Highlights:

Broadwind Energy, Inc. (NASDAQ:BWEN) reported sales of $56.1

million in Q1 2017, up 20% compared to $46.8 million in Q1 2016.

The increase was primarily due to a 16% increase in Towers and

Weldments segment revenue due to high shipments in advance of the

100% safe harbor Production Tax Credit deadline, and significantly

improved production flow in the Abilene tower plant. Additionally,

the current quarter included $3.3 million of sales from the newly

formed Process Systems segment, which includes the Abilene

compressed natural gas (CNG) and fabrication business and Red Wolf

Company, LLC (Red Wolf) as of the February 1, 2017 acquisition

date. These increases were partially offset by lower Gearing

segment revenue resulting from broadly lower second half 2016 order

intake.

The Company reported net income from continuing operations of

$6.5 million, or $.43 per share, in Q1 2017, compared to a net loss

from continuing operations of $.4 million, or $.02 per share, in Q1

2016. The current quarter includes a $5.1 million, or $.34 per

share income tax benefit due primarily to the partial release of a

tax valuation allowance related to the Red Wolf acquisition. The

remaining $.11 per share improvement was due mainly to the improved

production flow in the Towers and Weldments segment.

The Company reported a net loss from discontinued operations of

$.2 million, or $.01 per share, in Q1 2017, compared to near

break-even in Q1 2016. The Company reported non-GAAP adjusted

EBITDA (earnings before interest, taxes, depreciation,

amortization, share-based payments and restructuring costs) of $3.9

million in Q1 2017, compared to $1.7 million in Q1 2016 (please

refer to the reconciliation of GAAP measures to non-GAAP measures

at the end of this release). The $2.2 million improvement was

mainly attributable to the increased volume and productivity in the

Towers and Weldments segment as well as a $.4 million reduction in

Corporate expenses.

Broadwind CEO Stephanie Kushner stated, “Broadwind started the

year strong. Revenue was up 20% and we doubled our EBITDA margin to

7% from last year. Our team members’ focus on continuous

operational improvement and stringent cost reduction is reflected

in our financial performance. Towers results exceeded our plan, as

we operated at full capacity to meet aggressive customer delivery

schedules, while successfully converting to a new tower model in

the Abilene plant.

“Gearing revenue was soft due to weak order intake late last

year, but orders have risen sharply since the beginning of 2017 due

to recovering oil and gas markets and the expansion of our sales

organization. The work we did in 2016 to improve delivery times,

raise productivity and reduce costs will translate into significant

financial improvements as the year progresses.

Ms. Kushner continued, “Our tower order intake was weak in the

first quarter and the near-term demand outlook for our Manitowoc

plant is down significantly, as the impact of our customers

pre-ordering components in advance of the safe harbor Production

Tax Credit deadline was greater than we anticipated. While the

medium-term outlook for our tower business remains strong, we have

taken immediate action to reduce headcount and lower our tower

production rate through at least the next two quarters. Despite the

addition of Red Wolf and the recovery of Gearing volumes, we have

revised down our full-year outlook to reflect flat year-over-year

revenue with EBITDA growth exceeding 15 percent. We believe this

tower weakness is short-term and reflects the structure of the PTC

qualification rules. This does not alter our strategic objective of

doubling revenue and EBITDA margins over the next three years.”

Orders and Backlog

The Company booked $40.0 million of net new orders in Q1 2017,

compared to $39.0 million of net new orders booked in Q1 2016.

Towers and Weldments orders, which vary considerably from quarter

to quarter, totaled $29.1 million in Q1 2017, down from $35.4

million in Q1 2016, reflecting weaker demand for towers in the

upper Midwest, due to pre-buys of equipment by turbine

manufacturers and the locational mix of windfarms under

construction. Gearing orders totaled $7.3 million in Q1 2017, more

than double Q1 2016 orders of $3.5 million, due to increased orders

from oil & gas and industrial customers. Process Systems orders

totaled $3.6 million in Q1 2017.

At March 31, 2017, total backlog was $181.7 million, more than

double the backlog of $86.0 million at March 31, 2016.

Segment Results

Towers and Weldments Broadwind Energy produces

fabrications for wind, oil and gas, mining and other industrial

applications, specializing in the production of wind turbine

towers.

Towers and Weldments segment sales totaled $48.9 million in Q1

2017, compared to $42.0 million in Q1 2016. Tower sales increased

16% compared to Q1 2016 due to improved production flow at the

Abilene plant and higher material costs, which are generally passed

through to the customer. Operating income totaled $5.8 million in

Q1 2017, compared to $3.2 million in Q1 2016, due to the improved

throughput at the Abilene plant, and better overhead absorption at

both tower plants. Net income for the segment totaled $4.0 million

in Q1 2017, compared to $2.1 million in Q1 2016. Non-GAAP adjusted

EBITDA totaled $7.0 million in Q1 2017, compared to $4.3 million in

Q1 2016, due mainly to the factors described above. (please refer

to the reconciliation of GAAP measures to non-GAAP measures at the

end of this release)

GearingBroadwind Energy engineers, builds and

remanufactures precision gears and gearboxes for oil and gas,

mining, steel and wind applications.

Gearing segment sales totaled $3.9 million in Q1 2017, compared

to $4.8 million in Q1 2016. The $.9 million decrease was due to

reduced sales to oil & gas and mining industry customers

related to the weak order intake in the second half of 2016.

Operating loss was $1.5 million in Q1 2017, compared to $1.2

million in Q1 2016. The $.3 million increase was due to lower

sales, the absence of a $.1 gain from an asset sale recorded in Q1

2016 and higher compensation expense. Net loss for the Gearing

segment totaled $1.5 million in Q1 2017, compared to a net loss of

$1.2 million in Q1 2016. The Non-GAAP adjusted EBITDA loss for Q1

2017 totaled $.9 million, compared to $.5 million in Q1 2016, due

to the factors described above. (please refer to the reconciliation

of GAAP measures to non-GAAP measures at the end of this

release)

Process SystemsBroadwind Energy designs and

manufactures custom, modular systems for compression, filtration

and other specialized process applications for the global

market.

On February 1, 2017 the Company acquired Red Wolf which has been

combined with the Abilene CNG and fabrication business, previously

reported as a part of Towers and Weldments, to form the Process

Systems segment. The Process Systems segment results include a

partial period of Red Wolf results as of the acquisition date.

Process Systems sales for Q1 2017 totaled $3.3 million. For Q1

2017, Process Systems operating loss totaled $.8 million and net

loss for the Process Systems segment totaled $.7 million. The first

quarter loss reflects the absence of any CNG unit shipments and

included a $.2 million adverse impact of inventory revaluation

associated with purchase accounting and $.2 million of intangible

amortization associated with the Red Wolf transaction. Non-GAAP

adjusted EBITDA loss totaled $.5 million in Q1 2017. (please refer

to the reconciliation of GAAP measures to non-GAAP measures at the

end of this release)

Corporate

Corporate and other expenses totaled $1.9 million in Q1 2017,

compared to $2.3 million in Q1 2016. The decrease was due mainly to

lower health care costs in Q1 2017.

Cash and Liquidity

During Q1 2017, operating working capital (accounts receivable

and inventory, net of accounts payable and customer deposits)

increased to $16.4 million due to the addition of Red Wolf and

higher accounts receivable.

Capital expenditures, net of disposals, in Q1 2017 totaled $3.3

million. Expenditures included investments to upgrade the coatings

systems in the tower plants, and outlays associated with the

expansion of the Abilene tower plant which will be operational in

mid-2017.

Cash assets (cash and short-term investments) dropped as

expected to $.2 million at March 31, 2017, compared to $21.9

million at December 31, 2016, following the acquisition of Red Wolf

on February 1, 2017 for a closing cash payment of $16.5 million,

subject to adjustment and additional earn-out payments.

Debt and capital leases totaled $10.5 million at March 31, 2017,

including the $2.6 million New Markets Tax Credit loan, which is

expected to be substantially forgiven when it matures in 2018. The

Company’s credit line with The Private Bank and Trust Company had a

balance of $6.5 million at March 31, 2017. Late in the quarter, the

credit line was increased to $25 million to accommodate the

additional working capital associated with Red Wolf.

About Broadwind Energy, Inc.Broadwind Energy

(NASDAQ:BWEN) is a precision manufacturer of structures, equipment

and components for clean tech and other specialized applications.

From gears and gearing systems for wind, oil and gas and mining

applications, to wind towers and industrial weldments, we have

solutions for the clean tech, energy and infrastructure needs of

the future. With facilities throughout the U.S., Broadwind Energy's

talented team is committed to helping customers maximize

performance of their investments—quicker, easier and smarter. Find

out more at www.bwen.com

Forward-Looking StatementsThis release contains

“forward looking statements”—that is, statements related to future,

not past, events—as defined in Section 21E of the Securities

Exchange Act of 1934, as amended, that reflect our current

expectations regarding our future growth, results of operations,

financial condition, cash flows, performance, business prospects

and opportunities, as well as assumptions made by, and information

currently available to, our management. Forward looking statements

include any statement that does not directly relate to a current or

historical fact. We have tried to identify forward looking

statements by using words such as “anticipate,” “believe,”

“expect,” “intend,” “will,” “should,” “may,” “plan” and similar

expressions, but these words are not the exclusive means of

identifying forward looking statements. Forward looking statements

include any statement that does not directly relate to a current or

historical fact. Our forward-looking statements may include or

relate to our beliefs, expectations, plans and/or assumptions with

respect to the following: (i) state, local and federal regulatory

frameworks affecting the industries in which we compete, including

the wind energy industry, and the related extension, continuation

or renewal of federal tax incentives and grants and state renewable

portfolio standards; (ii) our customer relationships and efforts to

diversify our customer base and sector focus and leverage customer

relationships across business units; (iii) our ability to continue

to grow our business organically and through acquisitions; (iv) the

sufficiency of our liquidity and alternate sources of funding, if

necessary; (v) our ability to realize revenue from customer orders

and backlog; (vi) our ability to operate our business efficiently,

manage capital expenditures and costs effectively, and generate

cash flow; (vii) the economy and the potential impact it may have

on our business, including our customers; (viii) the state of the

wind energy market and other energy and industrial markets

generally and the impact of competition and economic volatility in

those markets; (ix) the effects of market disruptions and regular

market volatility, including fluctuations in the price of oil, gas

and other commodities; (x) the effects of the recent change of

administrations in the U.S. federal government; (xi) our ability to

successfully integrate and operate the business of Red Wolf

Company, LLC and to identify, negotiate and execute future

acquisitions; and (xii) the potential loss of tax benefits if we

experience an “ownership change” under Section 382 of the Internal

Revenue Code of 1986, as amended. These statements are based on

information currently available to us and are subject to various

risks, uncertainties and other factors that could cause our actual

growth, results of operations, financial condition, cash flows,

performance, business prospects and opportunities to differ

materially from those expressed in, or implied by, these

statements. We are under no duty to update any of these statements.

You should not consider any list of such factors to be an

exhaustive statement of all of the risks, uncertainties or other

factors that could cause our current beliefs, expectations, plans

and/or assumptions to change.

| |

|

BROADWIND ENERGY, INC. AND SUBSIDIARIESCONSOLIDATED

BALANCE SHEETS(IN THOUSANDS) |

| |

|

|

| |

|

|

|

|

|

March 31, |

|

December 31, |

| |

|

|

|

|

|

|

2017 |

|

|

|

2016 |

|

| |

ASSETS |

|

(Unaudited) |

|

|

| |

CURRENT ASSETS: |

|

|

|

|

| |

|

Cash and

cash equivalents |

|

$ |

216 |

|

|

$ |

18,699 |

|

| |

|

Short-term

investments |

|

|

- |

|

|

|

3,171 |

|

| |

|

Restricted

cash |

|

|

39 |

|

|

|

39 |

|

| |

|

Accounts

receivable, net of allowance for doubtful accounts of $153 |

|

|

|

|

| |

|

and

$145 as of March 31, 2017 and December 31, 2016,

respectively |

|

|

23,690 |

|

|

|

11,865 |

|

| |

|

Inventories, net |

|

|

25,775 |

|

|

|

21,159 |

|

| |

|

Prepaid

expenses and other current assets |

|

|

2,027 |

|

|

|

2,449 |

|

| |

|

Current

assets held for sale |

|

|

626 |

|

|

|

808 |

|

| |

|

|

Total

current assets |

|

|

52,373 |

|

|

|

58,190 |

|

| |

LONG-TERM ASSETS: |

|

|

|

|

| |

|

Property

and equipment, net |

|

|

55,982 |

|

|

|

54,606 |

|

| |

|

Goodwill |

|

|

5,568 |

|

|

|

- |

|

| |

|

Other

intangible assets, net |

|

|

17,491 |

|

|

|

4,572 |

|

| |

|

Other

assets |

|

|

274 |

|

|

|

294 |

|

| |

TOTAL ASSETS |

|

$ |

131,688 |

|

|

$ |

117,662 |

|

| |

|

|

|

|

|

|

|

|

| |

LIABILITIES AND STOCKHOLDERS'

EQUITY |

|

|

|

|

| |

CURRENT LIABILITIES: |

|

|

|

|

| |

|

Line of

credit and notes payable |

|

$ |

6,494 |

|

|

$ |

- |

|

| |

|

Current

portions of capital lease obligations |

|

|

470 |

|

|

|

465 |

|

| |

|

Accounts

payable |

|

|

19,495 |

|

|

|

15,852 |

|

| |

|

Accrued

liabilities |

|

|

8,536 |

|

|

|

8,430 |

|

| |

|

Customer

deposits |

|

|

13,574 |

|

|

|

18,011 |

|

| |

|

Current

liabilities held for sale |

|

|

371 |

|

|

|

493 |

|

| |

|

|

Total

current liabilities |

|

|

48,940 |

|

|

|

43,251 |

|

| |

LONG-TERM LIABILITIES: |

|

|

|

|

| |

|

Long-term

debt, net of current maturities |

|

|

2,600 |

|

|

|

2,600 |

|

| |

|

Long-term

capital lease obligations, net of current portions |

|

|

918 |

|

|

|

1,038 |

|

| |

|

Other |

|

|

4,098 |

|

|

|

2,190 |

|

| |

|

|

Total

long-term liabilities |

|

|

7,616 |

|

|

|

5,828 |

|

| |

COMMITMENTS AND CONTINGENCIES |

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

STOCKHOLDERS' EQUITY: |

|

|

|

|

| |

|

Preferred

stock, $0.001 par value; 10,000,000 shares authorized; no shares

issued |

|

|

|

|

| |

|

or

outstanding |

|

|

- |

|

|

|

- |

|

| |

|

Common

stock, $0.001 par value; 30,000,000 shares authorized;

15,255,688 |

|

|

|

|

| |

|

and

15,175,767 shares issued as of March 31, 2017 and |

|

|

|

|

| |

|

December

31, 2016, respectively |

|

|

15 |

|

|

|

15 |

|

| |

|

Treasury

stock, at cost, 273,937 shares as of March 31, 2017 and December

31, 2016 |

|

|

(1,842 |

) |

|

|

(1,842 |

) |

| |

|

Additional

paid-in capital |

|

|

379,098 |

|

|

|

378,876 |

|

| |

|

Accumulated

deficit |

|

|

(302,139 |

) |

|

|

(308,466 |

) |

| |

|

|

Total

stockholders' equity |

|

|

75,132 |

|

|

|

68,583 |

|

| |

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY |

|

$ |

131,688 |

|

|

$ |

117,662 |

|

| |

BROADWIND ENERGY, INC. AND SUBSIDIARIESCONSOLIDATED

STATEMENTS OF OPERATIONS(IN THOUSANDS, EXCEPT PER SHARE

DATA)(UNAUDITED) |

| |

|

|

|

|

|

| |

|

|

|

|

Three Months Ended March 31, |

| |

|

|

|

|

|

2017 |

|

|

|

2016 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Revenues |

|

$ |

56,060 |

|

|

$ |

46,757 |

|

| |

Cost of

sales |

|

|

49,686 |

|

|

|

42,795 |

|

| |

Gross

profit |

|

|

6,374 |

|

|

|

3,962 |

|

| |

|

|

|

|

|

|

|

| |

OPERATING EXPENSES: |

|

|

|

|

| |

Selling,

general and administrative |

|

|

4,420 |

|

|

|

4,075 |

|

| |

Intangible

amortization |

|

|

351 |

|

|

|

111 |

|

| |

|

Total

operating expenses |

|

|

4,771 |

|

|

|

4,186 |

|

| |

Operating

income (loss) |

|

|

1,603 |

|

|

|

(224 |

) |

| |

|

|

|

|

|

|

|

| |

OTHER (EXPENSE) INCOME, net: |

|

|

|

|

| |

Interest

expense, net |

|

|

(139 |

) |

|

|

(154 |

) |

| |

Other,

net |

|

|

- |

|

|

|

12 |

|

| |

|

Total other

expense, net |

|

|

(139 |

) |

|

|

(142 |

) |

| |

|

|

|

|

|

|

|

| |

Net income

(loss) before benefit for income taxes |

|

|

1,464 |

|

|

|

(366 |

) |

| |

Benefit for

income taxes |

|

|

(5,018 |

) |

|

|

(8 |

) |

| |

INCOME (LOSS) FROM CONTINUING

OPERATIONS |

|

|

6,482 |

|

|

|

(358 |

) |

| |

LOSS FROM DISCONTINUED OPERATIONS |

|

|

(155 |

) |

|

|

(19 |

) |

| |

NET

INCOME (LOSS) |

|

$ |

6,327 |

|

|

$ |

(377 |

) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

NET

INCOME (LOSS) PER COMMON SHARE - BASIC: |

|

|

|

|

| |

Income

(loss) from continuing operations |

|

$ |

0.43 |

|

|

$ |

(0.02 |

) |

| |

Loss from

discontinued operations |

|

$ |

(0.01 |

) |

|

|

(0.00 |

) |

| |

Net income

(loss) |

|

$ |

0.42 |

|

|

$ |

(0.03 |

) |

| |

|

|

|

|

|

|

|

| |

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING -

BASIC |

|

|

14,929 |

|

|

|

14,758 |

|

| |

|

|

|

|

|

|

|

| |

NET

INCOME (LOSS) PER COMMON SHARE - DILUTED: |

|

|

|

|

| |

Income

(loss) from continuing operations |

|

$ |

0.43 |

|

|

$ |

(0.02 |

) |

| |

Loss from

discontinued operations |

|

|

(0.01 |

) |

|

|

(0.00 |

) |

| |

Net income

(loss) |

|

$ |

0.42 |

|

|

$ |

(0.03 |

) |

| |

|

|

|

|

|

|

|

| |

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING -

DILUTED |

|

|

15,195 |

|

|

|

14,758 |

|

| BROADWIND ENERGY, INC. AND SUBSIDIARIESCONSOLIDATED

STATEMENTS OF CASH FLOWS(IN THOUSANDS)(UNAUDITED) |

| |

| |

|

|

|

|

|

| |

|

|

|

|

Three Months Ended March 31, |

| |

|

|

|

|

|

2017 |

|

|

2016 |

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

| |

Net income

(loss) |

|

$ |

6,327 |

|

$ |

(377 |

) |

| |

Loss from

discontinued operations |

|

|

(155 |

) |

|

(19 |

) |

| |

Income

(loss) from continuing operations |

|

|

6,482 |

|

|

(358 |

) |

| |

|

|

|

|

|

|

|

Adjustments to reconcile net cash used in operating

activities: |

|

|

| |

Depreciation and amortization expense |

|

|

2,101 |

|

|

1,657 |

|

| |

Deferred

income taxes |

|

|

(5,050 |

) |

|

- |

|

| |

Stock-based

compensation |

|

|

222 |

|

|

259 |

|

| |

Allowance

for doubtful accounts |

|

|

8 |

|

|

80 |

|

| |

Gain on

disposal of assets |

|

|

(2 |

) |

|

(138 |

) |

| |

Changes in

operating assets and liabilities: |

|

|

|

| |

|

Accounts

receivable |

|

|

(9,037 |

) |

|

(2,753 |

) |

| |

|

Inventories |

|

|

382 |

|

|

5,348 |

|

| |

|

Prepaid

expenses and other current assets |

|

|

423 |

|

|

(55 |

) |

| |

|

Accounts

payable |

|

|

2,883 |

|

|

1,848 |

|

| |

|

Accrued

liabilities |

|

|

(2,356 |

) |

|

(129 |

) |

| |

|

Customer

deposits |

|

|

(4,440 |

) |

|

(2,163 |

) |

| |

|

Other

non-current assets and liabilities |

|

|

239 |

|

|

(535 |

) |

| Net cash

(used in) provided by operating activities of continuing

operations |

|

|

(8,145 |

) |

|

3,061 |

|

| |

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

| |

Cash paid

in acquisition |

|

|

(16,659 |

) |

|

- |

|

| |

Purchases

of available for sale securities |

|

|

- |

|

|

(1,978 |

) |

| |

Sales of

available for sale securities |

|

|

2,221 |

|

|

36 |

|

| |

Maturities

of available for sale securities |

|

|

950 |

|

|

2,425 |

|

| |

Purchases

of property and equipment |

|

|

(3,261 |

) |

|

(950 |

) |

| |

Proceeds

from disposals of property and equipment |

|

|

2 |

|

|

- |

|

| Net

cash (used in) provided by investing activities of continuing

operations |

|

|

(16,747 |

) |

|

(467 |

) |

| |

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

| |

Net

proceeds from lines of credit and notes payable |

|

|

6,494 |

|

|

- |

|

| |

Payments on

long-term debt |

|

|

- |

|

|

(179 |

) |

| |

Principal

payments on capital leases |

|

|

(114 |

) |

|

(147 |

) |

| Net cash

provided by (used in) financing activities of continuing

operations |

|

|

6,380 |

|

|

(326 |

) |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

DISCONTINUED OPERATIONS: |

|

|

|

| |

Operating

cash flows |

|

|

74 |

|

|

826 |

|

| |

Investing

cash flows |

|

|

- |

|

|

151 |

|

| |

Financing

cash flows |

|

|

(109 |

) |

|

(12 |

) |

| Net cash

provided by (used in) discontinued operations |

|

|

(35 |

) |

|

965 |

|

| |

|

|

|

|

|

|

| Add: Cash

balance of discontinued operations, beginning of period |

|

|

2 |

|

|

- |

|

| Less: Cash

balance of discontinued operations, end of period |

|

|

- |

|

|

2 |

|

| |

|

|

|

|

|

|

| NET

INCREASE (DECREASE) IN CASH, CASH EQUIVALENTS, AND RESTRICTED

CASH |

|

|

(18,545 |

) |

|

3,231 |

|

|

CASH, CASH EQUIVALENTS, AND RESTRICTED CASH beginning of

the period |

|

|

18,800 |

|

|

6,519 |

|

|

CASH, CASH EQUIVALENTS, AND RESTRICTED CASH end of the

period |

|

$ |

255 |

|

$ |

9,750 |

|

| |

|

|

|

|

|

|

|

Supplemental cash flow information: |

|

|

|

| |

Interest

paid |

|

$ |

77 |

|

$ |

143 |

|

| |

Income

taxes paid |

|

$ |

3 |

|

$ |

12 |

|

| |

Contingent

consideration related to business acquisition |

$ |

2,944 |

|

$ |

- |

|

|

Non-cash investing and financing activities: |

|

|

|

| |

Issuance of

restricted stock grants |

|

$ |

222 |

|

$ |

259 |

|

| Red

Wolf acquisition: |

|

|

| Assets

acquired |

|

$ |

27,157 |

|

$ |

- |

|

| Liabilities

assumed |

|

$ |

7,554 |

|

$ |

- |

|

| |

BROADWIND ENERGY, INC. AND SUBSIDIARIESSELECTED

SEGMENT FINANCIAL INFORMATION(IN THOUSANDS)(UNAUDITED) |

| |

|

| |

|

|

|

Three Months Ended |

| |

|

|

|

March 31, |

| |

|

|

|

|

2017 |

|

|

|

2016 |

|

|

ORDERS: |

|

|

|

| |

Towers and

Weldments |

$ |

29,088 |

|

|

$ |

35,436 |

|

| |

Gearing |

|

7,319 |

|

|

|

3,540 |

|

| |

Process

Systems |

|

3,615 |

|

|

|

- |

|

| |

Total orders |

$ |

40,022 |

|

|

$ |

38,976 |

|

| |

|

|

|

|

|

|

|

REVENUES: |

|

|

|

| |

Towers and

Weldments |

|

|

$ |

48,895 |

|

|

$ |

42,015 |

|

| |

Gearing |

|

|

|

3,871 |

|

|

$ |

4,760 |

|

| |

Process

Systems |

|

3,294 |

|

|

|

- |

|

| |

Corporate and

Other |

|

|

|

- |

|

|

|

(18 |

) |

| |

Total

revenues |

|

|

$ |

56,060 |

|

|

$ |

46,757 |

|

| |

|

|

|

|

|

|

|

OPERATING PROFIT/(LOSS): |

|

|

|

| |

Towers and

Weldments |

|

|

$ |

5,849 |

|

|

|

3,241 |

|

| |

Gearing |

|

|

|

(1,531 |

) |

|

|

(1,202 |

) |

| |

Process

Systems |

|

(822 |

) |

|

|

- |

|

| |

Corporate and

Other |

|

|

|

(1,893 |

) |

|

|

(2,263 |

) |

| |

Total operating

profit/(loss) |

|

|

$ |

1,603 |

|

|

$ |

(224 |

) |

Non-GAAP Financial Measure The Company provides

non-GAAP adjusted EBITDA (earnings before interest, income taxes,

depreciation, amortization, and stock compensation) as supplemental

information regarding the Company’s business performance. The

Company’s management uses adjusted EBITDA when it internally

evaluates the performance of the Company’s business, reviews

financial trends and makes operating and strategic decisions. The

Company believes that this non-GAAP financial measure is useful to

investors because it provides investors with a better understanding

of the Company’s past financial performance and future results

allows investors to evaluate the Company’s performance using the

same methodology and information as used by the Company’s

management. The Company's definition of adjusted EBITDA may be

different from similar non-GAAP financial measures used by other

companies and/or analysts.

| |

BROADWIND ENERGY, INC. AND SUBSIDIARIESRECONCILIATION

OF NON-GAAP FINANCIAL MEASURES(IN THOUSANDS)(UNAUDITED) |

| |

|

| |

Consolidated |

|

Three Months Ended March 31, |

| |

|

|

|

|

2017 |

|

|

|

2016 |

|

| |

Net

Income/(Loss) from continuing operations |

|

$ |

6,482 |

|

|

$ |

(358 |

) |

| |

Interest

Expense |

|

|

139 |

|

|

|

154 |

|

| |

Income Tax

Provision/(Benefit) |

|

|

(5,018 |

) |

|

|

(8 |

) |

| |

Depreciation and Amortization |

|

2,101 |

|

|

|

1,657 |

|

| |

Share-based

Compensation and Other Stock Payments |

|

222 |

|

|

|

259 |

|

| |

Restructuring Expense |

|

- |

|

|

|

- |

|

| |

|

Adjusted EBITDA

(Non-GAAP) |

|

$ |

3,926 |

|

|

$ |

1,704 |

|

| Towers and

Weldments Segment |

Three Months Ended March 31, |

| |

|

2017 |

|

|

2016 |

| Net Income |

$ |

4,003 |

|

$ |

2,140 |

| Interest

Expense/(Benefit) |

|

15 |

|

|

10 |

| Income Tax

Provision/(Benefit) |

|

1,831 |

|

|

1,103 |

| Depreciation and

Amortization |

|

1,092 |

|

|

966 |

| Share-based

Compensation and Other Stock Payments |

|

58 |

|

|

38 |

| Adjusted EBITDA

(Non-GAAP) |

$ |

6,999 |

|

$ |

4,257 |

| Gearing

Segment |

|

Three Months Ended March 31, |

|

| |

|

|

2017 |

|

|

|

2016 |

|

|

| Net Loss |

|

$ |

(1,537 |

) |

|

$ |

(1,208 |

) |

|

| Interest

Expense |

|

|

4 |

|

|

|

5 |

|

|

| Income Tax

Provision/(Benefit) |

|

|

2 |

|

|

|

1 |

|

|

| Depreciation and

Amortization |

|

|

625 |

|

|

|

639 |

|

|

| Share-based

Compensation and Other Stock Payments |

|

|

19 |

|

|

|

48 |

|

|

| Adjusted EBITDA

(Non-GAAP) |

|

$ |

(887 |

) |

|

$ |

(515 |

) |

|

| |

|

|

|

|

|

| Process

Systems |

Three Months Ended March 31, |

| |

|

2017 |

|

|

|

2016 |

| Net

Income/(Loss) |

$ |

(699 |

) |

|

$ |

- |

| Interest

Expense |

|

1 |

|

|

|

- |

| Income Tax

Provision/(Benefit) |

|

(125 |

) |

|

|

- |

| Depreciation and

Amortization |

|

334 |

|

|

|

- |

| Share-based

Compensation and Other Stock Payments |

|

6 |

|

|

|

- |

| Adjusted EBITDA

(Non-GAAP) |

$ |

(483 |

) |

|

$ |

- |

| Corporate and

Other |

Three Months Ended March 31, |

| |

|

2017 |

|

|

|

2016 |

|

| Net

Income/(Loss) |

$ |

4,715 |

|

|

$ |

(1,290 |

) |

| Interest

Expense |

|

119 |

|

|

|

140 |

|

| Income Tax

Provision/(Benefit) |

|

(6,726 |

) |

|

|

(1,113 |

) |

| Depreciation and

Amortization |

|

51 |

|

|

|

52 |

|

| Share-based

Compensation and Other Stock Payments |

|

139 |

|

|

|

173 |

|

| Adjusted EBITDA

(Non-GAAP) |

$ |

(1,703 |

) |

|

$ |

(2,038 |

) |

| |

|

|

|

|

|

|

|

BWEN INVESTOR CONTACT:

Joni Konstantelos, 708.780.4819

joni.konstantelos@bwen.com

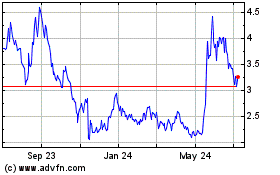

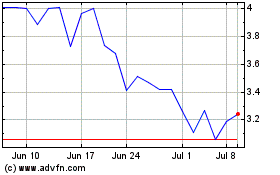

Broadwind (NASDAQ:BWEN)

Historical Stock Chart

From Aug 2024 to Sep 2024

Broadwind (NASDAQ:BWEN)

Historical Stock Chart

From Sep 2023 to Sep 2024