Vince Holding Corp. (NYSE:VNCE), a leading global luxury apparel

and accessories brand (“Vince” or the “Company”), today reported

unaudited results for the fourth quarter and fiscal year 2016 ended

January 28, 2017.

In this press release, the Company is presenting its financial

results in conformity with U.S. generally accepted accounting

principles ("GAAP") as well as on an "adjusted" basis. Adjusted

results presented in this press release are non-GAAP financial

measures. In addition, the Company is presenting an estimated

impact to EPS related to certain asset impairment charges as well

as the valuation allowance that was recorded against the Company’s

deferred tax assets in the fourth quarter of 2016. Certain

components included in the calculation of such impact are non-GAAP

measures. See "Non-GAAP Financial Measures" below for more

information about the Company's use of non-GAAP financial measures

and Exhibits 3, 4, and 5 to this press release for a reconciliation

of GAAP measures to such non-GAAP measures.

For the fourth quarter ended January 28, 2017:

- Net sales decreased 21.9% to $63.9

million from $81.8 million in the fourth quarter of fiscal

2015.

- Operating loss was $62.9 million, which

includes $55.1 million in non-cash long-lived asset impairment

charges, of which $53.1 million were related to goodwill and the

tradename intangible asset and $2.1 million were related to

property and equipment of certain retail stores, compared to

operating income of $4.8 million for the fourth quarter of fiscal

2015. In the fourth quarter of fiscal 2015, the Company recorded a

benefit from the recovery on the inventory write-down taken in the

second quarter of fiscal 2015 and the favorable adjustment to

management transition costs, totaling $2.5 million.

- Net loss was $162.1 million, or $3.28

per share, including an estimated impact of $3.13 per share related

to the aforementioned non-cash long-lived asset impairment charges

as well as the valuation allowance recorded against the Company’s

deferred tax assets (please refer to Exhibit 3). This compares to

net income of $1.8 million, or $0.05 per diluted share, for the

fourth quarter of fiscal 2015, which included a $0.04 per diluted

share benefit from the recovery on the inventory write-down and

favorable adjustment to management transition costs.

- The Company ended the fourth quarter

with 54 company-operated stores.

Brendan Hoffman, Chief Executive Officer, commented, “Results

for the fourth quarter came in below our expectations, due

primarily to challenges related to our systems conversion, which

led to delayed shipments of Spring product and off-price shipments,

as well as lower than expected performance in our pre-Spring

collection. Despite these recent challenges, we are encouraged by

the improved performance we have seen in our direct-to-consumer

channel in the first quarter, led by our e-commerce business as a

result of enhancements we have made to the website and the positive

response that we have driven with our marketing and social media

efforts. Overall, 2016 was largely a year for us to reset and

transition the business, as we have made great strides to establish

a foundation from which we can build Vince in a sustainable way. As

we look to 2017, we have made the prudent decision to suspend our

sales and EPS guidance as we work to make our new systems more

efficient and complete our business transition. This decision to

suspend guidance was further driven by the difficult retail

environment in which we continue to operate. That said, we remain

focused on expanding our direct-to-consumer business, optimizing

our wholesale channel, and growing our international presence over

the long-term.”

Marc Leder, Chairman of the Vince Board of Directors, stated,

“We believe that Vince remains a strong brand with a loyal customer

following. While we recognize that the apparel industry remains

challenging and there is still work to be done, we believe that the

management team has made important strides in resetting the brand

and we continue to support efforts to drive improved performance in

the business.”

Fourth Quarter Review:

- Net sales decreased 21.9% to $63.9

million from $81.8 million in the fourth quarter of fiscal 2015.

Wholesale segment net sales decreased 28.4% to $34.4 million

primarily due to a reduction in both off-price and replenishment

orders, as well as an increase in allowances. Direct-to-consumer

segment net sales decreased 12.6% to $29.4 million compared to the

fourth quarter of fiscal 2015. Comparable sales decreased 20.5%,

including e-commerce sales, as a result of declines in the number

of transactions, due to reduced traffic, and a decrease in average

order value.

- Gross profit was $29.2 million, or

45.7% of net sales. This compares to gross profit of $41.0 million,

or 50.1% of net sales, in the fourth quarter of fiscal 2015, which

included a $2.2 million benefit from the recovery on inventory

write-downs taken in the second quarter of 2015. Excluding this

benefit, gross profit was $38.8 million, or 47.5% of net sales, in

the fourth quarter of 2015. The decrease in the gross profit rate

for the fourth quarter of 2016 reflected an increase in product

costs, supply chain expenses, and allowances relative to the

decrease in net sales, partially offset by a favorable impact from

a channel mix shift and inventory reserves.

- Selling, general, and administrative

expenses were $39.1 million, or 61.1% of sales. This includes a

$2.1 million non-cash asset impairment charge related to property

and equipment of certain retail stores. In the fourth quarter of

fiscal 2015, SG&A was $36.2 million, or 44.2% of sales, which

included a $0.3 million favorable adjustment to management

transition costs taken in the second quarter. The remaining

increase in SG&A was driven by lower incentive compensation

offset by increased product development costs, strategic

investments, and an increase in rent and occupancy costs associated

with six new store openings since the fourth quarter of fiscal

2015.

For the fiscal year ended January 28, 2017:

- Net sales decreased 11.3% to $268.2

million from $302.5 million during fiscal year 2015. Wholesale

segment net sales decreased 15.5% to $170.1 million and

direct-to-consumer segment net sales decreased 3.1% to $98.1

million compared to fiscal year 2015. Comparable store sales

decreased 16.2% compared to the prior year period, including

e-commerce sales.

- Net loss was $162.7 million, or $3.50

per share, which includes an estimated impact of $3.33 per share

related to the non-cash long-lived asset impairment charges as well

as the valuation allowance recorded against the Company’s deferred

tax assets (please refer to Exhibit 3). This compares to net income

of $5.1 million, or $0.14 per diluted share, in fiscal 2015, which

includes a $7.7 million, or $0.20 per share, net charge associated

with the write-down of excess inventory and aged product to

expected net realizable value incurred in the second quarter and

subsequent recovery of inventory in each of the third and fourth

quarters, as well as net management transition costs.

Balance Sheet

The Company ended the fourth quarter with $21.0 million in cash

and cash equivalents and $50.2 million of borrowings under its debt

agreements.

Inventory at the end of the fourth quarter of fiscal 2016 was

$38.5 million compared to $36.6 million at the end of the fourth

quarter of fiscal 2015. The year-over-year inventory increase was

primarily due to lower inventory reserves as a result of less

excess and aged inventory.

Capital expenditures for the fourth quarter of fiscal 2016

totaled $1.6 million, primarily attributable to the investment in

our new systems and related infrastructure.

Going Concern

In accordance with new accounting guidance that became effective

for the Company’s fiscal year ended January 28, 2017, management

has concluded that there is substantial doubt about the Company’s

ability to continue as a going concern for the twelve months

following the date that the financial statements are issued,

specifically relating to its ability to comply with the

consolidated net total leverage ratio under its term loan facility.

The Company’s assessment did not take into account management’s

plans to mitigate such substantial doubt that could be reasonably

possible of occurring but are not final, including discussions with

lenders and with its majority shareholder on additional financing

options and actions to improve the capital structure of the

Company.

As of January 28, 2017, the Company was in compliance with

applicable financial covenants.

Please refer to Part I, Item 1A. Risk Factors and Note 1 of the

consolidated audited financial statements included in the Company’s

Annual Report on Form 10-K for the period ended January 28, 2017

for more details and risks associated with the management’s

conclusion.

Material Weaknesses

As a result of management’s assessment of the effectiveness of

the Company’s internal control over financial reporting as of

January 28, 2017, the Company identified deficiencies in internal

control over financial reporting that were assessed as material

weaknesses. The Company has subsequently performed additional

analysis, substantive testing and other post-closing procedures to

ensure that its consolidated financial statements were prepared in

accordance with U.S. GAAP. Accordingly, management believes that

its consolidated financial statements fairly present its financial

condition, results of operations and cash flows for the periods

stated, in all material respects.

The Company is taking specific steps to remediate these material

weaknesses by implementing and enhancing its control procedures.

These material weaknesses will not be remediated until all

necessary internal controls have been implemented, tested and

determined to be operating effectively. Until the controls are

remediated, the Company will continue to perform additional

analysis, substantive testing and other post-closing procedures to

ensure that its consolidated financial statements are fairly

presented and prepared in accordance with U.S. GAAP. Please refer

to Part I, Item 1A. Risk Factors and Part II, Item 9A. of the

Company’s Annual Report on Form 10-K for the period ended January

28, 2017 for more details on these material weaknesses.

Non-GAAP Financial

Measures

In addition to reporting financial results in accordance with

GAAP, the Company has provided, with respect to financial results

relating to the fourth quarter and fifty-two week period of fiscal

2015, adjusted cost of products sold, adjusted gross margin,

adjusted selling, general and administrative expenses, adjusted

operating income, adjusted income before taxes, adjusted income

taxes, adjusted net income and adjusted earnings per share, which

are non-GAAP financial measures, in order to eliminate the effect

on operating results of the inventory write-down for excess and

aged product and management transition costs. The Company believes

that the presentation of these non-GAAP measures facilitates an

understanding of the Company's continuing operations without the

impact associated with the inventory write-down and management

transition costs. In addition, with respect to the fourth quarter

and the fifty-two week period of fiscal 2016, the Company has

provided an estimated impact to EPS related to certain asset

impairment charges as well as the valuation allowance recorded

against the Company’s deferred tax assets in the fourth quarter of

2016. Certain components included in the calculation of such impact

are non-GAAP measures. Non-GAAP financial measures should not be

considered in isolation from, or as a substitute for, financial

information prepared in accordance with GAAP. A reconciliation of

GAAP to non-GAAP results has been provided in Exhibits 3, 4, and 5

to this press release.

2016 Fourth Quarter Earnings Conference

Call

A conference call to discuss the fourth quarter results will be

held today, April 28, 2017, at 8:30 a.m. ET, hosted by Vince

Holding Corp. Chief Executive Officer, Brendan Hoffman, and Chief

Financial Officer, David Stefko. During the conference call, the

Company may answer questions concerning business and financial

developments, trends and other business or financial matters. The

Company's responses to these questions, as well as other matters

discussed during the conference call, may contain or constitute

information that has not been previously disclosed.

Those who wish to participate in the call may do so by dialing

(877) 201-0168, conference ID 95795497. Any interested party will

also have the opportunity to access the call via the Internet at

http://investors.vince.com/. To listen to the live call, please go

to the website at least 15 minutes early to register and download

any necessary audio software. For those who cannot listen to the

live broadcast, a recording will be available for 12 months after

the date of the event. Recordings may be accessed at

http://investors.vince.com/.

ABOUT VINCE

Established in 2002, Vince is a global luxury brand best known

for utilizing luxe fabrications and innovative techniques to create

a product assortment that combines urban utility and modern

effortless style. From its edited core collection of ultra-soft

cashmere knits and cotton tees, Vince has evolved into a global

lifestyle brand and destination for both women’s and men’s apparel

and accessories. As of January 28, 2017, Vince products were sold

in prestige distribution worldwide, including approximately 2,300

distribution locations across more than 40 countries. With

corporate headquarters in New York and its design studio in Los

Angeles, the Company operated 40 full-price retail stores, 14

outlet stores and its e-commerce site, vince.com. Please visit

www.vince.com for more information.

This document, and any statements incorporated by reference

herein, contains forward-looking statements under the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements include the statements regarding, among other things,

our current expectations about the Company's future results and

financial condition, revenues, store openings and closings,

margins, expenses and earnings and are indicated by words or

phrases such as "may," "will," "should," "believe," "expect,"

"seek," "anticipate," "intend," "estimate," "plan," "target,"

"project," "forecast," "envision" and other similar phrases.

Although we believe the assumptions and expectations reflected in

these forward-looking statements are reasonable, these assumptions

and expectations may not prove to be correct and we may not achieve

the results or benefits anticipated. These forward-looking

statements are not guarantees of actual results, and our actual

results may differ materially from those suggested in the

forward-looking statements. These forward-looking statements

involve a number of risks and uncertainties, some of which are

beyond our control, including, without limitation: our ability to

maintain adequate cash flow from operations or availability under

our revolving credit facility to meet our liquidity needs

(including our obligations under the Tax Receivable Agreement with

the Pre-IPO Stockholders); our ability to continue as a going

concern; our ability to successfully operate the newly implemented

systems, processes, and functions recently transitioned from

Kellwood Company; our ability to remediate the identified material

weaknesses in our internal control over financial reporting; our

ability to ensure the proper operation of the distribution facility

by a third party logistics provider recently transitioned from

Kellwood; our ability to remain competitive in the areas of

merchandise quality, price, breadth of selection, and customer

service; our ability to anticipate and/or react to changes in

customer demand and attract new customers, including in connection

with making inventory commitments; our ability to control the level

of sales in the off-price channels; our ability to manage excess

inventory in a way that will promote the long-term health of the

brand; changes in consumer confidence and spending; our ability to

maintain projected profit margins; unusual, unpredictable and/or

severe weather conditions; the execution and management of our

retail store growth plans, including the availability and cost of

acceptable real estate locations for new store openings; the

execution and management of our international expansion, including

our ability to promote our brand and merchandise outside the U.S.

and find suitable partners in certain geographies; our ability to

expand our product offerings into new product categories, including

the ability to find suitable licensing partners; our ability to

successfully implement our marketing initiatives; our ability to

protect our trademarks in the U.S. and internationally; our ability

to maintain the security of electronic and other confidential

information; serious disruptions and catastrophic events; changes

in global economies and credit and financial markets; competition;

our ability to attract and retain key personnel; commodity, raw

material and other cost increases; compliance with domestic and

international laws, regulations and orders; changes in laws and

regulations; outcomes of litigation and proceedings and the

availability of insurance, indemnification and other third-party

coverage of any losses suffered in connection therewith; tax

matters; and other factors as set forth from time to time in our

Securities and Exchange Commission filings, including under the

heading "Item 1A—Risk Factors" in our Annual Report on Form 10-K

and our Quarterly Reports on Form 10Q. We intend these

forward-looking statements to speak only as of the time of this

release and do not undertake to update or revise them as more

information becomes available, except as required by law.

This press release is also available on the Vince Holding Corp.

website (http://investors.vince.com/).

Vince Holding Corp. and Subsidiaries

Exhibit (1)

Condensed Consolidated Statements of Operations

(Unaudited, amounts in thousands

except

percentages, share and per share data

)

Three Months Ended Fiscal Year

January 28, January 30, January 28,

January 30, 2017 2016 2017

2016 Net sales $ 63,879 $ 81,763 $ 268,199 $ 302,457 Cost of

products sold 34,663 40,782 145,380

169,941 Gross profit 29,216 40,981 122,819 132,516 as a % of net

sales 45.7 % 50.1 % 45.8 % 43.8 % Impairment of goodwill and

indefinite-lived intangible asset 53,061 — 53,061 — Selling,

general and administrative expenses 39,087 36,157

134,430 116,790 as a % of net sales 61.1 % 44.2 %

50.1 % 38.6 % (Loss) income from operations (62,932 ) 4,824 (64,672

) 15,726 as a % of net sales (98.5 )% 5.9 % (24.1 )% 5.2 % Interest

expense, net 1,023 1,313 3,932 5,680 Other expense, net (50

) 343 329 1,733 (Loss) income before income

taxes (63,905 ) 3,168 (68,933 ) 8,313 Provision for income taxes

98,243 1,390 93,726 3,214 Net (loss)

income $ (162,148 ) $ 1,778 $ (162,659 ) $ 5,099

(Loss) earnings

per share: Basic (loss) earnings per share $ (3.28 ) $ 0.05 $

(3.50 ) $ 0.14 Diluted (loss) earnings per share $ (3.28 ) $ 0.05 $

(3.50 ) $ 0.14

Weighted average shares outstanding: Basic

49,423,148 36,778,413 46,420,533 36,770,430 Diluted 49,423,148

36,779,438 46,420,533 37,529,227

Vince Holding

Corp. and Subsidiaries

Exhibit (2)

Condensed Consolidated Balance Sheets

(Unaudited, amounts in thousands)

January 28, January 30, 2017 2016

ASSETS Current assets: Cash and cash equivalents $ 20,978 $

6,230 Trade receivables, net 10,336 9,400 Inventories, net 38,529

36,576 Prepaid expenses and other current assets 4,768

8,027 Total current assets 74,611 60,233 Property, plant and

equipment, net 42,945 37,769 Intangible assets, net 77,698 109,046

Goodwill 41,435 63,746 Deferred income taxes and other assets

2,791 92,774 Total assets $ 239,480 $ 363,568

LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities:

Accounts payable $ 37,022 $ 28,719 Accrued salaries and employee

benefits 3,427 5,755 Other accrued expenses 9,992

37,174 Total current liabilities 50,441 71,648 Long-term debt

48,298 57,615 Deferred rent 16,892 14,965 Other liabilities 137,830

140,838 Stockholders' (deficit) equity (13,981 )

78,502 Total liabilities and stockholders' equity $ 239,480 $

363,568

Vince Holding Corp. and Subsidiaries

Exhibit (3)

Estimated Impact of Impairment Charges

and Valuation Allowance on

Fiscal 2016 Net Loss and Loss per

Share

(Unaudited, amounts in thousands except percentages,

share and per share data) For the three months

ended January 28, 2017 Estimated impact on

Loss before

income taxes

Provision for

Income Taxes

Net

Loss

Loss per

Share (b)

Goodwill Impairment Charge $ (22,311 ) $ (9,098 ) (a) $ (13,213 ) $

(0.27 ) Tradename Impairment Charge (30,750 ) (12,540 ) (a) (18,210

) (0.37 ) Retail Store Impairment Charge (2,082 ) (849 ) (a) (1,233

) (0.02 ) Valuation allowance against deferred tax assets —

121,836 (121,836 ) (2.47 ) Total $ (55,143 ) $

99,349 $ (154,492 ) $ (3.13 )

For the twelve months ended

January 28, 2017 Estimated impact on

Loss before

income taxes

Provision for

Income Taxes

Net

Loss

Loss per

Share (c)

Goodwill Impairment Charge $ (22,311 ) $ (9,098 ) (a) $ (13,213 ) $

(0.28 ) Tradename Impairment Charge (30,750 ) (12,540 ) (a) (18,210

) (0.39 ) Retail Store Impairment Charge (2,082 ) (849 ) (a) (1,233

) (0.03 ) Valuation allowance against deferred tax assets —

121,836 (121,836 ) (2.62 ) Total $ (55,143 ) $

99,349 $ (154,492 ) $ (3.33 ) (a) Based on a normalized tax

rate of 40.8%, derived by reference to statutory rates in the

jurisdictions in which the Company operates, without giving effect

to the Company’s valuation allowance. (b) Based on

49,423,148 weighted-average shares outstanding. (c) Based on

46,420,533 weighted-average shares outstanding.

Vince Holding Corp. and Subsidiaries

Exhibit (4)

Reconciliation of net income on a GAAP basis to “Adjusted

net income” (Unaudited, amounts in thousands except

percentages, share and per share data)

For the three months ended January 30, 2016 As

Reported Adjustments As Adjusted

Net sales $ 81,763 $ 81,763 Cost of products sold 40,782 $

2,161 (a) 42,943 Gross profit 40,981 (2,161 ) 38,820 as a %

of sales 50.1 % 47.5 % Selling, general and administrative expenses

36,157 323 (b) 36,480 as a % of sales 44.2 %

44.6 % Income from operations 4,824 (2,484 ) 2,340 as a % of sales

5.9 % 2.9 % Interest expense, net 1,313 1,313 Other expense, net

343 343 Income before income taxes

3,168 (2,484 ) 684 Provision for Income taxes 1,390

(1,018 ) (c) 372 Net income $ 1,778 $ (1,466 ) $ 312

Earnings per share: Basic earnings per share $ 0.05 $ (0.04

) $ 0.01 Diluted earnings per share $ 0.05 $ (0.04 ) $ 0.01

Weighted average shares outstanding: Basic shares 36,778,413

36,778,413 Diluted shares 36,779,438 36,779,438

(a)

To adjust cost of products sold to remove

the favorable impact of the recovery on inventory write downs taken

in the second quarter of approximately $2.2 million.

(b)

To adjust selling, general and

administrative expenses to remove the favorable impact of the

reversal of severance expense taken in the second quarter of

approximately $0.3 million.

(c)

Adjusted amount represents adjusted pretax

income multiplied by a normalized tax rate of 41%. The normalized

tax rate was derived by reference to statutory tax rates in the

jurisdictions in which the Company operates, without giving effect

to the Company’s valuation allowance or potential use of its net

operating loss carryforwards.

Vince Holding Corp. and Subsidiaries

Exhibit (5)

Reconciliation of net income on a GAAP basis to “Adjusted

net income”

(Unaudited, amounts in thousands except

percentages, share and per share data)

For the twelve months ended January 30, 2016

As Reported Adjustments As

Adjusted Net sales $ 302,457 $ 302,457 Cost of products

sold 169,941 $ (10,300 ) (a) 159,641 Gross profit

132,516 10,300 142,816 as a % of sales 43.8 % 47.2 % Selling,

general and administrative expenses 116,790 (2,702 )

(b) 114,088 as a % of sales 38.6 % 37.7 % Income from

operations 15,726 13,002 28,728 as a % of sales 5.2 % 9.5 %

Interest expense, net 5,680 5,680 Other expense, net 1,733

1,733 Income before income taxes 8,313 13,002

21,315 Provision for Income taxes 3,214 5,331 (c)

8,545 Net Income $ 5,099 $ 7,671 $ 12,770

Earnings

per share: Basic earnings per share $ 0.14 $ 0.21 $ 0.35

Diluted earnings per share $ 0.14 $ 0.20 $ 0.34

Weighted

average shares outstanding: Basic shares 36,770,430 36,770,430

Diluted shares 37,529,227 37,529,227

(a)

To adjust cost of products sold to remove

the net impact of inventory write downs of approximately $10.3

million primarily related to excess out of season and current

inventory.

(b)

To adjust selling, general and

administrative expenses to remove executive severance costs of $3.4

million and executive search costs of $0.6 million partially offset

by the favorable impact of $(1.3) million related to executive

stock option forfeitures.

(c)

Adjusted amount represents adjusted pretax

income multiplied by a normalized tax rate of 41%. The normalized

tax rate was derived by reference to statutory tax rates in the

jurisdictions in which the Company operates, without giving effect

to the Company’s valuation allowance or potential use of its net

operating loss carryforwards.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170428005189/en/

Investor Relations:ICR, Inc.Jean Fontana,

646-277-1200Jean.fontana@icrinc.com

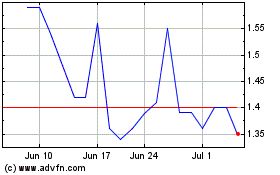

Vince (NYSE:VNCE)

Historical Stock Chart

From Mar 2024 to Apr 2024

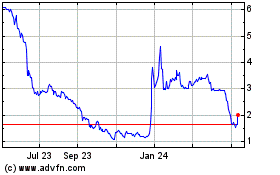

Vince (NYSE:VNCE)

Historical Stock Chart

From Apr 2023 to Apr 2024