(NASDAQ: HBNC) – Horizon Bancorp today announced its unaudited

financial results for the three month period ended March 31, 2017.

All share data has been adjusted to reflect Horizon’s three-for-two

stock split effective November 14, 2016.

SUMMARY:

- Net income for the first quarter of

2017 was $8.2 million or $0.37 diluted earnings per share compared

to $5.4 million or $0.30 diluted earnings per share for the same

period in 2016. The first quarter of 2017 represents an excellent

start to the year given that the first quarter is typically a

seasonal low revenue point for Horizon.

- Net income, excluding

acquisition-related expenses, gain on sale of investment securities

and purchase accounting adjustments (“core net income”), for the

first quarter of 2017 increased 38.9% to $7.5 million or $0.34

diluted earnings per share compared to $5.4 million or $0.30

diluted earnings per share for the same period of 2016.

- Return on average assets was 1.07% for

the first quarter of 2017 compared to 0.83% for the same period in

2016.

- Net interest income for the first

quarter of 2017 increased $5.8 million, or 29.3%, compared to the

same period in 2016.

- Net interest margin was 3.80% for the

first quarter of 2017 compared to 2.92% for the prior quarter and

3.45% for the same period in 2016. The improvement in net interest

margin reflects Horizon’s execution on its plan to reduce expensive

funding costs, which was accomplished in the fourth quarter of

2016.

- Net interest margin, excluding the

impact of prepayment penalties on borrowings and purchase

accounting adjustments (“core net interest margin”), was 3.66% for

the first quarter of 2017 compared to 3.45% for the prior quarter

and 3.36% for the same period in 2016.

- Horizon’s tangible book value per share

rose to $11.79 at March 31, 2017, compared to $11.48 at December

31, 2016.

- Commercial loans, excluding acquired

commercial loans, increased by an annualized rate of 12.8%, or

$33.8 million, during the first quarter of 2017.

- Consumer loans, excluding acquired

consumer loans, increased by an annualized rate of 18.8%, or $18.5

million, during the first quarter of 2017.

- On February 3, 2017, Horizon completed

the purchase and assumption of certain assets and liabilities of a

single branch of First Farmers Bank & Trust Company located in

Bargersville, Indiana. The acquired office was closed and

consolidated into Horizon’s existing Bargersville location.

- Our Grand Rapids team moved to their

new downtown loan production office during February 2017. This

office was approved to continue as a full service branch which will

take place in the second quarter of 2017.

- Early in the second quarter, Horizon

hired two additional seasoned commercial lenders for our Fort

Wayne, Indiana loan production office.

- At the beginning of the second quarter

of 2017, Michael Lamping, joined Horizon as Central Ohio Market

President. A loan production office will be opened in the greater

Columbus, Ohio area during the second quarter of 2017 and will

focus on commercial business.

- Horizon received regulatory approval to

open a new office in Noblesville, Indiana, which will be open later

this year.

- Horizon, for the first time, hired a

corporate general legal counsel in the first quarter. The objective

for this position is, in part, to better manage legal costs and to

more closely monitor changes in the regulatory and legal

landscape.

Craig Dwight, Chairman and CEO, commented: “During the first

quarter of 2017, Horizon’s business model of diversified and

balanced revenue streams was proven to be effective as an increase

in commercial and consumer lending helped to offset the seasonal

low in residential mortgage revenues. Excluding non-core items,

Horizon realized an increase in net income of $2.1 million, or

38.9%, in the first quarter of 2017 when compared to the same

period of 2016 resulting in an increase in core diluted earnings

per share of 13.3%. Core net interest margin increased in the first

quarter of 2017 to 3.66% from 3.36% for the same period in 2016.

Horizon also realized solid growth in service charges on deposit

accounts of 8.7%, interchange fees of 26.3% and fiduciary

activities of 17.6% in the first quarter of 2017 when compared to

the same period in 2016.”

Mr. Dwight continued, “Although commercial and consumer loan

growth was strong in the first quarter of 2017, total loan growth

was tempered by a decrease in our mortgage warehouse portfolio.

Excluding acquired loans, commercial loan growth increased by an

annual rate of 12.8% and was fueled by our growth markets of Fort

Wayne, Grand Rapids, Indianapolis and Kalamazoo, which combined

produced total loan growth of $39.7 million for the quarter.

Additionally, consumer loans, excluding acquired consumer loans,

increased by 18.8% on an annualized basis during the quarter as a

result of a new seasoned consumer loan portfolio manager in the

third quarter of 2016 and increasing our focus on the management of

direct consumer loans. The increases in commercial and consumer

loans were offset by a decrease in mortgage warehouse loans of

$46.4 million from December 31, 2016 to March 31, 2017. The

decrease in mortgage warehouse loans was primarily due to quicker

turn-around times by the end investors to fund loans which resulted

in a lower average balance in the portfolio during the first

quarter of 2017. With our established presence in the growth

markets of Kalamazoo and Indianapolis, coupled with our recent

investments in Fort Wayne, Grand Rapids and Columbus, Horizon is

well positioned to continue our growth momentum. In addition,

Horizon’s solid growth in trust and service fee income has

contributed to our plan to decrease dependence on margin income.

”

Dwight concluded, “We are pleased to have completed the purchase

of certain assets totaling $3.5 million and the assumption of

certain deposits totaling $14.8 million from First Farmers Bank

& Trust Company’s Bargersville, Indiana branch which closed on

February 3, 2017, enhancing our presence in this attractive and

growing central Indiana market.”

Income Statement Highlights

Net income for the first quarter of 2017 was $8.2 million or

$0.37 diluted earnings per share compared to $5.6 million or $0.25

diluted earnings per share for the fourth quarter of 2016. The

increase in net income and diluted earnings per share from the

previous quarter reflects increases in net interest income of $4.6

million and a decrease in non-interest expense and provision for

loan losses of $1.1 million and $293,000, respectively, which was

partially offset by a decrease in non-interest income of $1.9

million and an increase in income tax expense of $1.4 million.

Interest expense decreased $5.2 million primarily due to prepayment

penalties on borrowings of $4.8 million during the fourth quarter

of 2016. Interest income decreased $555,000 due to a decrease in

loan interest income of $924,000, offset by an increase in interest

on investment securities of $369,000 during the first quarter of

2017. The decrease in loan interest income was primarily due to the

decrease in mortgage warehouse loan balances in the first quarter.

The decrease in non-interest income was primarily due to a decrease

in the gain on sale of investments of $926,000 and a decrease in

gain on mortgage loan sales of $590,000.

Net income for the first quarter of 2017 was $8.2 million or

$0.37 diluted earnings per share compared to $5.4 million or $0.30

diluted earnings per share for the first quarter of 2016. The

increase in net income and diluted earnings per share from the same

period of 2016 reflects increases in net interest income and

non-interest income of $5.8 million and $172,000, respectively, and

a decrease in provision for loan losses of $202,000, partially

offset by an increase in non-interest expense and income tax

expense of $2.3 million and $1.1 million, respectively.

The increase in diluted earnings per share was partially offset

by an increase in dilutive shares outstanding as a result of the

stock issued in the Kosciusko Financial, Inc. and LaPorte Bancorp,

Inc. acquisitions in 2016. Excluding acquisition-related expenses,

gain on sale of investment securities and acquisition-related

purchase accounting adjustments, net income for the first quarter

of 2017 was $7.5 million or $0.34 diluted earnings per share

compared to $5.4 million or $0.30 diluted earnings per share in the

first quarter of 2016.

Non-GAAP Reconciliation of Net Income and Diluted

Earnings per Share (Dollars in Thousands Except per Share Data)

Three Months Ended March

31

Non-GAAP

Reconciliation of Net Income

2017 2016 (Unaudited) Net

income as reported

$ 8,224 $ 5,381 Merger expenses

- 639 Tax effect

-

(165 ) Net income excluding merger expenses

8,224 5,855

Gain on sale of investment securities

(35 )

(108 ) Tax effect

12 38

Net income excluding gain on sale of investment securities

8,201 5,785 Acquisition-related purchase accounting

adjustments ("PAUs")

(1,016 ) (547 ) Tax effect

356 191 Net income

excluding PAUs

$ 7,541 $ 5,429

Non-GAAP

Reconciliation of Diluted Earnings per Share

Diluted earnings per share as reported

$ 0.37 $ 0.30

Merger expenses

- 0.04 Tax effect

-

(0.01 ) Diluted earnings per share excluding

merger expenses

0.37 0.33 Gain on sale of investment

securities

(0.00 ) (0.01 ) Tax effect

0.00 0.00 Net income

excluding gain on sale of investment securities

0.37 0.32

Acquisition-related PAUs

(0.05 ) (0.03 ) Tax

effect

0.02 0.01

Diluted earnings per share excluding PAUs

$ 0.34

$ 0.30

Horizon’s net interest margin was 3.80% during the first quarter

of 2017, up from 2.92% for the prior quarter and 3.45% for same

period of 2016. The increase in the net interest margin compared to

the prior quarter was primarily due to prepayment penalties

incurred on high fixed-rate borrowings as part of Horizon’s balance

sheet restructuring transaction in the fourth quarter of 2016 in

addition to a decrease in average outstanding borrowings. Average

outstanding borrowings during the first quarter of 2017 were $132.3

million and $156.8 million lower when compared to the prior quarter

and the same prior-year period.

The increase in the net interest margin compared to the same

period of 2016 was primarily due to an increase in the yield earned

on loans and a decrease in the cost of borrowings. Excluding

prepayment penalties on borrowings and acquisition-related purchase

accounting adjustments, the margin would have been 3.66% for the

first quarter of 2017 compared to 3.45% for the prior quarter and

3.36% for the same period of 2016. Interest expense from the

prepayment penalties on borrowings was $4.8 million for the fourth

quarter of 2016. Interest income from acquisition-related purchase

accounting adjustments was $1.0 million, $900,000 and $547,000 for

the three months ended March 31, 2017, December 31, 2016, and March

31, 2016, respectively.

Non-GAAP

Reconciliation of Net Interest Margin (Dollars in Thousands,

Unaudited)

Three Months Ended March 31 December

31 March 31

Net Interest

Margin As Reported

2017 2016 2016 Net

interest income

$ 25,568 $ 20,939 $ 19,774 Average

interest-earning assets

2,797,429 2,932,145 2,367,250 Net

interest income as a percent of average interest- earning assets

("Net Interest Margin")

3.80 % 2.92 % 3.45 %

Impact of

Prepayment Penalties on Borrowings

Interest expense from prepayment penalties on borrowings

$

- $ 4,839 $ -

Impact of

Acquisitions

Interest income from acquisition-related purchase accounting

adjustments

$ (1,016 ) $ (900 ) $ (547 )

Excluding Impact

of Prepayment Penalties and Acquisitions

Net interest income

$ 24,552 $ 24,878 $ 19,227

Average interest-earning assets

2,797,429 2,932,145

2,367,250 Core Net Interest Margin

3.66 % 3.45 % 3.36

%

Lending Activity

Total loans increased $4.7 million from $2.144 billion as of

December 31, 2016 to $2.149 billion as of March 31, 2017 as

commercial loans increased by $36.5 million, residential mortgage

loans increased by $1.8 million and consumer loans increased by

$19.0 million. Offsetting these increases was a decrease in

mortgage warehouse loans of $46.4 million as of March 31, 2017.

Total loans, excluding acquired loans, mortgage warehouse loans and

loans held for sale, increased 2.7% for the three months ended

March 31, 2017. Commercial and consumer loans, excluding acquired

loans, increased $33.8 million, or an annualized growth rate of

12.8%, and $18.5 million, or an annualized growth rate of 18.8%,

respectively.

Loan balances in the Fort Wayne, Grand Rapids, Indianapolis and

Kalamazoo totaled $436.8 million as of March 31, 2017. Combined,

these markets contributed $39.7 million, or 10.0%, in loan growth

during the three months ended March 31, 2017.

Loan Growth by Type, Excluding Acquired Loans

Three Months Ended March 31, 2017 (Dollars in Thousands)

Excluding Acquired Loans

Acquired March 31 December 31

Amount FFBT Amount Percent

2017 2016 Change

Loans Change Change

(Unaudited) (Unaudited)

Commercial loans

$

1,106,471 $ 1,069,956 $ 36,515 $ (2,742 ) $ 33,773 3.2 %

Residential mortgage loans

533,646 531,874 1,772 (59 ) 1,713

0.3 % Consumer loans

417,476 398,429

19,047 (562 )

18,485 4.6 % Subtotal

2,057,593 2,000,259 57,334

(3,363 ) 53,971 2.7 % Held for sale loans

1,789 8,087 (6,298

) - (6,298 ) -77.9 % Mortgage warehouse loans

89,360

135,727 (46,367 ) -

(46,367 ) -34.2 % Total loans

$

2,148,742 $ 2,144,073 $ 4,669 $

(3,363 ) $ 1,306 0.1 %

Residential mortgage lending activity during the three months

ended March 31, 2017 generated $1.9 million in income from the gain

on sale of mortgage loans, a decrease of $137,000 from the same

period of 2016. Total origination volume for the three months ended

March 31, 2017, including loans placed into portfolio, totaled

$65.9 million, representing a decrease of 17.0% from the same

period of 2016. The decrease in mortgage loan origination volume is

primarily due to an increase in mortgage loan interest rates when

comparing the first quarter of 2017 to the same period of 2016.

Purchase money mortgage originations during the first quarter of

2017 represented 69.8% of total originations compared to 68.0% of

originations during the previous quarter and 65.3% during the first

quarter of 2016.

The provision for loan losses was $330,000 for the first quarter

of 2017 compared to $532,000 for the same period of 2016. The

decrease in the provision for loan losses during the first quarter

of 2017 was due to lower charge-offs, stable delinquency trends and

a decrease in non-performing loans.

The ratio of the allowance for loan losses to total loans

increased to 0.70% as of March 31, 2017 from 0.69% as of December

31, 2016 due to an increase in allowance for loan losses. The ratio

of the allowance for loan losses to total loans, excluding loans

with credit-related purchase accounting adjustments, was 0.89% as

of March 31, 2017 compared to 0.91% as of December 31, 2016. Loan

loss reserves and credit-related loan discounts on acquired loans

as a percentage of total loans was 1.31% as of March 31, 2017

compared to 1.39% as of December 31, 2016.

Non- GAAP Allowance for Loan and Lease Loss Detail

As of March 31, 2017 (Dollars in Thousands, Unaudited)

Horizon Legacy Heartland

Summit Peoples Kosciusko

LaPorte CNB Total Pre-discount

loan balance

$ 1,681,167 $ 14,698 $ 51,026 $ 139,602

$ 75,151 $ 189,149 $ 9,485

$ 2,160,278

Allowance for loan losses (ALLL)

14,983 71 - - - - -

15,054 Loan discount

N/A

867 2,431 3,260

994 5,466

307

13,325 ALLL+loan discount

14,983 938 2,431 3,260 994 5,466 307

28,379

Loans, net

$ 1,666,184 $ 13,760

$ 48,595 $ 136,342 $ 74,157

$ 183,683 $ 9,178

$ 2,131,899 ALLL/ pre-discount loan

balance

0.89 % 0.48 % 0.00 % 0.00 % 0.00 % 0.00 %

0.00 %

0.70 % Loan discount/ pre-discount loan

balance

N/A 5.90 % 4.76 % 2.34 % 1.32 % 2.89 % 3.24 %

0.62 % ALLL+loan discount/ pre-discount loan balance

0.89 % 6.38 % 4.76 % 2.34 % 1.32 % 2.89 % 3.24 %

1.31 %

Non-performing loans to total loans decreased 4 basis points to

0.46% at March 31, 2017 from 0.50% at December 31, 2016.

Non-performing loans totaled $9.8 million as of March 31, 2017, a

decrease of $849,000 from $10.7 million as of December 31, 2016.

Compared to December 31, 2016, non-performing commercial loans

decreased by $902,000, non-performing real estate loans increased

by $35,000 and non-performing consumer loans increased $18,000.

Expense Management

Total non-interest expense was $2.3 million higher in the first

quarter of 2017 compared to the same period of 2016. The increase

was primarily due to an increase in salaries and employee benefits

of $1.6 million, net occupancy expenses of $516,000, data

processing expenses of $202,000, and other expenses of $431,000

reflecting overall company growth, market expansion and recent

acquisitions. Professional fee expense decreased $218,000 in the

first quarter of 2017 when compared to the same period of 2016

primarily due to one-time expenses related to the Kosciusko

Financial, Inc. and LaPorte Bancorp, Inc. acquisitions in 2016.

Other losses decreased $217,000 in the first quarter of 2017 when

compared to the same period of 2016 due to a decrease in debit card

fraud-related expense. FDIC insurance expense decreased $142,000 in

the first quarter of 2017 when compared to the same period of 2016

as the assessment rate schedule was reduced effective for

assessment payments due in the fourth quarter of 2016 and 2017.

Use of Non-GAAP Financial Measures

Certain information set forth in this press release refers to

financial measures determined by methods other than in accordance

with GAAP. Specifically, we have included non-GAAP financial

measures of the net interest margin and the allowance for loan and

lease losses excluding the impact of acquisition-related purchase

accounting adjustments, total loans and loan growth, and net income

and diluted earnings per share excluding the impact of one-time

costs related to acquisitions, acquisition-related purchase

accounting adjustments and other events that are considered to be

non-recurring. Horizon believes that these non-GAAP financial

measures are helpful to investors and provide a greater

understanding of our business without giving effect to the purchase

accounting impacts and one-time costs of acquisitions and non-core

items, although these measures are not necessarily comparable to

similar measures that may be presented by other companies and

should not be considered in isolation or as a substitute for the

related GAAP measure. See the tables and other information

contained elsewhere in this press release for reconciliations of

the non-GAAP figures identified herein and their most comparable

GAAP measures.

Non-GAAP Reconciliation of Tangible Stockholders' Equity

and Tangible Book Value per Share (Dollars in Thousands Except

per Share Data)

March

31 December 31 March 31 2017

2016 2016 (Unaudited)

(Unaudited) Total stockholders’ equity

$ 348,575 $ 340,855 $ 261,417 Less: Preferred stock

- - - Less: Intangible assets

87,094

86,307 56,695 Total tangible

stockholder's equity

$ 261,481 $

254,548 $ 204,722 Common shares outstanding

22,176,465 22,171,596 17,974,970 Tangible book value

per common share

$ 11.79 $ 11.48 $ 11.39

About Horizon

Horizon Bancorp is an independent, commercial bank holding

company serving northern and central Indiana and southwest and

central Michigan through its commercial banking subsidiary Horizon

Bank, NA. Horizon also offers mortgage-banking services throughout

the Midwest. Horizon Bancorp may be reached online at

www.horizonbank.com. Its common stock is traded on the NASDAQ

Global Select Market under the symbol HBNC.

Forward Looking Statements

This press release may contain forward-looking statements

regarding the financial performance, business prospects, growth and

operating strategies of Horizon. For these statements, Horizon

claims the protections of the safe harbor for forward-looking

statements contained in the Private Securities Litigation Reform

Act of 1995. Statements in this press release should be considered

in conjunction with the other information available about Horizon,

including the information in the filings we make with the

Securities and Exchange Commission. Forward-looking statements

provide current expectations or forecasts of future events and are

not guarantees of future performance. The forward-looking

statements are based on management’s expectations and are subject

to a number of risks and uncertainties. We have tried, wherever

possible, to identify such statements by using words such as

“anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,”

“will” and similar expressions in connection with any discussion of

future operating or financial performance. Although management

believes that the expectations reflected in such forward-looking

statements are reasonable, actual results may differ materially

from those expressed or implied in such statements. Risks and

uncertainties that could cause actual results to differ materially

include risk factors relating to the banking industry and the other

factors detailed from time to time in Horizon’s reports filed with

the Securities and Exchange Commission, including those described

in its Form 10-K. Undue reliance should not be placed on the

forward-looking statements, which speak only as of the date hereof.

Horizon does not undertake, and specifically disclaims any

obligation, to publicly release the result of any revisions that

may be made to update any forward-looking statement to reflect the

events or circumstances after the date on which the forward-looking

statement is made, or reflect the occurrence of unanticipated

events, except to the extent required by law.

HORIZON BANCORP Financial Highlights

(Dollars in thousands except share and per share data and

ratios, Unaudited) March 31

December 31 September 30 June 30

March 31 2017 2016

2016 2016 2016 Balance

sheet: Total assets $ 3,169,643 $ 3,141,156 $ 3,325,650 $

2,918,080 $ 2,627,918 Investment securities 673,090 633,025 744,240

628,935 642,767 Commercial loans 1,106,471 1,069,956 1,047,450

874,580 797,754 Mortgage warehouse loans 89,360 135,727 226,876

205,699 119,876 Residential mortgage loans 533,646 531,874 530,162

493,626 442,806 Consumer loans 417,476 398,429 386,031 363,920

359,636 Earning assets 2,845,922 2,801,030 2,963,005 2,591,208

2,379,830 Non-interest bearing deposit accounts 502,400 496,248

479,771 397,412 343,025 Interest bearing transaction accounts

1,432,228 1,499,120 1,367,285 1,213,659 1,118,617 Time deposits

509,071 475,842 489,106 471,190 416,837 Borrowings 319,993 267,489

569,908 492,883 430,507 Subordinated debentures 37,516 37,456

37,418 32,874 32,836 Total stockholders’ equity 348,575 340,855

345,736 281,002 261,417

Income statement: Three

months ended Net interest income $ 25,568 $ 20,939 $ 24,410 $

20,869 $ 19,774 Provision for loan losses 330 623 455 232 532

Non-interest income 7,559 9,484 9,318 9,266 7,387 Non-interest

expenses 21,521 22,588 24,082 20,952 19,270 Income tax expense

3,052 1,609 2,589

2,625 1,978 Net

income 8,224 5,603 6,602 6,326 5,381 Preferred stock dividend

- - -

- (42 ) Net income available to

common shareholders $ 8,224 $ 5,603 $

6,602 $ 6,326 $ 5,339

Per share data: Basic earnings per share (1) $ 0.37 $ 0.25 $

0.31 $ 0.35 $ 0.30 Diluted earnings per share (1) 0.37 0.25 0.30

0.34 0.30 Cash dividends declared per common share (1) 0.11 0.11

0.10 0.10 0.10 Book value per common share (1) 15.72 15.37 15.61

14.90 14.54 Tangible book value per common share 11.79 11.48 11.83

11.45 11.39 Market value - high 28.09 28.41 20.01 16.76 18.59

Market value - low $ 24.91 $ 17.84 $ 16.61 $ 15.87 $ 15.41 Weighted

average shares outstanding - Basic 22,175,526 22,155,549 21,538,752

18,268,880 17,924,124 Weighted average shares outstanding - Diluted

22,326,071 22,283,722 21,651,953 18,364,167 18,012,726

Key ratios: Return on average assets 1.07 % 0.69 % 0.80 %

0.94 % 0.83 % Return on average common stockholders' equity 9.66

6.49 7.88 9.43 8.26 Net interest margin 3.80 2.92 3.37 3.48 3.45

Loan loss reserve to total loans 0.70 0.69 0.66 0.73 0.83

Non-performing loans to loans 0.46 0.50 0.58 0.68 0.87 Average

equity to average assets 11.12 10.59 10.18 9.94 10.16 Bank only

capital ratios: Tier 1 capital to average assets 10.26 9.93 9.65

9.39 8.98 Tier 1 capital to risk weighted assets 13.40 13.33 12.73

12.51 12.33 Total capital to risk weighted assets 14.05 13.98 13.34

13.23 13.10

Loan data: Substandard loans $ 30,865 $

30,361 $ 33,914 $ 28,629 $ 23,600 30 to 89 days delinquent 5,476

6,315 3,821 2,887 2,149 90 days and greater delinquent -

accruing interest $ 245 $ 241 $ 59 $ 24 $ 1 Trouble debt

restructures - accruing interest 1,647 1,492 1,523 1,256 1,231

Trouble debt restructures - non-accrual 998 1,014 1,164 1,466 2,857

Non-accrual loans 6,944 7,936

10,091 10,426

10,895 Total non-performing loans $ 9,834

$ 10,683 $ 12,837 $ 13,172

$ 14,984 (1) Adjusted for 3:2 stock

split on November 14, 2016

HORIZON BANCORP

Allocation of the Allowance for Loan and Lease Losses

(Dollars in Thousands, Unaudited)

March 31 December

31 September 30 June

30 March 31 2017

2016 2016 2016

2016 Commercial

$ 7,600 $ 6,579

$ 6,222 $ 6,051 $ 6,460 Real estate

1,697 2,090 1,947 2,102

1,794 Mortgage warehousing

1,042 1,254 1,337 1,080 1,014

Consumer

4,715 4,914

5,018 4,993

4,968 Total

$ 15,054 $ 14,837

$ 14,524 $ 14,226 $ 14,236

Net Charge-offs (Recoveries)

(Dollars in Thousands, Unaudited)

Three months ended March 31

December 31 September 30

June 30 March 31

2017 2016 2016

2016 2016 Commercial

$ (134 ) $ 49 $ (5 ) $ 101 $ 403 Real estate

38 64 - (31 ) 83 Mortgage warehousing

- - - - -

Consumer

209 197

162 172

344 Total

$ 113 $

310 $ 157 $ 242

$ 830

Total Non-performing Loans

(Dollars in Thousands, Unaudited)

March 31 December

31 September 30 June

30 March 31 2017

2016 2016 2016

2016 Commercial

$ 1,530 $ 2,432

$ 5,419 $ 4,330 $ 5,774 Real estate

5,057 5,022 4,251 5,659

5,974 Mortgage warehousing

- - - - - Consumer

3,247 3,229 3,108

3,183 3,236 Total

$ 9,834 $ 10,683 $ 12,778

$ 13,172 $ 14,984

Other Real

Estate Owned and Repossessed Assets

(Dollars in Thousands, Unaudited)

March 31 December

31 September 30 June

30 March 31 2017

2016 2016 2016

2016 Commercial

$ 542 $ 542 $

542 $ 542 $ 424 Real estate

2,413 2,648 3,182 2,925 3,393

Mortgage warehousing

- - - - - Consumer

20

26 67

69 - Total

$ 2,975

$ 3,216 $ 3,791 $ 3,536

$ 3,817

HORIZON BANCORP AND SUBSIDIARIES

Average Balance Sheets

(Dollar Amounts in Thousands,

Unaudited)

Three Months Ended

Three Months Ended March 31, 2017 March 31,

2016 Average Average Average

Average Balance Interest

Rate Balance Interest

Rate ASSETS Interest-earning assets Federal

funds sold $ 3,034 $ 5 0.67 % $ 2,424 $ 1 0.17 % Interest-earning

deposits 24,748 69 1.13 % 20,810 49 0.95 % Investment securities -

taxable 398,871 2,332 2.37 % 463,544 2,494 2.16 % Investment

securities - non-taxable (1) 270,522 1,637 3.41 % 182,275 1,237

3.79 % Loans receivable (2)(3) 2,100,254

24,791 4.79 % 1,698,197 19,747

4.69 % Total interest-earning assets (1) 2,797,429 28,834 4.28 %

2,367,250 23,528 4.09 % Non-interest-earning assets Cash and

due from banks 40,994 32,925 Allowance for loan losses (14,937 )

(14,508 ) Other assets 279,982 214,604

$ 3,103,468 $ 2,600,271

LIABILITIES

AND SHAREHOLDERS' EQUITY Interest-bearing liabilities

Interest-bearing deposits $ 1,960,337 $ 1,753 0.36 % $ 1,534,833 $

1,491 0.39 % Borrowings 249,923 937 1.52 % 406,679 1,759 1.74 %

Subordinated debentures 36,290 576 6.44

% 32,813 504 6.18 % Total

interest-bearing liabilities 2,246,550 3,266 0.59 % 1,974,325 3,754

0.76 % Non-interest-bearing liabilities Demand deposits

491,154 339,141 Accrued interest payable and other liabilities

20,672 22,521 Stockholders' equity 345,092

264,284 $ 3,103,468 $ 2,600,271

Net interest income/spread $ 25,568 3.69 % $ 19,774 3.32 %

Net interest income as a percent of average interest earning assets

(1) 3.80 % 3.45 % (1) Securities balances represent daily

average balances for the fair value of securities. The average rate

is calculated based on the daily average balance for the amortized

cost of securities. The average rate is presented on a tax

equivalent basis. (2) Includes fees on loans. The inclusion of loan

fees does not have a material effect on the average interest rate.

(3) Non-accruing loans for the purpose of the computations above

are included in the daily average loan amounts outstanding. Loan

totals are shown net of unearned income and deferred loan fees.

HORIZON BANCORP AND SUBSIDIARIES Condensed

Consolidated Balance Sheets

(Dollar Amounts in Thousands)

March 31 December

31 2017 2016 (Unaudited)

Assets Cash and due from banks

$

60,280 $ 70,832 Investment securities, available for sale

474,222 439,831 Investment securities, held to maturity

(fair value of $200,482 and $194,086)

198,868 193,194 Loans

held for sale

1,789 8,087 Loans, net of allowance for loan

losses of $15,054 and $14,837

2,131,899 2,121,149 Premises

and equipment, net

66,314 66,357 Federal Reserve and Federal

Home Loan Bank stock

24,090 23,932 Goodwill

77,644

76,941 Other intangible assets

9,450 9,366 Interest

receivable

12,581 12,713 Cash value of life insurance

74,598 74,134 Other assets

37,908

44,620 Total assets

$

3,169,643 $ 3,141,156

Liabilities Deposits Non-interest bearing

$

502,400 $ 496,248 Interest bearing

1,941,299

1,974,962 Total deposits

2,443,699 2,471,210 Borrowings

319,993 267,489

Subordinated debentures

37,516 37,456 Interest payable

523 472 Other liabilities

19,337

23,674 Total liabilities

2,821,068 2,800,301

Commitments and contingent liabilities Stockholders’

Equity Preferred stock, Authorized, 1,000,000 shares Issued 0

and 0 shares

- - Common stock, no par value Authorized

66,000,000 shares(1) Issued, 22,195,715 and 22,192,530 shares(1)

Outstanding, 22,176,465 and 22,171,596 shares(1)

- -

Additional paid-in capital

182,402 182,326 Retained earnings

169,950 164,173 Accumulated other comprehensive loss

(3,777 ) (5,644 ) Total

stockholders’ equity

348,575

340,855 Total liabilities and stockholders’ equity

$ 3,169,643 $ 3,141,156

(1) Adjusted for 3:2 stock split on November 14, 2016

HORIZON BANCORP AND SUBSIDIARIES Condensed Consolidated

Statements of Income

(Dollar Amounts in Thousands, Except Per

Share Data, Unaudited)

Three Months Ended March 31

2017 2016 (Unaudited)

(Unaudited) Interest Income

Loans receivable

$ 24,791 $ 19,747 Investment

securities Taxable

2,406 2,544 Tax exempt

1,637 1,237 Total interest

income

28,834 23,528

Interest Expense Deposits

1,753 1,491 Borrowed funds

937 1,759 Subordinated debentures

576

504 Total interest expense

3,266

3,754

Net Interest Income

25,568 19,774 Provision for loan losses

330

532

Net Interest Income after

Provision for Loan Losses 25,238

19,242

Non-interest Income Service charges on

deposit accounts

1,400 1,288 Wire transfer fees

150

121 Interchange fees

1,176 931 Fiduciary activities

1,922 1,635 Gain on sale of investment securities

(includes $35 and $108 for the three months ended March 31, 2017

and 2016 related to accumulated other comprehensive earnings

reclassifications)

35 108 Gain on sale of mortgage loans

1,914 2,114 Mortgage servicing income net of impairment

447 447 Increase in cash value of bank owned life insurance

471 345 Other income

44

398 Total non-interest income

7,559

7,387

Non-interest Expense Salaries and

employee benefits

11,709 10,065 Net occupancy expenses

2,452 1,936 Data processing

1,307 1,105 Professional

fees

613 831 Outside services and consultants

1,222

1,099 Loan expense

1,107 1,195 FDIC insurance expense

263 405 Other losses

50 267 Other expense

2,798 2,367 Total non-interest

expense

21,521 19,270

Income Before Income Tax 11,276 7,359 Income tax

expense (includes $12 and $38 for the three months ended March 31,

2017 and 2016, respectively, related to income tax expense from

reclassification items)

3,052

1,978

Net Income 8,224 5,381 Preferred stock

dividend

- (42 )

Net Income

Available to Common Shareholders $ 8,224

$ 5,339

Basic Earnings Per Share $

0.37 $ 0.30

Diluted Earnings Per Share 0.37

0.30

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170425006961/en/

Horizon BancorpMark E. SecorChief Financial Officer(219)

873-2611Fax: (219) 874-9280

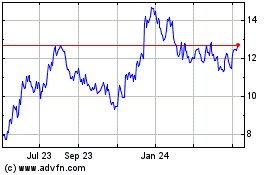

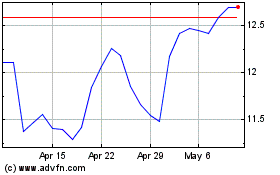

Horizon Bancorp (NASDAQ:HBNC)

Historical Stock Chart

From Aug 2024 to Sep 2024

Horizon Bancorp (NASDAQ:HBNC)

Historical Stock Chart

From Sep 2023 to Sep 2024