World Acceptance Corporation (NASDAQ: WRLD) today reported

financial results for its fourth fiscal quarter and twelve months

ended March 31, 2017.

Net income for the fourth quarter increased 6.8% to $31.9

million compared to $29.8 million for the same quarter of the prior

year. Net income per diluted share increased 6.4% to $3.64 in

the fourth quarter of fiscal 2017 compared to $3.42 in the prior

year quarter.

Total revenues increased to $144.6 million for the fourth

quarter of fiscal 2017, a 0.3% increase from the $144.1 million

reported for the fourth quarter last year. Revenues from the 1,258

offices open throughout both quarterly periods increased by 1.3%.

Interest and fee income decreased 1.6%, from $121.5 million in the

fourth quarter of 2016 to $119.5 million in the fourth quarter of

fiscal 2017 primarily due to a decrease in average earning loans

and an unfavorable move in exchange rates. Insurance and other

income increased by 10.6% to $25.1 million in the fourth quarter of

fiscal 2017 compared with $22.7 million in the fourth quarter of

fiscal 2016. The increase in other income was primarily due to an

increase in tax preparation revenue of $2.7 million. The tax

preparation business benefited from an interest and fee free tax

advance loan offering to qualifying customers. This was offset by a

$276,000 decrease in insurance revenue.

Accounts in the US that were 61 days or more past due increased

to 5.0% on a recency basis and to 7.0% on a contractual basis at

March 31, 2017, compared to 4.4% and 6.5%, respectively, at March

31, 2016. On a consolidated basis, accounts that were 61 days or

more past due increased to 5.5% on a recency basis and to 7.8% on a

contractual basis at March 31, 2017, compared to 4.7% and 7.1%,

respectively, at March 31, 2016. As a result of the higher

delinquencies, our allowance to net loans increased from 9.0% at

March 31, 2016, to 9.4% at March 31, 2017.

As previously disclosed, the Company ceased all in-person

collection visits effective December 18, 2015. During the fourth

quarter of fiscal 2016, the Company experienced higher than normal

delinquencies in January and February as well as higher than normal

charge-offs, especially in the month of March, as accounts became

more than 90 days past due. We continue to see elevated net

charge-offs and delinquencies compared to historical levels,

however we have seen an improvement in net charge-offs during the

fourth quarter of fiscal 2017 compared to 2016. The provision for

the quarter decreased $3.7 million when comparing the fourth

quarter of fiscal 2017 to the fourth quarter of fiscal 2016. This

is primarily due to a decrease in net charge-offs. Net charge-offs

as a percentage of average net loans on an annualized basis

decreased from 18.9% to 15.4% when comparing the two quarters. The

prior year net charge-off rate benefited from the monthly sale of

accounts previously charged-off totaling approximately $0.5

million. Consolidated net charge-offs excluding the impact of the

charge-off sale were down $7.5 million when comparing the two

fiscal quarters. The portion of the provision related to a change

in loans outstanding decreased $1.7 million quarter over quarter

due to gross loans outstanding decreasing $105.2 million in the

fourth quarter of 2017 versus $152.2 million in the fourth quarter

of 2016. Accounts 90 days past due in the US, which are fully

reserved, decreased by $5.7 million in the current quarter versus

$9.4 million the same quarter last year, which resulted in a $3.7

million increase in the provision.

General and administrative expenses amounted to $70.0 million in

the fourth fiscal quarter, a 5.2% increase over the $66.6 million

in the same quarter of the prior fiscal year. As a percentage of

revenues, G&A expenses increased from 46.2% during the fourth

quarter of fiscal 2016 to 48.4% during the current quarter. G&A

expenses per average open office increased by 6.6% when comparing

the two fiscal quarters. G&A expense increased primarily due to

an increase in personnel costs. Share based compensation increased

$1.7 million during the quarter due to the release of expense

previously accrued for the Group B performance based restricted

stock awards in the fourth quarter of 2016. During the prior year

quarter, the Company determined that the earnings per share target

of $13.00 per share was not achievable during the measurement

period which ended on March 31, 2017. Subsequently, the

Compensation Committee of the Board of Directors, amended the

awards allowing 25% of the Group B awards to vest for certain

officers. The amendment resulted in a net $1.7 million reduction of

compensation expense in the prior year quarter. The officers were

required to forfeit their remaining Group B shares as a part of the

amendment.

Interest expense for the fourth quarter decreased $1.8 million

compared to the fourth quarter of the prior year due to a 21.6%

decrease in the average debt outstanding. The Company has reduced

its outstanding debt by $79.5 million as of March 31, 2017,

compared to March 31, 2016. This is a result of not repurchasing

shares during the fiscal quarter as well as a decrease in loans

outstanding.

The Company’s fourth quarter effective income tax rate decreased

to 34.6% compared with 35.5% in the prior year’s fourth quarter.

Our effective tax rate benefitted from the settlement of a state

tax matter subsequent to year end.

Gross loans decreased to $1.06 billion as of March 31, 2017, a

0.7% decrease from the $1.07 billion of loans outstanding as of

March 31, 2016. Gross loans in the US decreased 2.2%, and gross

loans in Mexico increased 13.7% in US dollars. Gross loans in

Mexico increased 23.5% in Mexican pesos. Gross loans in the US

benefited from the acquisition of 14 branches and $18.9 million in

gross loans during the quarter. The gross loan balance for the

acquired branches was $18.3 million as of March 31, 2017. Without

the acquisition, consolidated gross loans would have decreased 2.4%

compared to prior year. Our unique borrowers in the US decreased by

62,039 or 7.8% during the fourth quarter of 2017. This is compared

to a decrease of 88,172 or 10.8% in the fourth quarter of 2016 and

a decrease of 73,180 or 8.6% in the fourth quarter of 2015. Year to

date we have increased our unique customers in the US by 7,631 or

1.0%, compared to a decrease of 45,867 or 5.9% in fiscal 2016 and

decrease of 11,914 or 1.5% in fiscal 2015.

Other key return ratios for the fourth quarter included an 8.8%

return on average assets and a return on average equity of 17.8%

(both on a trailing 12-month basis).

We remain optimistic about our Mexican operations. We have

approximately 160,000 accounts and approximately $116.5 million in

gross loans outstanding in Mexico. This represents a 13.7% increase

in loan balances in US dollars over last year, and an increase of

23.5% in Mexican pesos over March 31, 2016. Annualized Mexican net

charge-offs as a percent of average net loans decreased from 12.2%

in fiscal 2016 to 10.0% during the current fiscal year.

Additionally, our Mexican 61+ day delinquencies were 10.1% and

14.0% on a recency and contractual basis, respectively, as of March

31, 2017, a change from 7.3% and 12.3%, respectively, as of March

31, 2016. Excluding intercompany charges of $0.5 million in fiscal

2017 and $2.7 million in fiscal 2016, fiscal 2017 Mexican pretax

earnings amounted to $8.5 million, a 3.6% increase from the $8.2

million in pretax earnings during fiscal 2016.

Fiscal Year Results

For fiscal 2017, net income decreased 15.8% to $73.6 million

compared with $87.4 million for the year ended March 31, 2016.

Fully diluted net income per share decreased 16.6% to $8.38 in

fiscal 2017 compared with $10.05 for fiscal 2016.

Total revenues for fiscal 2017 declined 4.6% to

$531.7 million compared with $557.5 million during fiscal

2016. Net charge-offs as a percent of average net loans increased

from 14.8% during fiscal 2016 to 15.7% for fiscal 2017. Similar to

the quarter, revenues were impacted by a decrease in average

earning loans during the year. Net charge-offs for fiscal 2017 were

negatively impacted by the cessation of in-person visits as

discussed above.

Other Matters

As previously disclosed, on August 7, 2015, the Company received

a letter from the CFPB’s Enforcement Office notifying the Company

that, in accordance with the CFPB’s discretionary Notice and

Opportunity to Respond and Advise (“NORA”) process, the staff of

CFPB’s Enforcement Office is considering recommending that the CFPB

take legal action against the Company (the “NORA Letter”). The NORA

Letter states that the staff of the CFPB’s Enforcement Office

expects to allege that the Company violated the Consumer Financial

Protection Act of 2010, 12 U.S.C. §5536. The NORA Letter confirms

that the Company has the opportunity to make a NORA submission,

which is a written statement setting forth any reasons of law or

policy why the Company believes the CFPB should not take legal

action against it. Following the CFPB’s NORA Letter, the Company

made NORA submissions to the CFPB’s Enforcement Office. The Company

understands that a NORA Letter is intended to ensure that potential

subjects of enforcement actions have the opportunity to present

their positions to the CFPB before an enforcement action is

recommended or commenced. The Company continues to believe its

historical and current business practices are lawful.

About World Acceptance Corporation

World Acceptance Corporation is one of the largest small-loan

consumer finance companies, operating 1,327 offices in 15 states

and Mexico. It is also the parent company of ParaData Financial

Systems, a provider of computer software solutions for the consumer

finance industry.

Fourth Quarter Conference Call

The senior management of World Acceptance Corporation will be

discussing these results in its quarterly conference call to

be held at 10:00 a.m. Eastern time today. A simulcast of the

conference call will be available on the Internet at

https://www.webcaster4.com/Webcast/Page/1118/20663. The call will

be available for replay on the Internet for approximately

30 days.

This press release may contain various “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, that represent the Company’s expectations or

beliefs concerning future events. Statements other than those of

historical fact, as well as those identified by the words

“anticipate,” “estimate,” ”intend,” “plan,” “expect,” ”project,”

“believe,” “may,” “will,” “should,” “would,” “could” and any

variation of the foregoing and similar expressions are

forward-looking statements. Such forward-looking statements are

about matters that are inherently subject to risks and

uncertainties. Factors that could cause actual results or

performance to differ from the expectations expressed or implied in

such forward-looking statements include the following: recently

enacted, proposed or future legislation and the manner in which it

is implemented; the nature and scope of regulatory authority,

particularly discretionary authority, that may be exercised by

regulators, including, but not limited to, the Consumer Financial

Protection Bureau (the “CFPB”), having jurisdiction over the

Company’s business or consumer financial transactions generically;

the unpredictable nature of regulatory proceedings and litigation;

any determinations, findings, claims or actions made or taken by

the CFPB, other regulators or third parties that assert or

establish that the Company’s lending practices or other aspects of

its business violate applicable laws or regulations, which may or

may not be in connection with or resulting from the previously

disclosed civil investigative demand (CID) or the notice and

opportunity to respond and advise (NORA) letter from the CFPB; the

impact of changes in accounting rules and regulations, or their

interpretation or application, which could materially and adversely

affect the Company’s reported financial statements or necessitate

material delays or changes in the issuance of the Company’s audited

financial statements; the Company's assessment of its internal

control over financial reporting, and the timing and effectiveness

of the Company's efforts to remediate any reported material

weakness in its internal control over financial reporting; changes

in interest rates; risks related to expansion and foreign

operations; risks inherent in making loans, including repayment

risks and value of collateral; the timing and amount of revenues

that may be recognized by the Company; changes in current revenue

and expense trends (including trends affecting delinquencies and

charge-offs); the potential impact of limitations in the Company’s

amended revolving credit facility; and changes in the Company’s

markets and general changes in the economy (particularly in the

markets served by the Company). These and other factors are

discussed in greater detail in Part I, Item 1A, “Risk Factors” in

the Company’s most recent annual report on Form 10-K for the fiscal

year ended March 31, 2016 filed with the Securities and Exchange

Commission (“SEC”) and the Company’s other reports filed with, or

furnished to, the SEC from time to time. World Acceptance

Corporation does not undertake any obligation to update any

forward-looking statements it makes. The Company is also not

responsible for updating the information contained in this press

release beyond the publication date, or for changes made to this

document by wire services or Internet services.

World

Acceptance Corporation Consolidated Statements of

Operations (unaudited and in thousands, except per share

amounts)

Three Months Ended Twelve Months

Ended March 31, March 31,

2017 2016 2017

2016 Interest & fees $

119,478

121,461

468,759 495,133 Insurance & other

25,093

22,682

62,975 62,343 Total revenues

144,571 144,143

531,734 557,476 Expenses: Provision for loan losses

20,702 24,373

128,572 123,598 General and

administrative expenses Personnel

47,167 43,989

171,958 169,573 Occupancy & equipment

10,787

11,492

42,438 44,461 Advertising

2,932 2,322

17,866 16,863 Intangible amortization

107 121

490 529 Other

9,027 8,631

34,909 37,714

70,020 66,555

267,661 269,140 Interest expense

5,125 6,959

21,504 26,849 Total expenses

95,847 97,887

417,737 419,587 Income before taxes

48,724 46,256

113,997 137,889 Income taxes

16,873 16,431

40,397 50,493 Net income $

31,851 29,825

73,600 87,396 Diluted earnings per

share $

3.64 3.42

8.38 10.05 Diluted weighted average

shares outstanding

8,754 8,708

8,778 8,692

Consolidated Balance Sheets (unaudited and in thousands)

March 31, March 31, March 31,

2017 2016 2015

ASSETS Cash $

15,200 12,377 38,339 Gross loans

receivable

1,059,804 1,066,964 1,110,145 Less: Unearned

interest & fees

(291,908) (290,659) (297,402) Allowance

for loan losses

(72,195) (69,566) (70,438) Loans receivable,

net

695,701 706,739 742,305 Property and equipment, net

24,184 25,297 25,907 Deferred income taxes, net

39,025 38,131 37,345 Goodwill

6,067 6,121 6,121

Intangibles, net

6,614 2,917 3,364 Other assets, net

13,797 14,637 12,750 $

800,588 806,219 866,131

LIABILITIES AND SHAREHOLDERS' EQUITY Liabilities: Notes

payable

295,136 374,685 501,150 Income tax payable

12,519 8,259 18,204 Accounts payable and accrued expenses

31,869 31,373 31,209 Total liabilities

339,524

414,317 550,563 Shareholders' equity

461,064 391,902 315,568

$

800,588 806,219 866,131

Selected Consolidated

Statistics (dollars in thousands)

Three Months

Ended Twelve Months Ended March 31, March

31, 2017 2016

2017 2016 Expenses as a

percent of total revenues: Provision for loan losses

14.3

% 16.9 %

24.2 % 22.2 % General and

administrative expenses

48.4 % 46.2 %

50.3

% 48.3 % Interest expense

3.5 % 4.8 %

4.0 % 4.8 % Average gross loans receivable

$ 1,121,434 1,145,503

$ 1,100,700

1,147,956 Average net loans receivable

$

813,985 834,048

$ 796,642 834,964 Loan

volume

$ 517,644 $ 504,409

$ 2,507,840

$ 2,621,413 Net charge-offs as percent of average loans

15.4 % 18.9 %

15.7 % 14.8 %

Return on average assets (trailing 12 months)

8.8 %

10.0 %

8.8 % 10.0 % Return on average equity

(trailing 12 months)

17.8 % 24.0 %

17.8

% 24.0 % Offices opened (closed) during the period,

net

4 (11 )

(12 ) 19 Offices open at

end of period

1,327 1,339

1,327 1,339

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170509005592/en/

World Acceptance CorporationJohn L. Calmes Jr.,

864-298-9800Chief Financial Officer

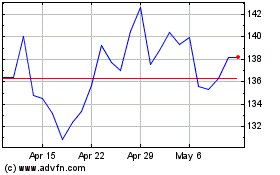

World Acceptance (NASDAQ:WRLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

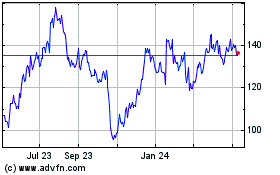

World Acceptance (NASDAQ:WRLD)

Historical Stock Chart

From Apr 2023 to Apr 2024