 2024 to Sep 2024

NGL Energy Partners (NYSE:NGL)

Historical Stock Chart

From Sep 2023 to Sep 2024