Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

May 23 2017 - 5:07PM

Edgar (US Regulatory)

Filed pursuant to Rule 433

Dated May 23, 2017

Issuer Free Writing Prospectus supplementing the

Preliminary Prospectus Supplement

dated May 23, 2017 and the

Prospectus dated May 8, 2017

Registration No. 333-217775

Tyson Foods, Inc.

Final

Term Sheet

$300,000,000 Floating Rate Senior Notes due 2019

|

|

|

|

|

Issuer:

|

|

Tyson Foods, Inc.

|

|

Ratings (Moody’s/S&P/Fitch):

|

|

Baa2(stable)/BBB(stable)/BBB(stable)*

|

|

Format:

|

|

SEC Registered

|

|

Ranking:

|

|

Floating Rate Senior Unsecured

|

|

Size:

|

|

$300,000,000

|

|

Trade Date:

|

|

May 23, 2017

|

|

Settlement Date:

|

|

June 2, 2017 (T + 7)

|

|

Final Maturity:

|

|

May 30, 2019

|

|

Interest Payment Dates:

|

|

Quarterly, on February 28, May 30, August 30 and November 30

|

|

First Interest Payment Date:

|

|

August 30, 2017

|

|

Interest Rate:

|

|

3-month U.S. dollar LIBOR plus 45 basis points. The interest rate for the floating rate notes due 2019 will be reset quarterly on each interest determination date

|

|

Public Offering Price:

|

|

100%

|

|

Day Count:

|

|

Actual/360

|

|

Optional Redemption:

|

|

The floating rate notes due 2019 will not be redeemable at the option of the Company prior to maturity

|

|

Special Mandatory Redemption:

|

|

If the AdvancePierre Acquisition described in the Preliminary Prospectus Supplement is not completed on or prior to December 25, 2017, or if, prior to such date, the Merger Agreement is terminated, 101%

|

|

Minimum Denominations/Multiples:

|

|

Denominations of $2,000 and in integral multiples of $1,000 in excess thereof

|

|

Joint Bookrunning Managers:

|

|

Morgan Stanley & Co. LLC

|

|

|

|

J.P. Morgan Securities LLC

|

|

|

|

Merrill Lynch, Pierce Fenner & Smith

Incorporated

|

|

|

|

Barclays Capital Inc.

|

|

|

|

RBC Capital Markets, LLC

|

|

Senior Co-manager:

|

|

Rabo Securities USA, Inc.

|

|

Co-managers:

|

|

Credit Agricole Securities (USA) Inc.

|

|

|

|

Goldman Sachs & Co. LLC

|

|

|

|

Mizuho Securities USA LLC

|

|

|

|

MUFG Securities Americas Inc.

|

|

|

|

U.S. Bancorp Investments, Inc.

|

|

|

|

Wells Fargo Securities, LLC

|

|

CUSIP:

|

|

902494 BA0

|

|

ISIN:

|

|

US902494BA07

|

|

Calculation Agent:

|

|

Bank of New York Mellon Trust Company, N.A.

|

|

Exchange Listing:

|

|

None

|

$350,000,000 Floating Rate Senior Notes due 2020

|

|

|

|

|

Issuer:

|

|

Tyson Foods, Inc.

|

|

Ratings (Moody’s/S&P/Fitch):

|

|

Baa2(stable)/BBB(stable)/BBB(stable)*

|

|

Format:

|

|

SEC Registered

|

|

Ranking:

|

|

Floating Rate Senior Unsecured

|

|

Size:

|

|

$350,000,000

|

|

Trade Date:

|

|

May 23, 2017

|

|

Settlement Date:

|

|

June 2, 2017 (T + 7)

|

|

Final Maturity:

|

|

June 2, 2020

|

|

Interest Payment Dates:

|

|

Quarterly, on March 2, June 2, September 2 and December 2

|

|

First Interest Payment Date:

|

|

September 2, 2017

|

|

Interest Rate:

|

|

3-month U.S. dollar LIBOR plus 55 basis points. The interest rate for the floating rate notes due 2020 will be reset quarterly on each interest determination date

|

|

Public Offering Price:

|

|

100%

|

|

Day Count:

|

|

Actual/360

|

|

Optional Redemption:

|

|

The floating rate notes due 2020 will not be redeemable at the option of the Company prior to maturity

|

|

Special Mandatory Redemption:

|

|

If the AdvancePierre Acquisition described in the Preliminary Prospectus Supplement is not completed on or prior to December 25, 2017, or if, prior to such date, the Merger Agreement is terminated, 101%.

|

|

Minimum Denominations/Multiples:

|

|

Denominations of $2,000 and in integral multiples of $1,000 in excess thereof

|

|

Joint Bookrunning Managers:

|

|

Morgan Stanley & Co. LLC

|

|

|

|

J.P. Morgan Securities LLC

|

|

|

|

Merrill Lynch, Pierce Fenner & Smith

Incorporated

|

|

|

|

Barclays Capital Inc.

|

|

|

|

RBC Capital Markets, LLC

|

|

Senior Co-manager:

|

|

Rabo Securities USA, Inc.

|

|

Co-managers:

|

|

Credit Agricole Securities (USA) Inc.

|

|

|

|

Goldman Sachs & Co. LLC

|

|

|

|

Mizuho Securities USA LLC

|

|

|

|

MUFG Securities Americas Inc.

|

|

|

|

U.S. Bancorp Investments, Inc.

|

|

|

|

Wells Fargo Securities, LLC

|

|

CUSIP:

|

|

902494 BB8

|

|

ISIN:

|

|

US902494BB89

|

|

Calculation Agent:

|

|

Bank of New York Mellon Trust Company, N.A.

|

|

Exchange Listing:

|

|

None

|

2

$1,350,000,000 3.550% Senior Notes due 2027

|

|

|

|

|

Issuer:

|

|

Tyson Foods, Inc.

|

|

Ratings (Moody’s/S&P/Fitch):

|

|

Baa2(stable)/BBB(stable)/BBB(stable)*

|

|

Format:

|

|

SEC Registered

|

|

Ranking:

|

|

Senior Unsecured

|

|

Size:

|

|

$1,350,000,000

|

|

Trade Date:

|

|

May 23, 2017

|

|

Settlement Date:

|

|

June 2, 2017 (T + 7)

|

|

Final Maturity:

|

|

June 2, 2027

|

|

Interest Payment Dates:

|

|

Semi-annually on June 2 and December 2

|

|

First Interest Payment Date:

|

|

December 2, 2017

|

|

Pricing Benchmark:

|

|

2.375% due May 15, 2027

|

|

UST Spot (Price/Yield):

|

|

100-24/2.290%

|

|

Spread to Benchmark:

|

|

T+128 bps

|

|

Yield to Maturity:

|

|

3.570%

|

|

Coupon:

|

|

3.550%

|

|

Public Offering Price:

|

|

99.833%

|

|

Day Count:

|

|

30/360

|

|

Make Whole Call:

|

|

T + 20 bps

|

|

Par call:

|

|

On or after 3 months prior to the maturity date

|

|

Special Mandatory Redemption:

|

|

If the AdvancePierre Acquisition described in the Preliminary Prospectus Supplement is not completed on or prior to December 25, 2017, or if, prior to such date, the Merger Agreement is terminated, 101%

|

|

Minimum Denominations/Multiples:

|

|

Denominations of $2,000 and in integral multiples of $1,000 in excess thereof

|

|

Joint Bookrunning Managers:

|

|

Morgan Stanley & Co. LLC

|

|

|

|

J.P. Morgan Securities LLC

|

|

|

|

Merrill Lynch, Pierce Fenner & Smith

Incorporated

|

|

|

|

Barclays Capital Inc.

|

|

|

|

RBC Capital Markets, LLC

|

|

Senior Co-manager:

|

|

Rabo Securities USA, Inc.

|

|

Co-managers:

|

|

Credit Agricole Securities (USA) Inc.

|

|

|

|

Goldman Sachs & Co. LLC

|

|

|

|

Mizuho Securities USA LLC

|

|

|

|

MUFG Securities Americas Inc.

|

|

|

|

U.S. Bancorp Investments, Inc.

|

|

|

|

Wells Fargo Securities, LLC

|

|

CUSIP:

|

|

902494 BC6

|

|

ISIN:

|

|

US902494BC62

|

|

Exchange Listing:

|

|

None

|

3

$750,000,000 4.550% Senior Notes due 2047

|

|

|

|

|

Issuer:

|

|

Tyson Foods, Inc.

|

|

Ratings (Moody’s/S&P/Fitch):

|

|

Baa2(stable)/BBB(stable)/BBB(stable)*

|

|

Format:

|

|

SEC Registered

|

|

Ranking:

|

|

Senior Unsecured

|

|

Size:

|

|

$750,000,000

|

|

Trade Date:

|

|

May 23, 2017

|

|

Settlement Date:

|

|

June 2, 2017 (T + 7)

|

|

Final Maturity:

|

|

June 2, 2047

|

|

Interest Payment Dates:

|

|

Semi-annually on June 2 and December 2

|

|

First Interest Payment Date:

|

|

December 2, 2017

|

|

Pricing Benchmark:

|

|

3.000% due February 15, 2047

|

|

UST Spot (Price/Yield):

|

|

100-27+/2.956%

|

|

Spread to Benchmark:

|

|

T+163 bps

|

|

Yield to Maturity:

|

|

4.586%

|

|

Coupon:

|

|

4.550%

|

|

Public Offering Price:

|

|

99.416%

|

|

Day Count:

|

|

30/360

|

|

Make Whole Call:

|

|

T + 25 bps

|

|

Par call:

|

|

On or after 6 months prior to the maturity date

|

|

Special Mandatory Redemption:

|

|

If the AdvancePierre Acquisition described in the Preliminary Prospectus Supplement is not completed on or prior to December 25, 2017, or if, prior to such date, the Merger Agreement is terminated, 101%

|

|

Minimum Denominations/Multiples:

|

|

Denominations of $2,000 and in integral multiples of $1,000 in excess thereof

|

|

Joint Bookrunning Managers:

|

|

Morgan Stanley & Co. LLC

|

|

|

|

J.P. Morgan Securities LLC

|

|

|

|

Merrill Lynch, Pierce Fenner & Smith

Incorporated

|

|

|

|

Barclays Capital Inc.

|

|

|

|

RBC Capital Markets, LLC

|

|

Senior Co-manager:

|

|

Rabo Securities USA, Inc.

|

|

Co-managers:

|

|

Credit Agricole Securities (USA) Inc.

|

|

|

|

Goldman Sachs & Co. LLC

|

|

|

|

Mizuho Securities USA LLC

|

|

|

|

MUFG Securities Americas Inc.

|

|

|

|

U.S. Bancorp Investments, Inc.

|

|

|

|

Wells Fargo Securities, LLC

|

|

CUSIP:

|

|

902494 BD4

|

|

ISIN:

|

|

US902494BD46

|

|

Exchange Listing:

|

|

None

|

This communication is intended for the sole use of the person to whom it is provided by us.

|

(*)

|

An explanation of the significance of ratings may be obtained from the rating agencies. Generally, rating agencies base their ratings on such material and information, and such of their own investigations, studies and

assumptions, as they deem appropriate. The rating of the notes should be evaluated independently from similar ratings of other securities. A credit rating of a security is not a recommendation to buy, sell or hold securities and may be subject to

review, revision, suspension, reduction or withdrawal at any time by the assigning rating agency.

|

4

The issuer has filed a registration statement (including a prospectus and a preliminary

prospectus supplement) with the Securities and Exchange Commission (the “SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus and the preliminary prospectus supplement in that

registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively,

the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Morgan Stanley & Co. LLC toll-free at 1-866-718-1649, J.P. Morgan Securities LLC collect at

1-212-834-4533 or Merrill Lynch, Pierce, Fenner & Smith Incorporated, toll-free at 1-800-294-1322.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY

APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

5

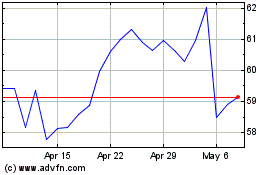

Tyson Foods (NYSE:TSN)

Historical Stock Chart

From Mar 2024 to Apr 2024

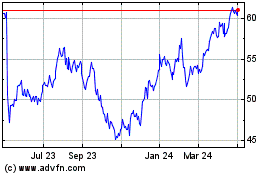

Tyson Foods (NYSE:TSN)

Historical Stock Chart

From Apr 2023 to Apr 2024