Visa Posts Stronger-Than-Expected Results but Profit Falls on Charges

April 20 2017 - 5:14PM

Dow Jones News

By Anne Steele

Visa Inc.'s profit tumbled 75% in the most recent quarter as it

booked charges related to the reorganization of its Europe

business, though revenue rose more than expected amid robust growth

in payments and cross-border volume and processed transactions.

Shares rose 2.8% after hours to $93.70.

Like rival Mastercard Inc., Visa is a payment network that

processes credit-card and debit-card transactions, making a

percentage off each.

The company purchased its European operations last June, a deal

designed to bring its global operations under one roof. And during

the latest quarter, Visa completed a legal entity reorganization of

Visa Europe and other units to align its global corporate structure

with the geographic jurisdictions in which it operates.

Accordingly, Visa recorded a $1.5 billion income tax provision and

a $192 million administrative expense tied to the charitable

donation of Visa Inc. shares acquired as part of Visa Europe.

In all for the fiscal second quarter, Visa earned $430 million,

or 18 cents a Class A share, down from $1.71 billion, or 71 cents a

share, a year earlier. Excluding items related to the

reorganization, earnings were 86 cents, topping the average analyst

estimate for 79 cents, according to Thomson Reuters.

Net operating revenue climbed 23% to $4.48 billion, above the

$4.3 billion analysts were looking for.

Payments volume for the quarter climbed 37% on a constant-dollar

basis to $1.7 trillion. Total processed transactions surged 42% to

26.3 billion.

The company is reaping the rewards from a growing credit-card

market and recent wins as companies, including Costco Wholesale

Corp. and USAA, switched card programs to its network. As lenders

continue to push generous rewards programs and credit-card issuance

keeps rising, the ripple effects are being felt by the Visa

network.

Cross-border volume growth more than doubled in the quarter from

a year earlier on a constant dollar basis.

Expenses, however, were also up, jumping 40%, mostly owing to

the Visa Europe transaction as well as increases in personnel and

marketing costs.

Visa lifted slightly its guidance for the current year, and now

anticipates adjusted earnings to increase at the high end of the

mid-teens, compared with previous guidance for growth in the

midteens on a percentage basis. The company still expects revenue

to rise at the high end of 16% to 18%.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

April 20, 2017 16:59 ET (20:59 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

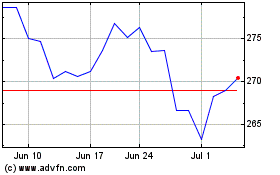

Visa (NYSE:V)

Historical Stock Chart

From Mar 2024 to Apr 2024

Visa (NYSE:V)

Historical Stock Chart

From Apr 2023 to Apr 2024