Filed Pursuant to Rule 425

Filing Person: SmartFinancial, Inc.

Subject Company: Capstone Bancshares, Inc.

Commission File

No. 001-37661

The following communication was provided to the employees of Capstone Bank on May 22, 2017.

Q: Who are SmartFinancial and SmartBank?

A: SmartFinancial, Inc. is a single-bank holding company based in Knoxville, Tennessee that operates SmartBank, a full-service commercial bank founded in 2007,

with over $1 billion in assets and 14 branches throughout East Tennessee and the Florida Panhandle.

Q: Will we be part of a publicly traded

company?

A: Yes. SmartFinancial stock is traded on the Nasdaq under the ticker symbol, SMBK.

Q: What do I say to clients who call with concerns as a result of the acquisition?

A: Refer them to the appropriate relationship managers, and if they have further questions, direct them to the appropriate management team member. A letter

will be mailed later in the week to all clients and shareholders with a copy of the press release.

Q: Who will lead the combined company? The Banks?

What will Capstone’s CEO role be?

A: At both the company (SmartFinancial) and the Bank (SmartBank),

Billy Carroll

is the

President & Chief Executive Officer. Tuscaloosa native,

Miller Welborn

is the Chairman of both SmartFinancial and SmartBank.

Robert Kuhn

will be assuming the role of Regional President for the states of Alabama and Florida for

SmartBank.

Q: Where will the company’s headquarters be? The Bank’s?

A: SmartFinancial’s headquarters is in Knoxville, and the bank will remained headquartered in Pigeon Forge.

Q: Who will the directors be?

A: The

SmartFinancial & SmartBank Board will consist of Miller Welborn, Chair; Bill Carroll, Vice Chair; Monique Berke; Doyce Payne; Frank McDonald; Vic Barrett; Billy Carroll; Ted Miller; David Ogle; Keith Whaley; and Geoff Wolpert. Capstone

directors Steve Tucker and Beau Wicks will be joining both boards as well – we are excited to have Steve and Beau joining our team.

Q: When will

the acquisition occur?

A: We currently anticipate the transaction taking place in the fourth quarter of 2017 with a planned systems conversion and

rebranding in February of 2018. We will begin integration planning immediately.

Q: What does this decision mean for me? Do I still have a job?

A: There will be no immediate changes. Unfortunately, in transactions such as these there is always some impact as a result of the overlap that exists

between the two companies and some Associates will be impacted. As you can imagine, this aspect of the transaction was extremely difficult for the management team and the board. We plan to communicate changes to impacted Associates by June 30,

2017.

Q: Will any locations close because of the merger?

A: We are committed to all markets where the banks currently operate and we would hope that additional markets arise for expansion opportunities given our

larger footprint.

Q: How are clients being notified about the transaction?

A: A press release is prepared and will be distributed nationally on May 22, 2017. Clients will be notified through our website, regular mail and email

where applicable. Shareholders will be notified through email and regular mail.

Q: How will the merger impact clients? What differences will they see?

A: None immediately. As we convert systems in February 2018, we will be communicating with clients to make the conversion process as smooth as

possible. We will continue to deliver the outstanding client service that both banks are known for, and that’s the real key.

Q: How should we

answer the phone? Starting when?

A: No changes on phone answering at this time.

Q: Will we have career opportunities at other locations now?

A: We will look to post job opportunities in all of our markets.

Q: Who should I contact if I have questions about the acquisition?

A: Any member of the executive management team should be able to answer questions; however, please do not hesitate to contact either Robert Kuhn

(robert.kuhn@capstonebankal.com), Billy Carroll (billy.carroll@smartbank.com) or Miller Welborn (miller.welborn@smartbank.com).

(continued on back)

Q: What if I have

HR-related

questions about the acquisition process?

A: You may contact your manager or Diane Short (diane.short@smartbank.com) or Becca Boyd (becca.boyd@smartbank.com), Corporate Human Resources, with

any questions that need immediate attention. If we don’t have specific answers yet due to timing or other considerations, we will share additional information with you as soon as we are able.

Q: How often will we receive updates regarding the acquisition?

A: Leaders of our companies have discussed our common commitment to thorough and ongoing communication. We are committed to provide updates as often as

reasonably possible and answer your questions as candidly as reasonably possible. You can always reach out to your manager or any member of the senior management team.

Q: What should I do if someone from the media calls to ask about the acquisition?

A: Send all media related inquires to Kelley Fowler at kelley.fowler@smartbank.com or 865.868.0611. Kelley will field the media inquiries and forward to the

most appropriate executive management team member.

Q: How and when will I get trained on SmartBank systems and processes?

A: Training on operations, policies and procedures may take place at your branch/office prior to the transition date, provided it is not disruptive to the

current operations of the branches/offices. You will receive future communication regarding training.

Q: Will my benefits change?

A: As part of our integration planning over the coming months, we will be reviewing benefits at both banks and making a determination on the appropriate

benefits for our combined company. There will be changes, but we assure you that we will provide a very sound benefits package. Our goal is to provide the best benefits package possible to our team members in order to recruit and retain the best

talent.

Q: Will our culture change?

A: Both banks

have a strong, and in many ways similar, culture – that was one of the key points discussed by both boards during the course of merger discussions. Culture is one of the most critical pieces of this transaction, and any changes will be for the

betterment and unity of the new combined teams and our bank’s brand identity.

Important Information for Investors and Shareholders

In connection with the proposed transaction, SmartFinancial, Inc.

(“SmartFinancial”)

will file with the Securities and

Exchange Commission

(“SEC”)

a registration statement on Form

S-4

containing a joint proxy statement/prospectus of Capstone Bancshares, Inc.

(“Capstone”)

and

SmartFinancial. A definitive joint proxy statement/prospectus will be mailed to shareholders of both SmartFinancial and Capstone.

Shareholders of SmartFinancial and Capstone are urged to read the joint proxy statement/prospectus and other

documents that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information

.

Shareholders will be able to obtain free copies of the registration statement and

the joint proxy statement/ prospectus (when available) and other documents filed with the SEC by SmartFinancial through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by SmartFinancial will also

be available free of charge on SmartFinancial’s website at www.smartbank.com or by contacting SmartFinancial’s Investor Relations Department at 423.385.3009.

SmartFinancial and Capstone and their directors and executive officers and other members of management and employees may be considered participants in the

solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of SmartFinancial is set forth in SmartFinancial’s proxy statement for its 2017 annual shareholders meeting. Other

information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to

be filed with the SEC when they become available.

Forward

Looking Statement Disclosure

This communication contains forward-looking statements. SmartFinancial cautions you that a number of important factors

could cause actual results to differ materially from those currently anticipated in any forward-looking statement. Such factors include, but are not limited to: the businesses of Capstone and SmartFinancial may not be integrated successfully or such

integration may take longer to accomplish than expected; the expected cost savings and revenue synergies from the proposed transaction may not be fully realized within the expected timeframes; disruption from the proposed transaction may make it

difficult to maintain relationships with clients or employees; the required governmental approvals for the proposed transaction may not be obtained on the proposed terms and schedules; Capstone’s shareholders and/or SmartFinancial’s

shareholders may not approve the proposed transaction; changes in prevailing economic and political conditions, particularly in our market areas, including the areas served by Capstone; credit risk associated with our lending activities; changes in

interest rates, loan demand, real estate values, and competition; changes in accounting principles, policies, and guidelines; changes in any applicable law, rule, regulation or practice with respect to tax or legal issues; and other economic,

competitive, governmental, regulatory and technological factors affecting our operations, pricing, products and services and other factors that may be described in our Annual Reports on Form

10-K

and Quarterly

Reports on Form

10-Q

as filed with the SEC from time to time. The forward-looking statements are made as of the date of this communication, and, except as may be required by applicable law or regulation,

SmartFinancial assumes no obligation to update the forward-looking statements or to update the reasons why actual results could differ from those projected in the forward-looking statements.

SmartFinancial (NASDAQ:SMBK)

Historical Stock Chart

From Aug 2024 to Sep 2024

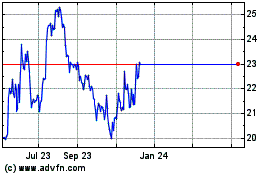

SmartFinancial (NASDAQ:SMBK)

Historical Stock Chart

From Sep 2023 to Sep 2024